A video asserting that the Reserve Bank of India has introduced fresh directives following the conclusion of the G20 summit is gaining traction on social media platforms. In the video, it is explained that the RBI has issued new guidelines pertaining to bank lockers, damaged currency notes, and the mandatory requirement of PAN for transactions exceeding 20 lakhs. Through this article let’s fact-check the claims made in this video.

Claim: RBI has introduced new guidelines pertaining to bank lockers, mutilated notes and making PAN mandatory for transactions, after the conclusion of G20 summit.

Fact: These guidelines have already been in effect for quite some time now. While the guidelines related to bank lockers came into form from 01 January 2022, the guidelines for the exchange of mutilated/soiled notes of Rs. 200 & Rs. 2000 were in effect from September 2018. On the other hand, the CBDT has made PAN/Aadhaar mandatory for transactions involving 20 lakhs and above in May 2022. Thus, this establishes that the guidelines have no connection with the recently concluded G20 summit. Hence, the claim made in the post is MISLEADING.

All the regulations detailed in the viral video regarding bank lockers, damaged notes, and the mandatory use of PAN for transactions are accurate. However, it’s important to clarify that these rules have been in effect for quite some time and are unrelated to the recently concluded G20 summit.

Safe Lockers:

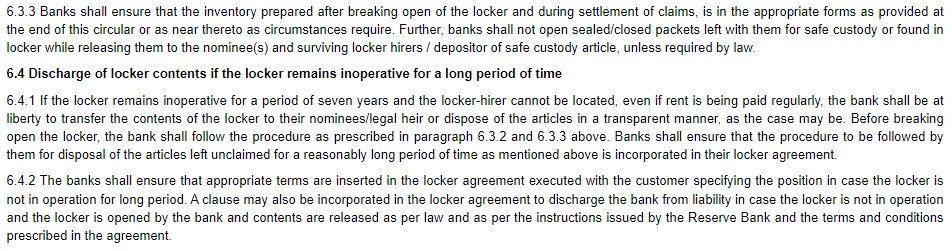

Pertaining to inoperative bank lockers, the RBI on 18 August 2021 issued new guidelines allowing the banks to break open a locker if it remains inoperative for a period of seven years and the locker-hirer cannot be located even if rent is being paid regularly.

The RBI guidelines say that the banks will give prior notice and reasonable time to the locker-hirer, before acting. These revised instructions shall come into force with effect from 01 January 2022, and be applicable to both new and existing safe deposit lockers.

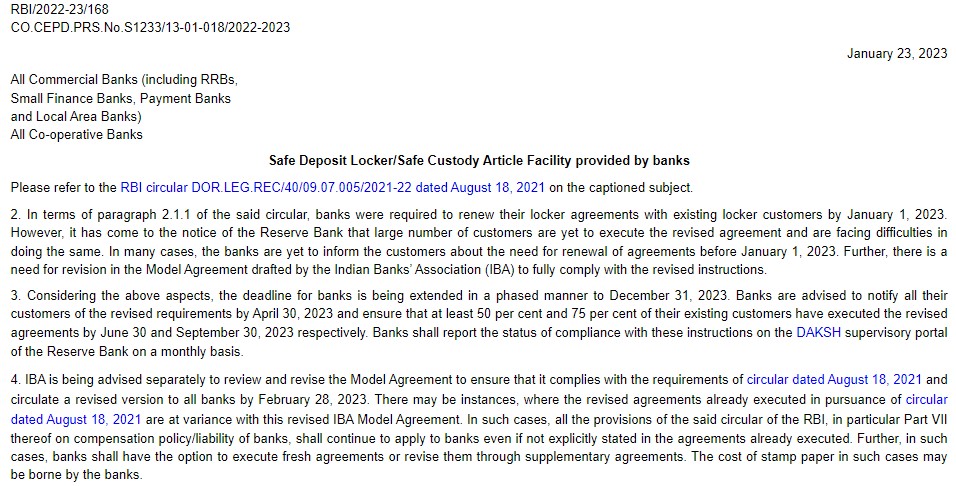

However, due to a significant number of customers not having completed the agreement process and, in certain instances, banks failing to notify customers about the necessity of agreement renewal, along with the need to revise the Model Agreement established by the Indian Banks’ Association (IBA) to fully align with the updated guidelines, the RBI, on 23 January 2023, extended the deadline for banks in a phased manner until 31 December 2023. According to this circular, by 30 June and 30 September, 50 percent and 75 percent, respectively, of existing customers should have signed the renewed agreements.

It is quite possible that this circular contributed to the misunderstanding that these were new regulations, as the deadline for the 75% target is this month end. However, it’s important to clarify that these regulations have been in effect for some time and are unrelated to the G20 summit.

