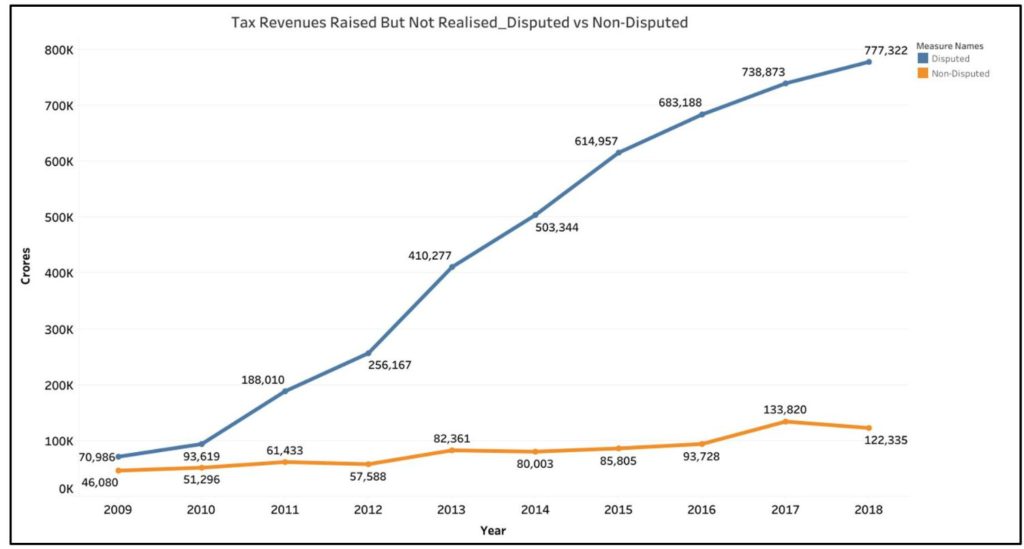

[orc]Along with the tax revenue realized by the government, substantial amounts of tax revenue remain unrealized because of disputes and non-payment. Of the total unrealized tax revenue up to 2017-18, proportion of ‘amounts under dispute’ was a whopping 84%.

Taxes are the main source of revenue for the Government of India (GoI). As per the budget presented for the FY 2019-20, the actual receipts of central government for 2017-18 was Rs. 21.37 lakh crores, of which the revenue through taxes was 12.42 Lakhs i.e. approximately 58% of the total GoI revenue.

