[orc]A Non-performing asset(NPA) is defined as a credit facility in respect of where the interest and/or installment of principal has remained ‘past due’ for a specified period of time. These are essentially Bad Loans or defaults. Usually, any amount to be received remains overdue for a period of more than 90 days is termed as a NPA.

India’s powerful public sector bank, the state bank of India recently signed a MOU with the Adani group to loan 6,200 crores for their ambitious mining project in Australia. While the decision has come under fire from a lot people, the real question is if it will become another Non-performing Asset or bad loan.

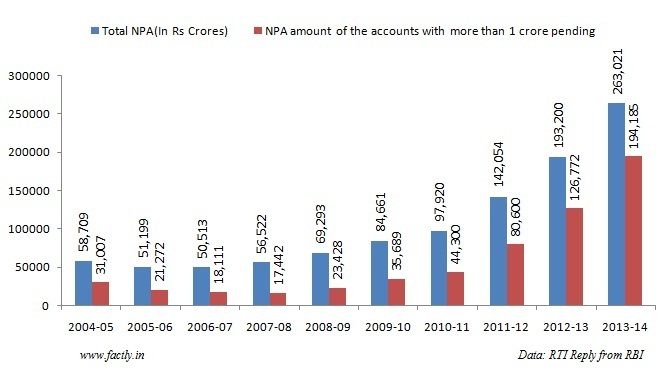

Data acquired from the RBI indicates a disturbing trend in the rise of NPA amounts in the last three years (2011-2014.) From 142,054 crores in 2011-12 to 263,021 crores in 2013-14.

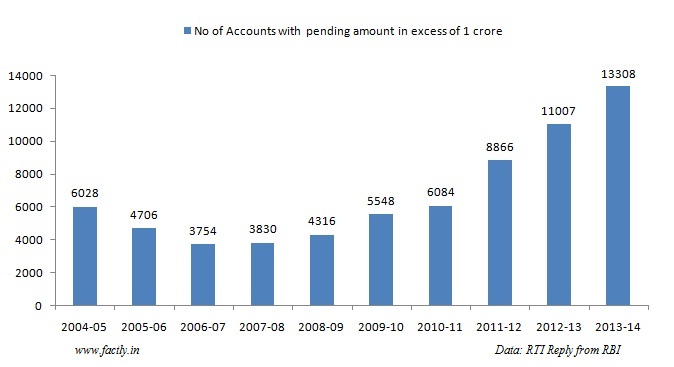

An equally dismal fact is the steep rise and two fold increase of NPA amounts of those accounts with amount of more than 1 crore. The number of accounts pending with more than one crore in 2011- 12 was 8,866, compared to 13,308 accounts in 2013-14.

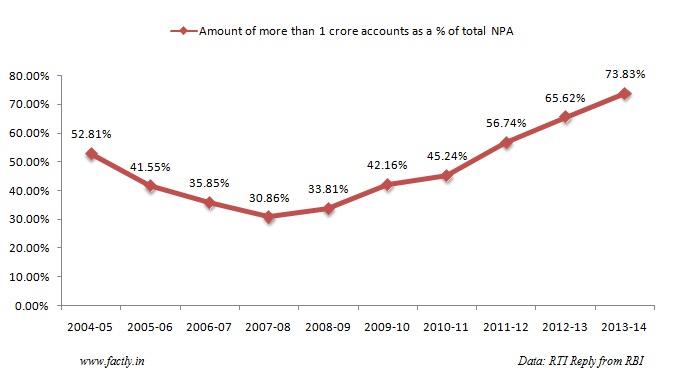

Also, the total NPA amount contributed by the accounts owing more than 1 crore has seen a consistent rise since 2008-09. The amounts contributed by these accounts saw a 7 times increase in 2013-14 compared to 2008-09. This overbearing debt could be a crucial factor in the slipping GDP growth. Despite several interventions by the government, there might not be a drastic change unless stricter regulation and limitations are introduced in regard to defaulters.

(Please read the follow up story to the NPA numbers here)