RBI released the 26th edition of the Financial Stability Report (FSR) in December 2022. The report touches upon global macro financial risks & analyses the health of Scheduled Commercial Banks (SCBs) in India.

The RBI recently released the 26th edition of the semi-annual Financial Stability Report (FSR) for December 2022. The nature and magnitude of risks and their implications which may affect the macroeconomic environment, financial institutions, markets, and infrastructure are reviewed in the report. The current status of different financial institutions, the state of credit growth, and the vulnerability of the financial system are some of the important topics covered in the report. An assessment of the resilience of the financial sector is also conducted through stress tests. The report is the collective assessment of the sub-committee of the Financial Stability and Development Council (FSDC), with inputs from other financial sector regulators such as RBI, SEBI, IRDAI including the Ministry of Finance.

Major international organizations have cut their global growth projections for 2023

Global macro-financial risks have increased amidst economic, financial, and political shocks. The report noted that the interplay of multiple shocks has led to the tightening of financial conditions and increased volatility in financial markets. The global growth projections of international organizations like IMF, World Bank, and OECD have been cut in comparison with the previous revisions. The global growth in 2023 is anticipated to drop to 2.7%. IMF notes a 25% chance that global growth will fall below 2% in 2023. Both advanced economies and emerging market and developing economies (EDMEs) may experience significant output slowdown while global trade volume decelerates, and inflation rises.

In short, the global economy is contending with significant roadblocks along with recessionary risks. In the case of EMDEs, global spillovers, debt fragility, currency volatility and capital outflows have resulted in harsher challenges. These global conditions are also affecting the Indian economy. However, the report notes that strength from the robust macroeconomic fundamentals has helped the Indian economy and domestic financial system remain strong despite the severe global risks.

This story focuses on the health of Scheduled Commercial Banks (SCBs) in the country which has been assessed on the basis of their recent performance, asset quality, capital adequacy, and risks, as per the FSR. Banking stability is considered a yardstick to determine whether an economy is sufficiently strong enough to withstand both internal and external shocks. The extent of financial stability in the economy and its ability to absorb shocks is determined by the stability in the banking sector.

Credit growth touched decadal high of 17.4% in December 2022

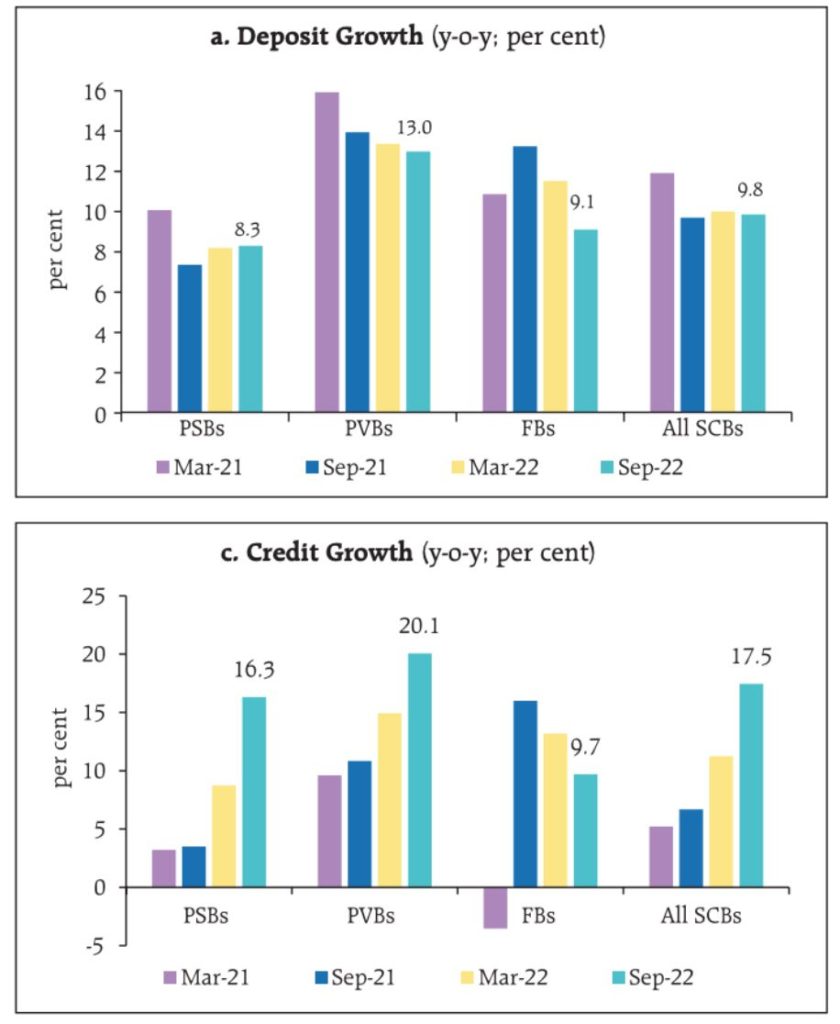

Credit growth year on year (y-o-y) of SCBs has been on an upward trajectory since the second half of 2021-22 indicating a continued rise in demand for loans in the economy. It touched 17.4% as of December 2022, the highest since 2011. The increase has been broad-based across geography, economic sectors, population groups, organizations, types of accounts and bank groups. The credit growth was much higher in Private Sector Banks (PVBs) as compared to Public Sector Banks (PSBs). Meanwhile, aggregate deposits in SCBs grew by 9.8% (y-o-y). According to the RBI Governor, the deposit growth looks low because of the base effect of the previous years.

