The PM recently announced the launch of a dedicated fund ‘PM CARES’ to cater to situations like the ones created by COVID-19 and similar disasters. However, the PMNRF already exists for a similar purpose. What is the difference between these funds and why is there a controversy around the setting up of this fund?

On 24 March 2020, Prime Minister Narendra Modi announced a nationwide lockdown to contain the spread of COVID-19 in the country. This epidemic has been declared as a natural disaster and Disaster Management Act-2005 was invoked. Subsequently, the Central Government and several state governments announced relief packages to those who are affected by the lockdown.

Meanwhile, on 28 March 2020, Prime Minister Narendra Modi announced via Twitter that the Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund (PM CARES) is being constituted.

As per the initial tweet, the fund was created as a response to people expressing their desire to contribute towards the fight against COVID-19. In the following tweet, the Prime Minister, apart from the appeal to contribute to the fund, also stated that this fund would be used to address future situations of distress. The official press release also offers only minimal information beyond what is provided in the tweets.

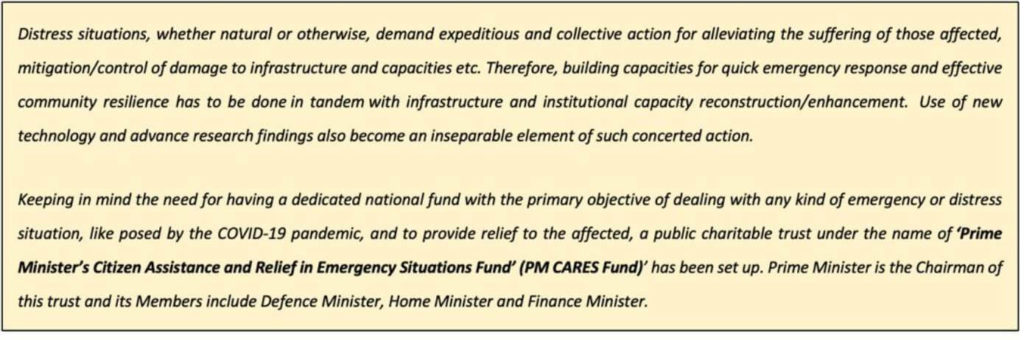

From the press release, it is learnt that the objective of creating this fund is the following.

Based on this, it can be inferred that the fund is a Public Charitable Trust and is set up as a dedicated national fund that deals with any kind of emergency or distress. However, it does not offer any additional information on the need for setting up this fund when the ‘Prime Minister’s National Relief Fund’ (PMNRF) already exists to serve a similar purpose.

PMNRF has been providing relief assistance for over 70 years

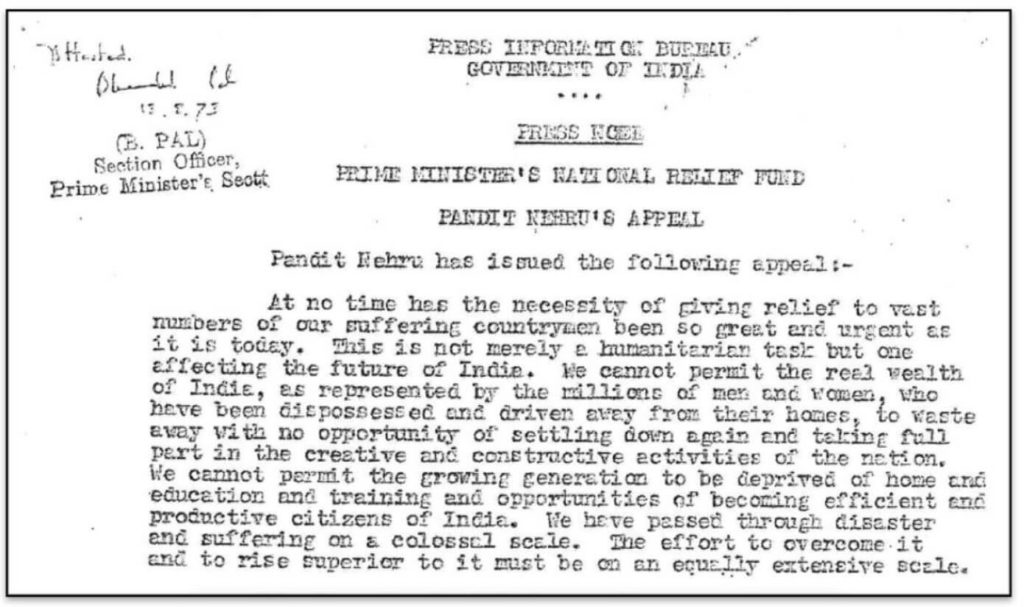

The PMNRF was started in 1948, following an appeal by the then Prime Minister of India, Jawaharlal Nehru, to support people displaced from Pakistan.

Over the years, PMNRF resources are being used to provide relief to families of victims killed in natural calamities like floods, cyclones, earthquakes etc and also to victims of major accidents and riots. The fund is also used to meet expenses related to treatments like – heart surgeries, kidney transplantation, cancer treatment, acid attack etc.

