The RBI setup the ‘Integrated Ombudsman Scheme 2021 (RB-IOS)’ in November 2021 to integrate the three existing ombudsman schemes. While the total number of complaints received under various ombudsman schemes increased by 9% in 2021-22, about 1/4th of the complaints was dealt by the Centralized Receipt and Processing Center (CRPC), established for preliminary scrutiny and processing of all physical and email complaints.

Provision of an Ombudsman helps understand customer grievances in relation to services provide by the respective entities and work towards resolution. The Reserve Bank of India’s (RBI) Integrated Ombudsman Scheme 2021 (RB-IOS) aims to achieve the same. This scheme integrated the following three existing three Ombudsman schemes of RBI:

- The Banking Ombudsman Scheme, 2006 (BOS)

- The Ombudsman Scheme for Non-Banking Financial Companies (NBFCs), 2018 and (OSNBFC)

- The Ombudsman Scheme for Digital Transactions (ODT).

Factly’s explainer on this Integrated Ombudsman Scheme can be read here. Introduced in 2021, one of the main goals of the integrated scheme is to ease the process of filing a complaint by being a single point of contact for all the complaints raised.

The recently released RBI’s Annual Report on Ombudsman schemes for 2021-22, provides data regarding the trends in the complaints. Factly’s analysis on the trends in earlier years can be read here, here and here. In the first of this two-part series, we look at the trends in complaints received.

9% increase in the total complaints received during 2021-22

The RBI-IOS was introduced in November 2021, and it received 72.58 thousand complaints during the remaining period of 2021-22. Along with RBI-IOS, Centralized Receipt and Processing Center (CRPC) was established for preliminary scrutiny and processing of all physical and email complaints. Main purpose of implementing CRPC is to screen and reduce the number of complaints forwarded to Ombudsman. 1.13 lakh complaints were handled and disposed by CRPC in 2021-22.

If the complaints received and resolved by CRPC are excluded, around 3.04 lakh complaints were received under the various ombudsman schemes for resolution during 2021-22. During the period April-November 2022, complaints were received through the three ombudsman schemes. 2.09 lakh complaints were received by BOS, over 20 thousand were received by OSNBFC and a further 2,281 received by ODT. Overall, a total of 4.18 lakh complaints were received during 2021-22 (April- March). It has to be noted that this is across the three earlier ombudsman schemes, the new integrated RB-IOS and CRPC

The number of complaints received in 2021-22 is 9% more than in 2020-21, when 3.82 lakh complaints were received across the three Ombudsman schemes. In the earlier years, the period of consideration was July-June as per RBI’s earlier fiscal year. During 2019-20, the total number of complaints received was 3.08 lakhs. While the trend of increasing year-on-year complaints continued in 2021-22 (April-March), the growth rate has reduced.

50% of the complaints received by ORBIOs in Delhi, Mumbai, Chennai, Kanpur & Chandigarh

As already highlighted, during 2021-22, 1.13 lakh complaints were received and disposed by CRPC and about 3.08 lakhs were handled by the 22 ORBIOs (Office of Reserve Bank of India Ombudsman) across the country, each of which has a geographical jurisdiction.

In 2021-22, the greatest number of complaints were received by New Delhi-II ORBIO with 24,259 complaints. The other two offices in Delhi i.e., New Delhi-I & New Delhi-III received 15.3 thousand and 8.8 thousand complaints respectively. The Kanpur ORBIO received the second highest with 24 thousand complaints which accounts for 7.95% of the total number of complaints. Mumbai has two offices, with Mumbai-I receiving 18.8 thousand complaints and Mumbai-II receiving 20.6 thousand complaints. Chennai & Chandigarh are next with 21.4 and 20.3 thousand complaints.

Compared to 2020-21, there is a fall in the number of complaints received across all the ORBIOs. This can be attributed to the disposal of complaints at the CRPC without they being forwarded to the ORBIOs.

