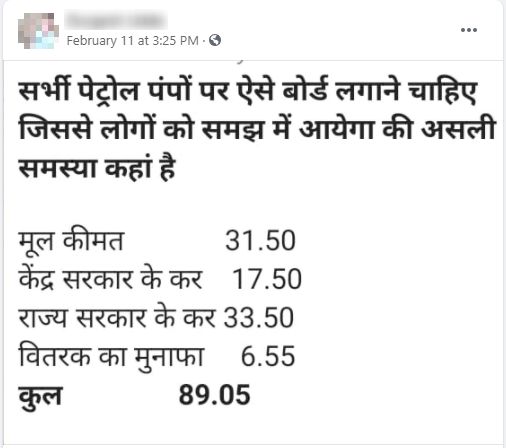

A post claiming that state governments are charging more tax on petrol than the central government is being widely shared across social media platforms. The post also shares a purported price buildup of petrol which alludes state government is charging almost double the tax compared to the central government. Through this article let’s fact-check the claim made in the post.

Claim: State governments are collecting more tax on petrol compared to the central government.

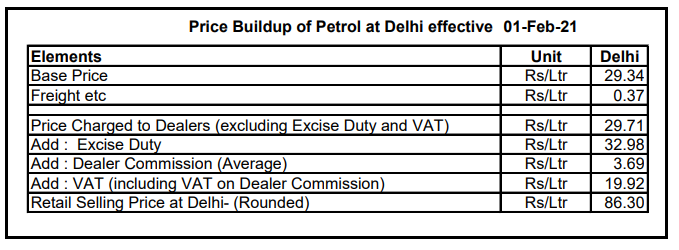

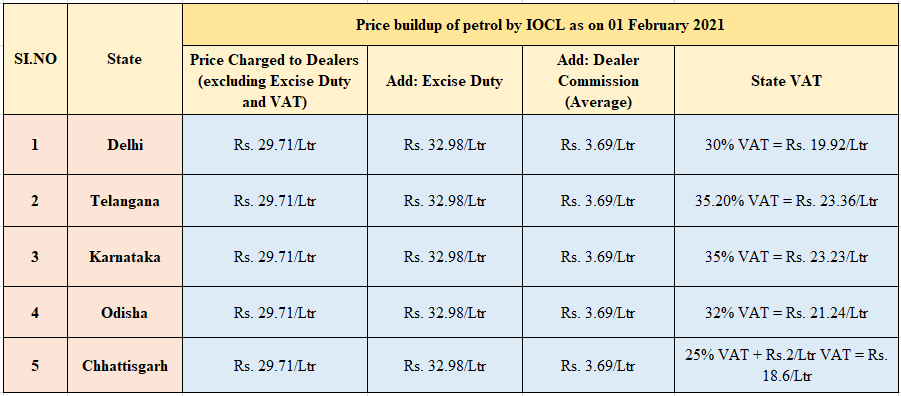

Fact: As per the price buildup by IOCL as of 01 February 2021 in Delhi, of the retail selling price, the price charged to dealers by IOCL is ₹ 29.71 and the Commission paid to the dealers is ₹ 3.69. The Central Excise Duty forms the major component with ₹ 32.98. Delhi levies a state VAT of 30% which amounts to ₹19.92. Even according to the price buildup of other states, the component of central tax is more compared to that of state VAT. Hence the claim made in the post is FALSE.

As per the price build-up by IOCL as of 01 February 2021 available on Petroleum Planning & Analysis Cell, the price of petrol per litre at any retail petrol pump of Indian Oil outlet in Delhi is Rs. 86.30. Of the retail selling price, the price charged to dealers by IOCL is ₹ 29.71 and the Commission being paid to the dealers is Rs. 3.69. The Central Excise Duty forms the major component with Rs. 32.98. Delhi levies a state VAT of 30% which amounts to Rs.19.92. Price buildup of Hindustan Petroleum and Bharat Petroleum can be seen here and here.

