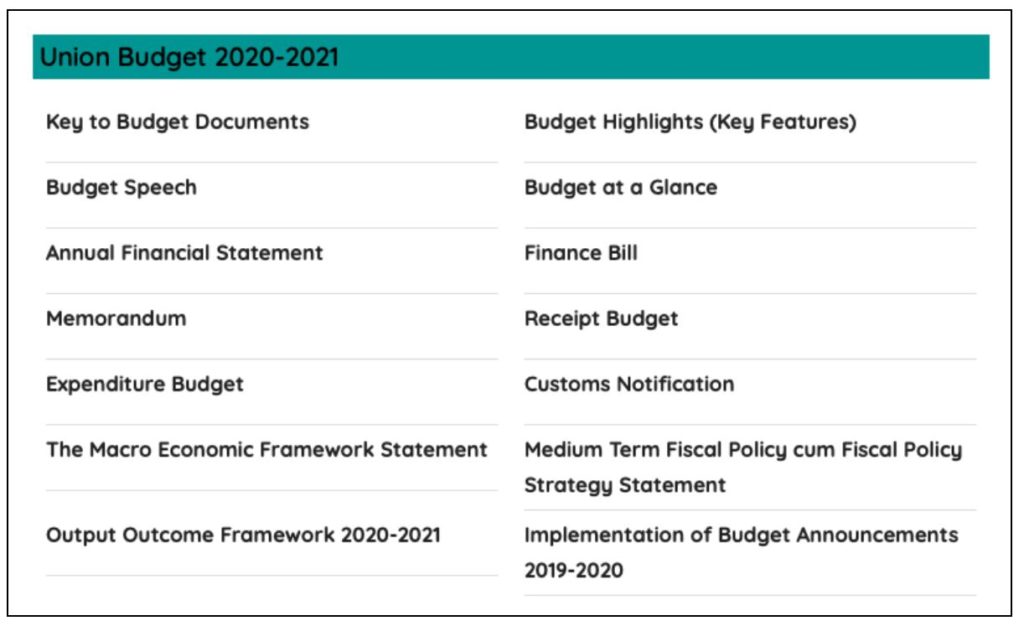

During the budget presentation in the parliament, multiple documents are presented by the government including the finance bill, appropriation bill, expenditure profile/budget, demand for grants, revenue budget, etc. What do all these documents contain? Here is a detailed explainer.

In an earlier explainer, we looked at the process followed in the preparation of the Union Budget and its presentation in the parliament. As part of the Union Budget presentation, various documents are presented by the government on the floor of the house. Here is a look at few such key documents.

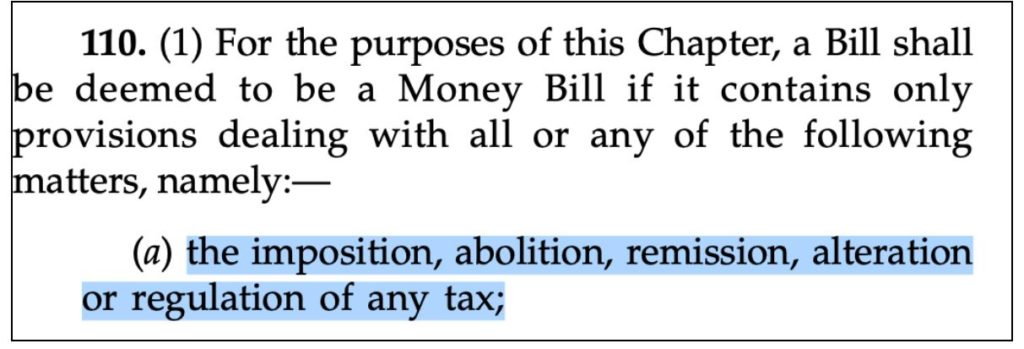

Finance Bill consists of the proposed changes in Taxation and other proposals

Finance Bill is one of the key documents presented as part of the Union Budget. It contains provisions for all the legal amendments required for the proposed changes in taxation and Financial proposals that are made in the Union Budget for the upcoming financial year.

- As per Article 110 of the Constitution of India, the Finance Bill is a Money Bill.

