The growing trend of financial guarantees given by the State Governments in India have been at the forefront of discussions in the recent times. The recent Reserve Bank of India’s Working Group Report (WGR) titled ‘Report on the Working Groups of State Government Guarantees’ has brought to limelight several issues and challenges relating to issuance and regulation of Guarantees by State Governments in India.

The growing trend of financial guarantees given by the State Governments in India has been at the forefront of discussions in recent times, due to its potential future contingent fiscal liability which affects the financial health of the governments and in turn the people.

The issuance of guarantees by the State Government is not new in India. But, due to the increasing number of guarantees and the high possibility of negative financial implications which can be caused due to the lack of proper checks and balances, administrative and legal measures, and other such reasons, the issue has been under considerable debate in the recent past.

While there have been some key legal and administrative developments at the Central level in the issuance and regulation of Guarantees, the recent Reserve Bank of India’s (RBI) Working Group Report (WGR) titled ‘Report on the Working Groups of State Government Guarantees’ has brought to limelight several issues and challenges relating to issuance and regulation of Guarantees by State Governments in India. Accordingly, the report has recommended measures that can be implemented to safeguard and ensure the financial health of the State Governments

Against this backdrop, we look at what Financial Guarantees are, the Administrative and Legal setup at the Central level, and current challenges at the State Level, as indicated in the WGR.

Guarantees are not direct Loans taken by Governments, but Potential Contingent Fiscal Liabilities which are considered as Debts/Loans

The Indian Contract Act, of 1872 defines Guarantee as a “contract to perform the promise, or discharge the liability, of a third person in case of default. Where only two parties are involved, i.e. where one party promises to save the other from loss caused by the conduct of the promisor himself, or by the conduct of any other person, such a contract is called a contract of indemnity.”

As per the above definition, the State Governments that issue Guarantees become liable in case of the default of loans by the loanee. In other words, the Public Sector Enterprises (PSEs) which undertake various types of projects or activities with projected social and economic benefits source their funding from institutions such as banks and other financial institutions in the form of loans. In such cases, the State or Central Governments become Guarantors or Promisors, in case of the eventuality where the PSEs default in clearing the debts, the onus of clearing them falls on the respective government as the contingent liable parties to clear the pending debts or loans. The principal objective with which the guarantees are given is to make them economically viable and to aid them in raising loans at lower rates.

Therefore, the WGR defines a Guarantee as “potential future liability that is contingent on the occurring of an unforeseen future event. If these liabilities get crystallised without having adequate buffer, it may lead to increase in expenditure, deficit, and debt levels for the State Government”

Several Administrative and Legal Developments at the Central Level in recent times

The system of governments acting as Guarantors on behalf of entities that take loans is most likely to have existed from the days of Independent India. However, there are no uniform applicable laws, rules, processes, and other such measures which are applicable equally to both State and Central Governments.

The recent (2022) policy document on Government Guarantees notes that the first ever basic instructions given on guarantees date back to May 1969, wherein it was stipulated that the guarantee proposal must be justified in the public interest. Thus, it means that the system of giving guarantees is likely to have its origin from the times of Independent India.

The same policy document also notes key developments in the administrative and legal measures on the issuance and control of Guarantees issued by the Government of India, which are summarized in the table below:

| Year | Development |

| May, 1969 | Basis Instructions on Guarantees were issued |

| December, 1994 | Guarantees Approval was Centralized with mandate obtaining prior approval from the Union Ministry of Finance |

| 1992 and 1993 | A uniform Guarantee fee for Domestic and External Borrowing was prescribed |

| 2002 | A vital decision was taken to not give guarantees in favour of Private Companies or Institutions |

| 2003 | Fiscal Responsibility and Budget Management Act was passed, which stipulated that the Central Government should not give additional guarantees with respect to any loan on the security of the Consolidated Fund of India in excess of one-half percent of gross domestic product, in any financial year |

| 2017 | The Financial Rules were revised, regulating the entire gamut of Sovereign guarantees, including guidelines for grant, review, accounting and monitoring of sovereign guarantees, submission of periodical reports, etc |

| 2022 | Government Guarantee Policy is Promulgated, wherein Guidelines have been issued with regard to proposal, approval, issuance, and monitoring of guarantees have been prescribed |

The table shows that there have been several key legal and administrative developments in several aspects related to the regulation of guarantees by the Government of India. However, when it comes to State Governments, there are no equal and uniform legal and administrative measures made as of today, when compared to the same measures developed at the Central Level. Some of these issues have been reported in the working group report.

Working Group Report notes Several Pressing Issues in Guarantees given by State Governments

The working group, comprising of members from the Union Ministry of Finance, RBI, and some State Governments, was constituted in July 2022, to assess the inherent risks associated with guarantees issued by State Governments on the fiscal health of states. The key issues noted by the group and pertinent recommendations made in its report are as follows:

Uniform Definition of Guarantees should be incorporated: The report noted that Guarantees are given by State Governments in various forms such as Conditional/Unconditional/Financial/ Performance Guarantees, Instruments, etc. Though the nature and scope of each of these are different, yet they are contingent liabilities on the part of the States. Accordingly, the report recommended for stipulation of a broader definition which would include all types of instruments and guarantees where the state government would have contingent liability.

