A major part of state government’s budgetary resources come from State’s Own Tax Revenue (SOTR). Here is a detailed analysis of SOTR & its share in overall tax revenue of states.

Like in the case of central government, each state incurs expenditure in the form of administrative costs, funding of various schemes, building of infrastructure etc. This is met by the income generated through various sources.

The income generated by states for various activities include revenue receipts like taxes & grants and capital receipts like loans.

Of this, Tax Revenue forms a substantial portion of revenue receipts for most of the states. The tax revenue earned by the states further includes ‘States own Tax Revenue’ (SOTR) and their respective share in the Union Taxes. The devolution of union tax revenue to the states depends on the recommendations of the Finance Commission.

SOTR varies from State-state

States which are able to generate more revenue on their own are less dependent on the devolution & central grants. The generation of SOTR varies from state to state, with few states performing very well on this front and few others still depending largely on their share of Union Taxes and Grants-in-aid provided by the Centre.

In general, SOTR includes revenues earned through – Sales Tax, State Excise duty, SGST, Land Revenue, Stamps & Registrations etc. Few states have other taxes relevant to their own state. In this story we analyse the trends of SOTR earned by the states for the five-year period of 2014-19.

The information submitted by each state to Comptroller and Auditor General (CAG) is considered for this analysis. For the numbers relating to 2018-19, ‘Monthly Key Indicator’ report for March-2019 is considered. For the numbers relating to the earlier years i.e. 2014- 18, the annual ‘Accounts at a Glance’ report submitted by the states to the CAG is considered. Delhi, Goa & Puducherry are excluded from the analysis as there is no data available on the CAG website.

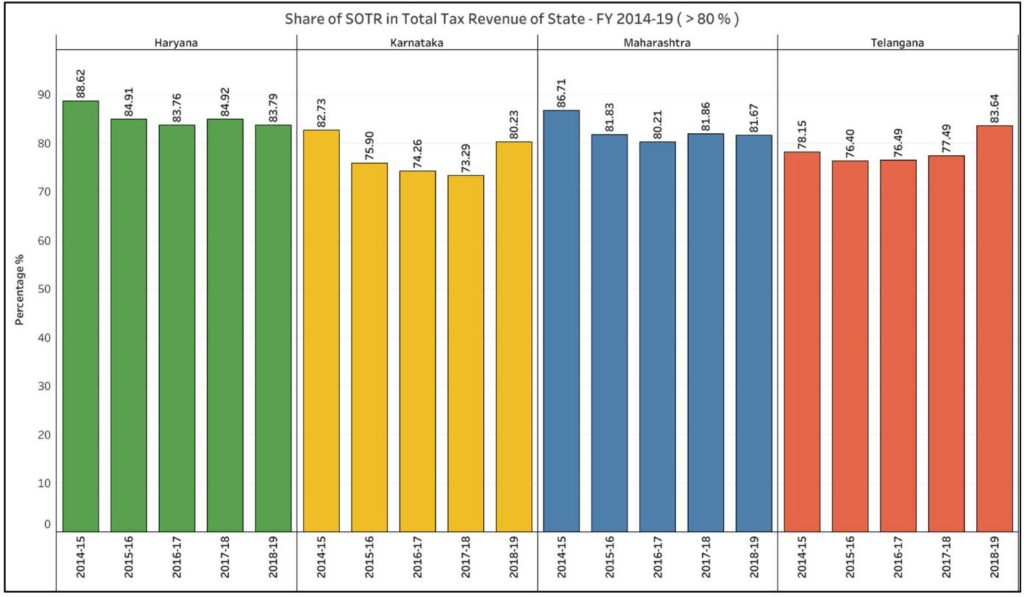

SOTR accounts for more than 80% of the total tax revenue in Haryana, Karnataka, Maharashtra & Telangana

For the year 2018-19, SOTR accounted for 83.79% of the tax revenue in Haryana. Even in the four years prior to this, SOTR accounted for 88.62%, 84.91%, 83.76% and 84.92% of the total tax revenue earned by the state. SGST followed by sales tax forms the major share of the SOTR in Haryana.

Telangana has managed to increase the share of SOTR to 83.64% of the total tax revenue for the first time in 2018-19. Although it did have a higher share of SOTR in earlier years, the share was in the 70s. This increase is both due to the increase is SOTR for 2018-19 (by 10 thousand cores) as well as a fall in amount received as devolution of union tax revenue. It is also one of the few states which is showing a year on year increase in the share of SOTR.

