Reserve Bank – Integrated Ombudsman Scheme, 2021 was launched on 12 November 2021. In this article, we look at the significance of changes brought about by this integrated scheme.

Strong impetus for integrated existing Ombudsman Schemes

The Reserve Bank of India’s (RBI) Integrated Ombudsman Scheme 2021 (RB-IOS) aims to resolve customer grievances in relation to services provided by all entities regulated by the RBI in an expeditious and cost-effective manner. The Integrated Ombudsman Scheme 2021 integrates the existing three Ombudsman schemes of RBI namely,

- The Banking Ombudsman Scheme, 2006;

- The Ombudsman Scheme for Non-Banking Financial Companies (NBFCs), 2018; and

- The Ombudsman Scheme for Digital Transactions, 2019.

These three Ombudsman schemes covered Banking, NBFCs, and Digital Transactions separately. In addition to integrating the three existing schemes, the Scheme also includes under its ambit Non-Scheduled Primary Co-operative Banks with a deposit size of ₹ 50 crore and above. The Scheme adopts the ‘One Nation One Ombudsman’ approach by making the RBI Ombudsman mechanism jurisdiction neutral.

The three abovementioned ombudsman schemes evolved over different periods of time and contained different grounds of complaints and different compensation structures. This led to uneven redress across customers of different financial entities, resulting in unequal treatment of aggrieved customers. Therefore, there was a strong impetus for integrating the existing ombudsman schemes into one and centralising the receipt and initial processing of complaints to impart process efficiency.

In fact, the present Integrated Scheme was prepared on the basis of the recommendations of the Committee (Internal Working Group) set up by RBI to review the existing Ombudsman Schemes. One of the most prominent recommendations made by the Committee was the convergence of the existing Ombudsman Schemes.

One portal, one email, one address

The ‘One-Nation Ombudsman’ is based on one portal, one email, and one address for the customers to lodge their complaints. The complaints under the Scheme made online shall be registered on the portal (https://cms.rbi.org.in). Complaints in electronic mode (e-mail: CRPC@rbi.org.in) and physical form, including postal and hand-delivered complaints, shall be addressed and sent to the place where the Centralised Receipt and Processing Centre of the Reserve Bank is established, for scrutiny and initial processing. A Centralised Receipt and Processing Centre has been set up at RBI, Chandigarh for receipt and initial processing of physical and email complaints in any language (Reserve Bank of India, 4th Floor, Sector 17, Chandigarh – 160017 in this format).

Additionally, a Contact Centre with a toll-free number – 14448 (9:30 am to 5:15 pm) – is also being operationalised in Hindi, English and in eight regional languages (Bengali, Gujarati, Kannada, Odia, Malayalam, Marathi, Tamil, Telugu) to begin with and will be expanded to cover other Indian languages in due course. The Contact Centre will provide information/clarifications regarding the alternate grievance redress mechanism of RBI and guide complainants in the filing of a complaint.

Single point of reference for all complaints against any Regulated Entity (RE)

According to RBI, it will no longer be necessary for the complainant to identify under which scheme he/she is filing the complaint with the ombudsman.

Previously, the customers were required to file complaints under the correct scheme, depending on the Regulated Entity (RE). The complaints had to be filed with the correct ombudsman office, based on the territorial jurisdiction with reference to the branch of the RE being complained against, failing which the complaint would get rejected.

For instance, the non-maintainable complaints formed a sizeable portion of the complaints received during 2019-20. It was observed that complaints were disposed of as non-maintainable largely due to the following reasons.

- being outside the territorial jurisdiction,

- being ‘First Resort Complaints’ (FRCs) – these are complaints made with the Ombudsman directly without having approached the concerned bank or RE first

- not represented properly.

The current Integrated Scheme addresses this concern by integrating all REs into one scheme with a single point of reference for all complaints.