- Since it is a Money Bill, it has to be passed by the Lok Sabha. Post the approval, it becomes the Finance Act.

- The finance bill avoids the need to bring out separate amendment laws for all the changes being proposed as part of the budget.

- The bill is introduced in the Lok Sabha and only requires its approval. It is further sent to Rajya Sabha, where it is discussed, and recommendations are made. These recommendations are not binding on the Lok Sabha. They may be accepted or rejected.

- As per the provisions in Article 117, the bill is introduced only on the recommendation of the President and shall not be introduced in the Rajya Sabha.

In an observation by PRS, it is noted that over the past few years, the Finance Bill has included items that are not related to the taxes or the expenditure of the government.

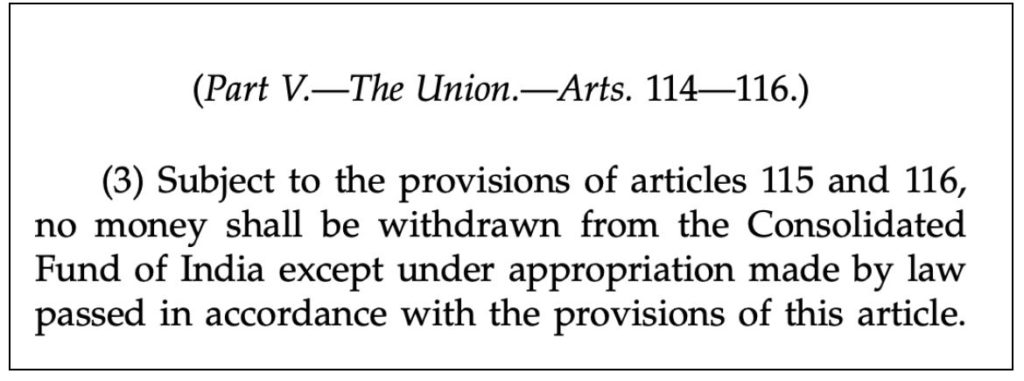

Apart from the Finance Bill, the Appropriation Bill is also introduced in the parliament as part of the Union Budget. As per Article 114, the Government of India can withdraw money from the consolidated Fund only after receiving approval from Parliament.

- This bill allows the government to withdraw the funds from the Consolidated Fund to meets its expenses during the financial year.

- It is introduced in Lok Sabha after the discussion on Budget proposals and Voting on Demand for Grants. It is passed by Lok Sabha and then sent to Rajya Sabha. Lok Sabha has the prerogative to either accept or reject any recommendations made by Rajya Sabha.

- Since 2016, the Appropriation Bill has an automatic repeal clause i.e., the Act gets repealed by itself after the statutory purpose is met.

While a Finance Bill contains provisions on how the government intends to meet its expenditure i.e., taxes, levies, etc., the Appropriation Bill consists of the details of the extent and the purpose for which the government wants to withdraw the money.

Economic Survey of India presents the Economic Performance over the last one year

Prior to the presentation of the Union Budget in the Parliament, the Ministry of Finance releases the annual ‘Economic Survey of India’. It is the flagship Annual Report of the Finance Ministry and is released a day prior to the budget presentation. This year, it is expected to be released on 31 January 2021.

- It is a detailed report of the country’s economic performance during the past year and assesses the progress of the economy.

- It features the particulars of all major schemes run by the government & their policies along with the outcomes.

- It is generally divided into two volumes. In addition to presenting a snapshot of the economy, the survey also provides estimates for the future. It lays the groundwork for the presentation of the budget.

- The Economic Survey is prepared by the team headed by the Chief Economic Advisor in the Ministry of Finance.

- There is no constitutional obligation on part of the government to present the Economic Survey of India, nor it is required to follow the recommendations made in the survey. However, it is prepared and tabled in view of the overall significance it holds in presenting a picture of the economy.

The survey to be presented this year holds significance as we would be able to ascertain the impact of COVID-19 on the economy in the previous year and the prospects for the future.