Purposes for which Guarantees can be issued should be clearly defined: To ensure financial viability, and to enable state/central governments to raise loans at lower rates, and other reasons, the report recommends that the purposes for which Guarantees can be given should be clearly defined in line with Rule 276 of General Financial Rules, 2017

Uniform Ceiling on Guarantees should be stipulated: The report noted that the total sum of guarantees given by the states each year has been increasing across most of the states in recent years.

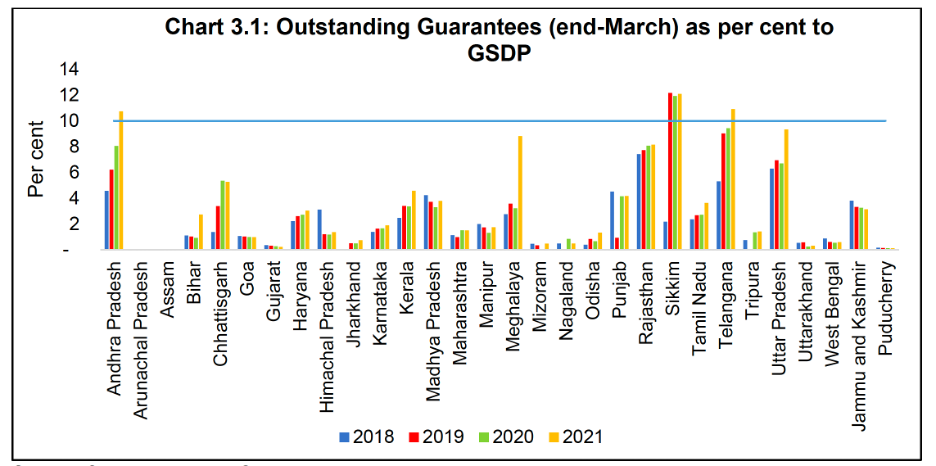

Source: Working Group Report

The above data shows the increase in the total amount of guarantees given each year across most of the states from the year 2018 to 2021. The States of Sikkim, Andhra Pradesh, and Telangana have crossed 10% of their annual GSDP being given as guarantees. Therefore, the report recommends that there should be a uniform ceiling on the total quantity of guarantees to be fixed to 5% of Revenue Receipts (RR) or 0.5% of Gross State Domestic Products (GSDP), whichever is lesser

Guarantee Conditions in the Central Guidelines can be incorporated by States: The report noted that the Central government Guarantee Policy stipulated several conditions such as issuance of guarantees only for the principal amount and normal interest component of the underlying loan, non-extension of guarantees to more than 80 percent of the project loan, and for external borrowings, private sector companies/institutions, etc. Accordingly, the report recommended that these guidelines be incorporated by the States also

Assigning of Risk Weight should be done: The report has also noted that one of the important issues that goes unnoticed is the prior assessment of risk factors in giving the guarantees. Pertinently, the report noted that “State Governments have been issuing guarantees on behalf of state public enterprises belonging to various sectors viz. power, co-operative, agriculture, transport, water supply, sanitation, housing, communication, industries, etc. The probability of default could vary across sectors, depending on the financial parameters of the sector and varying impact of macroeconomic shock. Therefore, reporting only the nominal value of guarantees may not present the true picture of the risk that the State Government would be exposed to. States should classify the projects/ activities as high risk, medium risk and low risk and assign appropriate risk weights before extending guarantees”

If such prior assessment and classification of projects is undertaken, it helps in making better decisions on assenting or rejecting of guarantees.

Monitoring Unit should be set up: The report recommended for setting up of an independent institution that would act as a Monitoring Unit, preferably under the Department of Finance, for the purpose of compiling, consolidating, maintenance of the database on guarantees and monitoring the same on a continuous basis

Data Disclosure should be done: The report also highlighted the necessity of regular disclosure and publishing of data relating to guarantees, so that it would help in auditing by institutions such as CAG and RBI. Therefore, it brings transparency in the entire process.

Off Budget Borrowings should be brought under Ceiling: The report also noted that state governments also take up specific projects through state agencies and provide guarantees for them. These projects do not fall within the ambit of the ceiling fixed by the Central Government and are termed as ‘Off Budget Borrowing’, though they are contingent liabilities and not reflected in the budget documents.

Recommendations of the Working Group Report should be taken up

One of the important issues noted in the WGR is that “State Government finances, already constrained by COVID-19 pandemic, have been facing new sources of risks in the form of rising expenditure on non-essential heads, expanding contingent liabilities, and the ballooning overdues of DISCOMs.”

Similarly, the WGR also noted the increasing trend in the number & amount of Guarantees given by State governments – “As upfront cash payment is usually not required in case of guarantees, that may be one of the reasons why the State Government guarantees have profligated in recent times. As these liabilities are contingent upon certain events, the quantum and timing of potential costs / cash outflows owing to guarantees are often difficult to estimate.”

Factly’s earlier story has also highlighted the fact that the total outstanding loans of most of the states have tripled between the years 2011 and 2021. Together with this, as noted by the working group report, the amount of guarantees, which are potential contingent liabilities, given by states is increasing year after year. Thus, these facts show that states are adding to the already existing high debt. Therefore, it poses serious questions on the stipulated objective of “Financial Health” of the States in the short run as well as in the long run.

The perusal of a number of issues noted and recommendations made by WGR shows several lacunae in the legal as well as administrative setup at the State level. Accordingly, the incorporation and vigorous implementation of the several measures that have been recommended by the working group would go a long way in ensuring the financial health of the states.