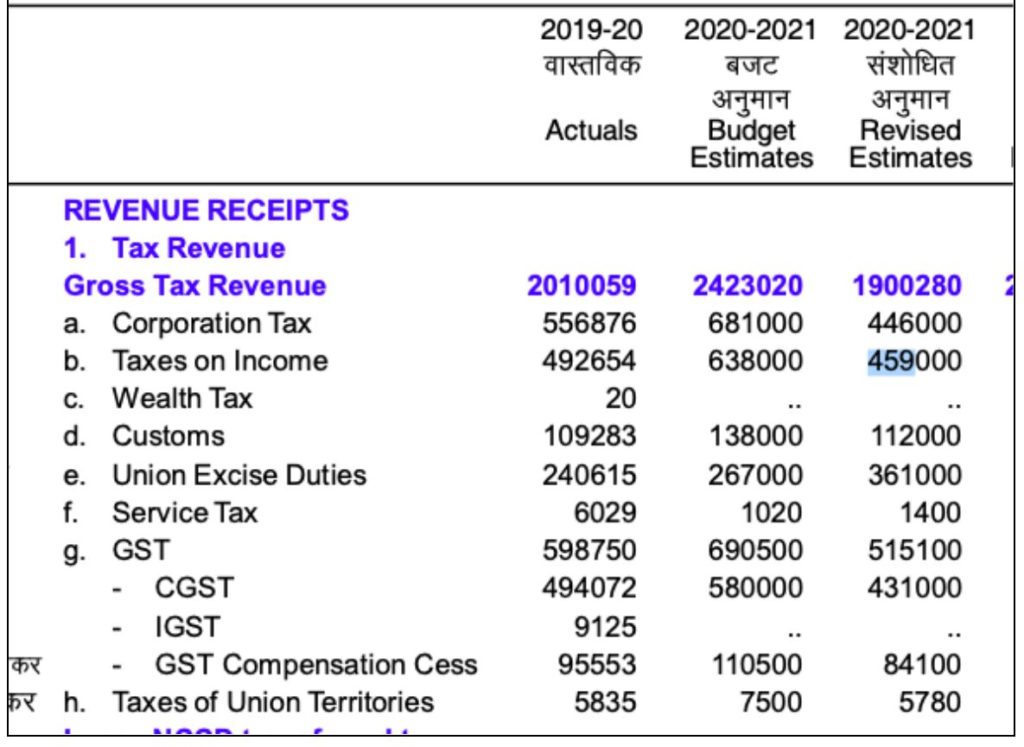

Lower tax revenues from both direct & indirect taxes were anticipated in 2020-21 because of the pandemic’s impact on the economy. As expected, the revenues from almost all types of taxes reduced in 2020-21 compared to 2019-20 if provisional figures for 2020-21 are to be believed. However, the Gross Tax Revenue of the Union Government for 2020-21 is slightly higher than that of 2019-20 mainly on account of the 63% increase in the ‘Excise Duty’ collections.

In the latest Union Budget for 2021-22, the Revised Estimate (RE) of Net Tax Revenue for 2020-21 was pegged at Rs.13.44 lakh crores. This is 18% less than the Budget estimate (BE) of Rs. 16.35 lakh crores, made during the presentation of the 2020-21 budget. This 18% reduction in the RE is not unique to 2020-21. Even for the previous year 2019-20, the RE was 9% less than the BE.

The higher difference in the RE and BE for 2020-21 is a reflection of the state of the economy impacted by the COVID-19 pandemic. Lower Tax revenues impact government spending and it is all the more problematic since the government has to spend more on welfare & stimulus measures to cushion the impact of the pandemic. The second wave of COVID-19 infection during the initial months of 2021-22 is more widespread and impacted the entire country. Many states have imposed lockdown measures to contain the spread. The impact of these measures on the economy in general and tax collection, in particular, will only be known in the coming months.

The actual revenue & expenditure figures for 2020-21 will only be known much later, during the presentation of the budget for 2022-23. However, provisional figures of revenue & expenditure for 2020-21 are available on the website of ‘Controller General of Accounts (CGA)’ in the Ministry of Finance. Using these provisional numbers, we analyse revenue numbers for 2020-21 and also the trend in tax revenue over the last few years to understand the impact of COVID-19, in this story.