Deficiency in service included as a ground for complaints

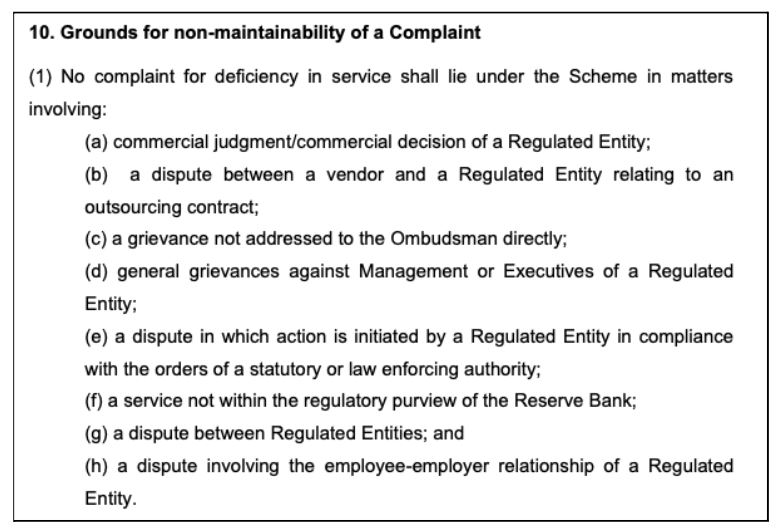

The Integrated Scheme defines ‘deficiency in service’ as the ground for filing a complaint, with a specified list of exclusions. Therefore, the complaints would no longer be rejected simply on account of “not covered under the grounds listed in the scheme”.

Previously, one of the primary concerns was the lack of maintainable grounds on which the consumer could challenge the actions of a regulated entity at the ombudsman or rejection of the complaint on technical grounds.

The Committee (Internal Working Group) set up by RBI to review the existing Ombudsman Schemes is also recommended to increase transparency and consumer awareness.

To achieve that, it suggested to broad-base the grounds of complaints and incorporate only a detailed ‘negative’ or ‘exclusions’ list for rejection of a complaint. The current Integrated Scheme addresses this by including a wider definition of deficiency of services.

Reduction in TAT and cost-free redressal

The time taken in resolving the complaint was also an area of concern. The Committee recommended a reduction in the turnaround time (TAT) for complaint resolution to 30 days in a phased manner over a period of two years.

The current ‘Integrated Ombudsman Scheme’ will provide cost-free redress of customer complaints involving deficiency in services rendered by entities regulated by RBI, if not resolved to the satisfaction of the customers or not replied within a period of 30 days by the regulated entity.

In other words, the customers can escalate complaints to the Ombudsman if the financial institution fails to address the complaint within 30 days. Even when customers are not satisfied with the resolution offered or explanation given by the financial institution, they can approach the ombudsman.

No limit on the disputes brought before the Unified Ombudsman

There is no limit on the amount in a dispute that can be brought before the Ombudsman for which the Ombudsman can pass an Award.

However, for any consequential loss suffered by the complainant, the Ombudsman shall have the power to provide a compensation up to ₹ 20 lakh, in addition to, up to ₹ One lakh for the loss of the complainant’s time, expenses incurred and for harassment/mental anguish suffered by the complainant.

The Scheme document also specifies that the RBI may, if it considers necessary in the public interest to do so, publish the report and the information received from the Ombudsman in consolidated form or otherwise.

A regulated entity has no right to appeal when an Award is issued by Ombudsman

Another key feature of the scheme is that the Regulated Entity will not have the right to appeal in cases where an Award is issued by the ombudsman against it for not furnishing satisfactory and timely information/documents.

The current Integrated Scheme prescribes a 15-days’ timeline for the REs to furnish information/documents to the office of the Ombudsman. By non-furnishing timely and satisfactory replies/documents, REs will lose the right to appeal in cases where an award is issued by the ombudsman against them.

Additionally, the responsibility of representing the regulated entity and furnishing information in respect of complaints filed by customers would be that of the ‘Principal Nodal Officer’ in the rank of a ‘General Manager’ in a Public Sector Bank or equivalent.

The RBI has published a list of entities covered under the new integrated scheme on the CMS portal. In addition, it has also published a list of entities not covered under the new scheme.

With the growing prominence of digital payments, the current ‘Integrated Ombudsman Scheme’ may come to the rescue of customers more efficiently. A grievance redressal mechanism that promotes financial consumer protection will boost customer confidence in the country.

Further Information: Complaints of the customers of entities not yet covered under the RB-IOS (Urban Co-operative Banks with deposits of less than ₹ 50 crores, NBFCs with assets of less than ₹ 100 crores, Housing Finance Companies, Core Investment Companies etc.) are handled by the Customer Education and Protection Cells (CEPCs). The process of filing complaints with CEPCs is the same as under RB-IOS.

Featured Image: One Nation One Ombudsman