Both the Central & State governments have appealed to corporates & citizens to donate to the respective funds in order to help the governments combat COVID-19. Contributions are pouring into these funds. However, unlike the contributions to the PM CARES or the PMNRF, contributions made to CMRF at the state level are not treated as CSR expenditure. We look into this issue in detail.

The government of India has on 28 March 2020, announced the constitution of a new trust fund called ‘PM CARES’ as part of fight against COVID-19. The rationale of creating a new Trust fund to handle an epidemic, when PMNRF already exists for the same purpose, has been questioned by many. Factly has earlier written a story on this issue.

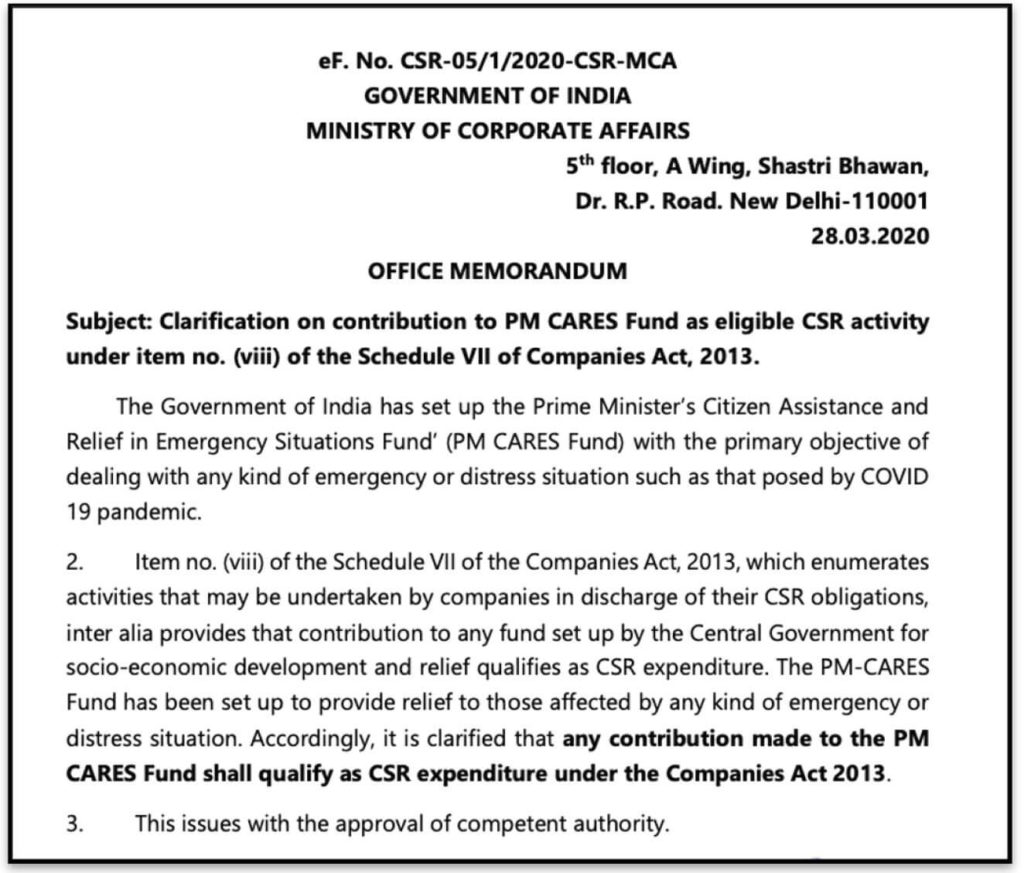

The press release that followed the tweet of the Prime Minister, had scant details of ‘PM CARES’. Subsequently, clarifications were issued by the government about some of the aspects related to this new Trust fund. One such is the memorandum issued by Ministry of Corporate Affairs (MCA), regarding the eligibility of contributions made towards PM CARES as CSR spending. As per this memorandum, all the contributions that are made to PM CARES shall qualify as CSR expenditure under the Companies Act 2013.

What is CSR expenditure?

Section 135 of the Companies Act 2013 mandates qualifying companies to spend a stipulated amount under Corporate Social Responsibility (CSR). As per the existing provisions, every company that fulfils any of the below criteria (during a financial year) is required to constitute a CSR Committee.

- Net worth of Rs. 500 crores or more

- Turnover of Rs. 1,000 crore or more

- Net profit of Rs. 5 crore or more

The company is required to spend every financial year, at least 2% of the average net profits made during the three immediately preceding financial years towards their CSR activities.

