The impact of COVID-19 on the government revenues was visible with the decrease in various tax revenues except for excise duties & customs. At the same time, the expenditure of the government increased significantly in the pandemic year due to the various measures & schemes announced to support the poor & vulnerable.

While presenting the Union Budget for 2021-22, the Government of India increased the Revised Estimates (RE) for Total Expenditure in 2020-21 by 13% compared to the Budget Estimates (BE). The Budget Estimate for Total Expenditure was Rs. 30.4 lakh crores, which is revised (RE) to Rs. 34.5 lakh crores.

In the previous year i.e 2019-20, the RE of ‘Total Expenditure’ was less than the BE. The year before, there has only been a minor increase in RE compared to BE. As such, the increase of 13% in the RE for 2020-21 assumes significance and reflects the impact of the COVID-19 pandemic. The government had to spend more because of the pandemic and had to offer aid & assistance to the poor & vulnerable sections of society. This might have led to the increased expenditure in 2020-21 compared to the initial BE.

In an earlier story, we highlighted the fall in Government revenues during 2020-21 and the prevailing trend of the slow growth of Tax revenues even before the pandemic began. In this story, we explore the trends in Government expenditure over the last few years and also understand the impact of COVID-19 on government spending.

As was the case for Revenue figures, even the actual expenditure figures for 2020-21 will only be known later during the presentation of the 2022-23 budget. This story is based on the provisional figures for 2020-21 as available on the website of the Controller General of Accounts (CGA).

Total Expenditure of the Union Government increased by 31% in 2020-21

As per the provisional figures provided by CGA, the ‘Total Expenditure’ of the Union Government for 2020-21 is Rs. 35.11 lakh crores. This is higher than the RE presented by the government during the Union Budget for 2021-22.

In 2019-20, the ‘Total Expenditure’ of the Union Government was Rs. 26.8 lakh crores i.e the provisional total expenditure for 2020-21 increased by around 31%. A month-on-month comparison between 2019-20 & 2020-21, shows that since October 2020, government expenditure for 2020-21 is higher than the corresponding month in 2019-20. Especially, the provisional figures for March 2021 are Rs. 6.92 lakh crores compared to the Total expenditure of only Rs.2.21 lakh crores in March 2020.

During the first half of 2020-21, the month-on-month total expenditure was less than the corresponding months in 2019-20 in May, August & September. However, in the later months, the expenditure during 2020-21 was higher than in 2019-20.

While the increase in the expenditure during 2020-21 compared to 2019-20 is remarkable, this increasing trend exists even prior to 2020-21 but to a lower extent. After a fall in the ‘Total Expenditure’ during 2016-17, there has been a consistently increasing trend with year-on-year growth.

Increase in both Revenue & Capital Expenditure of the government during 2020-21

The ‘Total Expenditure’ of the Government can be broadly classified into ‘Capital Expenditure’ & ‘Revenue Expenditure’.

Revenue Expenditure:

The revenue expenditure includes all the expenses involved in running the Government, providing various services, interest payments, subsidies, various schemes, etc. This expenditure does not result in the creation of assets for the government. Out of the ‘Total Expenditure’, the revenue expenditure of the government forms the major part.

The trends in revenue expenditure thus have a large bearing on the total expenditure trends of the government. The increase in the total expenditure over the years, and especially in 2020-21 can be attributed to the steep increase in revenue expenditure.

In the year 2020-21, the provisional revenue expenditure is Rs. 30.86 lakh crores. This is 31.2% higher than the revenue expenditure incurred by the ‘Government of India (GoI)’ in 2019-20. While the increase in the revenue expenditure in 2020-21 can be attributed to the expenditure that the government had to incur in face of the COVID-19 pandemic, the increase was visible even in 2019-20.

During 2016-17 & 2017-18, the share of revenue expenditure was 96% and 94% respectively out of the ‘Total Expenditure’, which in general is in the range of 85-90%.

Capital Expenditure

Capital expenditure is any expenditure that results in the creation of assets for the Government of India. Compared to revenue expenditure, the proportion of capital expenditure is lesser in the total government spending. Similar to Revenue expenditure, there has been a considerable increase in the capital expenditure incurred for 2020-21, compared to 2019-20. With an expenditure of Rs. 4.24 lakh crores in 2020-21, which is 27% higher than the previous year. While in terms of the amount, the capital expenditure in 2020-21 is the highest whereas 2015-16 recorded the highest growth in capital expenditure in over 10 years with a 28.6% increase.

The trends of growth rate have not been consistent for Capital expenditure.