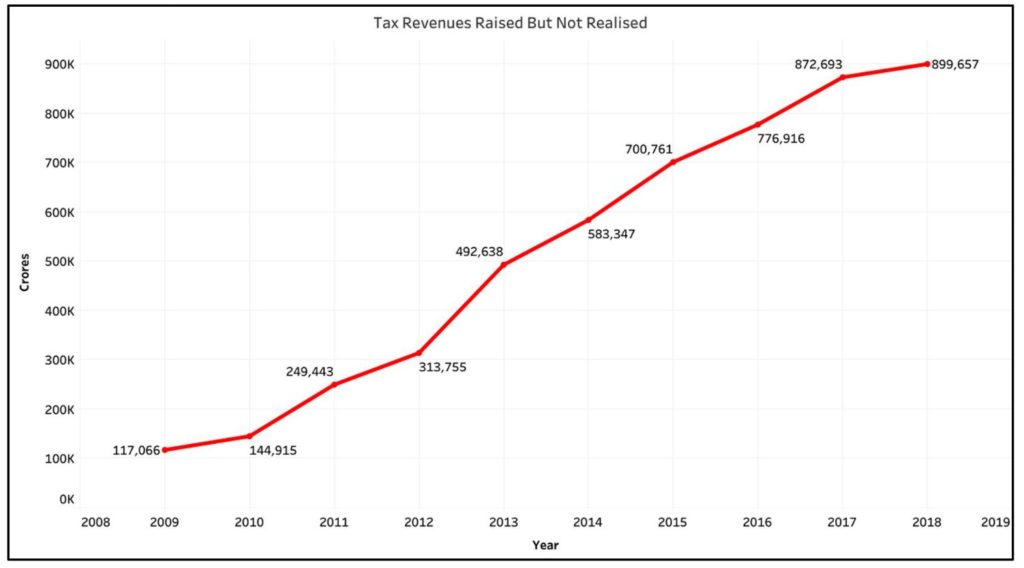

Since tax revenue is a major source for all government expenditure for implementation of various initiatives, tax revenues not realized result in reduced expenditure. The analysis of the numbers regarding tax revenues raised but not realized present a very concerning picture.

The receipt budget for 2018-19 indicates that as of reporting year 2017-18, a total of Rs. 8.99 lakh crores of tax revenue were raised but not realized, which is almost 75% of the GoI’s actual tax revenue in 2017-18.

Total unrealized Tax revenue increased by 6 times over the last 10 years

The total amount of tax raised but not realized has seen a consistent increase every year for the period 2013-18. For the year 2013-14, the unrealized tax revenue amounted to around Rs. 5.83 lakh crores, while by the year 2017-18,it increased to Rs. 8.99 lakh Crores i.e. an increase of 54%.

Whereas, during the earlier five-year period of 2008-13, the unrealized tax increased by Rs. 3.75 lakh crores. In the year 2008-09, the amount was Rs. 1.17 lakh crores which increased to Rs. 4.92 lakh crores by 2012-13 i.e. an increase more than four times. Over the last 10 years, i.e., from 2008-18, the unrealized tax revenues increased by Rs. 7.82 lakh crores i.e. by more than 6 times.

Correspondingly, during this 10 year period (2008-18), the actual tax revenue of GoI increased from Rs. 4.56 lakh crores in 2008-09 to Rs. 12.42 lakhs in 2017-18 i.e the actual tax revenues has nearly tripled.

Proportion of Unrealized Tax revenues under dispute increases over the years

The budget reports regarding the non-realization of tax revenues, categorizes the unrealized tax amounts into – ‘Amounts under dispute’ and ‘Amounts not under dispute’.

The reasons for unrealized tax amounts could include: the challenges involved in tax filing, non- compliance, interpretation of the tax laws which could either lead to under reporting of the taxable amount or evasion of tax etc. Such non-compliance could lead to notices being issued by the tax authorities and litigation with the tax authorities giving rise to ‘Tax Disputes’. Taxpayers can appeal against these notices with their arguments which are taken up on different levels including – CIT (A) (Commissioner of Income Tax – Appeals) , ITAT (Income Tax Appellate Tribunal) for Income Tax and Customs Excise and Service Tax Appellate Tribunal (CESTAT) for indirect taxes. Further appeals will lie with the High Court or the Supreme Court.

The un-realized tax amount which is under dispute between the tax authorities and the taxpayers is classified as ‘amounts under disputes’. The rest of the unrealized tax revenues are considered as ‘amounts not under disputes’.

The share of disputed amounts in the total unrealized tax revenues has increased over the last 10 years. For the year 2008-09, the disputed amount was 61% of the total unrealized tax revenue. Over the 10-year period, it has consistently increased and for the year 2017-18 the disputed amount accounted for 84% of the total unrealized amount. It needs to be noted that both the disputed amounts as well as non-disputed amounts have a near regular increase over the last 10 years, especially over the last five years.

For the total Rs. 7.77 lakh crores under disputes as of 2017-18, around Rs. 3.55 lakh crores i.e. 45% is pending between 1-2 years. A further Rs. 3.47 lakh crores are pending between 2-5 years with around Rs. 57000 crores pending between 5-10 years. Around Rs. 17000 crores is pending for more than 10 years.

