To mitigate the liquidity constraints, the Government of India introduced the ECLGS scheme in May 2020. Under this, 100 percent guarantee is extended to the member lending institutions (MLIs) in respect of credit extended by them to the borrowers. Data indicates that as of 30 November 2022, the amount guaranteed under this scheme increased to Rs. 3.58 lakh crore, while the number of borrowers benefitted improved to 1.19 lakh. Consumer Durables/FMCG, Corporate Retail Outlets, Traders, Services account for more than a third of the amount guaranteed under ECLGS.

MSMEs in India and their contribution to the country’s growth is well documented. They form a substantive chunk of the Indian economic system and play an important role in employment generation. Yet, this sector remains one of the most vulnerable in terms of cash flow management. Both supply and demand side reasons exist behind such vulnerability. The supply side difficulty is being unable to get adequate financial support even for profitable enterprises, while the demand side problem being the lack of creditworthiness of the enterprises. Healthy cash flow systems, both inward and outward, are lifeline to any business. Badly managed credit systems pose significant risks to the business. It is even more so for businesses that are relatively small and that do not achieve economies of scale.

Recognizing this issue, successive governments have introduced suitable measures to overcome these difficulties in the flow of credit to MSMEs. Despite such measures, MSMEs still remain susceptible to any crisis and the COVID-19 pandemic has exposed the financial vulnerability of the MSMEs.

In today’s story, we look at one such measure introduced by the Government of India to ease the liquidity constraints on MSMEs due to the COVID-19 pandemic. We also look at previous initiatives of the Government in this regard.

MSMEs and flow of credit

There are primarily two sources of credit availability to MSMEs- institutional and non-institutional. Institutional credit is led by the RBI and other agencies mandated by the RBI, while the non-institutional credit is majorly sourced from money-lenders and family and friends. The percentage of MSMEs using institutional credit remains low, because of the high-risk perception of banks in extending credit facilities to MSMEs, and this is more acute in the case of micro and small enterprises.

To ease the flow of credit to MSEs, the Government of India had introduced the Credit Guarantee Fund Scheme for Micro and Small Enterprises (CGMSE). A trust named Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) was established with contribution in ratio of 1:4 by the Small Industries Development Bank of India (SIDBI) and the Government of India (GoI). The details of the eligibility of lending institutions, credit facilities, guarantee cover, and term of the guarantee can be accessed here.

Consistent rise in the amount of guarantee approved under CGMSE.

Under the Credit Guarantee fund scheme for MSEs, the amount of guarantee approved has shown consistent increase, with few exceptions. The number of member lending institutions has also increased, after a brief decline during 2017-19. The average size of the loan issued fell from Rs. 5.27 lakh in 2014-15 to Rs. 4.41 lakh during 2016-17. During 2017-18, it rose to Rs. 7.24 lakh, thereafter which it declined gradually to Rs. 4.42 lakh in 2020-21. In 2021-22, it increased again to Rs. 7.83 lakh.

Since 2017, CGTMSE has experienced fundamental changes that have allowed it to broaden the scope of its programmes to include untapped markets including partial collateralized loans, retail trade, and untapped lenders like NBFCs, small finance banks, and scheduled cooperative banks.

Emergency Credit Line Guarantee Scheme (ECLGS)

COVID-19 pandemic and the subsequent containment measures had an adverse impact on the financials of the MSMEs. They were struggling with liquidity constraints to keep the enterprise running, and many of them were on the verge of bankruptcy and insolvency. To mitigate the liquidity constraints, the Government of India introduced the ECLGS scheme in May 2020. Under this, 100 percent guarantee is extended to the member lending institutions (MLIs) in respect of credit extended by them to the borrowers. The interest rate under the scheme is capped at 9.25 percent for Banks and Financial Institutions and 14 percent for Non-Banking Financial Institutions. The overall ceiling initially announced for ECLGS was Rs. 3 lakh crore which was subsequently enhanced to Rs. 4.5 lakh crore.

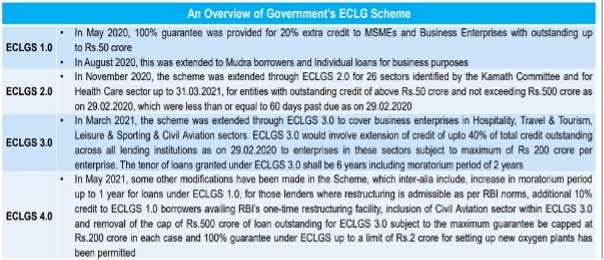

Initially restricted to MSMEs, the scheme was subsequently expanded to cover other sectors. So far, four extensions have been made. The four extensions done are as below.