Apart from Haryana, Maharashtra is another state where the SOTR share is more than 80% between 2014-19. In 2014-15, SOTR share in Maharashtra was highest at 86.71% of the total tax revenues. Share of SOTR in the subsequent years fell slightly but is still in the 80s.

In Karnataka, the share of SOTR was 80.23% of its tax revenue in 2018-19. In the previous years, it hovered in lower 70s. In the year 2014-15, SOTR accounted for 82.73% of the total tax revenue. The increase in 2018-19 is result of an increase in State tax revenues.

For all these four states, the tax revenue forms the major chunk of total revenue receipts with Non-tax Revenue and Grants-in-aid contributing a minor share.

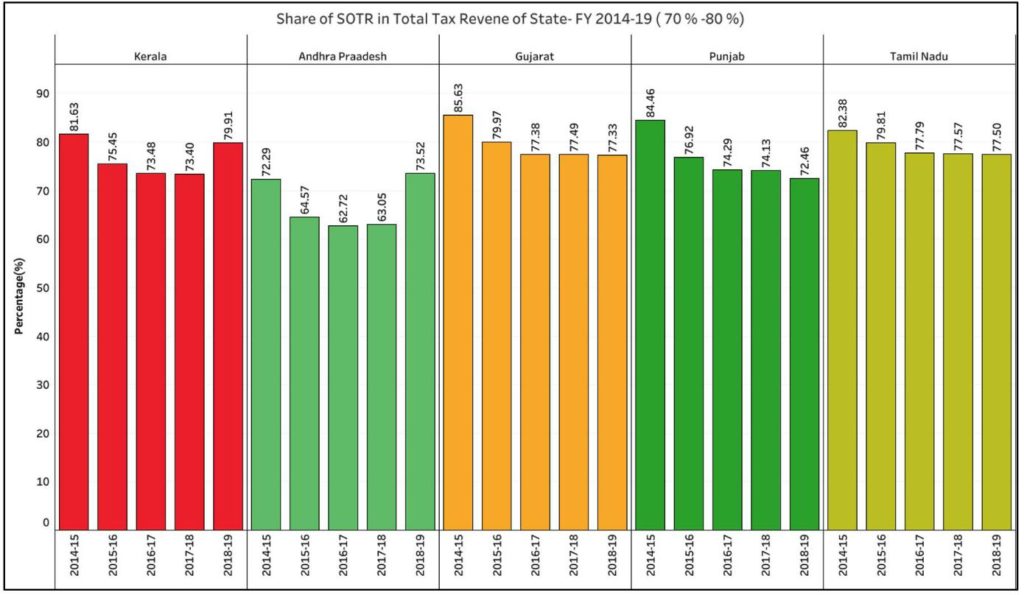

Share of SOTR between 70 -80% of the total tax revenues for five states

In 2014-15, the share of Kerala’s SOTR was at 81.63% of the total tax revenue. In the subsequent years, however, its share in the total tax has fallen while the amount has increased. In 2018-19, the share of SOTR in Kerala’s tax revenues was 79.91%.

Andhra Pradesh has managed to increase its SOTR share in 2018-19 to 73.52%, an increase by 10% from the previous year. During the previous three years between 2015-18, the states SOTR share hovered in the 60s. Even in the case of AP, the recent increase is due to both the increase in actual SOTR as well as the decrease in the state’s share in union taxes.

Although the three states of Gujarat, Kerala and Tamil Nadu have their SOTR share in 70s bracket, there is a consistent decline over the five-year period. Each of these states had the SOTR share in 80s in 2014-15. The proportionate increase of share in Union taxes was higher than SOTR which led to this situation.

