The Reserve Bank of India publishes half-yearly reports titled ‘Financial Stability Reports (FSR)’ covering various domestic economic issues along with an overview of the global economic situation. Here is a review of the December 2023 edition of the FSR report.

The global and national economies and their sustainability, stability and growth have been much-debated topics in the 21st century, so much so that the 2030 Sustainable Development Goals urges its signatory nations to aim to achieve higher levels of economic productivity and sustain per capita economic growth. Since the onset of the industrial era, economic security, independence and growth of every individual and the nation have not only been perceived as one of the utmost prioritized aims to be achieved but also as an end in itself.

However, history shows us that the global economy has always gone through upward and downward trends and vice-versa, due to various factors such as geo-political and financial conditions, fragmentation, etc., which have kept economies volatile. This is more so in the recent past with the disruption caused by the COVID-19 pandemic, which according to a 2021 study, has affected the global economy beyond anything in nearly a century. With the restoration of normalcy post-pandemic, the global economies started to grow again and are continuing to do so. However, nations continue to confront numerous economic challenges of both pre- and post-pandemic period. In such a scenario, the assessment of the economic stability of nations on the current date and with future projections becomes vital to formulate various measures necessary to ensure economic sustainability, security, and growth.

The Reserve Bank of India (RBI) publishes half-yearly reports titled ‘Financial Stability Reports (FSR)’ covering various domicile economic issues that are prevalent on the current day, with the details showcasing the trends and various economic prospects, along with an overview of the global economic situation.

In this story, we look at the global and national economic scenarios, the economic stability and the challenges which are currently faced by India, as highlighted in the recent December 2023 FSR report.

FSR highlights increasing Global Debt to GDP Ratio and Volatility of Global Economy

In its overview of the Global Macro Financial Outlook, the FSR notes that the global economy is faced with headwind issues such as geopolitical conflicts in the world’s biggest grain and oil supplying regions, geo-economic fragmentation, relatively tighter financial conditions, large fiscal imbalances and elevated public debt, and heightened uncertainty on the evolving economic outlook. Owning to these, the report notes that the volatility has increased in certain segments of financial markets and thus the financial stability challenges have become accentuated. Some of the important global challenges noted in the FSR are as below:

Slowing Growth Rates: The FSR highlighted that as per the International Monetary Fund (IMF), the overall economic growth rate would decline from 3% in 2023 to 2.9% in 2024, which is below the average of 3.8% during the pre-pandemic period (2000-19). Along with this, the growth in World Trade is projected to fall from 5.1% in 2022 to 0.9% in 2023. Though it is projected to increase to 3.5% in 2024, it will be below the pre-pandemic (2000-19) average of 4.9%.

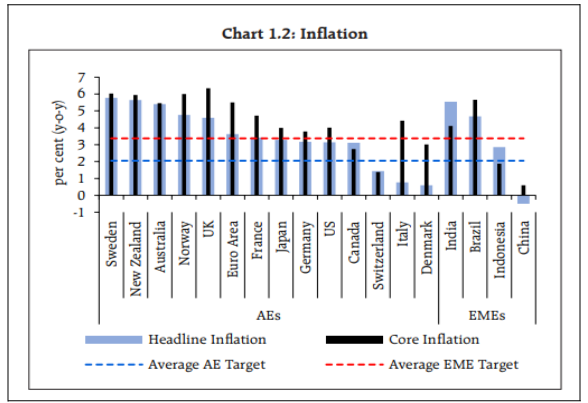

Increasing Inflation Rates: The inflation rates across the Advanced Economy (AEs) Countries and Emerging Market Economy (EMEs) Countries were found to be above the targeted levels of December 2023, on a year-on-year (y-o-y) basis.

The above graph shows that in some of the AE and EME countries, both core and headline inflation rates were above the targeted levels of inflation rates. Only Switzerland among AEs and China among EMEs had both headline and core inflation rates below the targeted levels, while the AEs like Italy and Denmark had headline inflation rates below the targeted levels. India, the EME country, had both core and headline inflation rates above the targeted levels.

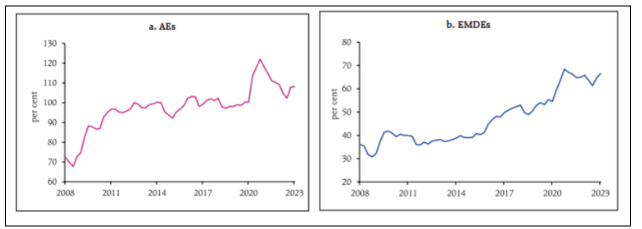

Mounting Public Debt: Mostly importantly, the FSR highlighted the steeping levels of outstanding public debt of both AEs and Emerging Markets and Developing Economies (EMDEs). In the year 2008, the overall Public Debt to GDP ratio was about 72% and 35% respectively for AEs and EMEDs. But it has increased steeply over the years and is projected to be about 93% and 65% respectively for AEs and EMDEs by the end of 2023. By 2028, it is further projected to increase to 116.3% and 78.1% for AEs and EMDEs, respectively.

