The results of five different surveys released by the RBI recently paint a very grim picture of the consumer confidence and industrial activity. The ‘Current Situation Index (CSI)’ for July 2020 is at an all-time low while the ‘Future Expectation Index (FEI)’ has shown a slight improvement compared to May 2020.

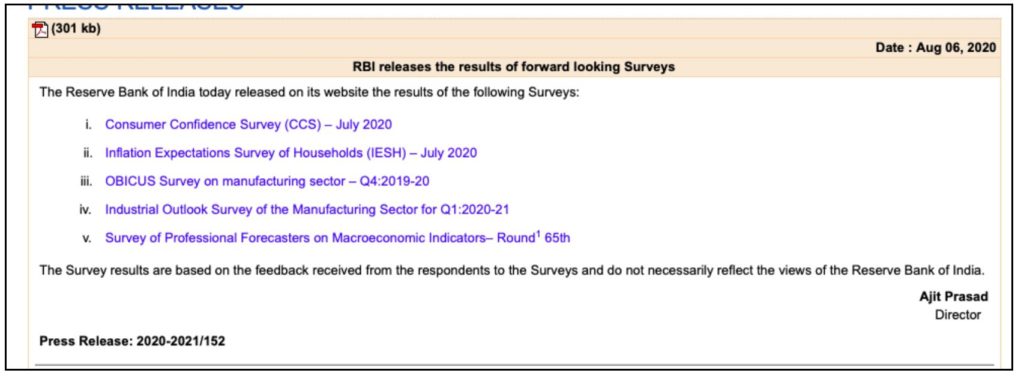

Recently, on 06 August 2020, the Reserve Bank of India (RBI) released the results of its forward looking surveys. Being India’s Central bank and the entity setting the nation’s monetary policy, RBI’s policy decisions have an immense impact on nation’s economy. However, to formulate any policy it needs to have an understanding of the ground reality and it is for this reason the RBI conducts certain surveys periodically (generally every quarter) on various aspects such as consumer confidence, industrial production, inflation expectations etc.

As is the case with most of the surveys, the results are dependent of varying factors like sample size, quality of the samples, background and preferences of the respondents etc. However, they provide a general understanding of the prevailing conditions, which in turn help RBI make relevant policy decisions.

On 06 August 2020, the RBI released the results of five surveys. In this story, we take a look at few of the critical observations from these surveys and explore the trends over the period of time.

‘Current Situation Index’ at its lowest in July 2020

As per the results released for July 2020 of Consumer Confidence survey, the Current Situation Index (CSI) for Economic Situation is at 53.8, which is an all-time low. The impact of lockdown due to COVID-19 and the general uncertainty all around is clearly visible in the low number for the index.

The survey was conducted based on the perceptions and expectations on – general economic situation, employment scenario, overall price situation, own income & spending etc. of 5,342 households across 13 major cities. Factly has earlier written a detailed story on Consumer Confidence Survey, how is it conducted and what it indicates.

While the current COVID-19 situation in the country has an impact on CSI, the lower index is a continuation of a downward trend which is observed for over a year now, which was preceded by phases of increase and decrease in CSI. Of course, the fall is quiet sharp since March 2020.

Meanwhile, the Future Expectation Index (FEI) which reflects how the consumers feel for the upcoming period has shown an improvement over May 2020, at 105.4. This is the first time since May 2019 that FEI has increased compared to the earlier round of survey.

Consumer perception on Income and Employment in July 2020 significantly lower than in May 2020

Consumer confidence indices are based the consumers perception and expectation on 5 different variables – Economic Situation, Employment, Price Level, Income & Spending. In the July 2020 round of survey, significant fall in Consumers current perception on Employment and income was observed.

- The perception regarding Employment was -65.1 with 78.1% of respondents saying that the situation has worsened. This is lower than in May 2020, where in it was -48.2. However, the expectation for next year improved from -5.9 to 10.4.

- Similarly, consumer’s perception regarding Income has also taken a hit. With 62.8% of the customers feeling that the Income situation has worsened, the indices for employment fell to -54.5 from -40.8 in May 2020. Similar to the earlier case, FEI for Income has improved from 18.1 to 26.3.

- The perception of economy has also come down from -60 in earlier round of survey to -65.9 in July 2020 round. 77.8% of the respondents feel that Economic situation has worsened. The perception of economic situation has been in the negative since May 2019. The expectation for the future is positive with 2.1 as against -11.7 for the earlier round.

