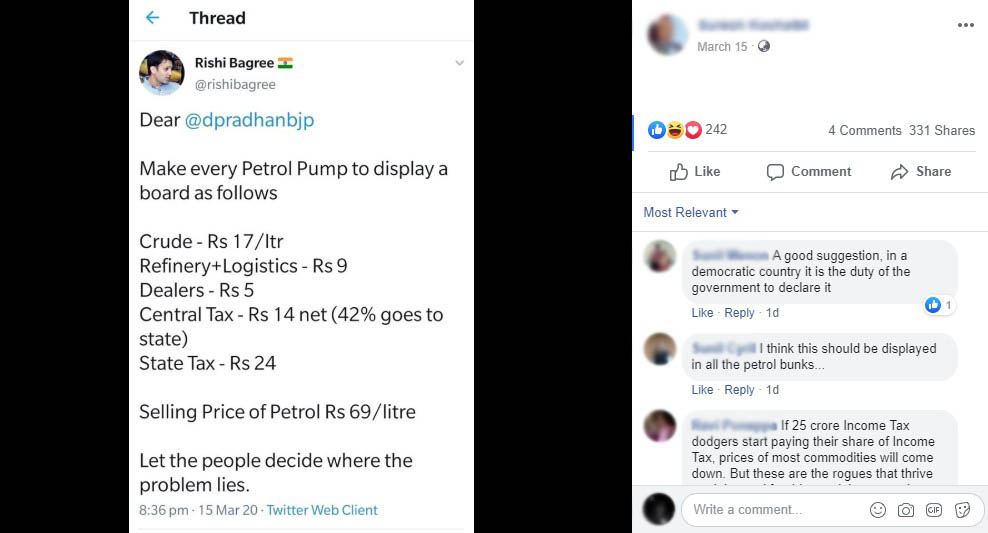

A post is being shared widely on social media with a claim that it shows the price build-up of Petrol. It tries to convey a message that the State Tax on Petrol is much more than the Central Tax. Let’s try to analyze the claim made in the post.

Claim: Price build-up of Petrol shows that the State Tax on Petrol is more than the Central Tax in Delhi.

Fact: The amounts of various taxes given in the post are not accurate. In Delhi, the State VAT is only Rs 14.49/Ltr., whereas the total amount collected by the central government in the form of taxes (Special Additional Excise + Road & Infrastructure + Basic Excise Duty) on per liter petrol amounts to Rs. 21.73. Also, the average Dealer Commission is Rs 3.54/Ltr. Hence the claim made in the post is FALSE.

In addition to the tweet shown in the picture, Rishi Bagree has tweeted (archived) that the above price break-up calculation is that of Delhi. On the Indian Oil website, the build-up of the Petrol price in Delhi can be found. The same can be also found on the Hindustan Petroleum and Bharat Petroleum websites.

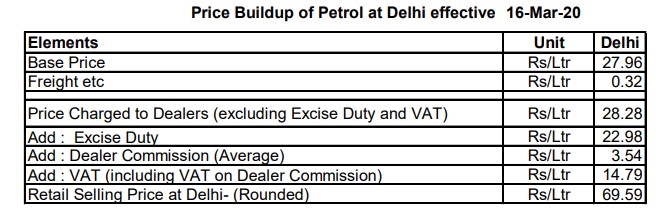

So, let’s compare the price build-up given in the post with the actual petrol price build-up in Delhi.

Crude + Refinery + Logistics – Rs 26/Ltr? No.

In the Indian Oil Price build-up, it can be seen that Base Price + Freight etc. add up to Rs 28.28/Ltr.

Dealer Commission – Rs 5/Ltr? No.

On average, the Dealer Commission is Rs 3.54/Ltr.

Central Tax – Rs 14/Ltr net (42% goes to state)? No.

In the Indian Oil Price build-up, it can be seen that the Excise duty is Rs 22.98/Ltr.

The central government levies taxes on petrol in the form of Basic Excise Duty (BED), Special Additional Excise Duty (SAED), and Additional Excise Duty (Road & Infrastructure) (AED), and other Cess introduced from time to time.

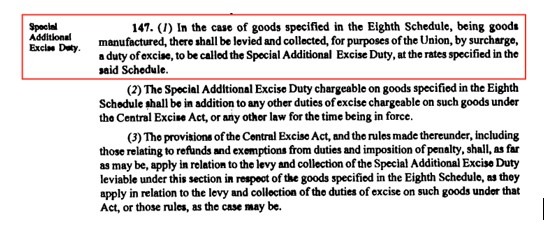

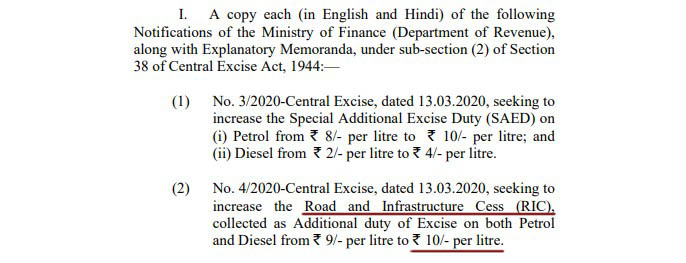

Of these taxes, Special Additional Excise Duty (SAED) was introduced by the Finance Act 2002. However, as per the act, the amount of excise duty levied under SAED is levied in the form of surcharge and hence the entire amount accrues to the union government. Hence the amount collected through this Special Additional Excise Duty (SAED) is not included in the divisible pool, and states would not get any share in it.