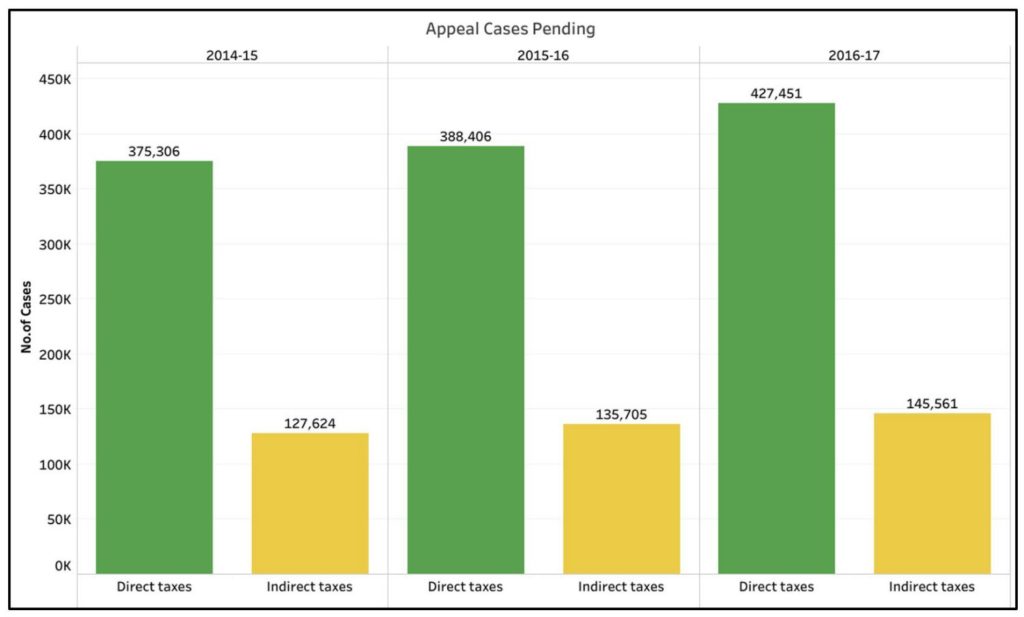

Pendency of tax dispute cases increasing each year

Responding to a question in Rajya Sabha on 03 April 2018, the Minister for Finance had provided details of the total cases relating to tax disputes in various appellate institutions. A total of 4.27 lakh cases for Direct Taxes and 1.45 lakh for Indirect taxes were pending by the end of 2016-17.

The number of pending cases has increased over the three years from 3.75 lakh in 2014-15 to 4.27 lakh in 2016-17 in the case of direct taxes and from 1.27 lakh in 2014-15 to 1.45 lakh in 2016-17 in the case of indirect taxes.