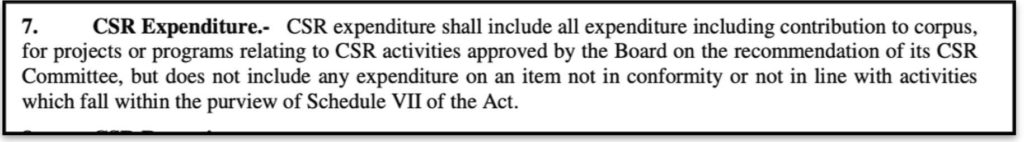

Companies (Corporate Social Responsibility Policy) Rules, 2014 later notified by the Central Government state that CSR expenditure includes expenditure made towards the CSR activities which are approved by the board and recommended by CSR committee and are in line with the permissible activities listed in Schedule VII of Companies Act 2013.

Contribution to relief fund set up Central Government is part of the approved list

In the clarification issued post the announcement of PM CARES fund by the Prime Minister, the MCA alluded to item (viii) under Schedule VII of Companies Act 2013 to justify the qualification of contribution to PM CARES as permissible CSR expenditure.

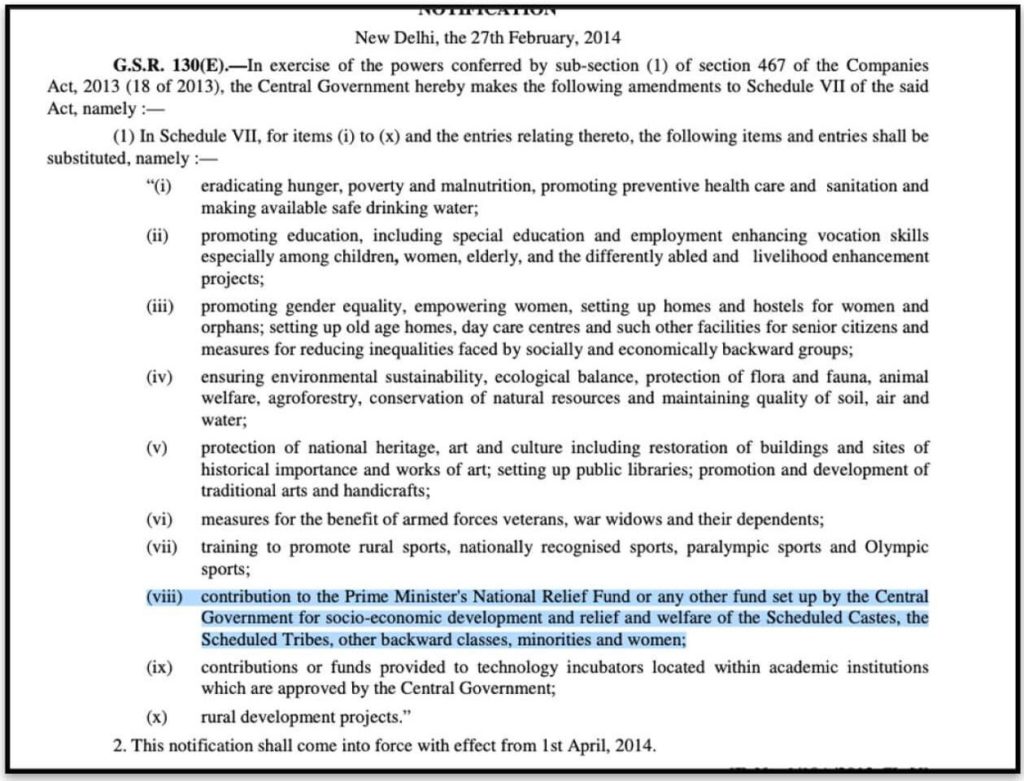

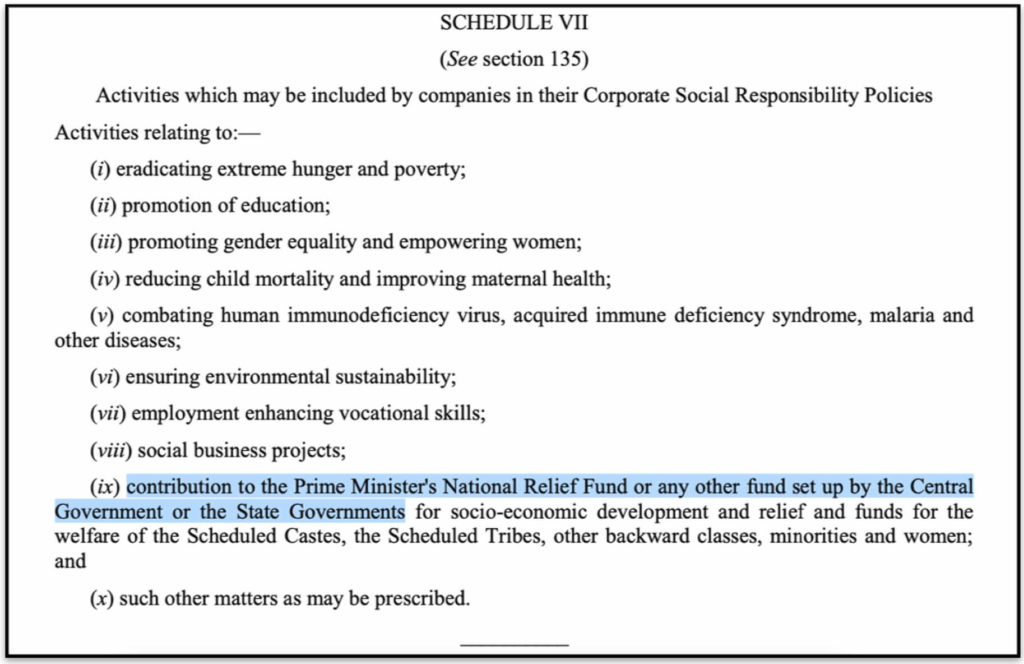

Section VII of Companies act 2013 provides the list of activities that are eligible to be considered as CSR activities and any expenditure incurred towards these activities will be counted as CSR expenditure.

As per this list, item (viii) refers to the contributions that are made to PMNRF or any other fund which is setup by the Central government for Socio-economic development, relief, welfare of SC, ST, BC, minorities and women.

Since PM CARES fund is established to provide relief for emergency & distress situations, the contributions made to it are eligible to be treated as CSR expenditure by companies.

Contributions to State relief funds not qualified as CSR expenditure

