A social media post claims that the government has granted relief to business entities by extending the implementation of section 43 B(h) of the Income Tax Act for one year. The post highlights that this extension has eased the burden on business entities, particularly concerning payments to MSMEs. Let’s fact-check the assertion made in the post through this article.

Claim: Government has extended the implementation of section 43 B(h) of the income tax act by one year.

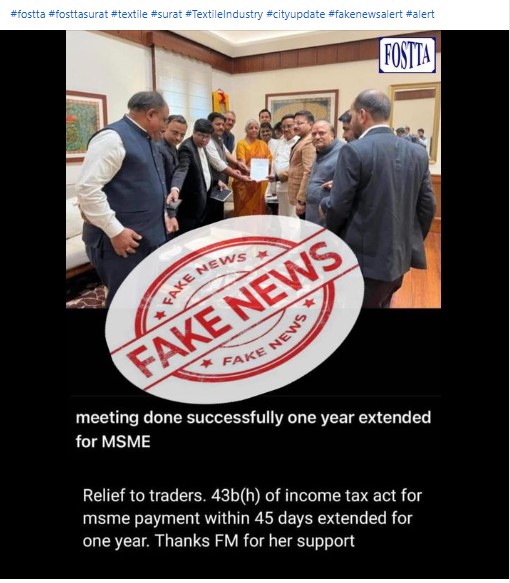

Fact: As per the reports, multiple representations have been made by industries from multiple forums seeking deferment in the implementation of section 43 B(h). However, contrary to the claim, the union government did not provide any relaxation yet. FOSTTA clarified that viral information is false and that the government has not issued any official decision in this matter. Hence, the claim made in the post is FALSE.

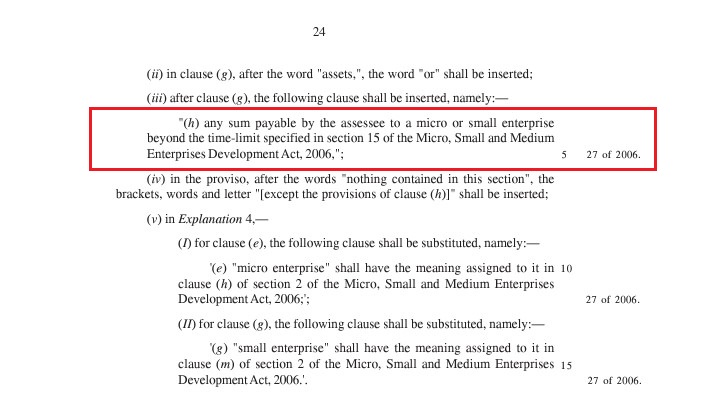

In 2023, the central government, through the Finance Act 2023, amended the Income Tax Act, of 1961 to ensure timely remittances for goods supplied by Micro and Small Enterprises (MSMEs). The amendment incorporated a new provision, clause 43 b(h), within the Income Tax Act, which mandates settlement for goods procured from MSMEs within 45 days. This aligns with the directives outlined in Section 15 of the MSMED Act, 2006, aimed at facilitating prompt payments to shield MSMEs from any adverse impacts due to delays in fund transfers.

The proposed bill stipulates that the amendment will become effective starting from 01 April 2024. It is in this context; that the viral message is circulating as the deadline for implementing this rule approaches. As the impact will be experienced for the first time this year, a business entity that fails to remit payment to its vendors classified as MSME within 45 days of delivery will not be eligible for purchase deductions in the year of purchase. Instead, the deduction can only be claimed in the year of actual payment. Therefore, the disallowance of deductions for outstanding payments would raise the taxable income and tax liabilities of companies for the fiscal year 2024.

Reports indicate that multiple representations have been made by industries from multiple forums seeking deferment in the implementation of the rule. However, contrary to the claim, the union government has not provided any relaxation yet, concerning section 43 b(h). However, there are reports suggesting that the government is considering postponing the implementation of the rule.

Following the news claiming a one-year extension granted by the government for the implementation of section 43 b(h), the Federation of Surat Textile Traders Association (FOSTTA) released a clarification, asserting that the viral information is false and that the government has not issued any official decision in this matter.

To sum it up, the Union Government did not announce any relaxation for the implementation of section 43 b(h) of the Income Tax Act.