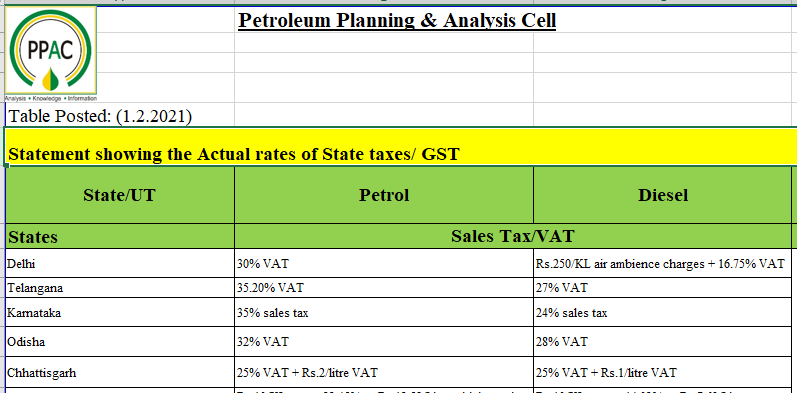

Sales tax (VAT) collected by state governments is not uniform in all states. It varies from state to state. As per the information available on the PPAC website, various state governments follow different approaches to collecting tax on petrol. For example, few states like Delhi, Karnataka, Telangana, Odisha etc. levy VAT on petrol and diesel. Whereas other states impose surcharges, fixed charges, etc. in addition to state VAT. Price build of few states calculated based on the price buildup of Delhi can be seen below. From this, it is evident that the tax that reaches the central exchequer in the form of excise duty and cess on petrol is more than the amount which reaches the state exchequer.

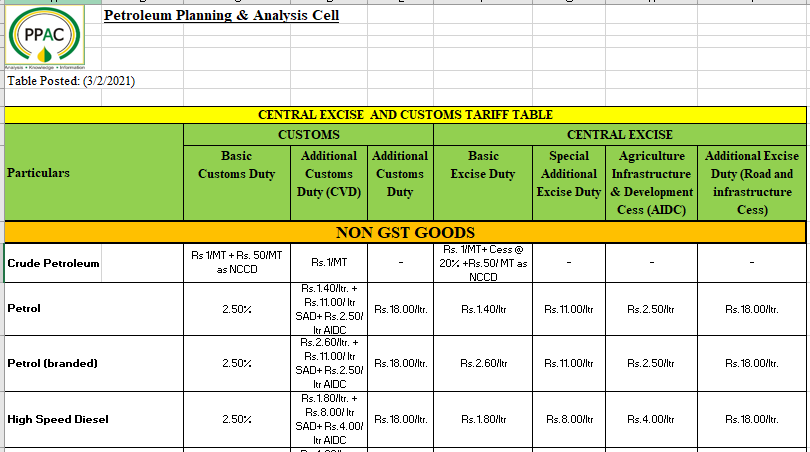

Generally, the central government collects basic excise duty, special additional excise duty, agriculture infrastructure & development cess, and Road and infrastructure cess. The funds collected in the form of cess are earmarked for the pre-determined purpose and these funds are not distributed among states. The states, however, receive their share in taxes collected in the form of central excise duty in proportions as recommended by the finance commission. However, this component of revenue collected on per litre petrol is very less compared to the State VAT and Central excise duty. FACTLY has earlier written a detailed explainer about the share of central and state governments on taxes levied on petrol and diesel, which can be read here.

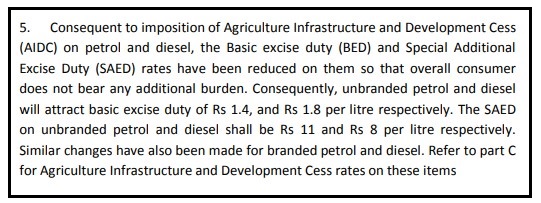

It is noteworthy to mention that in the recently proposed 2021-22 budget, central government has introduced agriculture and development cess of Rs. 2.5/Ltr on petrol and Rs. 4/Ltr on diesel. Consequent to the imposition of Agriculture Infrastructure and Development Cess on petrol and diesel, the Basic excise duty (BED) and Special Additional Excise Duty (SAED) rates have been reduced proportionately so that consumer does not bear any additional burden. However, this move will affect the states’ revenue as reduced excise duty implies a decrease in states’ share in the excise duty.

FACTLY has earlier written debunking claims related to central & states share on excise duty collected on petrol, price buildup of petrol and price of petrol in different states.

To sum it up, inaccurate details of price buildup of petrol are being shared stating State governments collect more tax on Petrol than Centre.