Like in the case of the Banking Ombudsman, the disposal rate of complaints received under both the Ombudsman scheme for NBFCs & Digital Transactions increased in the year 2020-21. A substantial number of complaints are still non-maintainable which is a cause for concern.

Apart from the Banking Ombudsman Scheme which resolves complaints relating to Banking transactions, the facility of Ombudsman also exists for any complaints relating to Non-Banking Financial Corporations (NBFCs) & Digital Transactions.

The Ombudsman Scheme for Non-Banking Financial Companies (OSNBFC) was introduced in 2018, for enabling the resolution of complaints regarding NBFCs registered with the Reserve Bank of India (RBI). The Ombudsman Scheme for Digital Transactions (OSDT), was introduced in 2019, to facilitate the settlement of complaints regarding digital transactions of customers of System Participants. System participant implies any person ‘other than a bank’ participating in payment under Payment and Settlement System Act, 2007. Even these two schemes are part of the RBI’s recently launched Integrated Ombudsman Scheme 2021 (RB-IOS).

In this story, we analyze the trends relating to OSNBFC & OSDT, as per the information provided in the Annual Report of Ombudsman Schemes for the year 2020-21.

90% increase in the complaints received under OSNBFC

In the first year after the OSNBFC was introduced i.e., during 2017-18, only 675 complaints were received. During the first complete year of operation during 2018-19, a total of 3,991 complaints were received. In the ensuing year of 2019-20, there was an exponential increase by almost 5-times in the number of complaints received under OSNBFC with 19.43 thousand complaints. During the transition year of 2020-21, a total of 26.95 thousand complaints were received for the 9-months between June 2020 and March 2021. A year-on-year (YoY) comparison between 2019-20 (July-March) and 2020-21 (April-March) shows a 90% increase in the number of complaints received under OSNBFC.

A major share of the complaints received was through online mode with 47.2% of total complaints in 2020-21(July-March), closely followed by an e-mail with 46.4%. There is an increase in the proportion of complaints received online, compared to 2019-20, when it was 39.8%.

40% of the complaints received by the New Delhi office of OSNBFC

The OSNBFC is administered through four offices located in New Delhi, Kolkata, Mumbai & Chennai to handle the complaints from North, East, West & South respectively. During 2020-21 (June-March), the greatest number of complaints was received by the New Delhi office with 10.7 thousand complaints. This accounts for 39.7% of all the complaints received under OSNBFC. The New Delhi office overtook Mumbai’s position in 2020-21.

Mumbai office received 31% of the complaints in 2020-21. However, in the previous year, it received the greatest number of complaints with over 8 thousand and constituted 41.2% of the total complaints in 2019-20.

Chennai & Kolkata offices have also witnessed an increase in the share of the complaints received in 2020-21. Chennai office, handling the complaints in the South zone accounted for 21.7% of the total complaints in 2020-21.

As was in the case of the banking ombudsman, the cost of handling a complaint decreased with the increase in complaints handled by a specific office. The average cost of handling a complaint during 2020-21was Rs. 1,025 in New Delhi and Rs. 1,235 in Mumbai. Comparatively, it is higher in Kolkata & Chennai with Rs. 3,617 and Rs. 2,107 respectively. The average cost of handling a complaint under OSNBFC is Rs. 1,692, slightly more than the cost of handling a complaint by the banking ombudsman.

The greatest number of complaints about Non-Adherence to FPC

Around 51.5% of the complaints received in 2020-21 were related to non-deposit-taking NBFCs while 32.8% were about deposit-taking NBFCs. Among the complaints received in 2020-21, 54.8% were the complaints relating to ‘Non-adherence to FPC’. FPC implies Fair Practices Code to be followed by NBFCs. Out of the 26.9 thousand complaints in the year, 14.75 thousand were under this category. Even in the previous year i.e., 2019-20, this category constituted the greatest number of complaints, though their share was lower.

Non-observance of RBI directions constituted the second-highest category, with 11.1% in 2020-21, but the share of these complaints fell from 18.6% in 2019-20. Levy of Charges without prior notice and non-transparency in contract/loan is the other major categories under which complaints were received. The share of non-transparency in contract/loans has reduced in 2020-21.

95% of the complaints under OSNBFC were disposed

Out of the 29.35 thousand complaints handled under the OSNBFC in 2020-21, 28.03 thousand were disposed of. This accounts for a 95.5% disposal rate. About 1.3 thousand complaints were carried forward to the next year.