For most of the months in 2020-21, Revenue Expenditure is higher than in 2019-20

A significant increase in the provisional ‘Total Expenditure’ in March 2021 compared to the same month in 2019-20 can be attributed largely to the increase in revenue expenditure during that month. In March 2020, the revenue expenditure was Rs. 1.9 lakh crores, whereas during March 2021, the provisional numbers reported by CGA indicate a revenue expenditure of Rs. 6.7 lakh crores, which is more than thrice the March 2020 amount. There is no detailed breakup available on the CGA website for March 2021 revenue expenditure figures to understand the reasons behind such a steep increase.

The higher expenditure during March 2021 is in continuation of the trend observed since November 2020. In addition to the last five months of 2020-21, the revenue expenditure during April, June & July of 2020 is higher during 2020-21, compared to the same months in 2019-20.

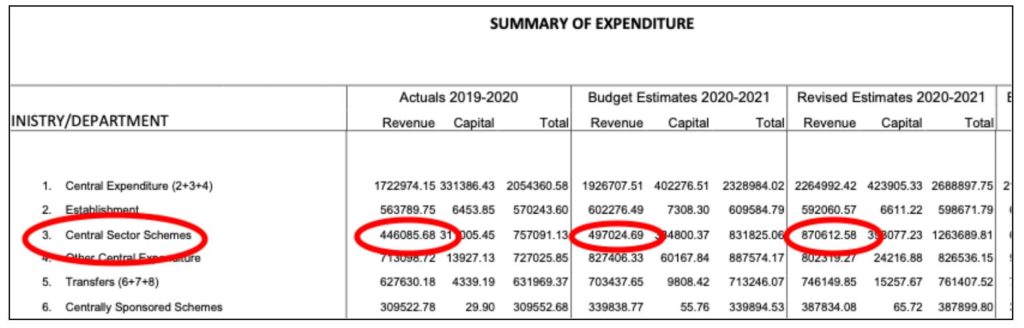

The expenditure summary presented as part of the 2021-22 budget, provides some insights on the steep increase in revenue expenditure for 2020-21.

As per the document, a significant contributor to this is the increase in 2020-21 is the increased expenditure for ‘Central Sector schemes’, compared to the initial BE for that year. The RE for Central Schemes was Rs. 8.7 lakh crores compared to BE of Rs.4.97 lakh crores. This is also significantly higher than the actual expenditure incurred in 2019-20 for ‘Central Sector Schemes’.

This may be due to the various schemes & support measures announced by the government of India to provide relief from the COVID-19 pandemic. The comparative higher Revenue expenditure in April, June & July months coincide with the relief measures announced during the lockdown period. The higher expenditure in the later months can be attributed to the implementation of the various schemes and the continued support in the wake of the pandemic.

However, the figures reported for 2020-21 are provisional. The extent of the actual spending on ‘Central Sector Schemes’ & the overall expenditure incurred will only be known much later.

Significant increase in the amount of ‘Loans’ disbursed during 2020-21

Loans disbursed by the ‘Union Government’ form part of its capital expenditure. As highlighted earlier, although capital expenditure accounts for a lesser proportion of the total government spending, there has been a significant increase even in this for 2020-21.

A part of this increase can be attributed to the ‘Loans’ disbursed by the Central Government. As per the information provided on the CGA website, the provisional value for the number of loans disbursed in 2020-21 is Rs.1.1 lakh crores, compared to around Rs. 24.2 thousand crores in 2019-20. In other words, the loans disbursed by the GoI increased by more than 4 times in 2020-21.

As in the case of ‘Centrally Sponsored Schemes’, even this increase in loans disbursed can be attributed to COVID-19 relief efforts of the Central Government. Monthly data indicates that the majority of these loans disbursed was during the last five months of the year i.e November 2020 to March 2021.

CGA also provides the data of the revenue expenditure incurred by the Government in the form of interest payments for outstanding debts. While there is an increase in the interest payments for 2020-21, the increase has not been significantly different from the trends in previous years.

Therefore, the share of interest payments in revenue expenditure fell from 26% in 2019-20 to 22% in 2020-21, indicating higher revenue expenditure in other areas. However, the GoI borrowed significantly in 2020-21 to meet the increased expenditure. Only the domestic market borrowings in 2020-21 were more than Rs. 13 lakh crores. Hence the interest payments on all these loans might contribute to the expenditure in 2021-22.

Impact of COVID-19 pandemic visible in the expenditure trends

The total expenditure of GoI has been significantly higher in 2020-21 compared to the previous years. This is understandable as the government had to spend higher amounts on new schemes & measures aimed at supporting the poor & vulnerable affected by the pandemic. At the same time, the government revenue did not increase at the same pace forcing the government to borrow from various sources to meet the expenditure. Since the pandemic is still affecting the country, its impact on spending & government revenue could be similar even in 2021-22.

Featured Image: Total Expenditure of the Indian Government