The budget for 2021-22 would be presented on 01 February 2021. The budget and the economic survey assume great importance this year on account of COVID-19’s impact on the economy. But what is the process followed in the preparation of the Union Budget? Here is an explainer.

The Union Budget 2020-21 would be presented 01 February 2021 during the Parliament’s Budget Session, which would commence from 29 January 2021.

On the back of an economy severely impacted by the COVID-19 pandemic, this budget assumes prominence. The First Advance estimates released by the National Statistical Office, have already indicated a contraction of the economy by 7.7% in 2020-21.

While the Union budget is presented during the budget session of the parliament, the activities for the preparation of this budget start many months earlier. In this explainer, we take a look at the process of preparation and presentation of the budget.

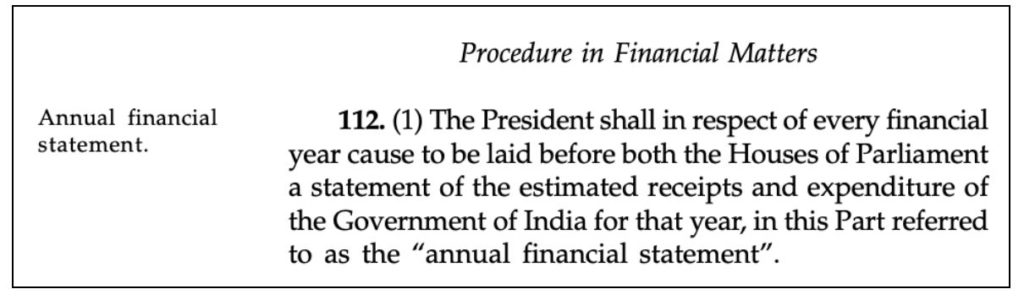

Presentation of an Annual Budget is enshrined in the constitution

Article 112, of the Constitution of India, states that a statement of estimated receipts and expenditure of the Government of India for a financial year needs to be laid before both the houses of the Parliament. Here the Union Budget is referred to as ‘Annual Financial Statement’.

The budget is required to be passed by the parliament before it comes into effect from 01 April i.e., the beginning of India’s financial year.

As per Article 77(3), a Union Minister is made responsible by the President of India to conduct transactions of the Government. Accordingly, Union Finance Minister is made responsible to prepare the budget/annual financial statement, present it and pilot it through the parliament.

More specifically, it is prepared by the Department of Economic Affairs (DEA) of the Ministry of Finance. Earlier, there were two budgets presented – the Railway Budget and the General Budget. However, based on the recommendation by NITI Aayog, the Railway budget has been merged into General Budget and a single Annual Budget is being presented since 2017-18.

Extensive consultation and deliberations take place during the budget preparation process

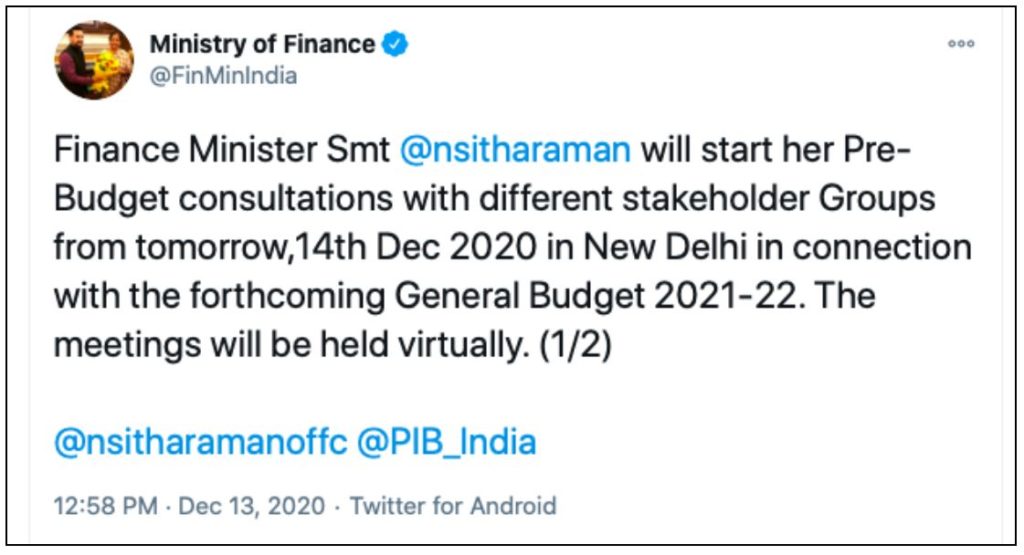

The Union Budget is prepared by the Finance Minister with the assistance of various advisors and bureaucrats. The Finance Ministry seeks the view of industry leaders and economists as well prior to the preparation of the Union Budget.