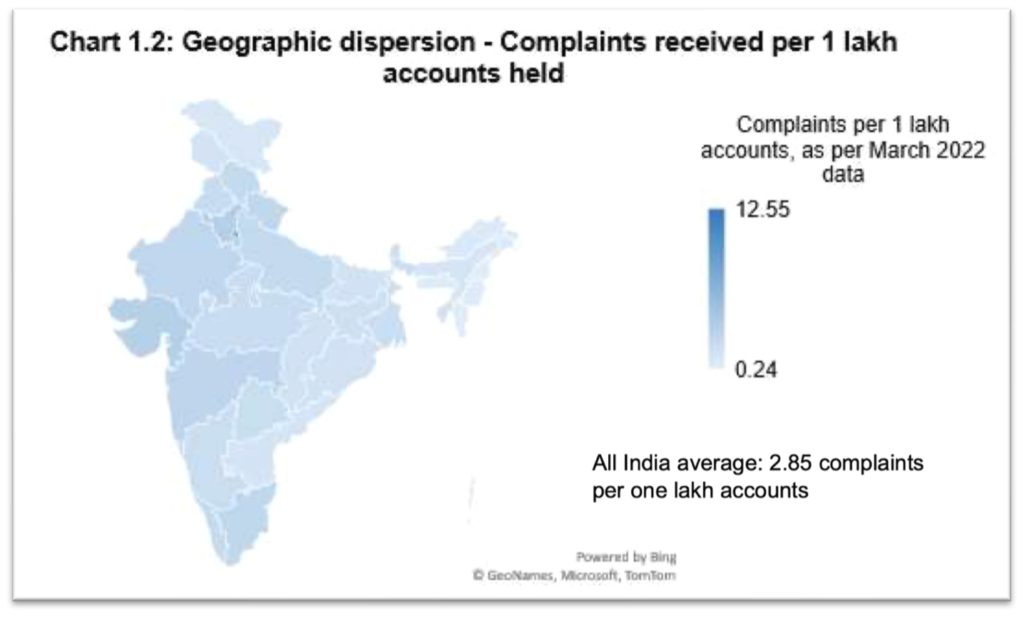

Delhi, Haryana, Gujarat, Maharashtra have major share of Ombudsman complaints

As per the Annual report for 2021-22, about 2.85 complaints are received per one lakh accounts on average across India. In terms of geographical distribution, i.e., the number of complaints in proportion to the total number of accounts held by Scheduled Commercial Banks (SCBs) in a State, Delhi, Chandigarh, Haryana, Gujarat & Maharashtra are the top-5 states. Comparatively, this average is lower in Northeast India.

The annual report observes that the higher complaints in these top states could be due to higher awareness levels, better availability of financial services, connectivity (physical & online), among other things.

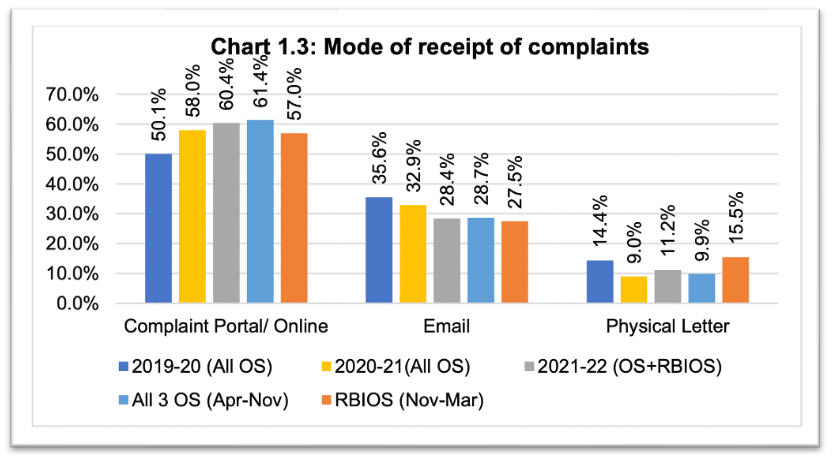

A higher proportion of the complaints received are through the complaint portal. In 2021-22, before the implementation of the integrated ombudsman scheme, 61.4% complaints were received through the portal. After the implementation of the integrated scheme, this share is 57%.

There is an increased proportion of complaints received through physical letters after the introduction of the integrated scheme, with this accounting for 15.5% of the total complaints received. Prior to that, it was about 9.9% with the three older schemes. It remains to be seen if this trend of complaints received through physical letters increases in the coming years.