GNPA and NNPA of all SCBs have declined

The Gross Non-Performing Asset (GNPA) ratio of all SCBs continued to decline and stood at a seven-year low of 5% in September 2022, down from 5.9% in March 2022 as a result of a decrease in slippage, an increase in write-offs and the continuous improvement in loan growth. During this same period, the net non-performing assets (NNPA) ratio stood at a ten-year low of 1.3%. The NNPA Ratio in March 2022 was 1.7%.

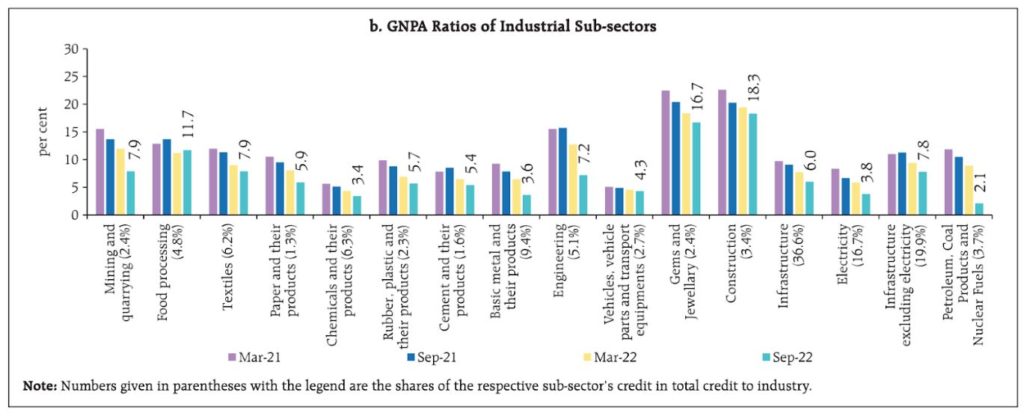

Among the different types of banks, PVBs’ NNPA ratio dropped to below 1% in the first half of 2022-23. Sectoral analysis reveals the improvement in the GNPA ratio across most sectors. With respect to the industrial sector, the ratio continued to improve across all sub-sectors except food processing. It remained elevated for gems and jewellery and construction sub-sectors like in the previous half year. Also, the asset quality in the personal loans segment improved in the first half of 2022-23, particularly for housing and vehicle loans.

NPA growth has increased among small borrowers in the last 1.5 years

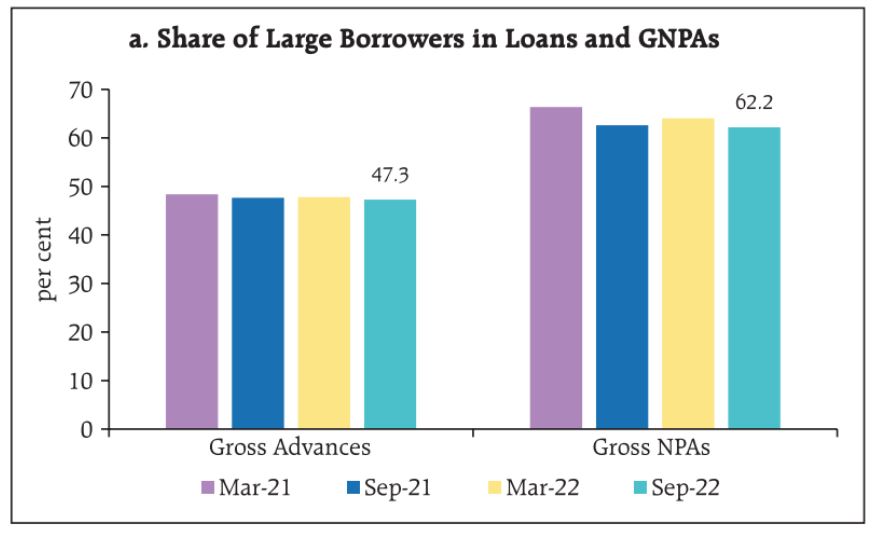

The share of large borrowers in SCBs’ loans has been declining in recent years. From accounting for nearly 53% in March 2021, their share dropped to 47.7% in March 2022 and further down to 47.3% in September 2022. This points towards a decline in credit concentration and diversification of borrowers. Simultaneously, their share in total GNPAs dropped from 77.9% in March 2021 to 62.3% in March 2022 and marginally moderated to 62.3% in September 2022. This indicates that NPA growth has increased among small borrowers in the last 1.5 years. The GNPA ratio of large borrowers has also been declining over the last two years and touched 7.7% in March 2022.

