[orc]A Non-performing asset(NPA) is defined as a credit facility in respect of where the interest and/or installment of principal has remained ‘past due’ for a specified period of time. These are essentially Bad Loans or defaults. Usually, any amount to be received remains overdue for a period of more than 90 days is termed as a NPA.

(This is a follow up story to the one on NPA numbers)

The economic meltdown of 2008 has created a financial crisis at different levels around the world. In India, the downturn of the economy and the increasing burden of debt or Non- Performing Asset (NPA) in banks is a serious concern. The majority of these banks being Public Sector Undertakings (PSU) or government owned.

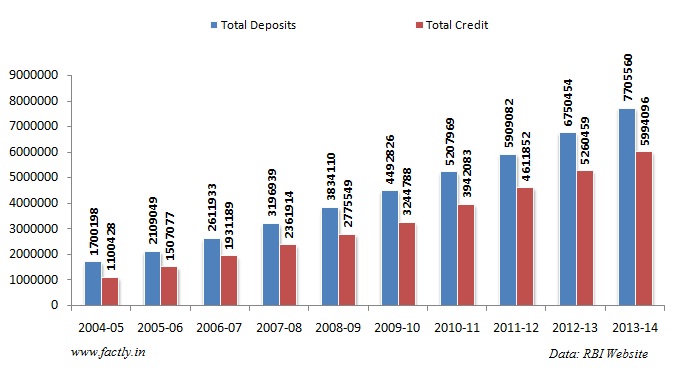

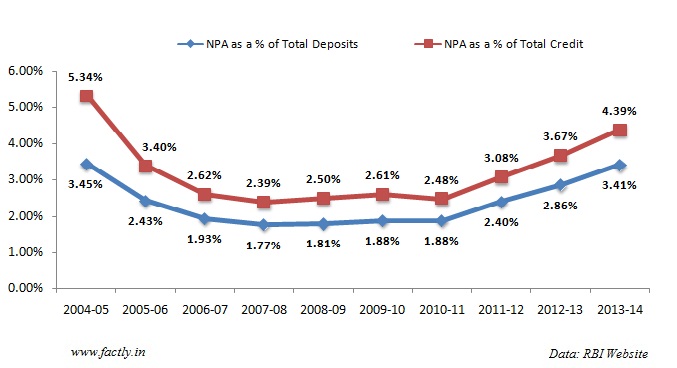

The silver lining is definitely the consistent growth of deposits as well as credit in the last few years. Overall Credit has increased from 2,775,549 crores in 2008-09 to 5,994,096 crores in 2013-14 and deposits have risen fro, 3,834,110 crores to 7,705,560 crores in 2013-14. For the period between 2008-09 and 2010-11 the NPA as a percentage of both credit and deposits has been consistent. But the figures from the last three years indicate a substantial increase in the NPA as a percentage of both credit & deposits.

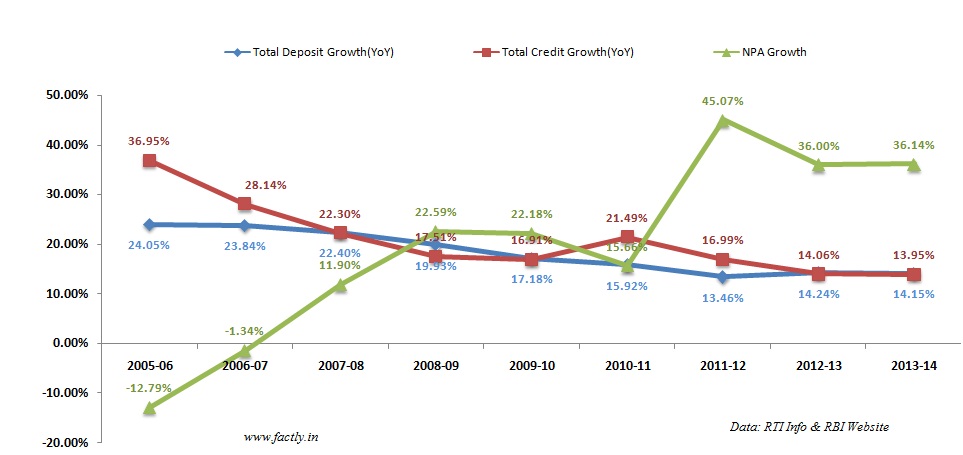

While the total credit and deposits have grown consistently at 15 %, NPAs have increased 2-3 times the growth of the credit and deposits. If NPAs are the yardstick to measure the health of the Indian banking sector, it is definitely very ill. This calls for an urgent need to create revised framework for the credit appraisal process and stricter regulation to control the NPAs.