In the light of the Union Finance Minister launching the ‘National Asset Monetisation Pipeline’, wherein the union government plans to monetize 6 lakh crore rupees worth assets over the next four years, a social media post claiming that the Modi government is planning to sell 6 lakh crore rupees worth assets is being widely shared. Let’s fact-check the claim made in the post.

Claim: Modi government is planning to sell 6 lakh crore rupees worth national assets over the next four years.

Fact: Through National Asset Monetisation Pipeline, the government is planning to lease out public assets for specified time period through different instruments including the PPP model. Ownership of these assets will remain with government and the government will retain these assets after the specified lease period. This idea is misconstrued as government trying to sell off the national assets. In fact such attempts were made even during the previous UPA regime when the then government proposed to monetise assets of Air India. Hence the claim made in the post is MISLEADING.

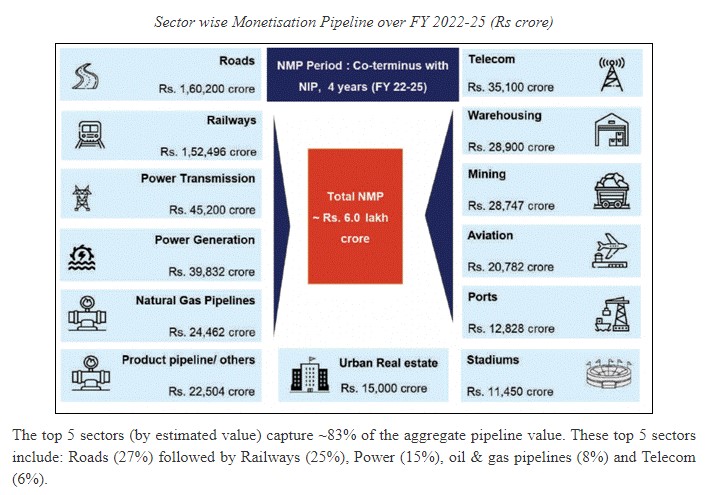

Earlier this week, the Union Finance Minister Nirmala Sitharaman launched the National Asset Monetisation Pipeline, wherein the government envisages to monetise 6 lakh crore worth of assets like roads, airports, sports stadiums, railway stations, warehouses etc. over the next four years from FY 2022 to FY 2025, with assets worth Rs 0.88 lakh crores to be rolled out for monetization in the current financial year. The pipeline has been developed by NITI Aayog, and accordingly NITI Aayog released a report elucidating the proposed monetisation pipeline.

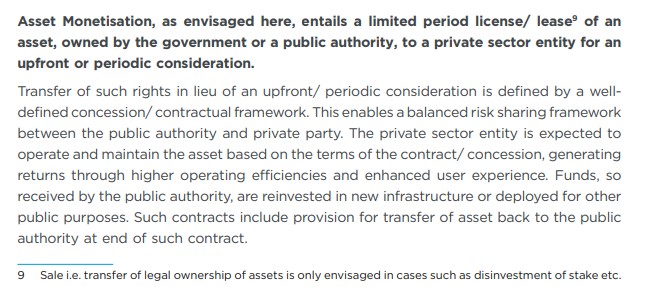

The proposed idea of asset monetization is misconstrued as the union government selling off the national assets. However, the government claims that ‘the ownership of these assets (listed for monetization) remains with the government. There will be a mandatory hand-back. They will have to be given back (to the government) after a certain time’. Even as per the report released by the NITI Aayog, the proposed ‘asset monetisation entails a limited period license/ lease of an asset, owned by the government or a public authority, to a private sector entity for an upfront or periodic consideration.’