Number of indicators considered in macro stress tests has been increased

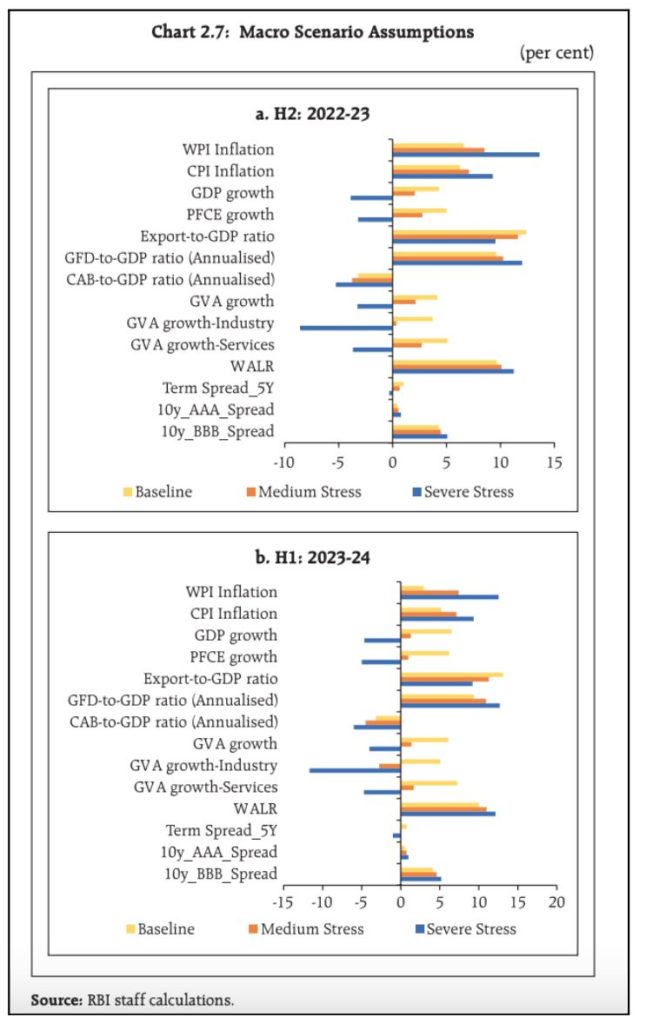

RBI’s macro stress test is used to test how resilient SCBs are to unexpected changes in the macroeconomic environment. The model outcomes of the test help banks in decision-making. Three different plausible scenarios have been considered here to evaluate the bank’s financial position under the hypothetical conditions. These are baseline scenarios derived from the forecasted values of macro variables and two adverse scenarios- medium, and severe stress. Since the 25th edition, RBI included a wider set of macroeconomic and macro-financial indicators- about 14 indicators, in the model. Only about 6 such indicators were considered in the older reports. The indicators considered and their values used in the test as per RBI’s calculations is given below.

As per the macro stress test, SCBs are well placed to adapt to the macroeconomic shocks

The macro stress test indicates that SCBs can comply with the minimum capital requirements under severe stress scenarios as well. That is, SCBs are well capitalized with the capacity to absorb macroeconomic shocks even in the absence of any further capital infusion by stakeholders. The capital-to-risk weighted assets ratio (CRAR) at the system level in September 2023 is projected at 14.9%, 14% and 13.1%, under baseline, medium and severe stress scenarios respectively.

Further, the test also shows that the GNPA ratio of all SCBs may improve from 5.0% in September 2022 to 4.9% by September 2023, under the baseline scenario. If the macroeconomic environment worsens to a medium or severe stress scenario, the ratio may rise to 5.8% and 7.8%, respectively. Across banks, GNPA ratios of PSBs may rise from 6.5% in September 2022 to 9.4% in September 2023, while for PVBs, they may go up from 3.3% to 5.8% under the severe stress scenario.

RBI raised concern over virtual assets as they form an unstable ecosystem

The report also touched upon cryptocurrency or digital currency. It was skeptical over the future of the asset class and added that they form an unstable ecosystem. Referring to the failure of TerraUSD/Luna, FTX and Celsius, the report states that crypto assets remain highly concentrated and interconnected. To minimize the risk associated with such volatile assets, RBI suggested the use of the ‘same-risk-same-regulatory-outcome’ principle through which the virtual currency be regulated like traditional financial intermediaries and banks. The other option suggested was the prohibition of crypto assets since their real-life use cases were next to negligible.