Growth Rate of ‘Gross Tax Revenue’ declined since 2017-18

As per the information available on the CGA website, the ‘Gross Tax Revenue (GTR)’ for the year 2020-21 is Rs. 20.24 lakh crores. These figures are provisional and might change slightly as the figures are reconciled over the next few months. This is only a slight increase over the Rs. 20.1 lakh crores of GTR for 2019-20.

While the slight increase in 2020-21 GTR compared to 2019-20 might sound positive, it has to be noted that the RE for GTR was severely curtailed compared to the BE. While lower than expected GTR was anticipated for 2020-21 due to the pandemic, the growth rate in GTR was declining even in the earlier years. In 2019-20, there was a negative growth rate of -3.38% in the GTR, meaning the GTR for 2019-20 was lower than that of 2018-19. This negative growth rate in 2019-20 can be seen as a continuation of the declining trend in the growth rate observed since 2017-18.

Overall, though the less than expected GTR for 2020-21 can be attributed to the pandemic, the decreasing trend was visible even before the pandemic struck.

Tax Revenues picked up in the latter half of 2020-21

As already highlighted earlier, despite 2020-21 being a pandemic year, the GTR was on par and slightly more than the 2019-20 figures. However, this is on the back of negative growth in 2019-20 which means that the GTR for 2020-21 is lower than that of 2018-19.

The month-wise figures of GTR for 2020-21 indicate that the impact of the pandemic is evident but was more prominent or limited to the first six months of 2020-21. The month-on-month comparison with 2019-20 indicates that the greatest fall in GTR was in April 2020 compared to April 2019. GTR in April 2020 was only Rs. 67.5 thousand crores compared to Rs. 1.21 lakh crores in April 2019. The lower month-on-month figures for GTR in 2020-21 continue till September 2020 i.e., the first half of 2020-21 with the exception of August 2020 which witnessed a minor increase in GTR compared to August 2019.

Starting October 2020, there has been a significant increase in the GTR and month-on-month figures for 2020-21 were significantly higher than in 2019-20. The greatest increase was recorded in December 2020, when the GTR of the Union Government was Rs.1.03 lakh crores more than the GTR in December 2019. The recovery during the latter half of 2020-21 covered up the losses during the first half to an extent. However, we will be able to ascertain the actual quantum of recovery only when the final figures for March 2021 are available.

However, the increase in tax revenue in 2020-21 compared to 2019-20 was not uniform across tax groups.

Significant fall in the Direct Tax revenue in 2020-21, mainly on account of lower Corporate Tax revenue

Among the various Taxes & Duties levied by the Centre, Corporate Tax and Income Tax are considered to be Direct taxes, as they are levied directly on the income of the company/individual. Direct Taxes also include Wealth Tax which was abolished in 2015. Hence, ‘Direct Taxes’ currently imply only Corporate Tax and Income Tax.

The ‘Net Direct Tax’ collection for 2020-21, is estimated at Rs. 9.26 lakh crores. This is more than 10% lower than the 2019-20 figure of Rs. 10.37 lakh crores. This is a continuation of a declining trend that began in 2019-20 when the ‘Net Direct Tax revenue’ was lower than 2018-19.

This decline is primarily because of the fall in ‘Corporate Tax’ revenues in 2020-21. This is in continuation of the declining trend that also began in 2019-20. The ‘Corporate Tax’ revenue fell from Rs. 6.64 lakh crores in 2018-19 to Rs. 4.57 lakh crores in 2020-21 (provisional figures). While the pandemic has impacted the collections, the declining trend began much before the pandemic.

The Monthly Corporate tax revenue figures indicate that, with the exception of December 2020, the revenue was lower across all the months in 2020-21, compared to the same months in 2019-20.

On the other hand, even the ‘Net Income Tax’ revenue decreased in 2020-21, though not at the same rate as ‘Corporate Tax’. The provisional figures for 2020-21 peg the ‘Net Income Tax’ revenues at Rs. 4.69 lakh crores, down from Rs. 4.8 lakh crores for 2019-20. This is the first time in many years that the ‘Income Tax’ revenues have decreased. The monthly trends indicate that during the first four months of the financial year, the month-on-month ‘Income Tax Revenue’ was lower for 2020-21 compared to the same month in 2019-20. However, since August 2020, the monthly Income Tax revenue is higher than the same month in 2019-20.

