A social media post which claims that ‘starting from April 1, all UPI transactions more than ₹2000 to be charged 1.1% is being widely shared. Through this article, let’s fact-check the claim made in the post.

Claim: All UPI transactions more than ₹2000 to be charged 1.1%, starting from April 1.

Fact: No charges will be applicable for regular UPI based bank account payments, starting 01 April 2023. The circular issued recently by NPCI is related to UPI based wallet payments. And even these interchange charges and service charges are borne by banks and wallet institutions, not the general consumers. NPCI has issued a clarification in this regard. Hence the claim made in the post is MISLEADING.

UPI Interoperability:

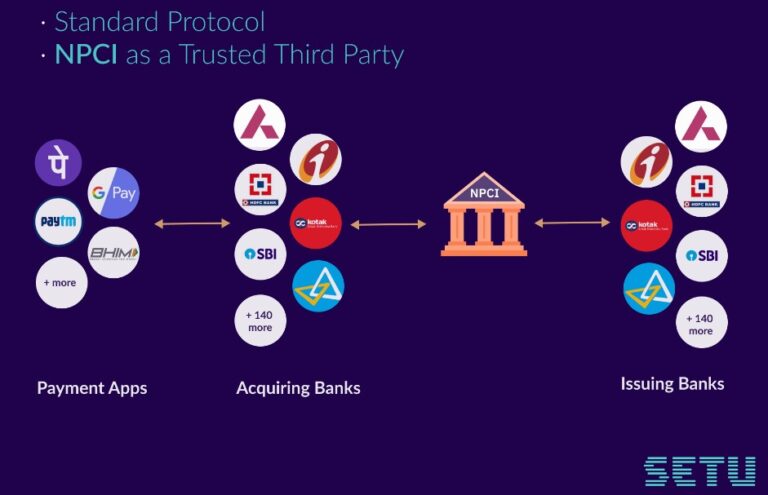

National Payments Corporation of India (NPCI) in 2016 developed an online money payment system called Unified Payments Interface (UPI). Customers can send money from their bank account to another bank account in seconds using applications like Google Pay, Phone Pay, Paytm, which works based on this system.

Users, with their phone number/UPI ID/QR code linked to the bank, can possibly send money from the bank account registered in one app to the account registered in another app. This is called Interoperability, which basically means connecting various banks and facilitating transactions through the UPI system.

However, few of these UPI applications like Phone Pay, Amazon Pay, Mobi Kwik etc. have their own Prepaid Payments Instruments (PPI) like wallets. Customers can add money from their bank accounts to these wallets and use them.

Till recently these wallets lack interoperability, i.e., money in one wallet cannot be sent to another company’s wallet or UPI payments through these wallets to QR code generated by other entities. Over the years, RBI has directed these UPI service providers to enable interoperability through PPI(wallets) and issued guidelines in this regard. However, many of these service providers failed to do so.

NPCI circular imposing interchange fee:

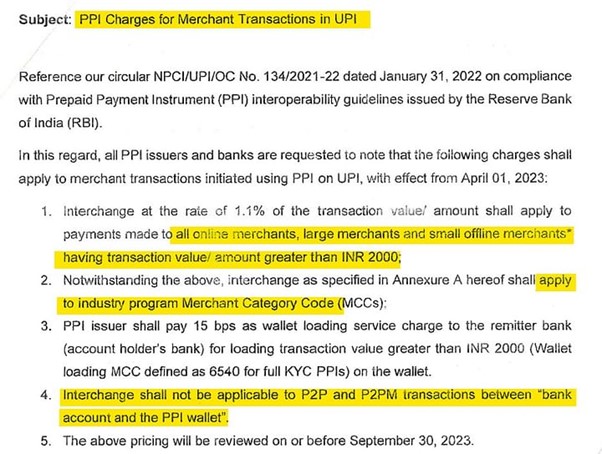

Subsequently, NPCI, on 24 March 2023, issued a circular proposing an interchange fee applicable to merchant transactions initiated through PPI on UPI, with effect from 01 April 2023.

NPCI circular only talks about charging only those transactions initiated through PPI. And moreover, these charges are only applicable to merchants, not the public.

For example, if a user pays Rs. 3000 by scanning the QR code of ICICI Bank from the phone pay wallet at an HP Petrol Bunk, then ICICI Bank shall pay 0.5% i.e., Rs. 15 to the phone pay. This is called interchange fee.

Further, as per the circular, the PPI issuer shall pay 15 bps as wallet loading charges to the remitter bank (account holders bank) for loading transaction value greater than Rs. 2000 on the wallet.

For example, if any user loads Rs. 3000 in his Paytm wallet from Access Bank, Paytm shall have to pay 0.15% i.e., Rs. 4.5 to Access Bank.

However, it is this circular of NPCI, that led to the confusion, as it was misinterpreted as all UPI transactions over Rs. 2000 are to be charged.

NPCI denied the rumors :

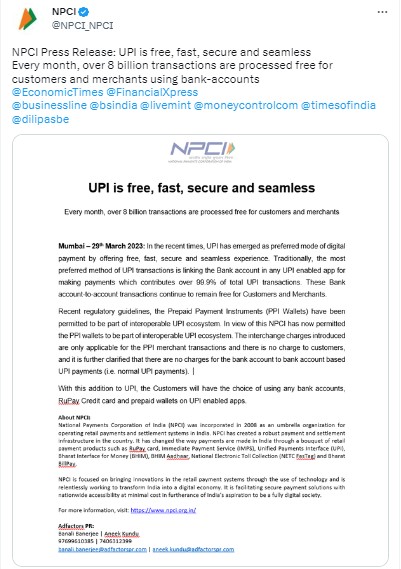

Following the misinterpretation of the NPCI circular proposing charges on UPI-wallet based transactions, NPCI on 29 March 2023, through a tweet clarified that users will not be charged on UPI transactions.

The tweet categorically mentions that interchange charges are only applicable for PPI merchant transactions. PIB also cleared the air regarding the viral claim.

Although general UPI transactions do not attract any charges as of now, some banking experts opined that charges imposed on UPI-based wallet payments may ultimately have an indirect impact on consumers in near future.

To sum it up, NPCI clarified that all UPI transactions are free for general users. Interchange fee is between Merchants and Banks for transactions made through PPIs.