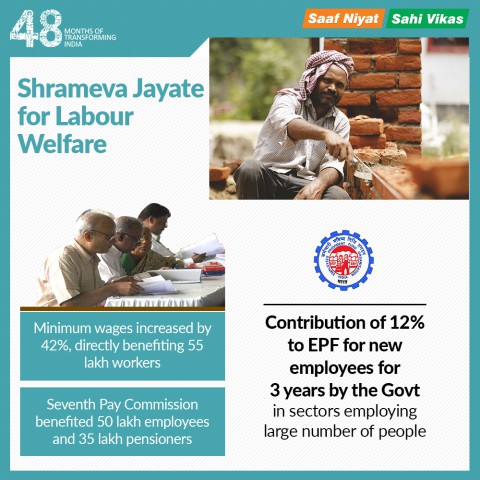

[orc]The BJP government published an infographic on the 48-months portal that makes 3 claims about labour welfare under the present government. This article is a fact check of the claims.

The BJP government published an infographic on the 48-months portal that makes 3 claims about labour welfare under the present government. This article is a fact check of the claims.

Has minimum wage increased by 42%?

The first claim is that ‘Minimum wage increased by 42%, directly benefiting 55 lakh workers’.

The annual report (2017-18) of the Ministry of Finance states that ‘the employment sector in India poses great challenge in terms of its structure which is dominated by informal workers, high levels of under employment, skill shortages and labour markets with rigid labour laws and institutions. In this context, the Government has undertaken the exercise of rationalization of the 38 Labour Acts by clubbing them into 4 labour codes viz Code on Wages, Code on Industrial Relations, Code on Social Security and Code on Occupational Safety, Health and Working conditions’. This is still work in progress as the relevant bill has not been passed by the Parliament.

The annual report (2017-18) of the Ministry of Labour and Employment states that ‘by simplifying, amalgamating and rationalizing, the relevant provisions of the minimum wages Act, 1948, the payment of bonus Act, 1965 and the equal remuneration Act, 1976. The draft code on wages bill, 2017 has been introduced in the Lok Sabha in August 2017 and referred to standing committee on labour’.

The report also states that ‘the Minimum Wages Act, 1948 was enacted to safeguard the interests of the workers mostly in the unorganised sector. Under the provision of the Act, both the Central Government and State Governments are the appropriate governments to fix, revise, review and enforce the payment of minimum wages to workers in respect of scheduled employments under their respective jurisdictions. There are 45 scheduled employments in the Central Sphere and as many as 1709 in the State Sphere. The enforcement of the Minimum Wages Act, 1948 is ensured at two levels. While in the Central Sphere, the enforcement is done through the Inspecting officers of the Chief Labour Commissioner (Central) commonly designated as Central Industrial Relations Machinery (CIRM), the compliance in the State Sphere is ensured through the State Enforcement Machinery’.

A response in Lok Sabha states that ‘according to the provisions contained in the Minimum Wages Act, 1948, the appropriate Government revises the minimum wages in all the scheduled employments under its jurisdiction at an interval not exceeding five years. Recently, Central Government has revised the basic minimum wages in January 2017 for Agriculture, Construction, Non-Coal Mines, Stone-Mines, Sweeping and Cleaning, Watch & Ward and Loading/ Unloading, after consultation with the Minimum Wages Advisory Board. However, in the Central sphere, wages are revised on half yearly basis effective from 1st April and 1st October every year by addition of Variable Dearness Allowance’. What this essentially means is that the central government can only revise minimum wages for employment under its jurisdiction. It cannot exercise control or revise minimum wages of any employments under the jurisdiction of the respective state government.

The following table shows the differences between the last revised minimum wages of the UPA and the latest one of the BJP government. The comparison is for the semi-skilled (skilled workers are taken where the category is not existing) in A category places including the variable dearness allowance (VDA).

| Employment Type | 2014 | 2018 |

|---|---|---|

| Agriculture | 235 | 389 |

| Construction | 363 | 617 |

| Non-Coal Mines | 273 | 466 |

| Sweeping and Cleaning | 329 | 558 |

| Watch & Ward | 363 | 679 |

| Loading/ Unloading | 329 | 558 |

While the central government exercises control over the eight sectors mentioned above, the states are responsible for a lot more. For example, in the state of Telangana , the Government of Telangana have fixed minimum rates of wages in (73) Scheduled employments under Minimum Wages Act, 1948 in which 65 employments (industry related) are covered under part-I and 8 (Agriculture related) Scheduled employments under part-II of the said Act. Presently, the wages have been fixed to each and every category under the above specific employments and as a result wages are fixed covering nearly for 20 to 40 categories of workers in each employment’.

While this points to the fact that the claim itself is misleading, in the budget speech of 2019-20, the finance minister stated that ‘during the last five years, the minimum wages of labourers of the all categories have been increased by 42%, which is the highest ever’.