The disposal rate was a slight improvement over the last year when it was already a high of 95.3%. Despite an increase in the number of complaints received, the disposal rate was not affected.

In 2018-19, when the total complaints handled were much lower at 4.02 thousand, the disposal rate was 99%.

Another improvement observed in 2020-21 is the fall in the number of long pending complaints. In 2019-20, out of the 908 complaints pending at the end of the year, 281 were more than 3 months old. However, in 2020-21, out of the 1,319 complaints pending at the end of the year, only 197 were pending for more than 3 months.

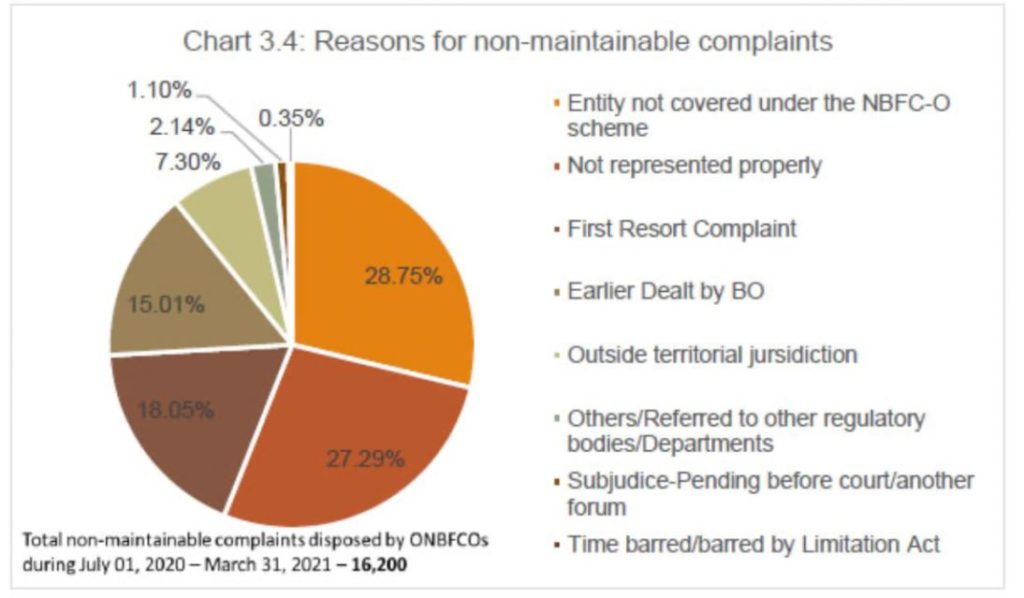

Out of the total complaints handled, non-maintainable complaints have the major share with 55.2%. Of the 11.83 thousand maintainable complaints disposed of in 2020-21, 3.49 thousand were related to Bajaj Finance Limited. About 73.7% of the maintainable cases disposed of were through mutual agreement/settlement, while about 26.2% of the disposed cases were rejected.

The three major reasons for non-maintainable complaints were:

- entity not being covered under the OSNBFC

- complaints not being represented properly

- the complaints being FRCs

99.1% of the complaints handled by OODTs were disposed of in 2020-21.

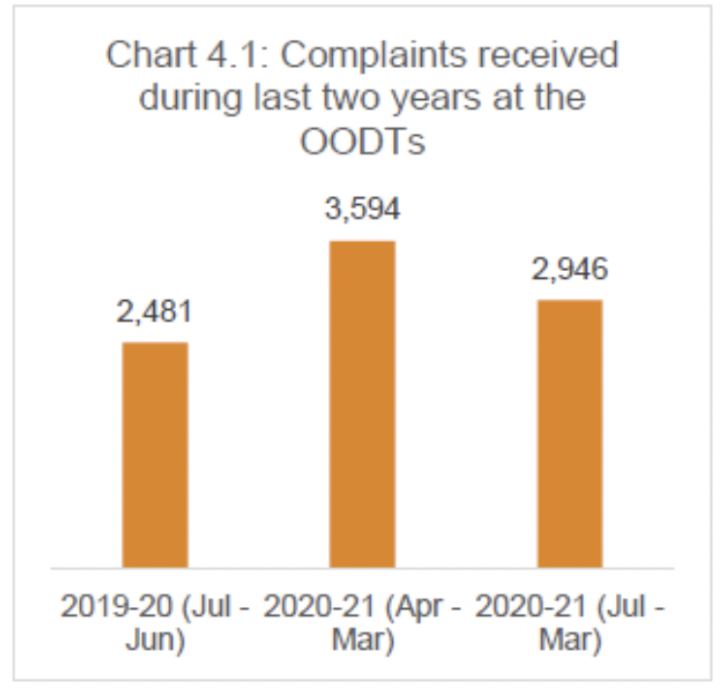

There was only a slight increase in the number of complaints received under OSDT. In 2020-21 (July-March), a total of 2,946 complaints were received in 9 months. In 2019-20, 2.48 thousand complaints were received. As per YoY comparison, 3.59 thousand complaints were received in 2020-21(April-March).