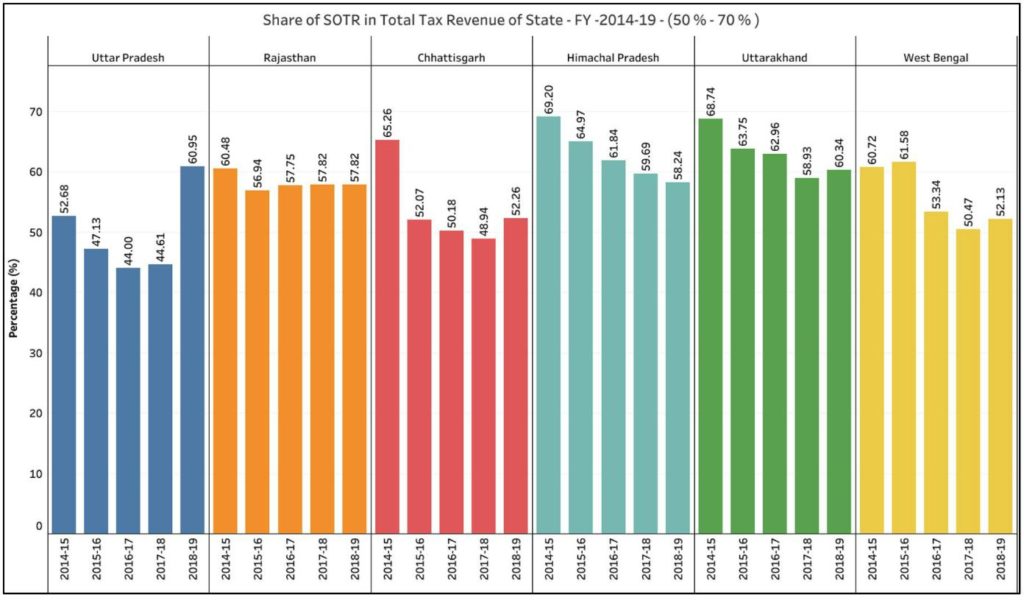

UP’s SOTR share in total tax revenue crossed 60% in 2018-19

Uttar Pradesh has been among the low performing states in terms of Tax Revenues earned through SOTR. In 2014-15, the share of SOTR was 52.68% of the total tax revenue which further reduced in the subsequent three years to 47.13%, 44% and 44.61% respectively. However, in 2018-19, there has been a steep increase in the share of SOTR to 60.95%. This increase is due to around 60% increase is SOTR compared to that of the previous year. The phenomenal increase in state GST collection in 2018-19 is the main contributor which increased to more than ₹ 82 thousand crores in 2018-19.

Chhattisgarh, Himachal Pradesh, Rajasthan, Uttarakhand and West Bengal all have recorded a fall in their share of SOTR in total tax revenue year on year during the period 2014-19. For these states’ revenue earned through SGST could not cover up the reduction relating to taxes on Sales, Trade etc.

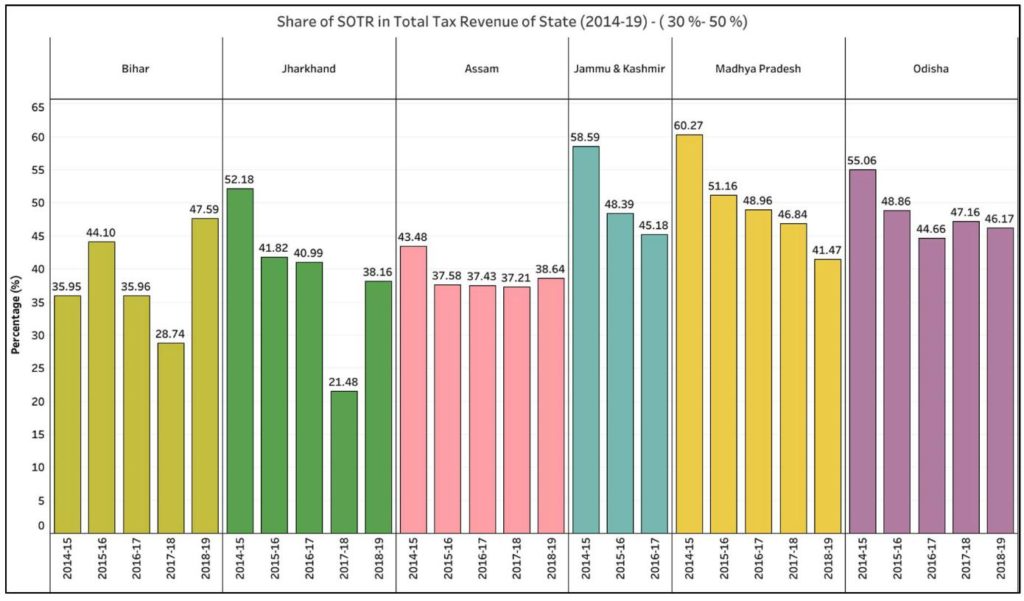

Bihar & Jharkhand have increased their SOTR share in 2018-19

As in the case with U.P, Bihar also saw a significant jump in SOTR in 2018-19. While the share of SOTR in total tax revenue is still a lowly 47.59%, this is a significant improvement over 28.74% and 35.96% in the previous two years. This increase can be attributed to a significant increase in the SGST collection. It also needs to be noted that since 2016-17, Bihar does not have income through Excise tax due to the prohibition of liquor in the state.

