RBI recently released the Annual Report of Ombudsman Schemes for the year 2020-21. The report notes that the number of complaints to the banking ombudsman has increased by about 11% while the disposal rate has also increased significantly. Here is a review.

The Reserve Bank of India (RBI) recently launched the Integrated Ombudsman Scheme 2021 (RB-IOS). The Scheme launched in November 2021, integrates three existing Ombudsman Schemes of RBI. Factly had earlier written an explainer on this integrated scheme. Single point of reference for all complaints, better Turn Around Time (TAT) and cost-free redressal are a few of the targeted benefits of the integrated scheme.

Recently, the RBI released the Annual Report of Ombudsman Schemes, 2020-21. This report covers the period of 01 July 2020 to 31 March 2021, to align with the change of RBI’s Financial year from “July-June” to “April-March”. The Annual Report covers the activities under the earlier three separate Ombudsman schemes, as the integrated scheme was only launched recently. In this story, we analyse the data relating to Banking Ombudsman Scheme (BOS), as provided in the recent annual report.

11% Y-o-Y increase in the number of complaints received under BOS

As indicated earlier, there is a shift in the accounting year of RBI from July-June to April-March. To accommodate the change, the annual report for 2020-21 covers only the 9-month period of July 2020 to March 2021.

As per the latest Annual report, the total number of complaints received by BOS during this transition year of 2020-21 (July -March) was 2.73 lakhs. In the previous complete year of 2019-20 (July-June), this number stood at 3.08 complaints.

The Annual report also provides data for 01 April 2020 to 31 March 2021, to facilitate a YoY (year on year) comparison. During this 12-month period, 3.41 lakh complaints were received by the 22 Offices of Banking Ombudsman (OBS), which is around 11% more than during 2019-20 (July 2019 to June 2020).

Maximum complaints relate to ATM/Debit Cards

Complaints relating to ATM/Debit Cards continue to account for the highest share of complaints received by the banking ombudsman though the share has reduced over the years. During 2020-21(April-March), 60.2 thousand complaints relating to ATM/Debit Cards were received, accounting for 17.6% of the total complaints. In other words, more than one in six complaints received by the banking ombudsman were related to ATM/Debit Cards.

During 2019-20 (July-June), 67.8 thousand complaints were related to ATM/Debit Cards i.e., 22 % of the total complaints in that year. This indicates a YoY fall in the number of complaints relating to ATM/Debit Cards. The fall is evident even when the complaints for only the 9-month period of the transition year are considered. During the period 2020-21(July-April) around 47.5 thousand complaints related to ATM/Debit Cards were received, despite an overall increase in the number of complaints to the banking ombudsman.

The increase in the total number of complaints can be attributed at large to those related to Credit Cards and of failure to meet commitments. A total of 40.71 thousand i.e., 11.9 % of the total complaints during 2020-21 (April-March) were related to Credit Cards. During 2019-20 (July-June), they constituted only 9.3%. Specifically, during July-March of 2020-21, 33.7 thousand complaints, constituting 12.36% of the total complaints during the transition year, were related to Credit Cards.

There is also a significant increase in the number of complaints received for ‘Failure to meet Commitments’. The share of these complaints during 2020-21 (April-March) was 10.5%, up from 8.1% during 2019-20 (July-June). Complaints categorized as ‘Others’ form a significant 11.6% of the total complaints. A major part of those complaints are the ones relating to non-payment of cash or the cash being debited from the account, but ATM did not dispense the amount.

Rate of Disposal increased to 96.7% during 2020-21

Out of the 3.02 lakh complaints handled during the 2020-21 (July-March), around 2.92 lakh complaints were resolved i.e., around 96.7 % of the complaints handled. This is an improvement over the previous year when 92.3% of the complaints handled in 2019-20 (July-June) were resolved.

This increase in disposal has significantly reduced the number of complaints pending at the end of the year. At the beginning of July 2020, there were 24.49 thousand pending complaints carried forward from the previous year. However, by the end of March 2021, the number of pending complaints fell to around 10.08 thousand.

Out of the 24.49 thousand complaints that were carried forward from 2019-20, 13.35 thousand were complaints that were pending for more than 3 months. The significant aspect of the performance of OBOs during 2020-21 was the faster disposal of the complaints. The number of complaints that were pending for more than 3 months was brought down to only 827. Unlike the earlier year, a major portion of the complaints that are pending by the end of March 2021, are those pending for less than one month.

Mutual Settlement is the major mode of disposal of the Maintainable complaints

The complaints received by the banking ombudsman are categorized as Maintainable & non-Maintainable complaints. Maintainable complaints are all those complaints that fall under the grounds for complaints specified under Clause 8 of BOS.