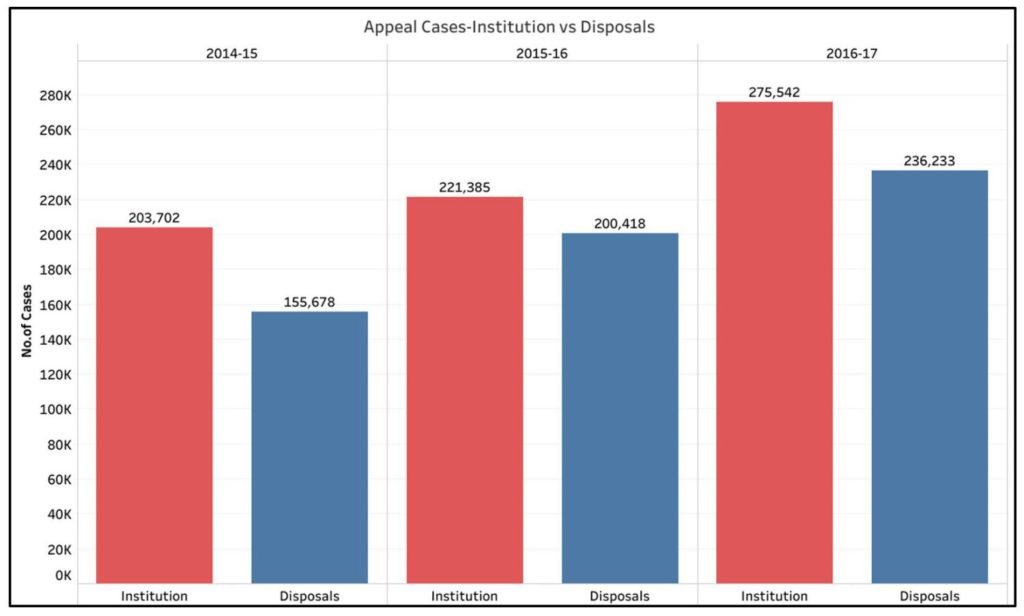

The increase in pendency of cases is both due to the increase in number of new cases and disposal not being on par with the number of new cases being lodged

Total number of new appeals accepted in various Appellate institutions have increased from 1.5 lakh in 2014-15 to 2.05 lakh in 2016-17 in the case of direct taxes. On the other hand, number of new appeals relating to indirect taxes have also gone up from 53,497 in 2014-15 to 69,853 in 2016-17.

Correspondingly the number of disposals increased from 1.11 lakh in 2014-15 to 1.76 lakh in 2016-17 in the case of direct taxes and from 44,669 in 2014-15 to 59,930 in 2016-17 in the case of indirect taxes.

While the rate of disposal is not on par with the rate of new appeals being lodged, it can be observed that the number of disposals for both the direct and indirect taxes have increased over the three years 2014-2017.

Of the total pending cases for direct taxes as of 2016-17, 68% (2.9 lakh) are pending with Commissioner of Income Tax – Appeals. This is the first appellate institution, before the cases move to other institutions of appeal. The Income Tax Appellate Tribunal has 22% (92,386) of the pending cases in the case of direct taxes.

As for indirect taxes, CESTAT (Customs Excise and Service Tax Appellate Tribunal), which is the second level of appellate institution has 57% (83,338) of the pending cases. The Commissioner- Appeal has 31% (45,163) of the pending cases.

The rest of the appeal cases for both direct and indirect taxes are pending with Supreme court and various High Courts.

One trend that is clearly visible in this three-year period 2014-17, as per the data provided in the in Rajya Sabha, is the decrease in the number of new appeals in the Supreme court for both direct and indirect taxes.

Withdrawal of appeals and standardizing interpretation of the law are among the measures initiated

In the same answer, the Ministry of Finance has acknowledged the higher rates of pending litigations in the various appellate institutions and has provided the actions being taken to reduce the number of litigations. The complexity of the existing Income Tax laws and the various interpretation of the provisions of the law are cited as the reason for the high number of litigations for direct taxes.

According to the government, following are the some of the initiatives being undertaken to reduce pendency.

- Setting target of 500 disposals each year for CIT(A) under Central Action Plan (CAP)- 2017-18. 70-100 target for Commissioner (Indirect taxes) per month.

- Brief of standard process for applying provisions u/s 14A, 68 and 147 of the Income Tax Act, which were identified as to be the cause for a substantial part of litigations.

- Circulars on the departmental perspective of key contentious issues.

- Increasing the monetary limit from Rs. 15 lakh to Rs. 50 lakhs for Single Member Court (SMC), widening the scope for dispute resolution at ITAT level.

- Implementation of National Judicial Reference System (NJRS).

- The minimum threshold of appeals pertaining to indirect taxes are set at Rs. 25 lakhs (Supreme Court), Rs. 20 Lakhs (High Court) & Rs. 10 Lakhs (CESTAT). Any appeal with revenue below the threshold is with-drawn.

- Similar cases for which a finality has been earlier arrived at Supreme Court are also being withdrawn.

- Liquidate all pendency at Commissioner level up-to 30 June 2017, in the case of indirect taxes.

Featured Image: Unrealized Tax Revenue

1 Comment

Pingback: Fact Check: How true is Congress party’s claim regarding shortfall in Government earnings - Fact Checking Tools | Factbase.us