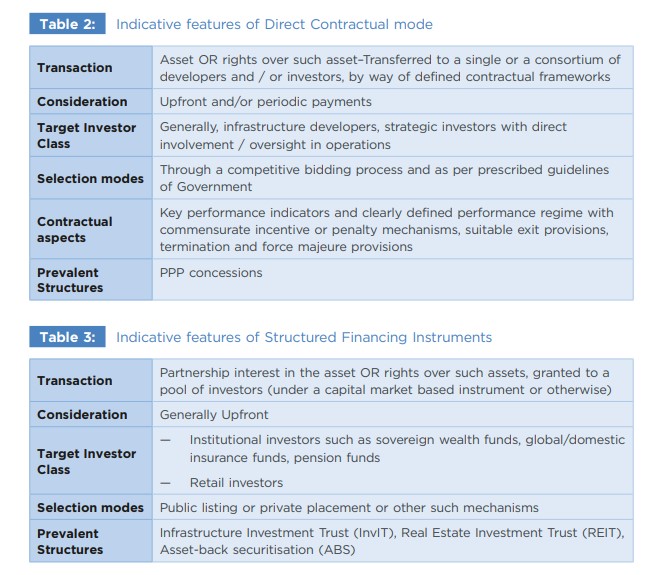

Accordingly, NITI Aayog delineated four approaches namely Market approach, Capex approach, Book value approach and the Enterprise value approach to estimate the monetization value of the assets. Assets identified through these methods are monetised through range of instruments like Real estate investment trusts (REITs) and infrastructure investment trusts (InvITs) to monetise assets in the roads and power sectors under the structured financing models. Likewise, different PPP models namely Operate Maintain Transfer (OMT), Toll Operate Transfer (TOT), and Operations, Maintenance & Development (OMD) are followed to monetise brownfield assets like highways & airports under direct contractual models.

Asset Monetisation- Congress government:

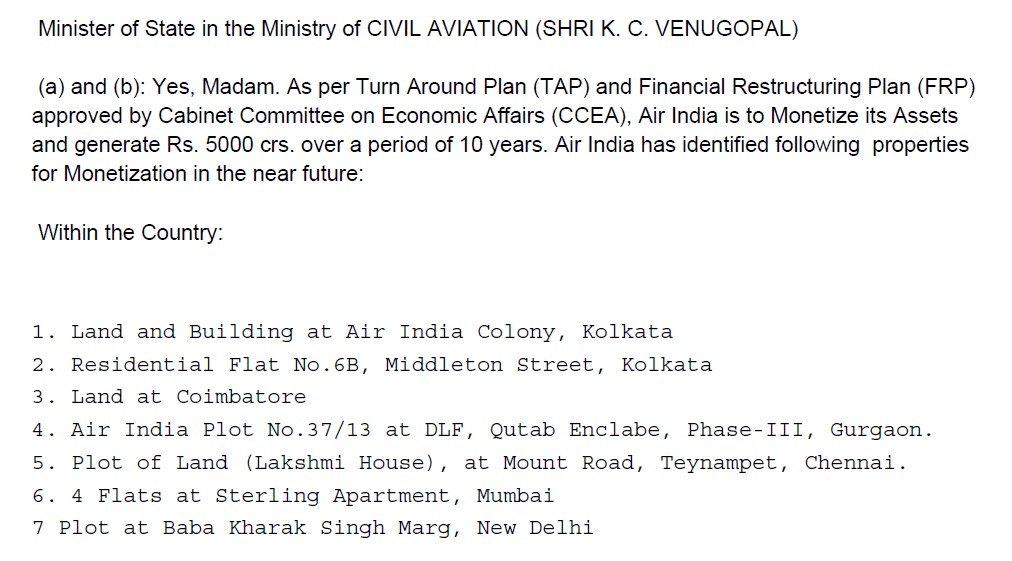

However, this is not the first time government of India is monetizing the national assets. Even during the UPA regime, attempts were made to monetize the assets of Air India. Back in 2014, in a written reply to a question regarding the same, the then government stated that it is considering a proposal to monetize assets of the Air India, and the answer further listed the properties which the government was planning to monetize.

Responding to the criticism towards the proposed monetization pipeline Union minister Smriti Irani recalled instances like Mumbai-Pune highway monetisation, proposal to monetize New Delhi railway station during the Congress rule.

To sum it up, the central government is not selling off assets worth 6 lakh crores through the proposed National Asset Monetization Pipeline.