- The perception as well as the expectation on the price levels are both in negative. While the perception on current Price levels fell to -76.2, even the future expectation is -61.5. Nearly 80% of respondents feel that the prices have increased and around 72% feel that the process would further increase. This signifies that the consumers feel that there would be a continuation of higher inflation even in the future. This trend is further backed up by results of ‘Household Inflation Expectation survey’.

- A greater number of consumers continue to feel that the spending has decreased. 17.2% of respondents felt there spending has decreased compared to around 12% in May 2020. The expectation for the future also holds the same trend with 10.6% expecting a fall in spending as against 8.7% in earlier round.

- A more detailed look into the spending indicates that a major portion of the consumers who took the survey, feel that that the spending on non-essential items has decreased compared to that of essential items. However, in both the cases, the perception is that the spending has decreased than before. The trends in the survey about spending points towards an increasing tendency to reduce spending and increase the savings in context of uncertain times.

Sharp fall in the Business Assessment Index for Q1’FY 20-21

The 90th round of Industrial Outlook Survey of Manufacturing Sector was also conducted during April-June’2020. The survey assesses the business climate of Indian manufacturing companies. A total of 802 companies responded in this round of survey.

As per the survey, Business Assessment Index (BAI), which is based on the current assessment of the respondents fell to 55.3 for Q1 of 2020-21, a sharp fall from 102.2 in the previous quarter i.e. Q4 of 2019-20. This is also the all-time low. This is based on various parameters.

- The Net response for Production fell from 13.8 to -63.9 for Q1 of 2020-21.

- Order Books also entered into negative, with net response at -54.9 as against 10 in the previous quarter.

- As per a greater number of respondents, there is a fall in the capacity utilization in the current assessment quarter with the net responses at -61.6, while it was 2.0 earlier. The capacity utilization is on declining trajectory since Q1 of 2018-19, with the previous quarter (Q4 of 2019-20) being an exception.

- Meanwhile, a higher share of respondents feel that the Pending orders are ‘below normal’.

- As for trade parameters, a higher number of respondents feel that there is a decrease in the imports as well as exports, with net responses in both the cases being in negative.

- 32.5% of respondents feel that there is a fall in employment, while only 3.9% assess that the employment has increased. The Net responses is negative for Q1 of 2020-21 at -28.6 as against a positive 2 in earlier quarter.

- 57.6% of the respondents feel that the overall economic situation has worsened, resulting in net response value to fall from 12.8 to -48.9 in the current quarter.

Apart from BAI, there is another index calculated with the responses of the survey i.e. Business Expectation Index (BEI) , which is based on the expectation of the respondents for the next quarter for each of the parameter. The positive expectations across most of the parameters are less when compared to the previous quarter, resulting in BEI falling to 99.5 for Q2 of 2020-21, compared to the expectation they had for the current quarter, which stood at 108.8.

The Demand conditions in manufacturing sector as per OBICUS (Order Books, Inventories and Capacity Utilization Survey) also does not show a positive trend. Although the capacity utilization for Q4 of 2019-20 had increased compared to previous quarter, it is significantly lower compared to the same quarter of 2018-19. Meanwhile, Manufacturing companies have received fewer orders in Q4 of 2019-20 compared to previous quarter. While there is an increase in Raw materials to Sales Ratio (RMI) (indicating lesser production), the Finished goods to Sales Ratio (FGI) has come down.

The assessment and expectation point to further decline of an already ailing economy

The Consumer Confidence survey points to the declining confidence of the consumers across various parameters. Their assessment of the economic situation, Income levels and employment show a decline compared to earlier round of survey. Meanwhile, their perception of inflation and spending indicate a more pragmatic approach in view of the uncertainty.

While the lockdown imposed across the country and the prevailing COVID-19 situation can be cited as the major reasons for the drastic fall in the indices of customer confidence, it has to be noted that the declining trend has been observed for over an year, even before the onset of COVID-19.

The Industrial situation also does not present a positive picture, with most of the respondents from the industry expressing a negative response on various parameters. Even in this case, a review of the data indicates that the slowdown has been there for some time now and is magnified because of COVID-19.

As per the Survey of Professional Forecasters on macro-Economic Indicators, the real GDP is likely to contract by 5.8 % for 2020-21. While the respondents expect a positive turn-around in the next one year, the continuing uncertainty might dampen these expectations unless structural changes are made to address the issues that are continuing for more than a year now.