92.7% of the complaints in 2020-21 (July-March) received were online. This was an improvement of over 90.2% in 2019-20.

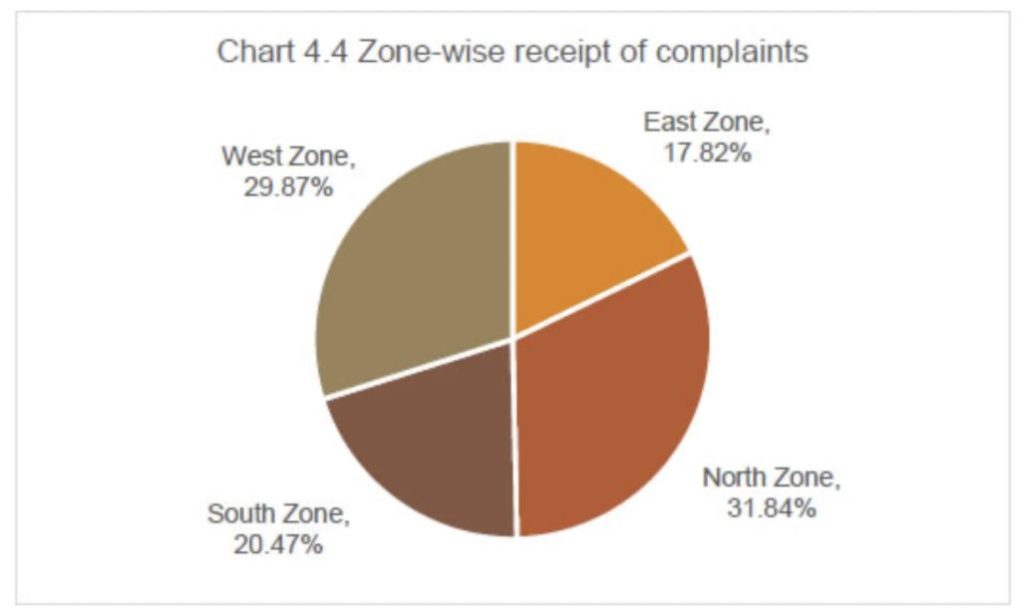

85.8% of the complaints received were about pre-paid payment instruments. 31.8% of the complaints received were from North Zone, followed by West Zone. There are 22 offices under the OSDT among which the greatest number of complaints were received by the Mumbai-II office, followed by the Delhi-I & Bhopal offices.

3.17 thousand out of the 3.20 thousand complaints handled under the OSDT in 2020-21 were disposed of i.e., a disposal rate of 99.1%. A total of 230 complaints were carried forward from the previous year. In 2019-20, the disposal rate was 90.9 %. By the end of 2020-21, only 28 complaints were pending of which 18 were less than one month old.

51% of the complaints under OSDT were about Fund Transfers/UPI etc.

Of the 2,946 complaints received in 2020-21 (July-March), 1,507 complaints were about ‘Fund Transfers/ UPI/ BBPS/ Bharat QR Code’. This accounts for 51% of the total complaints received in 2020-21. Even during 2019-20, most complaints belonged to this category, but with a lower share of 43.9%.

Complaints relating to Mobile or Electronic Fund Transfers constituted 22.9% of the total complaints in 2020-21. In the previous year, they had a higher share of 24.1%.

Disposal Rates higher under OSNBFC & OSDT

Like in the case of the banking ombudsman, the disposal rates by the ombudsman for NBFC and digital transactions are higher and have improved in 2020-21. Most of the complaints were disposed of through mutual agreements. Among the complaints which were non-maintainable, many of them were first resort complaints and the complainants did not reach out to the service providers before contacting the ombudsman.

The 2020-21 annual report for all the three ombudsman makes it clear that the disposal rate across the ombudsman scheme has improved in 2020-21. With the launch of the integrated scheme, one hopes that this would continue to improve.

Featured Image: BI’s Annual Report of Ombudsman Schemes