Update (APRIL 01, 2021):

In view of the difficulties arising out of the COVID-19 pandemic central government has issued a notification on 31 March 2021extending the last date for linking of Aadhaar number with PAN from 31 March 2021 to 30 June 2021.

A post claiming that failure to link one’s PAN (Permanent Account Number) with Aadhaar number by 31 March 2021, which is the last date for doing so would attract a penalty of Rs. 10,000. Through this article let’s fact-check the claim made in the post.

Claim: Penalty of Rs. 10,000 for not linking one’s Aadhaar number with their PAN card by 31 March 2021.

Fact: The current deadline for linking one’s PAN with Aadhar is 31 March 2021. While it is true that one could be levied with a fine for not linking these two numbers, the maximum penalty for not linking is Rs. 1,000 and not Rs. 10,000. Hence the claim made in the post is MISLEADING.

After multiple extensions of deadlines to link PAN with Aadhaar, the current deadline is 31 March 2021. Failure to do so would attract a penalty and even the PAN would be deemed invalid.

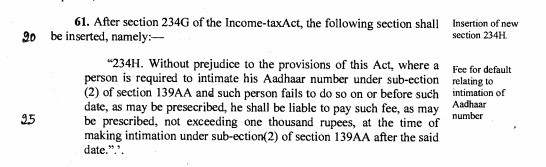

While it is true that one could be levied a fine for not linking these two numbers, the maximum penalty for not linking one’s PAN with Aadhar is not Rs. 10,000. The Finance Bill, 2021 which was passed in the Lok Sabha recently introduces a new section 234H into the Income Tax Act, 1961. It is according to this section an individual can attract a penalty up to Rs. 1,000 for not linking his/her PAN with Aadhaar. Multiple news articles reporting the same can be read here, here, and here.

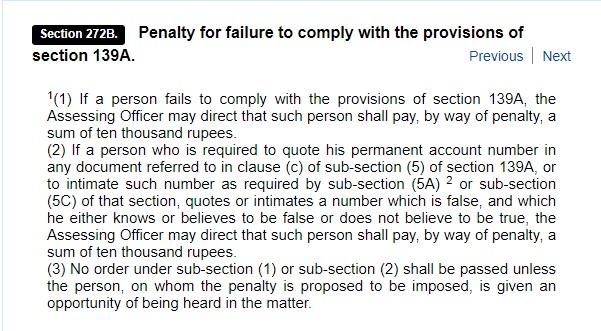

However, according to section 272B of the Income Tax Act, 1961 which reads ‘If a person fails to comply with the provisions of section 139A, the Assessing Officer may direct that such person shall pay, by way of penalty, a sum of ten thousand rupees’. In all likelihood, it is this section which could have been misconstrued as failure to link Aadhaar number under section 139AA would attract a penalty of ten thousand rupees. In other words, penalty for not complying with the provisions of Sec 139A would have been misunderstood as penalty for violation of Sec 139AA.

To sum it up, failure to link PAN with Aadhar before 31 March 2021 or the last date as specified by the government would attract a maximum penalty of Rs. 1,000 but not Rs. 10,000. Read the detailed procedure on how to link PAN with Aadhaar here.