While the purpose of creating a PM CARES despite the existence PMNRF has not clearly explained by the government, one of the points being put forward informally is that it would be a more dedicated fund to be used for the epidemic on hand and any others that arise in the future.

Since the respective State governments are at the fore-front of tackling the current epidemic, there are suggestions around the need for contributions to be made to support the state efforts. CM relief funds and other State relief funds are few sources through which the states can raise the required resources to be utilized for relief activities.

Apart from the individual contributions, donations from corporates form a major part of the contributions made to such relief funds.

Since the contributions to the new fund i.e. PM CARES will be considered as permissible CSR expenditure, there were queries around the eligibility of contributions being made to Chief Minister’s Relief Fund (CMRF) at the state level.

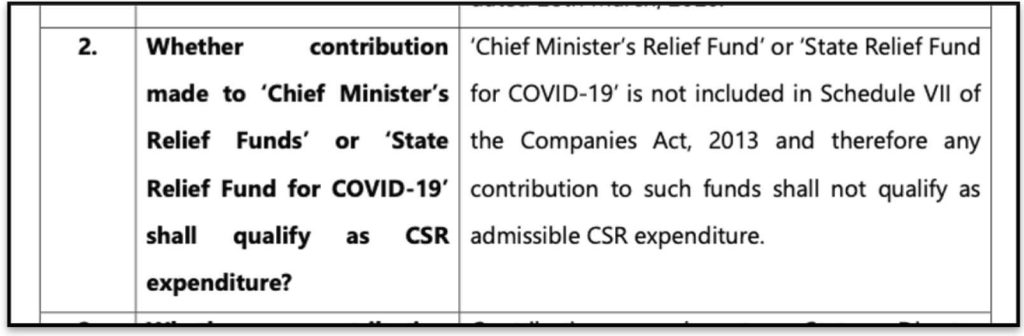

To provide clarity, on 10April 2020, MCA released ‘COVID-19 related Frequently Asked Questions (FAQs) on Corporate Social Responsibility (CSR)’ .

As per these FAQs:

- Contributions to PM CARES fund are included as part of CSR expenditure

- Contributions to CMRF or ‘State Relief Fund: Covid-19’ are not considered to be CSR expenditure.

- Contributions made to State Disaster Management Authority to combat COVID-19 are included as part of CSR expenditure.