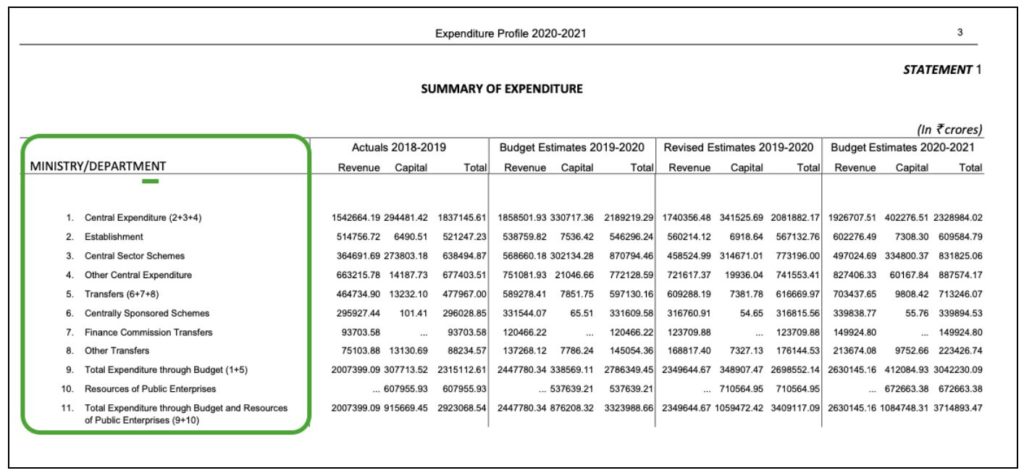

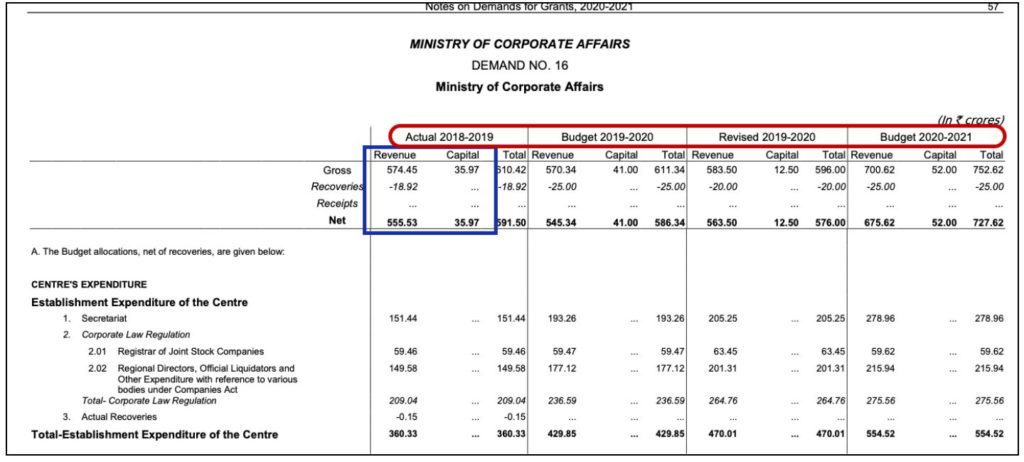

Actual Budget figures are only available for the completed financial year

As observed in the earlier story, the activity of preparation and presentation of Budget is an estimate for the upcoming financial year. The Demands-in-grants, expenditure, etc. are all estimates for the future.