Finally, it can be said that the minimum wages for sectors under the central sphere have increased by varying amounts where as the claim makes a blanket statement about minimum wages having increased across the board.

On the other hand, there is no publicly available data on how many people have actually benefitted from this revision in the central sector.

Claim: Minimum wage increased by 42%, directly benefiting 55 lakh workers.

Fact: Firstly, the central government has very limited jurisdiction to determine wages (as compared to state governments) since only a few sectors are under in the central sector. Secondly, no comprehensive data is available to verify how many people have benefitted from the increase in wages. Hence the claim is MISLEADING.

How many people benefitted from the seventh pay commission?

The second claim is that ‘Seventh pay commission benefitted 50 lakh employees and 35 lakh pensioners’.

The report of the Seventh Pay Commission states that ‘the Government of India has also, from time to time, set up various Pay Commissions for improving the pay structure of its employees so that they can attract better talent to public service. In this 21st century, the global economy has undergone a vast change and it has seriously impacted the living conditions of the salaried class. The economic value of the salaries paid to them earlier has diminished. The economy has become more and more consumer economy. Therefore, to keep the salary structure of the employees viable, it has become necessary to improve the pay structure of their employees so that better, more competent and talented people could be attracted for governance’.

The annual report (2017-18) of the Ministry of Finance states that ‘the recommendations of the 7th Central Pay Commission in respect of Central Government employees, Armed Forces personnel, Members of All India Services, etc. which were submitted to the Government on 19th November, 2015, were accepted by the Government in respect of matters pertaining to pay and pension in July, 2016. The decision of the Government in regard to the recommendations pertaining to pay and pension entailed an additional financial implication of Rs. 84,933 crores in the year 2016-17’.

The same report goes on to describe that ‘the decisions of the Government on the recommendations of the 7th Central Pay Commission benefited over 1 crore Central Government employees, including Armed Forces personnel and Members of All India Services, comprising approximately 53 lakh pensioners including Armed Forces personnel’.

Hence the numbers reported by the ministry in their annual report are far higher than the numbers in the claim. However, pay commissions are setup on a regular basis and till date, seven pay commissions have been set up to review and make recommendations on the work and pay structure of the central government employees and the army personnel.

Claim: Seventh pay commission benefitted 50 lakh employees and 35 lakh pensioners.

Fact: The decisions of the Government on the recommendations of the 7th Central Pay Commission benefited over 1 crore Central Government employees and Members of All India Services, comprising approximately 53 lakh pensioners including the armed forces personnel. The numbers are far higher than the claim because of the inclusion of the armed forces personnel. Hence the claim is TRUE. However, pay commissions are setup on a regular basis and till date, seven pay commissions have been set up to review and make recommendations on the work and pay structure of the central government employees and the army personnel.

What is the government’s contribution to EPF?

The third claim is that ‘contribution of 12% to EPF for new employees for 3 years by the government in sectors employing large number of people’.

The annual report (2017-18) of the Ministry of Labour and Employment details that the employees provident fund organization (EPFO) is ‘reposnsible for administration of the employees provident funds and miscellaneous provisions Act, 1952. The schemes for provident fund, family pension and deposit linked insurance are implemented by the organization for the benefit of workers covered under the scheme. The organization is also responsible for administration of employees’ pension scheme, 1995’.

The Employees’ Provident Funds and Miscellaneous Provisions Act, 1952, after the latest amendment states that ‘the contribution which shall be paid by the employer to the fund shall be 10% of the basic wages, dearness allowance and retaining allowance, if any, for the time being payable to each of the employees whether employed by him directly or by or through a contractor, and the employee’s contribution shall be equal to the contribution payable by the employer in respect of him and may, if any employee so desires, be an amount exceeding ten percent of his basic wages, dearness allowance and retaining allowance if any, subject to the condition that the employer shall not be under an obligation to pay any contribution over and above his contribution payable under this section’.

The scheme document of the Pradhan Mantri Rojgar Protsahan Yojana states that ‘in the Budget Speech 2016-17, it was stated that in order to incentivize creation of new jobs in the formal sector, Government of India will pay the Employee Pension Scheme contribution of 8.33% for all new employees enrolling in EPFO for the first three years of their employment. This will incentivize the employers to recruit unemployed persons and also to bring into the books the informal employees. In order to channelize this intervention towards the target group of semi-skilled and unskilled workers, the scheme will be applicable to those with salary up to Rs 15,000 per month. I have made a budget provision of Rs 1,000 crore for this scheme’.

The scheme has been amended in April 2018, where the government will pay the full employer’s contribution (both EPF & EPS).

Claim: Contribution of 12% to EPF for new employees for 3 years by the government in sectors employing large number of people.

Fact: Government of India will pay the full employer’s contribution (both EPF & EPS) of 12%. Hence, the claim is TRUE.

This story is part of a larger series on the 4-years of the Modi government. This series has been made possible with the flash grant of the International Fact Checking Network (IFCN). Read the rest of the stories in this series here