The RBI’s advisory committee that looked into the advances & overdraft facilities to states recently submitted its report. Data till February 2021 indicates that States have increasingly relied on ways & means advances, special drawing facilities & overdraft to tide over the pandemic-induced fiscal stress. This is in addition to the market borrowings.

The impact of the COVID-19 pandemic on the economy is quite evident through the GDP and tax collection data. The nationwide lockdown during the first wave of COVID-19 infection in 2020 and the mitigation efforts through localized lockdowns & curfews by the State governments during the second wave, resulted in disruption in the economic activity. These disruptions had a domino effect on various sectors including the revenues earned by the government.

In an earlier story, it was observed that there is a shortfall in the ‘Direct Tax’ revenues earned by the Central government, with the increased Excise duty on Petrol coming to the rescue. In another story, we have noted that there is a fall in the revenues of the States as well due to the pandemic. This had resulted in a 57% increase in the market borrowings of the State governments during the first half of 2020-21, to manage the fiscal deficit. In addition to the market loans, States depend on other sources as well to make up for the deficit due to the loss in revenues. In this story, we take a look at the different sources that the States rely on for fiscal deficit management and the trends during the pandemic.

RBI provides financial accommodation to the States to manage cashflows

Similar to the Union government, states incur various expenses. These include expenditure towards various schemes, administrative expenses, interest payments, etc. As part of the annual budget, the states plan the expenditure based on the revenue estimates for the year. However, in reality, various factors influence the State’s ability to meet such expenditure and result in fiscal deficit leading to cashflow issues. There could be issues because of the mismatch between estimated revenues during a particular month vis-à-vis estimated expenditure or an unexpected shortfall in the revenues or an increase in the expenditure. Such situations were common during the lockdown months when the revenues plummeted, but the expenditure increased because of the various welfare schemes.

To help the states tide over such shortfalls in revenue and to meet their expenditure, the Reserve Bank of India (RBI) provides financial accommodation to the States. This is done in the form of Ways & Means Advances (WMA). Section 17(5) of the Reserve Bank of India (RBI) Act, 1934 governs the facilitation of WMA by RBI to the states.

WMA is of two types:

- Normal WMA also referred to as clean advance (started in 1937)

- Special WMA started in 1953, which is now referred to as Special Drawing Facility (SDF) since 2014.

WMA: The extent to which the states can opt for WMA is reviewed periodically. A committee set up by RBI reviews the criteria that determine the WMA limits. When WMA was introduced in 1937, the WMA limit was kept equal to the minimum balance of the respective State governments which was later revised periodically as a multiple of the respective states’ minimum balance. Since 1999, an Informal Advisory Committee (IAC) is constituted by RBI to work out the criteria for setting WMA limits.