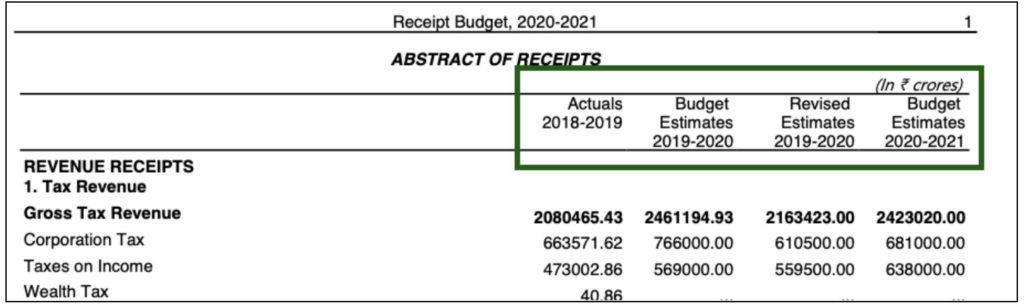

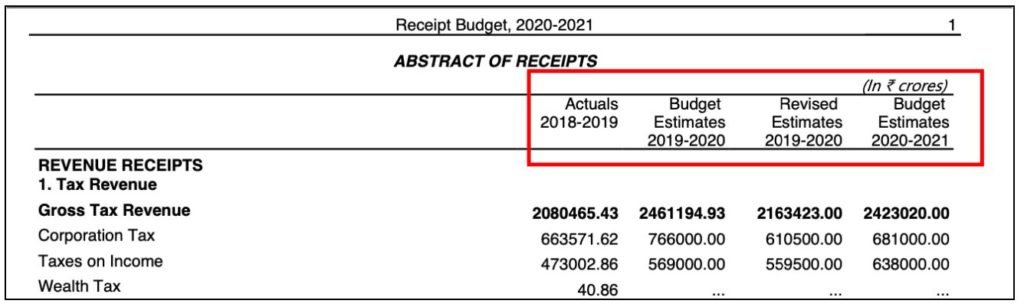

Upon a glance through the Budget documents, one can find figures attributed as “Budget Estimate” (BE) for the expenditure and receipts under various heads. Apart from these figures, one can also notice “Revised Estimates” and “Actuals’ also being mentioned. Understanding these different numbers is key to understand the Budget.

Budget Estimate: This is the estimate for next year. In the upcoming Budget to be presented, it would be Budget Estimates for 2021-22. In the above screenshot, taken from the Receipt Budget of 2020-21, the Budget Estimates are provided as BE 2020-21. In few documents, you can also find the BE for last year, which is for reference as you compare the last year’s estimates with revised Estimates (in the example it is provided as BE 2019-20).

Revised Estimate: The Revised Estimate (RE) is for the current year i.e., in the budget to be presented on 01 February, this would be for 2020-21. In the above example from the last year’s budget, the RE is for 2019-20.

The budget involves a revised statement of the current year, compared to what was estimated when the previous budget was presented. This provides a picture of the probable deviation from the Budget estimates. This is a half-yearly revision and might not necessarily reveal the actual picture.

Actuals: These are the actual figures for the completed year. When the 2021-22 budget is presented, the completed year would 2019-20 (note that we are still in 2020-21 by the time the budget is presented). In the above example of last year’s budget, the Actuals belong to the year 2018-19.

In summary, the Budget for 2021-22, will contain:

- Budget Estimates for 2021-22

- Revised Estimates for 2020-21

- Actuals for 2019-20

In a way, there would be a reference to three years budget in a single budget document.

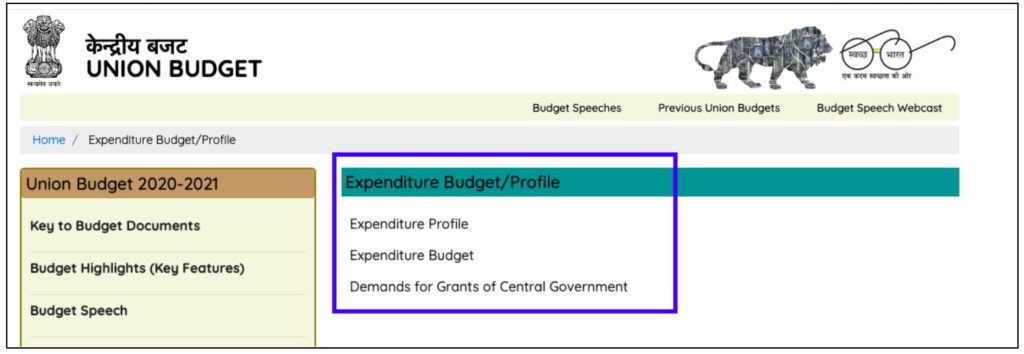

Expenditure Budget provides details of Union Government’s expenditure

Among the various Budget documents presented as part of the Union Budget, the Expenditure budget is one of the prominent ones. The Expenditure Budget presented by the government highlights the allotment & disbursement of funds to different ministries, departments, sectors etc. in a financial year. The expenditure is broadly classified into two categories – Capital Expenditure and Revenue Expenditure.