As part of the preparation of Union Budget 2021-22, Union Finance Minister has begun consultations with different Stakeholder groups from 14 December 2020 via virtual meetings.

The DEA also seeks the suggestions and inputs from the general public.

Generally, the budget-making process starts in the third quarter of the financial year. There are multiple stages in the Budget making process, with the initial step being “Estimates of Expenditure and Revenues”.

Estimates of Expenditure is prepared based on the inputs received from various ministries and departments

Two key aspects of the budget are to draw up and estimate the expenditure by various government departments for the next financial year and to ascertain the revenues it is estimated to generate to meet this expenditure.

The Preparation of the Budget starts with these two activities concurrently i.e., “Estimates of Expenditure” & “Estimates of Revenue”.

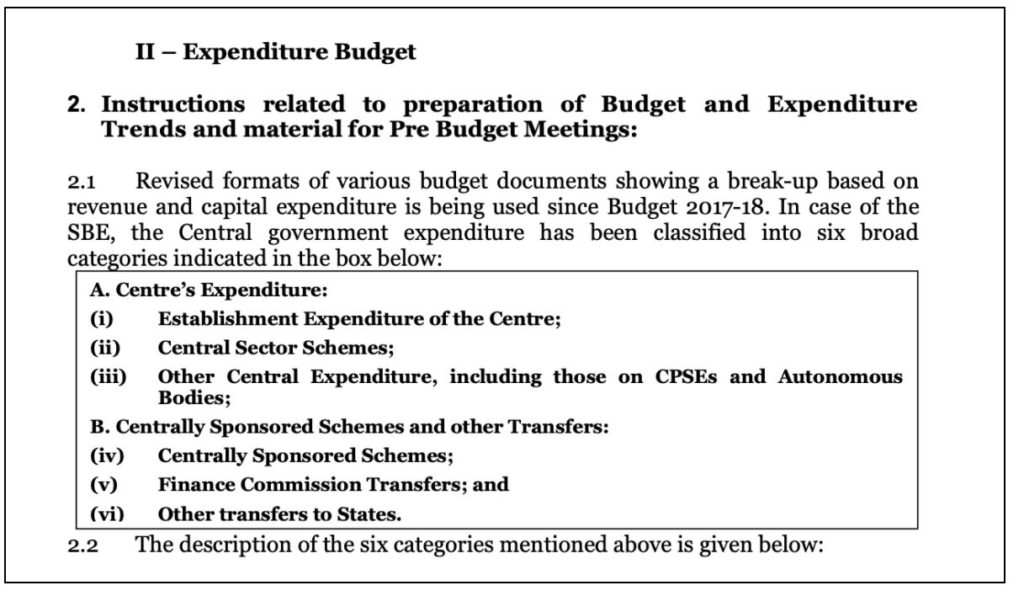

The process of estimating the expenditure for the next financial year begins with the various ministries/departments providing initial estimates of revenue & capital expenditure. The Ministry of Finance issues the notification to respective Ministries & Departments, to prepare the estimates and demand for grants.

The expenditure estimates of the various departments & ministries are developed based on the formats given in the finance ministry notification. Accordingly, respective Ministries/Departments submit their proposals for Demands-in-Grants.

Ascertaining the revenues and narrowing the deficit

While the government departments prepare estimates for the expenditure, the government also needs to ascertain the expected revenues to meet the budget expenditure.

- The Receipts of the government can be Capital receipts & Revenue Receipts. The Capital receipts include – repayment of loans given by the government, receipts from Public sector disinvestment & borrowings whereas Revenue Receipts include – Tax revenues, dividends from PSUs, Interest payments on loans given, etc. The estimate for Tax revenues is based on the existing rates of taxation and the likely growth in the upcoming fiscal year. These estimates are provided to the Revenue Secretary.

- Once the Receipts and Expenditure estimates are made, they are matched up and the expected shortfall i.e., the deficit is ascertained. Based on the consultation with Chief Economic Advisor, the government may decide to opt for external borrowings to bridge the deficit.