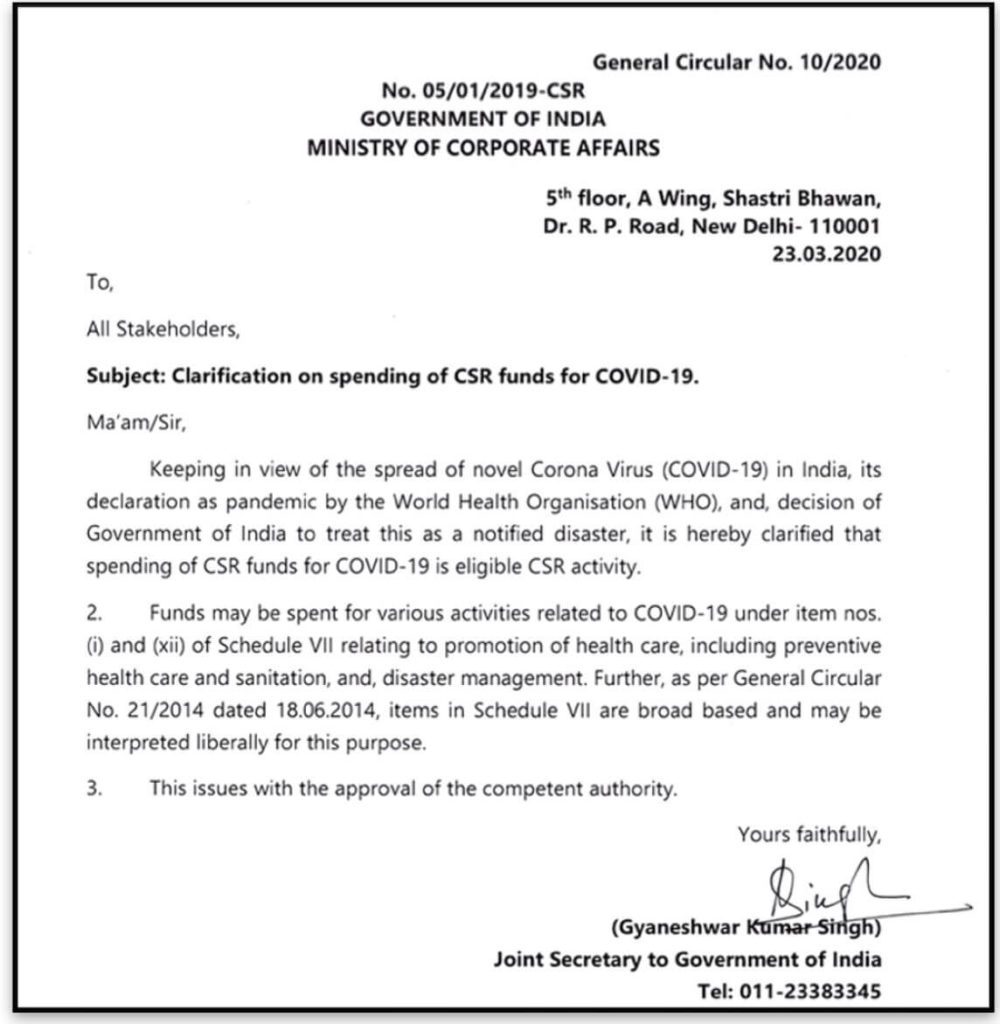

While the rationale for the inclusion of PM CARES has already been discussed, the eligibility of contributions to State Disaster Management Authority is in reference to MCA’s clarification issued on 23 March 2020.

However, the reason for not including contributions made to CMRF or other State Relief funds is that these are not included in Schedule VII of Companies Act 2013, which was the basis for inclusion of PM CARES fund. It has to be noted that currently, the list of items in Schedule VII only mentions about the funds set up by Centre and does not include any mention of the states.

Companies Act passed by the Parliament in 2013 included State Funds also

Schedule VII of the Companies Act -2013, passed by the parliament and notified by August 2013 included the funds set up by State Governments for relief to be considered as CSR expenditure.

Point IX of Schedule VII mentions thus,

“contribution to the Prime Minister’s National Relief Fund or any other fund set up by the Central Government or the State Governments for socio-economic development and relief ………….”

However, this has been subsequently amended and the rules relating to CSR contributions under this law has did not include the funds set up by the state governments.

The reasons for removing ‘State’ funds’ from the permissible list of activities is not documented in any of available sources.

Encouraging corporate donations under CSR to State funds would help states

Donations by corporates are generally higher than the individual contributions. Including corporate donations to CMRF or any other state level relief fund in the list of CSR activities would encourage more corporates to come forward and donate to these funds.