The Capital Expenditure results in the creation of a Physical Asset or an Investment, while the Revenue Expenditure includes operational expenses like – Payment of wages, pensions, interest, subsidies, etc.

The Expenditure portfolio of the Union Budgeted is presented in three different documents:

- Expenditure Profile

- Expenditure Budget

- Demands for Grants

Expenditure Profile

It compiles the information from all the Ministries and Departments and sketches a complete profile of the financial performance of the Union government. It is an important explanatory document that helps in economic analyses.

The statements in the document are provided on the basis of the information given by the various ministries.

- It contains the information of budgetary trends on important policy issues like – Gender budget, the welfare of Women & Children, Resource allocation to north-eastern States, Welfare of SCs/STs, etc.

- Expenditure Profile includes information about government schemes – Central sector schemes, Centrally sponsored schemes, Subsidies, Investments in PSUs, etc.

Expenditure Budget

Expenditure Budget contains information of the government expenditure in the financial year – ministry & department wise.

The expenditure of each Ministry/Department is divided into – Capital expenditure & Revenue Expenditure. The information includes the Budget Estimates, Revised Estimates along with the Actuals as explained earlier.

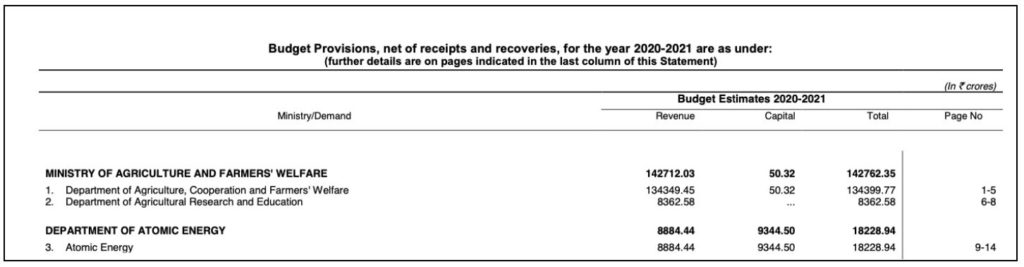

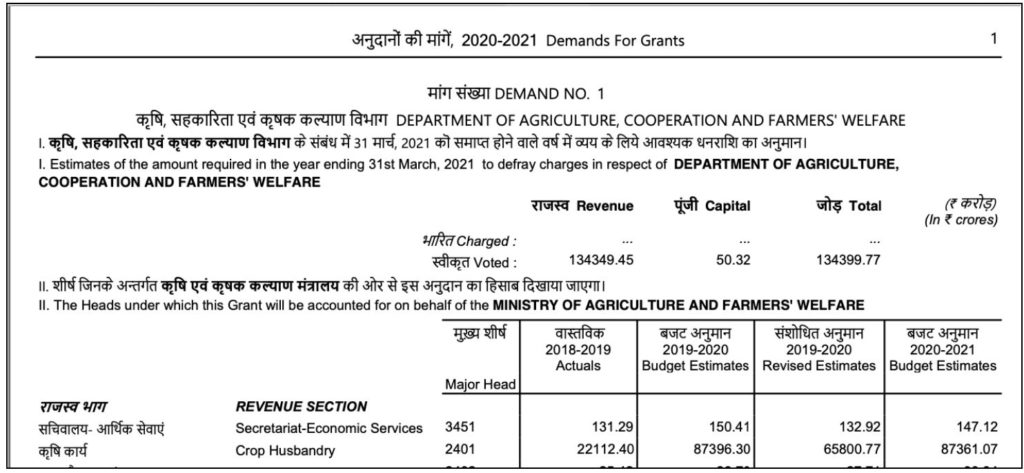

Demand for Grants

As per Article 113, any proposal or estimate seeking withdrawal of money from Consolidated Fund of India needs to be presented before Lok Sabha, in the form of Demand for grants. Every Ministry/Department is required to prepare a demand for grants for the expenditure that is expected to be incurred during the next financial year.

