Members of the Employees Provident Fund Organization (EPFO) who have a provident fund (PF) account receive a guaranteed yield on their investment that is risk-free and tax-free. The interest rate decided by the EPFO is a dynamic process and there is no fixed/standard rate as to which should be paid. Here is a review.

The Employees Provident Funds & Miscellaneous Provisions Act of 1952 was passed in an effort to give employees and their dependents a dignified life once they were no longer able to support themselves through their normal means. This is also in accordance with the recognized need for a social security cover as enumerated in the Directive Principles of State Policy of Indian Constitution.

While contributions made by employers and employees keep this fund functional, equally important role is played by the income generated by the investments made by EPFO. Members of the Employees Provident Fund Organization (EPFO) who have a provident fund (PF) account receive a guaranteed yield on their investment that is risk-free and tax-free.

In today’s story, we look at the trends in EPFO interest rates and how EPFO generates income using the corpus fund to pay PF interest to EPFO subscribers.

How much money does EPFO has?

It is often misconstrued that EPF is a single scheme. However, EPFO administers three schemes with differing objectives.

- Employee Provident Fund Scheme (EPF),1952

- Employee Pension Scheme (EPS),1995

- Employees’ Deposit Linked Insurance Scheme (EDLI), 1976

The data pertaining to corpus managed by EPFO under the three Schemes EPF, EPS and EDLI excluding the Corpus managed by exempted Provident Fund Trusts is as below.

Who manages EPFO corpus fund?

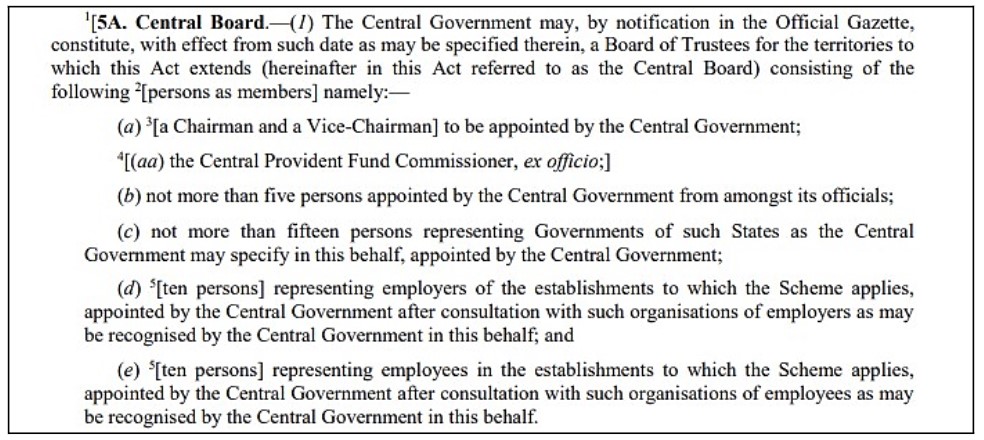

The power to administer the funds constituted under the EPF & MP Act 1952 shall vest in Central Board of Trustees (CBT) constituted as per the clause 3 of the Section (5A) of the above act. The composition of the Central Board is as follows.

The Sub-Committee on Finance & Investment of the CBT is tasked with the responsibility of overseeing the investments done by the fund managers of EPFO, recommending appropriate investment guidelines to ensure optimum returns, and suggesting a rate of interest to be credited to the subscriber accounts among other things.

How are funds in EPFO corpus are invested?

The investment of funds of EPFO is done as per the investment pattern notified by the Ministry of Labour and Employment. Additionally, such investments shall be made only by keeping the benefits of subscribers in mind. Due diligence must be given to the investment pattern to ensure the diversification of investments. The guidelines require that the process of investing should be transparent, and the trustees shall be held responsible for investment decisions taken.

Additionally, any investment is made only in such securities with at least two credit rating agencies registered with Securities Exchange Board of India (SEBI). Further, one of the two required ratings should necessarily be from any of the following four Credit Rating Agencies (CRAs) i.e., CRISIL, CARE, ICRA and India Ratings.

The latest investment pattern approved by the CBT is from 2015, with subsequent amendments based on market conditions.

The investment made should be such that the turnover ratio, defined as the ratio between the values of securities traded in the year to the average value of portfolio at the beginning and the end of the year, should not exceed two.

How much is the interest rate paid?

As per a parliamentary response, the interest rate decided by the EPFO is a dynamic process and there is no fixed/standard rate as to which should be paid. It is primarily based on the necessity of safeguards to balance both the growth and surplus funds. The data on the interest rates by EPFO indicate that the current rate of 8.15% is lowest in the last four decades. Despite the recent hike by 0.15% from 8.1% in 2021-22, the interest rate is still lower than earlier interest rates.

How has been the interest earnings on investments?

It is important for the investments to generate optimum returns to keep the EPFO corpus growing and also pass on the benefits to the subscribers. Investing in different classes of assets generates interests. The data on the interest earnings on investments made by EPFO show an increase over the past five years.

The CBT decided to invest in Exchange Traded Funds from 2015, in Nifty EFT and Sensex EFT. The year-wise trend shows an increase in the amount invested in ETFs. The gross amount invested in the ETF till 31 March 2021 is Rs.1,37,895.95 Crores. Further, the details of cost price of investment in ETF till 31 March 2022, and Notional Market Value [as per Net Asset Value (NAV)]on 31 March 2022 stands at Rs. 1,59,299.46 Crores and Rs. 2,26,919.18 Crores respectively, as answered in Parliament. The absolute return on investments in EFTs in 2016 was 7.45%, which is less than the interest rate provided by EPFO. The ETF units pertaining to Calendar year 2016 and 2017 were redeemed in 2021 generating a revenue of Rs. 3,277 Crores and Rs. 4,073 Crores respectively. However, ETFs still account for only 8.7% of the investment of corpus at face value as on 31 March 2022.

Are these EPF interest rates sustainable? A tightrope walk in future.

Though the interest rates of EPF is at a four-decade low of 8.15%, it is still significantly better than the alternatives available in the market. Similar complementing options such as PPF, RBI’s floating Rate Bond, Senior Citizens savings schemes, Sukanya Samriddhi Yojana offer interest rates below 8% and with specific conditions attached to them.

Further, majority of investments by EPFO are in Government backed securities, whose 10-year average yield hovers around 7%. This is still lower than the interest rate provided by EPFO. With returns slowing down and quantum of pay-outs increasing, it would not be sustainable for EPF to continue with higher interest rates. The 2018 defaults by DHFL & ILFS also resulted in losses to EPFO and with reduced EPF contributions and greater withdrawals, the COVID-19 pandemic significantly affected the corpus.

With the global markets slowing down, and the uncertainty of the Russia-Ukraine war has put global economy in doldrums. In such a scenario, the fund should be sustainable with a guaranteed return, and this basic premise should act as a foundation for deciding on the future course of interest rates.