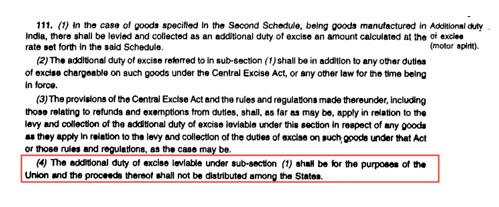

Additional Excise Duty (AED) on petrol was introduced by the Finance Act 1998, also known as Road & Infrastructure Cess. However, the entire amount collected in the form of additional excise duty under the Finance Act 1998 also goes to the Central Government, and states have no share. Similarly, AED was introduced on diesel through the Finance Act 1999. The states will not have a share in this either.

All in all, states have a 42% share of the basic excise duty. However, this 42% is further distributed to each state in a proportion as recommended by the finance commission.

The Finance Act, 2018 has increased the Special Additional Excise Duty (SAED) from Rs 8 / Ltr of petrol to Rs 10 / Ltr and further, the Road & Infrastructure Cess is increased to Rs. 10/Ltr from Rs 8/Ltr. However, the states will not get any share of the revenue collected in the form of SAED and Road & Infrastructure cess. States will get a 42% share in the remaining Rs. 2.98 basic excise duty, which is Rs. 1.25. The remaining 58% of the basic excise duty which is Rs. 1.73 will reach the central exchequer, which sums up the total amount collected by the central government in the form of taxes (Special Additional Excise + Road & Infrastructure + Basic Excise Duty) on per liter petrol to Rs. 21.73.

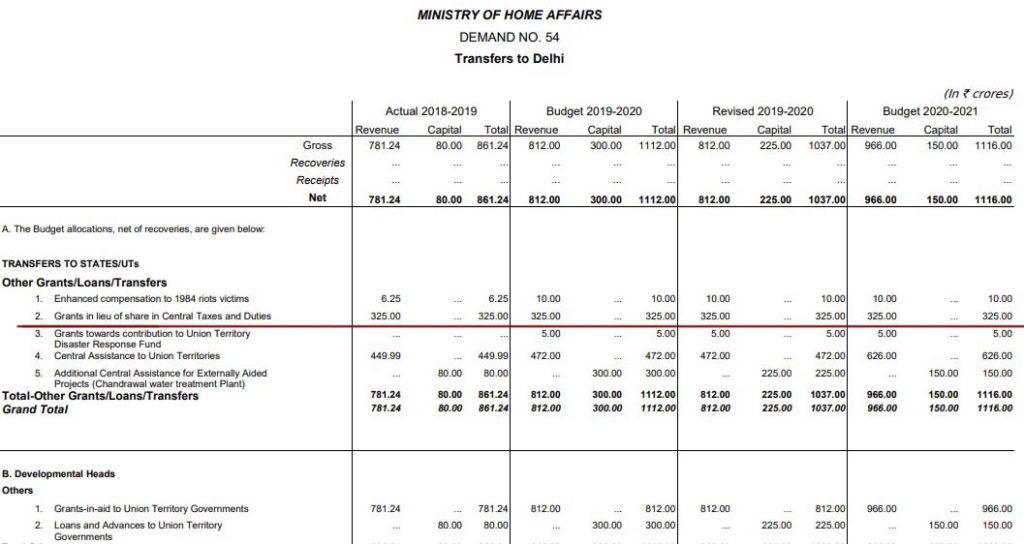

On the other hand state government of Delhi collects Rs. 14.79 as state VAT on petrol. Also, Delhi government receives grants in lieu of share in Central Taxes and Duties, as Delhi government will not have any share in the divisible pool of the central taxes as other states have. So, the argument that Delhi government receives 42% share of the central taxes on petrol does not hold true.

State Tax – Rs 24/Ltr? No.

In India, the tax levied by each state government is different and those tax rates can be seen on the website of ‘Petroleum Planning and Analysis Cell’ of the Central government. As of 18 March 2020, the tax rate levied by Delhi is 27% i.e. Rs 14.79/Ltr.

Although the Delhi state government receives their share of central taxes in the form of grants, these grants are received as a proportion of the total cumulative taxes which the center collects and not just petrol.

To sum it up, false inaccurate figures shared as the price build-up of Petrol in Delhi.

CORRECTION (JULY 06, 2021): Earlier, this article erroneously mentioned that both the Basic Excise Duty (BED) and Special Additional Excise Duty (SAED) collected by the Central Government would go into the ‘Divisible Pool’ which would then be distributed to the State Governments. But the Special Additional Excise Duty introduced through the Finance Act 2002 does not form part of the divisible pool and hence the states would not have any share in it. The details in this article have been updated accordingly to reflect this change. Error is regretted.

Did you watch our new video?