These are collectively presented in the Lok Sabha as part of the Union Budget.

The information in both “Expenditure Budget “and “Demand for Grants” includes Charged Expenditure and Voted Expenditure. Voted Expenditure is the expenditure, which is subject to vote in the parliament while Charged Expenditure is not subjected to vote and is charged on the Consolidated Fund.

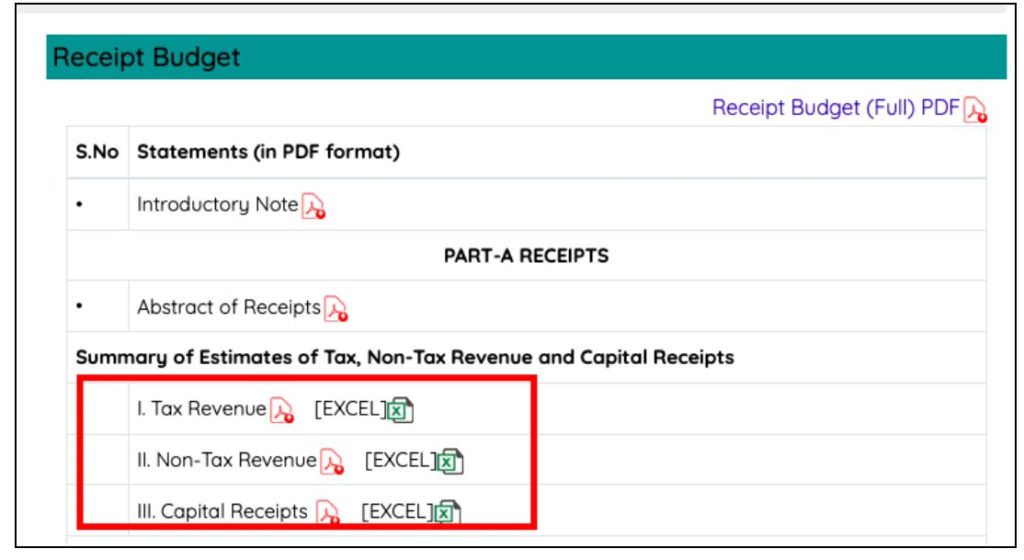

Receipt Budget provides a snapshot of the various Income sources

The expenditure for the upcoming financial year is not only driven by the need but also by the availability of resources to meet the need. Hence to draw any Expenditure estimate, it is important to estimate the revenue sources for the upcoming year.

This information also shapes up the policy regarding taxation, taking external loans, schemes/policies to stimulate growth, etc. Hence the Receipt Budget is one of the most important documents in a Union Budget.

- It contains an extensive list of income generated from different sources by the government for a specific financial year.

- It provides a break-up of the revenue generated under various heads.

- The Receipt budget has details of – Tax Revenue, Non-tax revenue, Capital receipts, etc. along with an analysis of the Fiscal tends of the year.

As is the case with other budget documents, the Receipt Budget figures include:

