Data from the budget documents indicates that a significant portion of taxes remain locked in disputes, pending resolution across various judicial forums. Taxes on Income and Expenditure consistently account for the lion’s share of unrealized tax revenues. In 2023-24, this category reached a record high, making up 92% of all unrealized taxes, surpassing its previous peak of 90% in 2022-23.

Taxes are the lifeblood of public finance, shaping how governments allocate resources and fund development. They form the backbone of both the Centre and States’ revenue streams. The Union Government’s actual tax revenue for 2023-24 stood at ₹23.27 lakh crore, with the 2025-26 Budget Estimates projecting it at ₹28.37 lakh crore. Given the heavy reliance on tax collections, any shortfall can ripple through government finances, affecting economic growth and public spending plans.

At the same time, the fiscal deficit—the gap between government spending and income— remains a crucial concern, with actuals for 2023-24 at ₹16.54 lakh crore and budget estimates for 2025-26 pegged at ₹15.68 lakh crore. To maintain financial stability and meet expenditure needs, mobilizing tax revenue is paramount. However, a significant portion of taxes remain locked in disputes, pending resolution across various judicial forums. These unrealized revenues can strain government finances and limit its fiscal flexibility.

This two-part analysis delves into key data on tax arrears—taxes that have been assessed but remain uncollected. This first part focuses on unrealized tax revenues, providing an update to our earlier story, while the second part explores pendency and litigation management in tax disputes.

Find the dataset on the Tax Revenues Raised but not realized on Dataful

Cumulative Taxes raised but not realised stand at Rs. 31 lakh crores by 2023-24

There are several ways to improve tax revenues—expanding the tax base, adjusting tax slabs, and ensuring a litigation-free collection process. Each approach has its own costs and benefits, but in the current economic scenario, measures like widening the tax base or modifying slabs have their limitations. This leaves us with a more pragmatic and effective solution: streamlining tax collection by minimizing litigation. While not an easy task, it remains the most viable path to securing much-needed revenue without placing additional burdens on taxpayers.

Data on taxes raised but not realized reveals a troubling trend—unrealized tax revenue has been steadily increasing year after year. Between 2004-05 and 2023-24, the unrealized tax revenue increased from Rs. 1.1 lakh crores to Rs. 31.1 lakh crores. While this number has grown consistently, the past two years have seen an unexpected surge, with unrealized tax revenues reaching ₹21 lakh crore in 2022-23 and soaring to ₹31 lakh crore in 2023-24. To put this into perspective, if even 50% of these unrealized taxes were recovered, it could significantly reduce—if not entirely wipe out—the fiscal deficit. This highlights the sheer magnitude of uncollected taxes and the critical role they could play in strengthening public finances.

Almost 70% of the unrealized taxes are under dispute

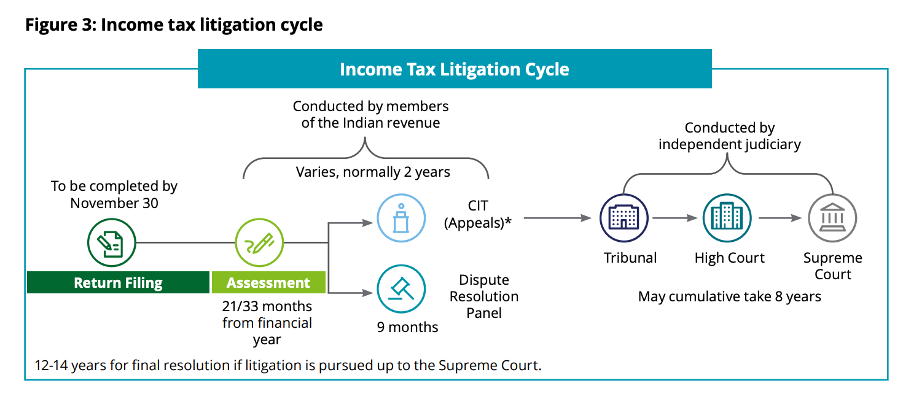

Taxes often remain uncollected due to various factors, including complexities in tax filing, non-compliance, and differing interpretations of tax laws. These issues can lead to underreporting of taxable income or outright tax evasion. When discrepancies arise, tax authorities issue notices, which may escalate into legal disputes. Taxpayers have the right to challenge these notices through multiple appellate levels, starting with the Commissioner of Income Tax (Appeals) [CIT(A)] for direct taxes or the Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) for indirect taxes. Further appeals can progress to the Income Tax Appellate Tribunal (ITAT), High Courts, and even the Supreme Court. Below is the general litigation cycle for direct tax disputes.

Unrealized tax revenues are not just a consequence of disputes in courts and tribunals but also stem from delays and inefficiencies within the tax departments themselves. The multi-layered tax administration process often leads to prolonged pendency and arrears, making tax recovery a slow and cumbersome affair.

An analysis of unrealized tax revenue composition reveals that nearly 70% of the total amount remains tied up in disputes, while the remaining 30% is not under dispute. To better understand the trends, the data has been divided into four distinct periods:

- T1: 2004-05 to 2008-09

- T2: 2009-10 to 2013-14

- T3: 2014-15 to 2018-19

- T4: 2019-20 to 2023-24

Over time, the share of unrealized tax under dispute has fluctuated significantly. In T1, disputed taxes accounted for 65% of the total unrealized amount, rising sharply to 87% in T3. However, this trend reversed in T4, with the proportion dropping to 68%, meaning the share of unrealized taxes not under dispute increased from 13% in T3 to 32% in T4. Interestingly, to combat the tax disputes and make it litigation-free, the Government of India launched the Direct Tax Dispute Resolution Scheme in 2016 and enacted the Direct Tax Vivad se Vishwas Act, 2020.

This growing backlog of undisputed yet uncollected taxes points to inefficiencies in tax administration, highlighting gaps in enforcement and collection mechanisms.

As of 2023-24, more than 90% of the unrealized tax revenue is from taxes on income and expenditure

Unrealized tax revenue primarily stems from two broad sources: Taxes on Income and Expenditure and Taxes on Commodities and Services. The former includes Corporation Tax and other income taxes, while the latter comprises Customs, Union Excise, Service Tax, Central GST (CGST), and Integrated GST (IGST).

A clear trend emerges when analysing these categories—Taxes on Income and Expenditure consistently account for the lion’s share of unrealized tax revenues, averaging around 85% of the total. In 2023-24, this category reached a record high, making up 92% of all unrealized taxes, surpassing its previous peak of 90% in 2022-23. This growing backlog in direct tax cases litigation may be a key factor behind the government’s push for a New Tax Regime, which aims to simplify tax structures and reduce litigation, ultimately improving compliance and revenue realization.

Nearly half of unrealized tax revenues from Income and Expenditure are 1-2 years old

The age of unrealized tax revenues varies significantly across categories. For taxes on income and expenditure, more than half of both disputed and non-disputed amounts are between 1-2 years old. In comparison, 31% of disputed and 24% of non-disputed unrealized taxes from commodities and services fall within this timeframe.

Looking at a broader timeline, 88% of disputed and 81% of non-disputed unrealized taxes from income and expenditure are less than 5 years old, with only 2% and 5%, respectively, being over 10 years old. Similarly, for commodities and services, 76% of disputed and 55% of non-disputed unrealized taxes are under 5 years old, while 4% of disputed and 17% of non-disputed amounts have been pending for over a decade. This data highlights that while most unrealized taxes are relatively recent, a significant backlog still lingers, especially in the commodities and services category.

In the next part, we examine the pendency of cases across different levels of judicial administration and explore key statistics on litigation management.