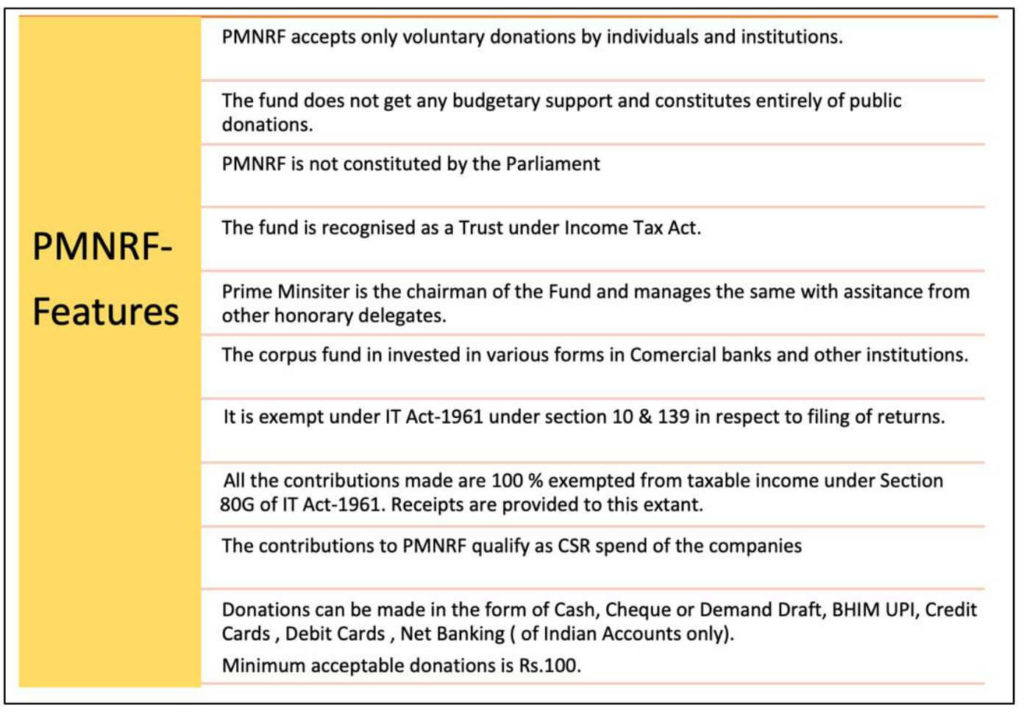

Features of PMNRF are the following.

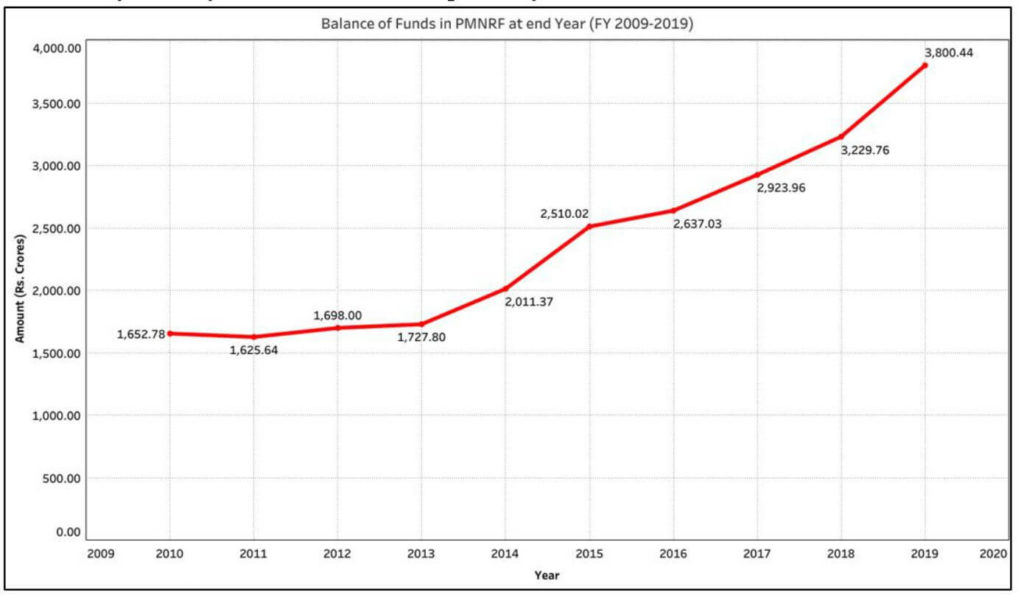

As per the PMNRF’s Statement of Income and Expenditure for the year 2018-19, the balance of funds available at the end of FY 2018-19 was Rs. 3,800.44 crores. The availability of these funds further raises questions around the need for creating a new fund ‘PM CARES’ for tackling COVID-19 and other disasters.