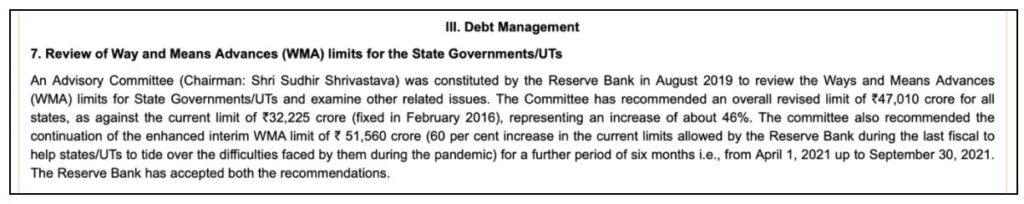

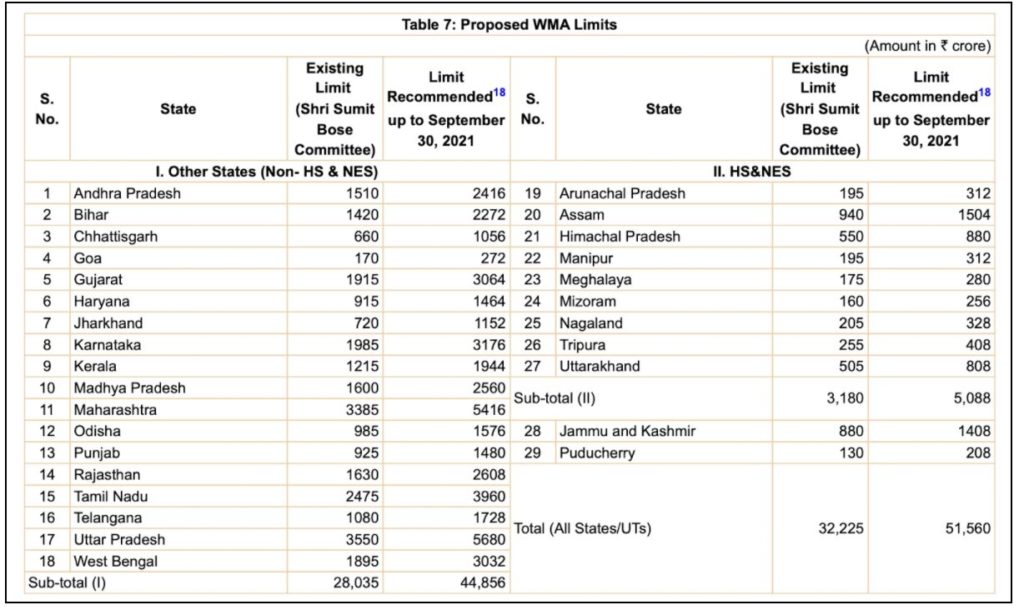

Currently, an Expenditure-based WMA limit is being followed. The current recommendations were provided by a new committee constituted in August 2019. Before the committee could come up with its recommendations, the pandemic broke out in 2020 and hence an interim report for 2020-21 was released.

In response to the fiscal stress to the State governments due to pandemic, the WMA limits for all the states were increased by 30% on 01 April’2020 i.e., to Rs. 41.9 thousand crores from the earlier Rs. 32.25 thousand crores. This was further increased to Rs. 51.56 thousand crores on 17 April 2020. While these measures were initially valid until 17 September 2020, the RBI has recently extended this to 30 September 2021.

Special Drawing Facility (SDF): Apart from WMA, the State Governments are further provided the option of Special Drawing Facility (SDF). This facility was in place since 1953 and is provided against the collateral of their investments in marketable securities issued by the Government of India. While a limit was set earlier, the IAC has decided to allow the states to draw freely against their holdings of GoI securities since 1999.

RBI provisions for Overdraft Facility beyond WMA & SDF

In case the States require additional financial resources beyond WMA & SDF, there is also a provision for Overdraft Facility (ODF).

Overdraft Facility (OD): The States can borrow money from RBI beyond WMA & SDF, to adjust the fiscal position, but are required to pay back immediately. When advances to State Governments exceed their SDF and WMA limits, an OD facility is provided. The regulations and limits on the usage of ODF have evolved over the period of time. As per the current norms, States governments are allowed to run on OD for up to 14 consecutive days.

In case it extends beyond this time limit, the RBI & related agencies will stop the payments related to the respective State Governments. The State governments are allowed to have OD for 5 consecutive working days. However, if this is occurring more than once, the RBI stops the payments irrespective of the 14-day limit. Overall OD should not exceed 36 days in a quarter.

All the advances granted to the State governments i.e., WMA, SDF & OD attract interest on the outstanding amount.

In view of COVID-19, the RBI has provided greater flexibility in OD facility to help tide over the mismatches in their cashflows. As per these interim measures:

- The states can now be on OD continuously for 21 working days instead of the earlier 14 working days.

- The number of days that a state can be in OD for a quarter is enhanced to 50 working days instead of the earlier 36 days.

This facility was provided up to 31 March 2021. Based on the recommendations by IAC this flexibility was discontinued and the rules around overdraft were reverted to earlier ones.

Utilization of SDF & WMA increased during 2020-21 compared to earlier

As stated earlier in reference to an earlier story, the reliance of States on market loans has increased in 2020-21 compared to the earlier years, in view of the pandemic. This was also observed even in the case of the financial support extended by RBI to the States in the form of WMA, SDF & OD.

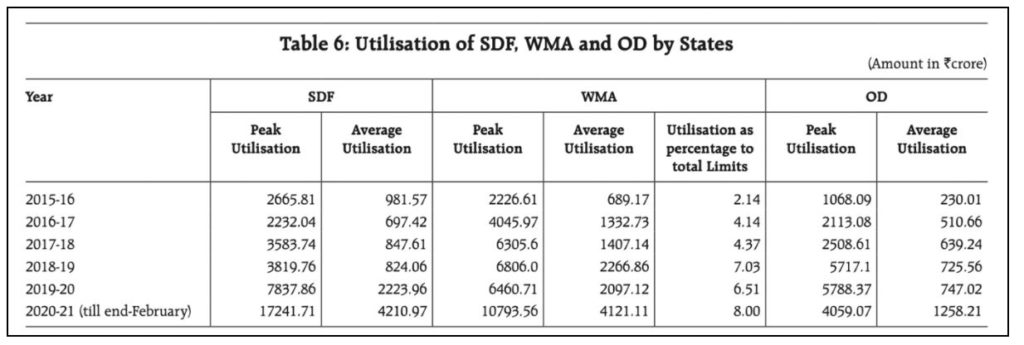

As per the ‘Report of the Advisory Committee on Ways & Means Advances to State Governments’, the Average utilization of WMA during 2020-21 (until February 2021) was Rs. 4.12 thousand crores across all the States. This is nearly twice the utilization in 2019-20. The Average Utilization is derived by dividing the total Utilization by the number of days the facility was utilized by the states.

