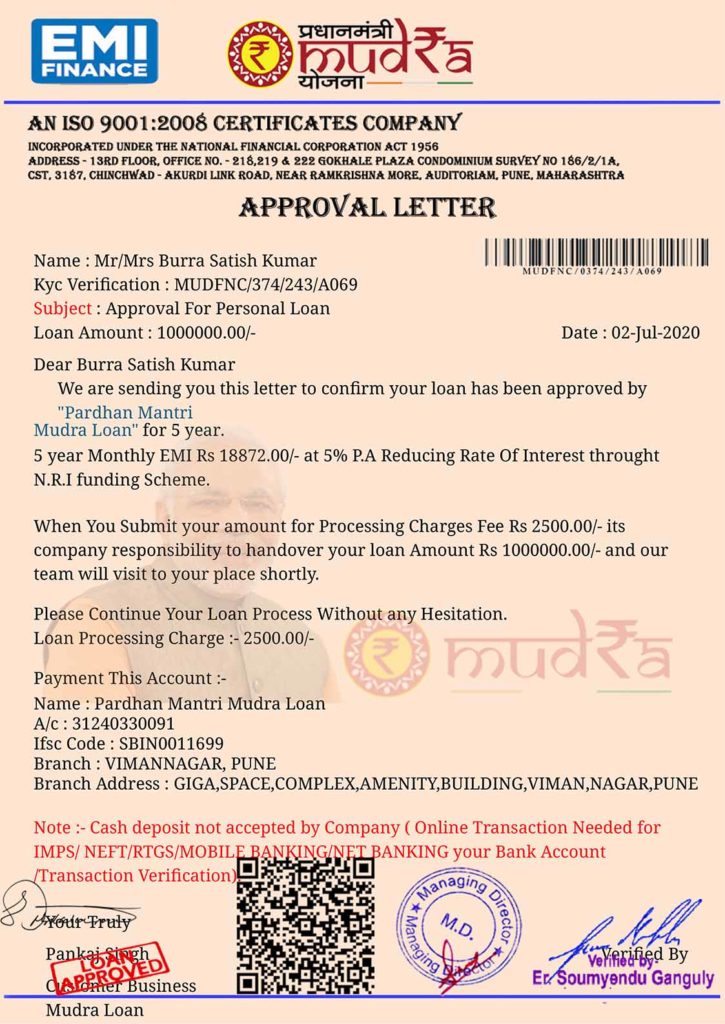

We received a document (purported ‘MUDRA Loan Approval Letter’) on FACTLY’s WhatsApp helpline to check its authenticity.

When we looked on the internet, it was found that a Facebook page with the name – ‘Pradhanmantri Mudra Yojna’ has also posted a similar letter with the description – ‘Government Approval Letter’. In the letters, it is mentioned that a processing fee/legal charge must be paid so that the loan amount can be handed over. Let’s check the authenticity of the letters.

Claim: MUDRA Loan Approval Letters asking borrowers to pay legal charge/processing fee for loan disbursement.

Fact: There are a lot of inconsistencies and mistakes in the approval letters. Neither ‘Mudra Finance Private Limited’ nor ‘Mudra Finance Limited’ can be found in the ‘List of Partner institutions shortlisted to be partners of MUDRA’. Also, there is no ‘National Financial Corporation Act 1956’, which is mentioned in the letter. Hence the claim made in the post is FALSE.

Before checking the authenticity of the letters, let’s understand a bit about the PM MUDRA Yojana (PMMY). On the MUDRA (Micro Units Development and Refinance Agency) website, it can be read that ‘the scheme was launched by the Prime Minister on April 8, 2015 for providing loans up to 10 lakhs to the non-corporate, non-farm small/micro enterprises. These loans are classified as MUDRA loans under PMMY. These loans are given by Commercial Banks, RRBs, Small Finance Banks, MFIs and NBFCs. The borrower can approach any of the authorized lending institutions or can apply online through this portal www.udyamimitra.in. Under the aegis of PMMY, MUDRA has created three products namely ‘Shishu’, ‘Kishore’ and ‘Tarun’ to signify the stage of growth/development and funding needs of the beneficiary micro unit/entrepreneur and also provide a reference point for the next phase of graduation/growth’. A detailed article by FACTLY regarding the PMMY scheme can read here.

Various people across the country have received similar MUDRA loan approval letters on their respective names. Some of those letters can be seen here, here, here, here, and here. There are a lot of clues in the letters which suggest that they are fake. Let’s look at each of them one by one.

Clue 1: Different letterheads and watermarks

It can be seen that the design of the letterhead varies in the letters. The logos of ‘EMI Finance’ and ‘Mudra Loan’, and the watermarks are not consistent. Also, it can be seen in some letters that the logo of PMMY mentions ‘True stories of achievement’, which is picked up from the success stories page on the official MUDRA website.

Clue 2: Same signature – Different names

Clue 3: Approval agencies

Neither ‘Mudra Finance Private Limited’ nor ‘Mudra Finance Limited’ can be found in the ‘List of Partner institutions shortlisted to be partners of MUDRA’. Also, there is no ‘National Financial Corporation Act 1956’, which is mentioned in the letter.

Clue 4: Same loan amount – Different Processing fee/Legal charge

In one of the documents on the MUDRA website, it can be read that ‘banks may consider charging an upfront fee as per their internal guidelines. The upfront fee/processing charges for Shishu loans are waived by most banks’. For example, on the SBI website, it can be seen that the processing Fee is nil for Shishu and Kishore loans to MSE Units and for Tarun loans, it is 0.50% (plus applicable tax) of the loan amount. But the processing charges given in these letters are not uniform in the approval letters. For the same loan amount, the processing fee given is different.

There are a lot of other inconsistencies and grammatical mistakes in the letters, which are very rare in official bank letters. The account details given in the letters for depositing the processing/legal fee are different in each letter. The company addresses and the helpline numbers are also not the same. Most of the given phone numbers are not working. FACTLY (posing as a borrower who received a similar letter) was able to talk to a person on one of the phone numbers. The person on the phone demanded the mentioned amount (which he said will be refunded) to be deposited in the given account number so that the loan amount can be disbursed.

The official website of ‘MUDRA’ is ‘https://www.mudra.org.in/’. But, in one letter, a website address – ‘www.financemudra.net’ is given, which is not working now. The archived version can be seen here. In another letter, there is a website – ‘http://mudrapmyojana.com/’. The phone number given on the website is also invalid. On looking about the website on ‘who.is’, it was found that the website was registered recently in May 2020 and the phone number given for registering the website can be found on another website – ‘Tata Fianance’ (Another dubious website which was registered recently in March 2020). So, it is not a government website. The official website mentions that the borrowers can file an online application for MUDRA loans on Udyamimitra portal.

Also, many people across the country have complained on social media that they have received similar fake letters on WhatsApp. Some of them have also paid huge amounts and complained that they have been duped. Those complaint posts can be read here, here, and here.

To sum it up, these ‘MUDRA Loan Approval Letters’ asking borrowers to pay processing fee/legal charge for loan disbursement are fake.

Did you watch our new video?

1 Comment

Pingback: These ‘MUDRA Loan Approval Letters’ asking borrowers to pay processing fee/legal charge for loan disbursement are fake – Factly – BIJIN WORLD