Although there is an increase in Jharkhand’s SOTR in 2018-19, the state has reduced SOTR earnings during the five-year period. Assam, Madhya Pradesh & Odisha are the other two states which have seen a fall in SOTR, with the reduced SGST collections. The share of SOTR data for 2017-18 and 2018-19 is not available for J&K. But even this state has shown a declining trend compared to the previous years. Jharkhand does receive a considerable amount in the form of Grants-in-aid from the Centre.

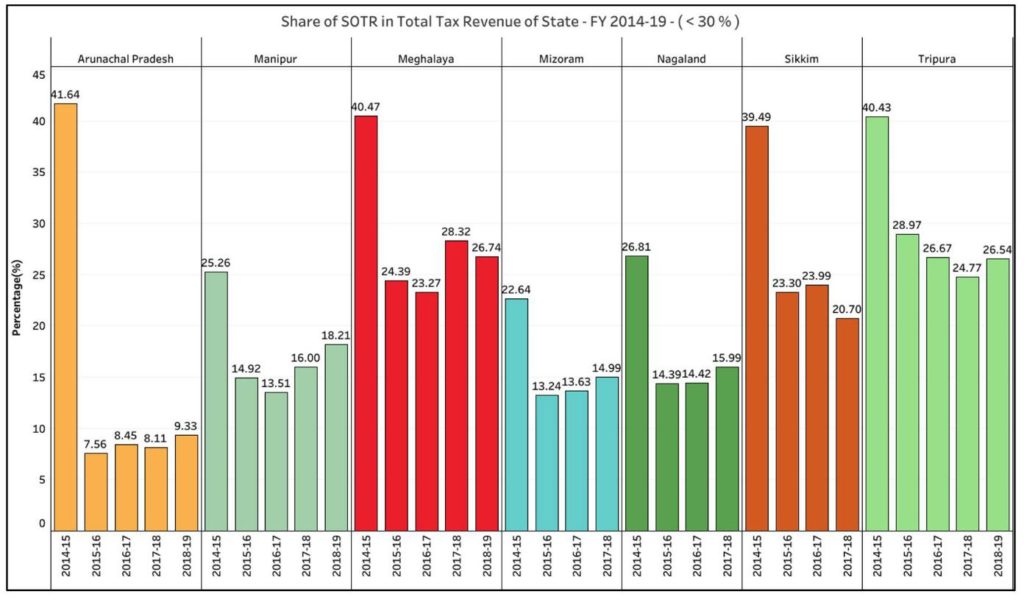

Majority of the Tax revenue of North East states is their share of Union taxes

Over the five-year period, the State’s share of Union Taxes received by Arunachal Pradesh has increased from ₹ 1,109 crores to around ₹ 10 thousand crores. During the meantime, SOTR has only increased from ₹ 462 crores to ₹ 1,073 crores. The share of SOTR has therefore fell drastically from 41.64% in 2014-15 to only 9.33% in 2018-19.

Even the other states in North East India are also heavily dependent on their share of central taxes. Among these states, Meghalaya and Tripura are considerably better with a higher SOTR share. However, even for these states, SOTR does not cross 30% with the major chunk of the tax revenue coming from their share in central taxes.

The data in respect to the division of tax revenue into SOTR and Share in Union taxes, is not available in 2018-19 for Sikkim, Mizoram and Nagaland. However, even these states show a significant fall in the share of SOTR. Apart from the tax revenues, the North-Eastern states also receive substantial Grants-in-Aid.

Fall in share of SOTR across multiple States

North Eastern States, Bihar, Jharkhand, U.P etc. are the states with a lesser share of SOTR and have been receiving a major portion of their tax revenue through devolution of union tax revenue.

Meanwhile, among the larger states, Maharashtra, Karnataka, A.P, Telangana, Kerala, Tamil Nadu etc. SOTR share is substantially higher in the state’s total tax revenues.

However, a common trend that can be seen in recent years (2014-19) is the general fall in SOTR across multiple states, including the higher-performing ones. One key contributor to this is the lower SGST revenues. In the case of some states like U.P, an increase in SGST revenue has helped in the increase of SOTR.

The states with a higher SOTR are also observed to have been doing well in their SGST collections. However, only two years of data is available post the implementation of GST and it would be too early to predict future trends.

Focus on creating avenues to increase SOTR could help in having stable budgets and economic planning, irrespective of the changes in the devolution of union tax revenue.