Exchange of mutilated/soiled notes:

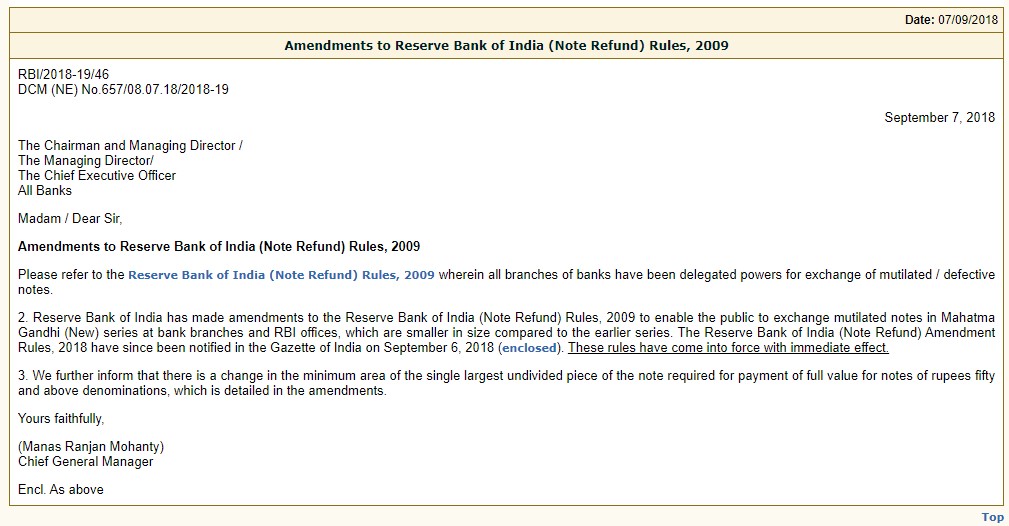

In September 2018, the RBI made amendments to the Reserve Bank of India (Note Refund) Rules, 2009, specifically regarding the exchange of soiled or mutilated 200 and 2000 rupee notes. These guidelines were introduced to establish a clear exchange policy for these new denominations.

While the previous rules detailed the exchange process for older denominations (such as Rs 5, Rs 10, Rs 50, Rs 100, Rs 500, Rs 1,000, Rs 5,000, and Rs 10,000), the updated rules incorporated the newly introduced denominations of Rs 200 and Rs 2000, taking into account their size differences.

As stated in the viral video, the new guidelines specify that in order to receive a full refund for a damaged Rs. 2000 note, the undivided area of the largest single piece of the note must be 88 square cm, and for a half refund, it should be 44 square cm. In the case of a damaged Rs. 200 note, the criteria for a full refund is 78 square cm, and for a half refund, it is 39 square cm.

The circular from September 2018 categorically states that the new guidelines will come into effect immediately, thereby contradicting the viral assertion that the RBI introduced these rules in response to the conclusion of the G20 summit.

Making PAN mandatory:

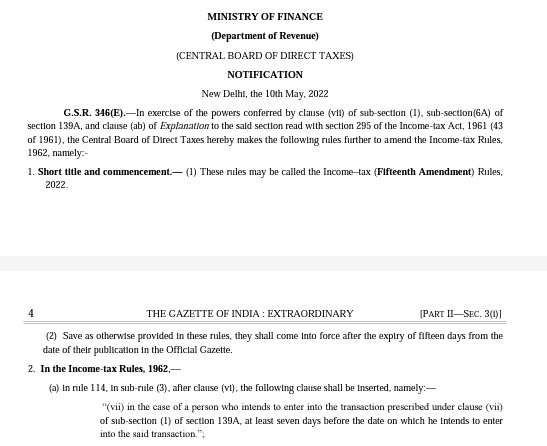

Pertaining to the guideline making PAN card mandatory for transactions involving 20 lahks and above, as asserted in the viral video the government in May 2022, has made quoting PAN or Aadhaar mandatory for withdrawals or deposits of ₹ 20 lakh or above from bank accounts, in a financial year.

However, this guideline was not issued by the RBI; instead, it was the Central Board of Direct Taxes (CBDT) that implemented this regulation. The purpose behind this amendment to the Income Tax Rules is to combat tax evasion associated with large cash transactions. Earlier, PAN is required for cash deposits of Rs. 50,000 or more per day.

The CBDT notified amendments in the Income Tax Rules, 1962 prescribing new transactions for obtaining and quoting PAN. Further as per the notification the new guidelines would take effect from May 26, 2022, thus, contradicting the viral claim that this is a newly introduced rule.

To sum it up, these banking regulations have been in effect for some time and have no connection to the G20 summit.