An increase in the Average utilization can be seen even in the case of SDF as well as OD during 2020-21 (end of February 2021) compared to the previous years.

Even in the case of Peak utilization i.e., the highest single utilization of the options provided by RBI, the utilization for WMA & SDF was higher compared to the highest utilization in the earlier years. While the increase observed in 2020-21 in WMA, SDF and OD can be attributed to the excess requirement of the states during the pandemic, the increase in dependence on these can be observed in the earlier years as well.

- In the case of WMA, while the Average utilization reduced in 2019-20 compared to 2018-19, the annual average utilization during these two years is nearly thrice the levels of the amount in 2015-16. In fact, in 2016-17, there was a two-fold increase in the Average WMA utilization by the States compared to 2015-16.

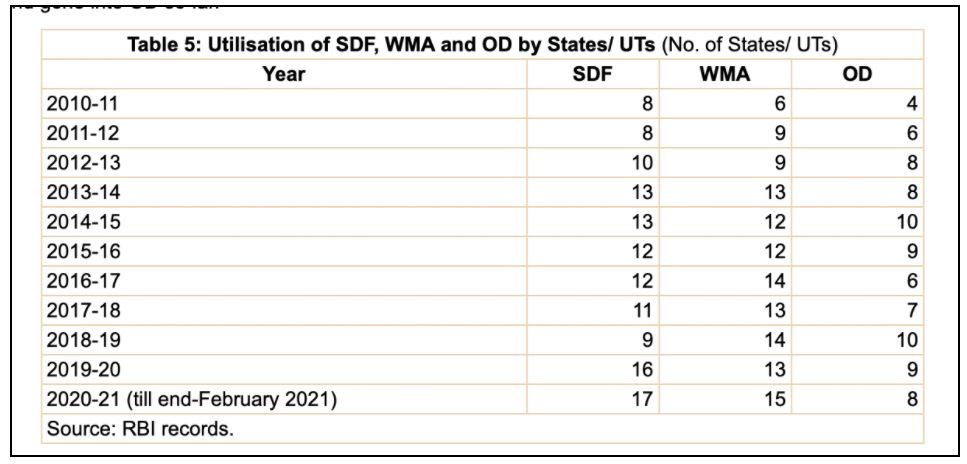

- The number of states utilizing this facility has also increased over the years. In 2010-11, 6 states have opted for WMA which increased to 13 states by 2013-14. In 2020-21, 15 states opted for WMA to meet their fiscal deficit, the highest so far.

- In the case of SDF, while the Average utilization has doubled during the pandemic year, the steep increase can also be seen in the preceding year. During 2019-20, the average SDF utilization was Rs. 2.23 thousand crores. This is nearly thrice the amount in 2018-19. The number of states availing SDF also increased from 9 states in 2018-19 to 17 states in 2019-20.

Increase in utilization of WMA, SDF & OD during 2nd & 3rd quarters of 2020-21

The nationwide lockdown was announced during March 2020 and continued till the end of May 2020 post which the economy started to open up in phases. The impact of the economic slowdown was evident in the reliance of the States on RBI’s financial support during the 2nd & 3rd quarters of 2020-21.

The greatest utilization across these options was during September 2020. The increase observed during June 2020 and December 2020 for SDF & WMA is higher compared to the same period in 2019. While the impact of the COVID-19 pandemic is visible, it ought to be noted that the drawings by the states in 2019-20 were also higher than the earlier the year of 2018-19.

While there is a fall in the drawings for WMA & SDF during the end of 2020-21, the reliance on OD has continued to increase. In fact, February 2021 recorded the highest monthly average for OD, slightly higher than September 2020.

Data indicates that COVID-19 has worsened the already declining fiscal health of the states

The data available in the “Report of the Advisory Committee on Ways & Means Advances to State Governments” up until the end of February 2021 indicates that the pandemic had a severe impact on the fiscal position of the states. This is reflected in the increased borrowings from RBI across all the means i.e., WMA, SDF & OD post lockdown, compared to the earlier years. This is in addition to the increased market borrowings that the states were resorting to.

The other significant aspect is that the increase in reliance on WMA & SDF can be observed even prior to the pandemic. This could be because of the fall in SOTR (States own Tax Revenues) as highlighted in an earlier story.

The increase in ODF at the end of 2020-21, could be an indicator that more states going beyond WMA & SDF to manage their deficit. While COVID-19 certainly has exacerbated the situation, the decline had set in for a few of the states much prior to COVID-19.

With many states experiencing a more severe 2nd wave during March & May 2021, resulting in localized lockdowns during this period, the coming months could witness increased reliance on all these facilities like in 2020. With early signs of a potential third wave, the fiscal position of the states could worsen unless the vaccination gathers pace, and the economy picks up.

We would look at the other sources that the states are relying on cover the fiscal deficit i.e., Market borrowings, in our next story.