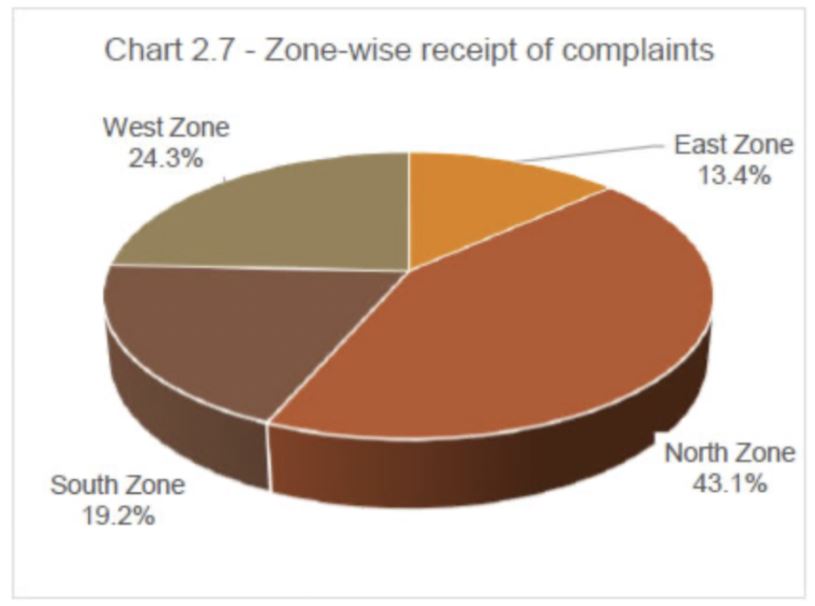

Data from the annual report of the Ombudsman Schemes indicates that more than 50% of the complaints were received from the metropolitan areas. North Zone tops the list of complaints with a 43.1% share. Further, 89% of the complaints were received through the digital mode.

In the previous story, we reviewed the trends in the complaints received under the Banking Ombudsman Scheme (BOS), based on the Annual Report of Ombudsman Schemes, 2020-21.

Among the three existing ombudsman schemes of RBI, we specifically looked at the Banking Ombudsman Scheme (BOS) and the trends relating to the number of complaints, category of complaints, mode & rate of disposal, etc.

In this follow-up story, we look at the data of the BOS for trends related to receipt of complaints by the Ombudsman Office, mode of receipt of the complaints, demographics, category of banks, etc. We also discuss a few examples of complaints received by the Office of the Banking Ombudsman (OBOs) and the resolution provided in those complaints.

Chandigarh OBO received the greatest number of complaints.

The greatest number of complaints were received in the North Zone with 43.1% of the total complaints in 2020-21, about 1.17 lakh complaints. As per the update provided in the annual report, there is a 12.7% year-on-year (YoY) increase in the number of complaints received in the North Zone.

For the year 2020-21, the West Zone registered a growth of 13.5% in the number of complaints. It also accounts for the second-highest share of complaints received in the country. Compared to the North & West Zones, the South Zone and East Zone have a lower share of the complaints in 2020-21.

The high number of complaints received in the North Zone is mainly contributed by the complaints in OBO Chandigarh. In 2020-21, more than 28 thousand complaints were received by this OBO alone. However, in terms of city-wise complaints, New Delhi tops with 43.2 thousand complaints, received in the three different OBOs in New Delhi. Kanpur also has a significant number of complaints with 21.16 thousand.

In the West Zone, the OBOs in Mumbai have registered 18.6 thousand (Mumbai-I) & 15.2 thousand (Mumbai-II) complaints in 2020-21, while Ahmedabad OBO received 17.2 thousand complaints. Among the OBOs in South Zone, Hyderabad OBO received the most cases with about 17 thousand.

The average cost of Handling a complaint was reduced to Rs. 1,605

As per the latest annual report, the total cost of handling 3.02 lakh cases in 2020-21 (July-March) was Rs. 48.55 crores. This comes to an average of Rs.1,605 per complaint.

Over the years, the efficiency in handling the complaints has improved resulting in a reduction in the handling cost per complaint. In 2019-20, Rs. 77.36 crores were spent to handle 3.2 lakh complaints, resulting in an average of Rs. 2,412 per complaint. This was an improvement over 2018-19 when the average cost of handling one complaint was Rs. 3,145.

While the average cost per complaint has certainly improved at the national level, the average cost to handle the complaints is not the same across all the OBOs. Chandigarh, which has the greatest number of complaints in 2020-21, also has the lowest average cost with Rs. 1,066 per the complaint, followed by Jaipur at Rs. 1,113. Jammu & Guwahati branches have incurred the highest average cost in handling. In fact, the average cost of handling a complaint in Jammu is almost six times the national average.

One common trend visible from the data is that the average handling cost per complaint is high in OBOs that received fewer complaints. The same is the case in OBOs like Ranchi, Raipur, Thiruvananthapuram, etc. This could be due to fixed overhead costs in each of the OBOs irrespective of the number of complaints.