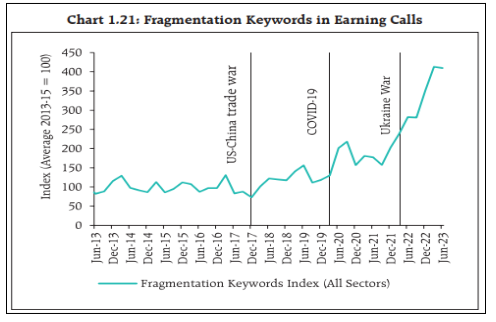

Geo-economic Fragmentation: The FSR also highlighted that certain historical events such as the US-China trade war, COVID-19 and the Ukraine war have caused higher geo-economic fragmentation, and the ‘Fragmentation Keywords Index’ for all sectors has tripled from a base value of 100 in 2013 to about 400 in 2023. Such fragmentation poses macro-financial risks in different forms such as trade barriers, disruption in capital flows, ruptures in commodity markets, technological decoupling, and migration restrictions, which threaten to reverse the benefits of global integration.

Along with these issues, the FSR also mentioned other issues such as the vulnerability of AEs in bond markets, cyber security, climate finance, etc. Specifically on the issue of bond markets, the report highlighted that globally, the number of corporates that have defaulted in bond payments has increased to 118 in September 2023, almost double the amount on a y-o-y basis.

Summing up these global issues, the FSR stated that these numerous global economic challenges and issues are projected to further increase further in the near future. Therefore, it states that the global economy’s sustainability and growth remain volatile and unpredictable.

India Economy is Resilient, though some challenges persist

The FSR also stated that though the global economy is faced with multiple challenges which render it volatile and susceptible to macro-economic shocks, the Indian economy is resilient to such shocks as it is characterized by strong balance sheets derived from various positive economic factors and prudent policies.

At the same time, the FSR also states that though the Indian economy is resilient, the global external factors and spillover effects such as a slowdown in world trade, tighter global financial conditions, increasing fragmentation and geopolitical strife remain contingent risks to external demand.

Some of the salient aspects highlighted about the Indian economy in the FSR are as below:

Decline in Inflation Rates: The headline inflation which was at its peak at 7.4% in July 2023 has come down to 5.6% in November 2023. However, it remains susceptible to food shocks. The core inflation has eased up to 4.1%, the lowest since 2020.

Improvement in Capital Inflows: Though the global economic atmosphere is volatile, the capital inflows have increased and the net inflows of foreign portfolio investments (FPI) in the year 2023-24 (up to 20 December 2023) was US$ 30.6 billion, as against net outflows of US$ 3.3 billion during the same period in the previous year.

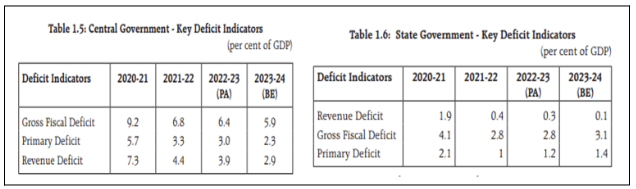

Decline in Gross Fiscal Deficit (GFD): The GFDs of both central and state governments have comparatively declined. While the central government’s GFD has decreased from 9.2% during the pandemic period of 2020-21 to 5.9% in 2023-24 (as per budget estimates), the overall state governments’ GFD has decreased from 4.1% to 3.1% during the same period.