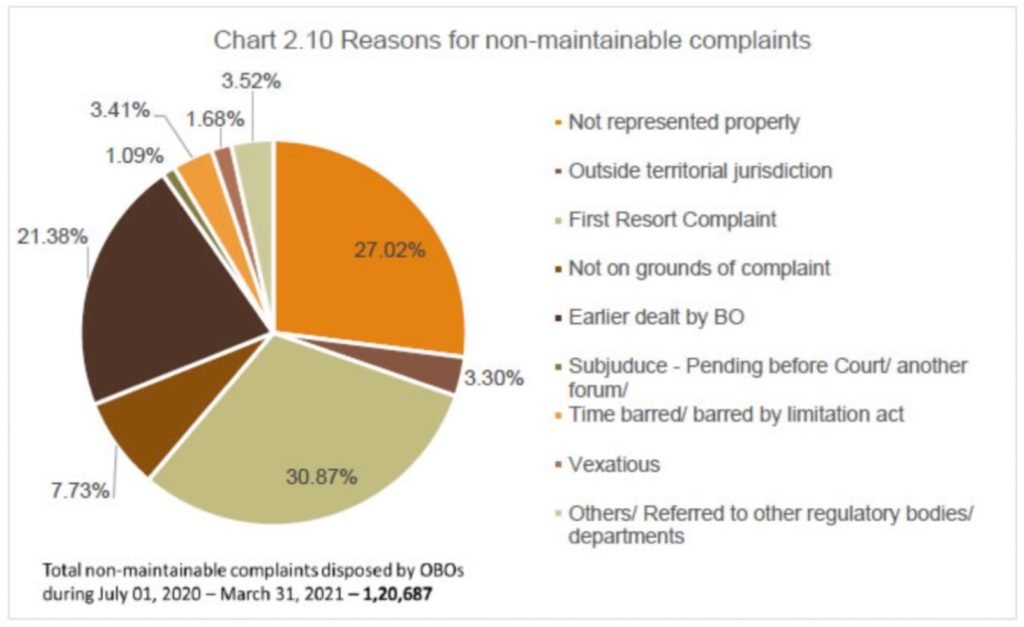

The proportion of non-Maintainable complaints (out of total complaints) fell to around 39.9% during 2020-21 compared to 45.7% in 2019-20. The complaints being first resort complaints (FRC) is the main reason for non-maintainable complaints. FRC are those that are directly submitted to the banking ombudsman without filing the same with the respective bank. The other two major reasons for non-maintainability include, ‘not represented properly’, ‘complaints already dealt with earlier’.

Among the maintainable complaints that were disposed, the major mode of disposal is by mutual consent/agreement. Out of the 1.71 lakh maintainable complaints in 2020-21 (July-March), 1.24 lakhs i.e., around 72.7% were settled through mutual agreement. The proportion remains nearly the same as the earlier year when out of the 1.73 lakh maintainable complaints in 2019-29, 73.1% were disposed through mutual agreement.

Another key mode of disposal was the rejection of the complaint. Around 27.1% of the complaints were disposed of by rejecting the complaints. The major reason for the rejection of the complaints is that the complaints are not as per grounds of complaint (Clause 8) – Clause 13(a). About 97% of the rejected complaints are due to this reason.

The Turn Around Time (TAT) of the banking ombudsman to dispose the complaints has improved significantly. During 2019-20, it was 95 days, which reduced to 55 days during 2020-21 (July-March).

Improvement in TAT across most categories

The TAT has improved across most categories of complaints. Among the most significant improvement is in the category of ATM/Debit cards. During 2019-20, the TAT for this category was 102 days, which improved to 62 days in 2020-21.

Among the other major categories of complaints, the TAT of complaints regarding Mobile/electronic banking reduced from 95 days to 56 days and in the case of Credit Cards, it reduced 50 days from 96 days.

Complaints relating to Direct Selling Agents (DSAs) and recovery agents had the highest TAT of 104 days in 2019-20, which reduced to 49 days in 2020-21. As per the annual report, the significant improvement in TAT of disposal is due to the stabilization and fixing of the technical glitches of the Complaint Management System (CMS).

Operational issues with Banks along with lack of customer awareness are major reasons for complaints.

In the Root Cause Analysis (RCA) provided in the Annual Report, issues with billing and fees levied, harassment/misbehaviour by recovery agents and wrong reporting to Credit Information Companies (CICs) were observed to be the major reasons for complaints relating to Credit Cards. It has to be noted that there has been a significant increase in the number of complaints regarding Credit Cards.

Opaqueness regarding the charges & fees, operational issues of Credit Card companies like non-coordination between the departments, erroneous reporting, etc. are analysed to be among the root causes. Negligence & lack of awareness among the customers is also a key reason for the complaints filed. The increase in the number of complaints relating to credit cards can be attributed to a few of these reasons.

Unauthorized & fraudulent transactions in accounts are another major reason for which complaints were raised. As per the RCA provided in the report, the main reasons for these issues can be attributed to a lack of awareness on part of the consumers along with lapses in the KYC process.

The Integrated Ombudsman Scheme launched recently is expected to make the process of registering the complaints as well as disposal simpler. However, improvements in the banking process and improving consumer awareness are key to reducing complaints.

Featured Image: Complaints to Banking Ombudsman