Revenue through Union Excise Duties increased by 63% in 2020-21

While there has been a fall in the ‘Direct Tax revenue’ for 2020-21, the Indirect Tax Revenue has increased. The major components of the Indirect Taxes include – GST (CGST, IGST, Compensation Cess), Custom Duties, Union Excise Duties. Prior to the introduction of GST, Service Tax used to be one of the major components of the Centre’s Indirect Tax revenue.

The overall revenue from these major Indirect Tax sources for 2020-21 is Rs. 10.77 lakh crores. This is an increase over previous years revenue of Rs. 9.57 lakh crores. While there is an increase in the overall Indirect Tax revenue, there are variations in the trends for various taxes.

Goods & Services Tax (GST):

- Net CGST for 2020-21 fell by around 7.6% compared to 2019-20. From Rs. 4.94 lakh crores in 2019-20, it fell to Rs. 4.56 lakh crores in 2020-21.

- Even in the case of ‘Net GST compensation Cess’, the revenue fell by around 11%, from Rs. 95.5 thousand crores in 2019-20 to Rs. 85.1 thousand crores in 2020-21. This is the first time since the introduction of GST that there is a fall in the collections of compensation cess.

- In the case of IGST, the Net IGST during 2019-20 & 2020-21 is drastically lower than the net IGST of Rs. 1.76 lakh crores in 2017-18. This is due to the fact that IGST collections were apportioned to the respective states starting 2018-29. The Central Government has also transferred GST dues to the States during 2020-21. This could be another reason for the lower ‘Net IGST’.

Customs & Excise Duties:

While the GST revenues fell during 2020-21, there is an increase in the net revenues through Custom Duties & Union Excise duties.

- Custom duties increased by nearly 23% in 2020-21 to Rs. 1.34 lakh crores, from Rs. 1.09 lakh crores in 2019-20. The declining trend in the revenues collected through Custom duties post the introduction of GST, was reversed in 2020-21.

- A similar trend was observed in the case of Union Excise duties. There is a whopping 63% increase in the net revenue through Union Excise duties in 2020-21 compared to 2019-20. In 2020-21, Rs. 3.89 lakh crores were collected compared to Rs. 2.39 lakh crores in 2019-20.

A month-month comparison shows that since June’2020, the revenue through ‘Excise duties’ was higher every month, compared to the same month in 2019-20. The provisional figure for March’2021 has the greatest difference.

Shortfall in Direct Tax revenues & GST compensated through increased excise duties on Petroleum products.

It is evident from the available data that there is a fall in the tax revenues from major sources of the Union government in 2020-21. This includes direct taxes of Income Tax & Corporate tax along with the indirect tax of GST. The BE for ‘Corporation Tax’ in 2020-21 was Rs. 6.81 lakh crores and for Income Tax was Rs. 6.38 lakh crores. However, the actual collection from these taxes is much lower. In fact, the RE for both direct tax sources was almost 30% lower compared to the BE for 2020-21. The same can be said about GST.

Meanwhile, the budget estimate for Union Excise Duties was Rs. 2.67 lakh crores. However, the actual collection during 2020-21 is much higher. This is also reflected in the Revised estimates for excise duties. The Union government is trying to compensate for the loss in Tax revenue from Direct Taxes & GST, through the increase in the Excise duties.

As per the information available on the website of Petroleum Planning & Analysis Cell (PPAC), the contribution of excise duties on petroleum products to the Central Exchequer, during the first 9 months of 2020-21 was Rs. 2.36 lakh crores. This is already more than the Rs. 2.23 lakh crores collected in 2019-20 through excise duty on petroleum products. The actual contribution of excise duty on petroleum products could be much higher in 2020-21.

The data clearly indicates that the excise duty on petroleum products could be contributing around 15% to the GTR of the Union Government. If one includes the other forms of revenue through petroleum products like cesses, customs duty, corporate taxes, etc. the contribution could be even higher.

Excise Duty on Petrol & Diesel increased significantly in May 2020

The Central Government increased the excise duty on Petrol & Diesel by Rs. 10 and Rs. 13 respectively in May 2020 through changes to various duties & cesses. This increase is clearly reflected in the excise duty collection figures starting June 2020.

In earlier stories on Factly, we have highlighted how there has been a decrease in the consumption of Petroleum products during 2020-21, with the situation improving only in the latter part of the year. Despite the reduced consumption, the excise duty revenues increased significantly starting June 2020, mainly on account of the increased duty on petrol & diesel.