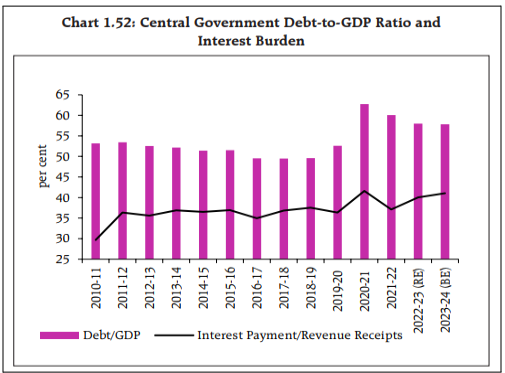

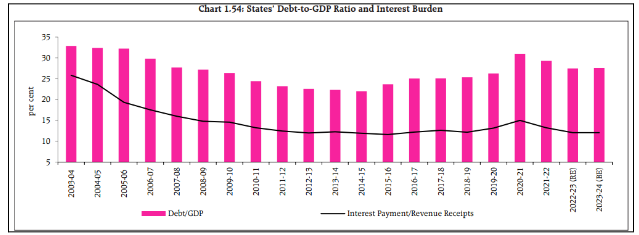

Decline in Debt-to-GDP ratio: Together with GFD, the ratio of Debt to Gross Domestic Product (GDP) of both Central and State governments has also decreased during the pandemic period. The central government debt-to-GDP ratio is projected to fall from 62.8% during the pandemic-period to 57.4% in the year 2023-24 (as per budget estimates), while the state debt-to-GDP fell from 31% during pandemic-period to 27.5% by March 2023.

Banking Sector Soundness: The report notes that the domestic banking system remains resilient, bolstered by strong buffers, robust earnings, and the ongoing strengthening of balance sheets. To demonstrate this, the FSR has also presented figures of growth in various factors which show the soundness of the banking sector in India. These include a decline in the ratio of Gross Non-Performing Assets (GNPA) and Net Non-Performing Assets (NNPA), strengthened earnings as reflected in Return of Asset, Return of Equity (RoE), etc.

Together with these, the FSR also highlights the growth in the economy can be witnessed in the growth of other sectors such as Non-Banking Financial Companies (NBFCs), microfinance, increased lending of banks to Micro, Small and Medium Enterprises (MSME), etc.

Analysing all these factors and trends in the growth of pertinent sectors, the FSR stated that the Indian financial system has seen an easing of stress during the first two quarters of 2023-24, as indicated by the Financial System Stress Indicator (FSSI). In summary, the FSR states that the Indian economy has sustained momentum and resilience.

Higher Debts and Guarantees Remain Continent Challenges to India

Though the FSR highlights positive trends in the Indian economy, its growth and resilience, it also states that “Global spillovers, rising interconnectedness in the domestic financial sector and the increasing role of NBFCs in the provision of financial services remain contingent risks. Banking capital, regulatory prudence, and strong balance sheets, however, should ensure that the domestic banking system is well positioned to withstand shocks and support the productive needs of the economy.”

One of the key issues highlighted in the report is the issue of prevailing debts of both central and state governments. The data presented in the FSR shows that the ratio of debt to the total GDP of both centre and all states stands at an average of over 50% and 30%, respectively.

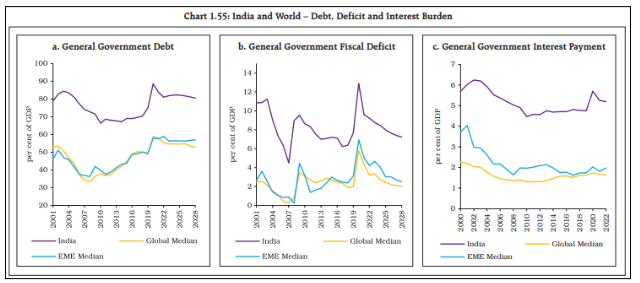

The above data shows that the Debt to GDP ratio has never been under 50% for central government during the period of 2011-12 to 2023-24 and below 30% for state governments during the period of 2003-04 to 2023-24. Along with these, the report also highlights that when compared to the median average of global countries, including the EME countries, India’s debt, fiscal deficit, and interest payment ratios to the total GDP are way above the global average median figures.

It is important to note that the Fiscal Responsibility and Budget Management Act (FRBMA) passed in the year 2003 mandated the Indian government to limit the overall debt of the central government to below 40% of the GDP and the overall debt of the general government (both state and central governments) to 60% of the GDP by 2024-25. However, the above data shows general government’s debt is about 80% from the year 2001 to the current year, and it is projected to be about the same figure even by the year 2028. Therefore, the higher debt is one of the major issues despite considerable progress that has been witnessed in GDP growth y-o-y.

Along with these, the increasing amounts of guarantees that are given by the state governments are another potential fiscal contingent liability in addition to the outstanding debt. The recent RBI working group report highlighted several issues about the increasing trend in the total sum of the guarantees (as a percentage of GDP) given by the state governments.

Factly’s stories on state governments’ debts, guarantees and previous FSR of RBI can be accessed here, here & here

At present, India has to deal with these pressing issues of rising government debt and guarantees of central and state governments, though the progress in economy, GDP and other economic aspects are evident. In addition, as highlighted in the FSR, the changing climate and its consequential economic impacts, the global economy’s volatility, etc. remain impeding challenges to India.