- Actuals for the previous financial year

- Budget Estimates for the current year

- Revised Estimates for the current year

- Budget Estimates for the next year

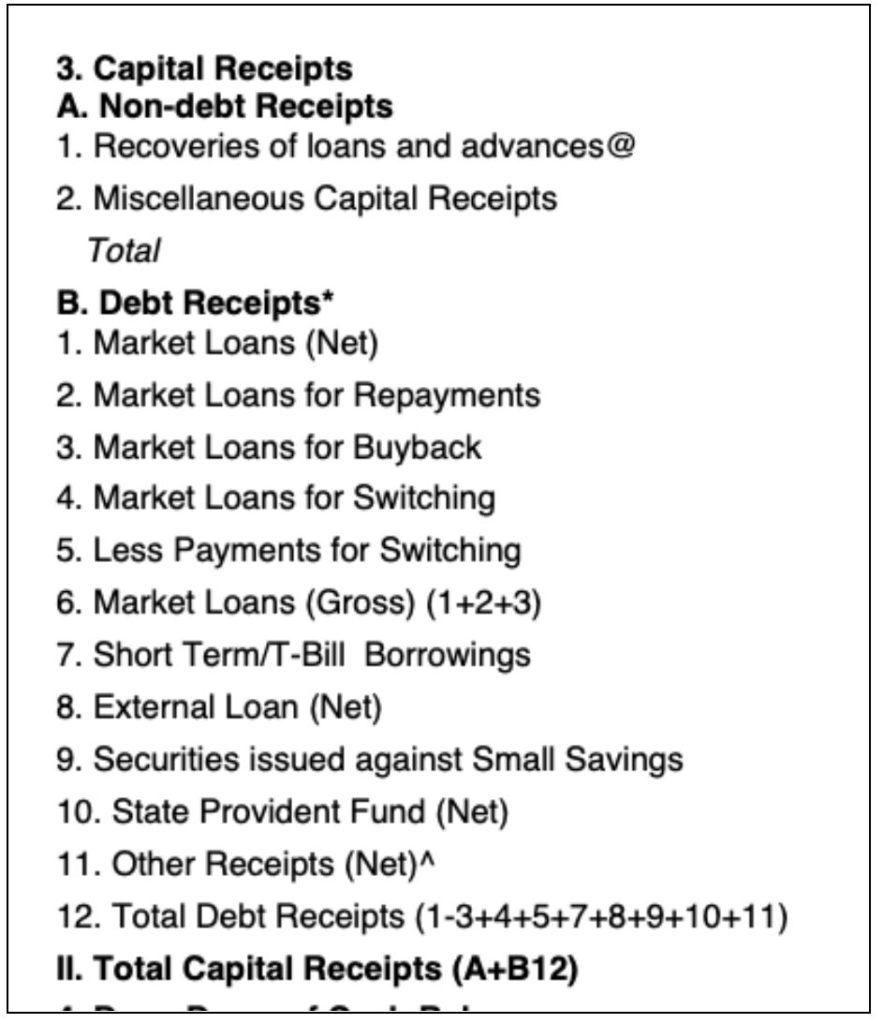

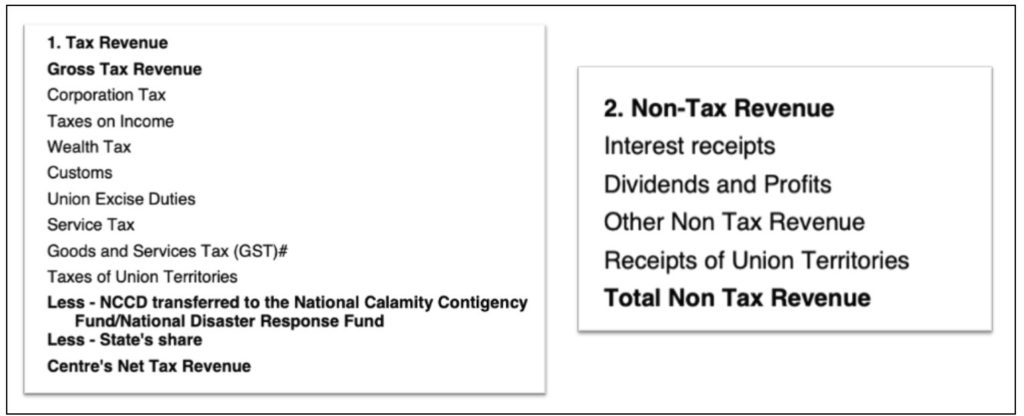

The Budget Receipts are classified into:

- Revenue Receipts

- Capital Receipts

Revenue Receipts refer to those receipts which neither create any liability nor cause a reduction in assets of the government. For example, any amount that is borrowed by the government is not a revenue receipt as it increases the liabilities of the government. They are recurring and regular in nature.

Revenue Receipts include (i) Tax – Revenue & (ii) Non-Tax Revenue

Tax-Revenue includes revenue from various taxes – Corporation Tax, Tax on Income, Wealth Tax, Custom, GST, etc. Non-Tax revenues include – Interest receipts, dividends, etc.

The Capital Receipts include the information about the various assets & liabilities of the government, prepared on the inputs received from various Ministries & Departments. These include – Non-debt receipts (that do not lead to debts- divestments in PSU, recovery of loans, etc.) & Debt-receipts.