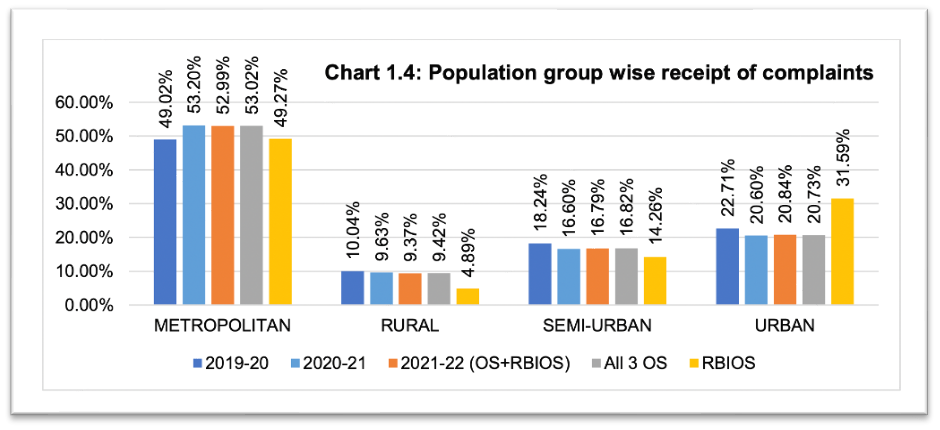

A major portion of the complaints received continue to be from Metropolitan cities followed by Urban centres. Post the implementation of the integrated scheme, there is an increase in the share of the complaints received from urban areas. This is at the expense of the fall in complaints from rural areas.

Majority of complaints against Banks are those relating to Debit Cards and Online banking

In 2021-22, the complaints related to ATM/Debit cards and Online banking remain the greatest in terms of complaints against banks. Despite the number complaints related to ATM/Debit cards being the highest, the share continues to have a declining trend. This is due to an increase in the complaints related to other areas of banking – mobile/electronic banking, credit cards, loans & advances, etc.

Among NBFCs, a major share are the complaints related to loans & advances or non-adherence to Fair Practices Code (FPC). In the case of NBPSPs (Non-Banking Payment System Participant), nearly 39% are relating to Mobile or Electronic Fund transfers while another 30% of the complaints are issues with UPI related fund transfers. All these are the complaints which are handled by ORBIOs.

51% of the complaints received are related to Public Sector banks

In the previous year i.e., 2020-21, 45% of the complaints received were related to Public Sector Banks (PSBs). In 2021-22, this increased to 50.8%. During April-November, when there were 3 different schemes, PSBs received 51.37% of the complaints, while after the implementation of the integrated ombudsman, the share is 49%. In terms of absolute numbers, the number of complaints fell from 1.74 lakhs to 1.54 lakhs.

The complaints against private sector banks received by ORBIOs fell from 1.26 lakhs to 94.2 thousand. While there is an increase in the number of complaints received against payment and small finance banks, this is a continuation of trend observed in the recent years, with the share of complaints relating to payment and small finance banks on the rise.

A fall in the complaints related to NBFCs is also observed in 2021-22, which also contributed to reduction of its share in the total complaints. In 2020-21, the share was 8.15%, which fell to 7.33% in 2021-22. In 2021-22, prior to implementation of the integrated scheme, the share was 7.8% of the complaints, that fell to 5.8% for the Integrated ombudsman scheme.

Decrease in the number of complaints received by ORBIOs with implementation of Integrated scheme

In the earlier years, a considerable portion of the complaints were non-maintainable complaints or complaints that were raised incorrectly. One of the main purposes of introducing CRPC as part of the new Integrated Ombudsman framework, is to handle such complaints so that there is lesser burden on ombudsman offices.

As noted earlier, there is a discernible impact on the number of complaints received by ORBIOs. Around 1.13 lakh complaints were received and disposed by CRPCs, the impact of which can be seen in the fall in actual number of complaints handled by Ombudsman offices during 2021-22.

However, this observation is based on data of only the first few months. It is to be seen if this trend continues in the ensuing years. Furthermore, the purpose of reducing the burden on ORBIOs is to ensure a better disposal of the complaints. We will analyse the trends of disposal in the next story.