In the year 2018-19, the total income of PMNRF through contributions, interest & refund was Rs. 783.18 crores while the expenditure in the form of relief was Rs. 212.5 crores. It is not even the cases of dwindling funds as except for 2010-11, over the 10-year period between 2009-19, the income of PMNRF has always been higher than the expenditure. Because of this reason, with the exception of 2010-11, the balance of funds available with PMNRF at the end of a year has seen a year-on-year increase over the past 10 years.

Donations to PM CARES to be 100% tax-exempt

With a national fund to provide disaster relief already existing and that too with considerable corpus, the rationale for constituting a new fund is not clear. As highlighted earlier, the press release by PMO does not provide enough clarity on different aspects of the trust fund.

From the details provided, apart from the information provided regarding its purpose as a fund to tackle disaster, it is understood that:

- Prime Minister is the chairman of the trust and the members include – Defence Minister, Home Minister and Finance Minister.

- It enables micro-donations.

- Donation can be made through Bank Transfer, UPI, Internet Banking, Debit & Credit Cards.

- Donations to the fund will be exempted from Income Tax under Section 80G.

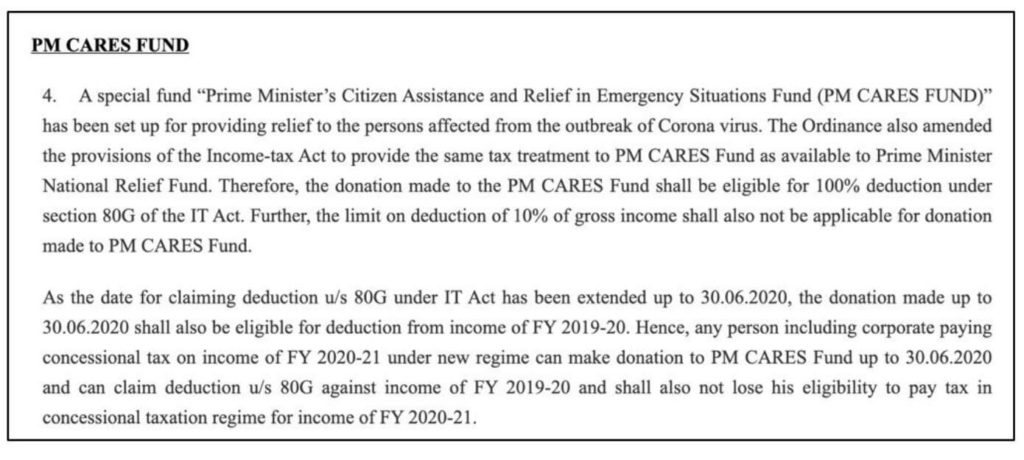

The extent of IT exemption was not provided in the initial press release. However, as per the Taxation and Other Laws (Relaxation of Certain Provisions) Ordinance, 2020 issued by Finance Ministry on 31 March 2020, donations made to ‘PM CARES’ fund would be 100% tax exempt under Section 80(G).

Furthermore, as per a Memorandum of Corporate Affairs Ministry, any contributions made to PM CARES fund would qualify as CSR expenditure of companies.

Many unanswered questions regarding the need for this fund

The Hindu reported the apprehensions raised by Congress leaders other prominent voices about the opaqueness in the rules and expenditure of the trust as well as non-utilization of the available funds in PMNRF.

While, the balance in PMNRF is being shown at Rs. 3,800.44 crores, there are reports which highlight the low liquidity of only 15% of this fund, which makes it a challenge to be used in case of emergency. According to these reports, bulk of the corpus is invested in fixed deposits, state development loans etc.

Further, a story in The Wire highlights the lack of information on the public domain in respect to – Trust Deed of PM CARES, compliance with the rules of Public Trust, constitution & announcement of the fund and the members involvement.

Meanwhile, there are arguments in public domain that are in favour of creating the new fund. As per story on Business Line, few legal experts are of the opinion that attaching the fund to COVID-19 and allowing micro donations would encourage more people to come forward and donate.

However, all these are opinions interpretations & assumptions. The true rationale of setting up a new fund despite the existence of PMNRF with similar objectives can be explained only by the government.

Factly has written to PMO asking for the rationale of setting up PM CARES. This article will be updated as soon as a response is received. We contacted the PMO contact in the Press Information Bureau (PIB) who directed us to the press release and did not provide any additional information.

4 Comments

It seems one difference is that Congress President is a permanent trustee in PMNRF. In PM CARES Fund, PM has discretion to use fund as he deems fit with due consultation with Finance, Home and Defence Minister.

Not true. From 1985, the congress president has been removed as the permanent trustee. Only the PM has ultimate authority on PMNRF starting 1985

Hi Rakesh, I am also doing a research on this. Could you share some references for the Change made in 1985. Thanks Rohit

Pingback: ಪ್ರಧಾನಿ ಪರಿಹಾರ ನಿಧಿಯಿಂದ ಹಣ ತೆಗೆಯಲು ಸೋನಿಯಾ ಒಪ್ಪಿಗೆ ಬೇಕೆ? ಅದಕ್ಕಾಗಿ ಮೋದಿ PM CARES ಶುರು ಮಾಡಿದರೆ? - Naanu gauri