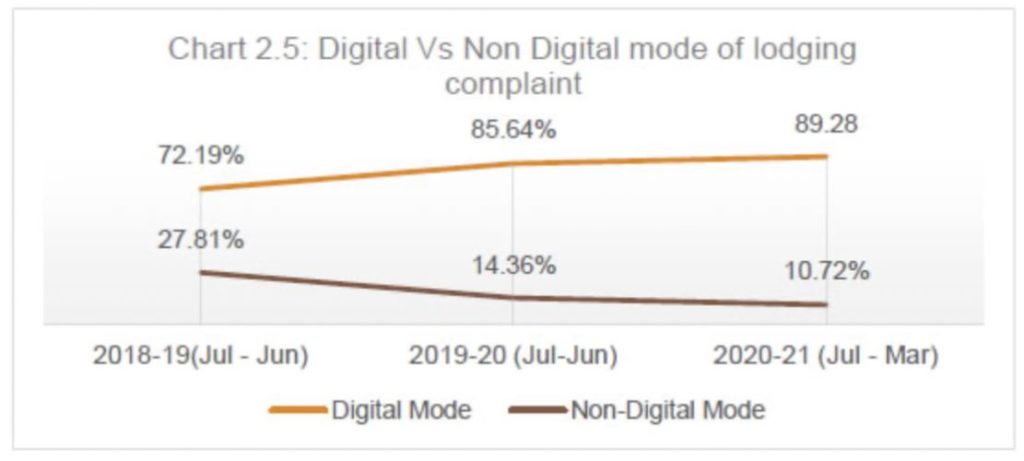

89% of the complaints received through Digital mode

In the earlier story, we had highlighted that the issues relating to Complaint Management System (CMS) were resolved which could be one of the major reasons for an increased number of complaints. This is also visible from the fact that digital is the preferred mode of the complaint.

In 2020-21, 89% of the complaints were received through Digital mode. This includes Online registration of the complaints through the CMS portal and through e-mails. Out of the total complaints received, around 60% are received online and 29% through e-mails.

The remaining 11% of the complaints were received in Physical form i.e., Post, Fax Courier, etc. In the previous year also i.e., 2019-20, there was a major jump in the usage of digital mode. In 2019-20, a total of 85.6% of the complaints were received through the digital mode, up from around 72% in 2018-19. The usage of the CMS portal increased continuously, at the expense of both e-mail and non-digital modes.

In terms of the geographical split, 53.8% of the complaints received were from Metropolitan areas, followed by around 20% from other Urban areas. Only 16.3% of complaints were from Semi-urban areas and the remaining 9.4% were from Rural areas.

The clear geographical split in terms of metros accounting for more than half the complaints could be due to higher banking transactions in these areas coupled with the awareness of the BOS in the urban areas.

37% of the complaints were about Private Sector Banks

The share of Private Sector Banks in the total number of complaints increased in 2020-21, compared to the previous year, 2019-20. During 2020-21(July-March), 1.01 lakh complaints were received pertaining to private sector banks, which is around 37 % of the total complaints.

In 2019-20 (July-June), around 98.62 thousand i.e., 31.9% of the total complaints were related to the Private Sector banks. As far as YoY comparison is concerned (April to March), 1.26 lakh complaints i.e., 36.9% were received in 2020-21(April – March).

Nationalized banks accounted for 30.1% of all the complaints in 2020-21. Their share has slightly increased compared to the earlier year. The trend in the case of SBI is very different. The share of complaints concerning SBI fell from 29.6% in 2019-20 to 21.04% in 2020-21.

Wrong notices for dues paid, fraud with ATM transactions, etc. among the complaints by customers with Banking Ombudsman

As highlighted in the earlier story, around 96.7% of the complaints received by OBOs in 2020-21 were disposed of. A major portion of the complaints received was related to ATM/Debit Cards, Mobile or electronic Banking, Credit Cards, etc.

A review of the different complaints highlights the wide variety of the complaints that are received and the action taken to resolve the same. While the details related to all the complaints or a centralised Database are not available in the public domain, the RBI has released occasional reports or included details of some important cases in various annual reports. The “Compendium of Cases Handled by the Banking Ombudsman Offices” is one such report. The Annual Report for 2017-18 provided details of a few exemplary cases dealt with by OBOs.

Wrong outstanding dues notice on Credit cards despite Settlement

One of the complaints received was related to Credit Card payments. As per the customer, he has paid Rs. 35,000 for the settlement of outstanding dues for two credit cards. However, he later received a notice for Rs. 1.24 crores and Rs. 1.58 crores to be paid. The response from the bank was that the information was sold to ARC (Asset Reconstruction Company) inadvertently and has now advised the ARC to nullify the outstanding dues. The OBO directed the bank to nullify the dues and clean up the credit history with CIC (Credit Information Company).

Delay by the bank in blocking the card in wake of reported fraud

ATM/Debit card-related frauds are the most common nature of complaints received. According to one of the complaints received by the OBO, a customer received a call stating that his ATM card was blocked and need the credentials to unlock them.

The credentials were provided by the customer and Rs. 53,900 was debited from the account.

Realizing the fraud, the customer immediately informed and requested the bank to block the card. However, fraudulent transactions were done to a total loss of Rs. 6.88 lakhs. The OBO observed that since the customer has immediately informed the bank, and as the bank did not take any action to disallow further transactions, it needs to pay Rs. 6.35 lakhs to the customer i.e., the amount is fraudulently withdrawn after duly informing the bank.

Lack of double-verification process at bank end to identify the lapse by customer

Among the other major type of complaints received are the ones related to ‘Online Bank Transfers’. In one of the complaints received, the complainant alleged that the bank transferred Rs.11,24,994 instead of Rs. 1,13,882 to the beneficiary through an RTGS transaction.

The bank in its submission stated that the complainant has filled the RTGS form incorrectly, even though the accompanying cheques had the right amount. The amount as per the RTGS form was processed. The OBO observed that despite the wrong entry in the RTGS form by the customer, the issue was with the Bank. The bank ought to have put a maker-checker concept in place, where the mismatch ought to have been identified. Hence, it directed the bank to transfer the difference amount along with interest at the Savings bank rate.

Featured Image: Banking Ombudsman Scheme