A study conducted by the SBI Research team concluded that the ECLGS scheme saved 13.5 lakh MSME units, 1.5 crore jobs and prevented 14% of the outstanding MSME loans turning into NPA.

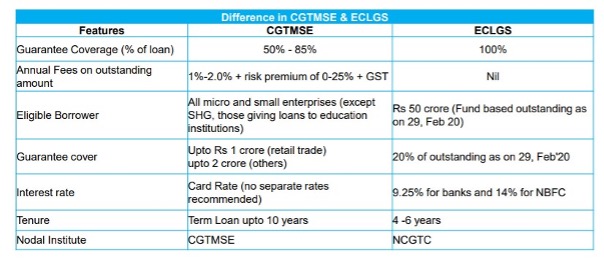

How is ECLGS is different from CGTMSE?

Though CGTMSE and ECLGS are guarantee schemes by the Government, there is a significant difference in their characteristics. CSTMSE came into force from 01 August 2000, while ECLGS was launched during the COVID-19 period, i.e., 2020. Apart from this, below is the gist of the differences.

Performance of ECLGS

As mentioned earlier, since the inception of the scheme in May 2020, it has been extended four times to cover various sectors. This must be kept in mind when looking at the data on the amount and the number of guarantees issued under this scheme.

As on 30 August 2020, the scheme provided guarantees worth Rs. 1.08 lakh crore to 0.24 lakh beneficiaries. The amount rose to Rs. 1.63 lakh crore and beneficiaries increased to 0.42 lakh as on 09 September 2020. Till November 2020 (ECLGS 1.0), the scheme was restricted to MSMEs and other businesses with an outstanding up to Rs. 50 Crores.

As on 02 July 2021, the amount guaranteed increased to Rs. 2.73 lakh crore, and the number of beneficiaries stood at 1.14 lakh. As per the latest data as of 30 November 2022, the amount guaranteed under this scheme increased to Rs. 3.58 lakh crore, while the number of borrowers benefitted improved to 1.19 lakh. The data for these two dates includes data of all the extensions of the scheme, from ECLGS 1.0 to ECLGS 4.0.

Five states account for half of the amount guaranteed under ECLGS.

The cumulative amount guaranteed under the ECLGS scheme grew by more than 200% between 31 August 2020 and 30 November 2022. The state wise growth of the amount guaranteed is not uniform. As of 30 November 2022, around five states namely Maharashtra, Tamil Nadu, Gujarat, Karnataka, and Uttar Pradesh accounted for half of the total amount guaranteed under ECLGS. The share of top ten states in the amount guaranteed rose from 71% in 2020 to 76% in 2022.

The average ticket size (ATS) of the loan is highest for Delhi with Rs. 22 Lakhs, while it is lowest for West Bengal with Rs. one Lakh as of 2022. Interestingly, Delhi has more medium-sized enterprises while West Bengal is dominated by micro-enterprises. Also, the effect of expansion of the coverage of ECLGS scheme is clearly visible in the trend in average ticket size of loan. For West Bengal, the ATS in 2020 was Rs. 4.4 Lakh, which reduced to Rs. 1 Lakh in 2022, while for Delhi, it grew from Rs. 13.8 Lakhs to Rs. 22 Lakhs during the same period.

Services and consumer durables account for 35% of the total amount guaranteed as of 2022.

The data on industry wise issue of amount guaranteed under the ECLGS shows that services industry and consumer durables/FMCG, corporate retail outlets and traders’ industry cumulatively account for 35% of the total amount guaranteed as of 30 November 2022. If textiles industry and hospitality, sports and leisure industry are also included, these four industries account for half of the total amount guaranteed.

Interestingly, the hospitality and consumer durables industry were not much significant in 2020, while they form a considerable proportion of amount guaranteed in 2022.

Impact of ECLGS has been positive so far.

The impact of the Emergency Credit Line Guarantee Scheme (ECLGS) has been studied in August 2022 by TransUnion CIBIL Ltd. As per the assessment, the following positives are observed in flow of credit as well as the change in behaviour of the borrowers.

- Micro-enterprises benefitted the most, with 83% of the total borrowers belonging to the micro-enterprises category.

- The average number of new trades opened per borrower grew by 15% as compared to 6% for the eligible borrowers who did not avail ECLGS.

- The NPA rate is 4.8% for ECLGS availed borrowers, while it is 6.1% for those who did not avail ECLGS.

One important observation from the study is the lower utilization of ECLGS in subsequent expansions than in the initial stage. It highlights that such lower utilizations despite expansion of coverage indicates the need for liquidity is higher among lower segments than higher loan segments.