The setup, functioning and rationale of State relief funds and CMRF are similar to that of PM CARES fund i.e. these funds provide for a focussed source of resources in terms of tackling an epidemic or disaster and such relief efforts. In fact, contributions to both these funds are 100% exempt under section 80G of the Income Tax act.

Since the central government has allowed for funds donated to State Disaster Management Authority to be treated as CSR expenditure, it would be prudent to extend the same even for CMRF and other State relief funds, which are more popular with the common public.

Furthermore, there is greater likelihood of corporates contributing to the relief efforts locally (place of operations) i.e. within the state rather than at national level.

States have started looking at overcoming this technical hurdle. In Tamil Nadu, the CM has directed the funds under Chief Minister’s Public Relief Fund (CMPRF) to be diverted to Tamil Nadu State Disaster Management Authority (SDMA) since the contributions made to SDMA qualify as CSR expenditure.

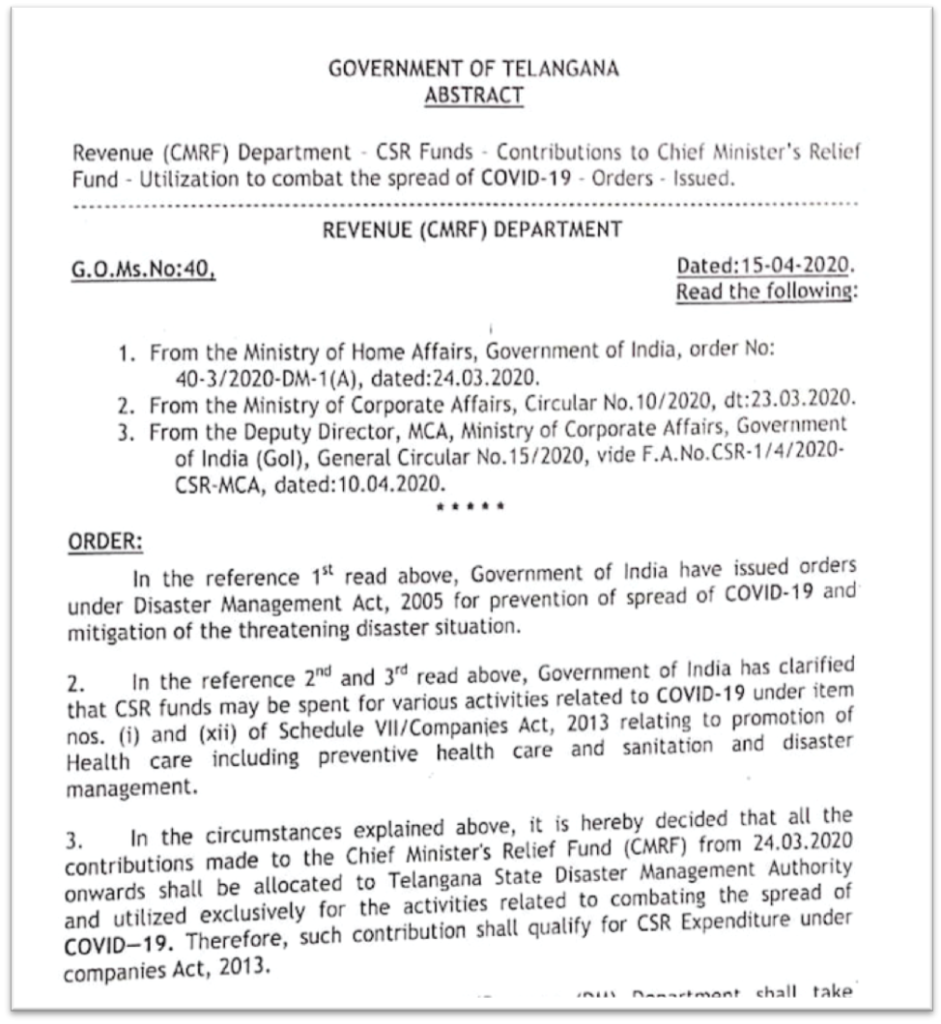

Apart from Tamil Nadu, Telangana has also taken a similar action. As per the G.O issued by the government, all the contributions that are made to CMRF since 24 March 2020 would be allocated to Telangana State Disaster Management Authority. Thereby these contributions would qualify as CSR expenditure.

It is high time that the central government has a relook at its position of not allowing contributions to CMRF and other state relief funds to be part of CSR expenditure, in this critical hour of need.

Featured Image: CSR expenditure