- Based on the deficit, the government comes up with proposals to stimulate growth in various sectors which could lead to higher revenue generation in the upcoming year. Tax policies also form part of these fiscal initiatives.

Budget needs to gain the acceptance of the house

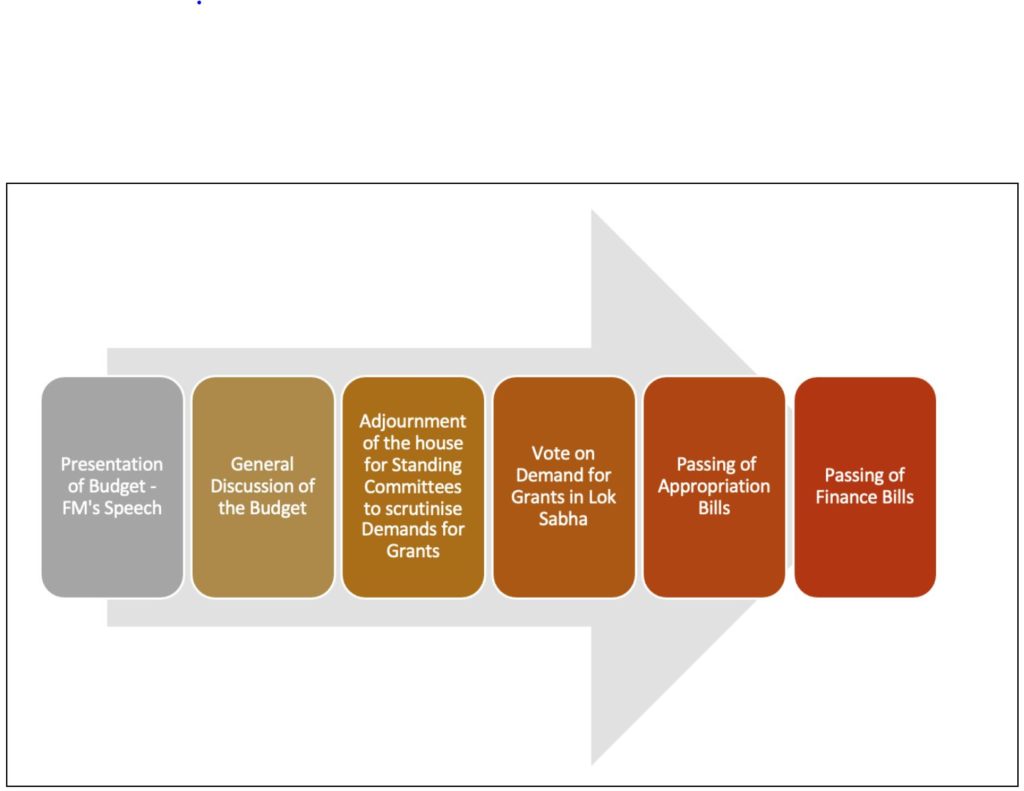

Articles 112-117 of the Indian Constitution, enshrine powers of parliament in the enactment of the Budget. Accordingly, the Union Minister of Finance presents the budget through the Budget Speech, where-in the key highlights of the proposed budget are provided. The budget goes through various stages in the parliament.

- As highlighted earlier, this year’s Union Budget would be presented in the Parliament on 01 February 2021. In the year of a general election, the budget is presented twice – an interim budget to secure a vote-on-account for the next few months, and later the complete budget after a new government is formed.

- This presentation of the budget in the house is followed by a discussion on the budget. The initial general discussion is on the broad outlines of the budget, policies, etc. This takes place in both the houses of the parliament.

- Later, the session is adjourned for the respective Standing committees to review the demand-for-grants and submit their reports to the house. To facilitate this, the house would be adjourned from 15 February 2021 to 08 March 2021.

- Since it would take around a couple of months to pass the budget, the government would need a sanction of the amount for the maintenance during this period. Article 116, provides for a special provision – ‘Vote on Account’, through which the Vote of the house is obtained by the government for an amount which would generally suffice for the expenditure to be incurred in the next two months. In a general election year, this is done for an expenditure estimate of 2-4 months.

- Once the Standing committee reports are presented in the house, there is a ministry wise discussion of the committee of reports and voting on the Demand for Grants takes place. The time allotted for this discussion is decided by the speaker based on due consultations.

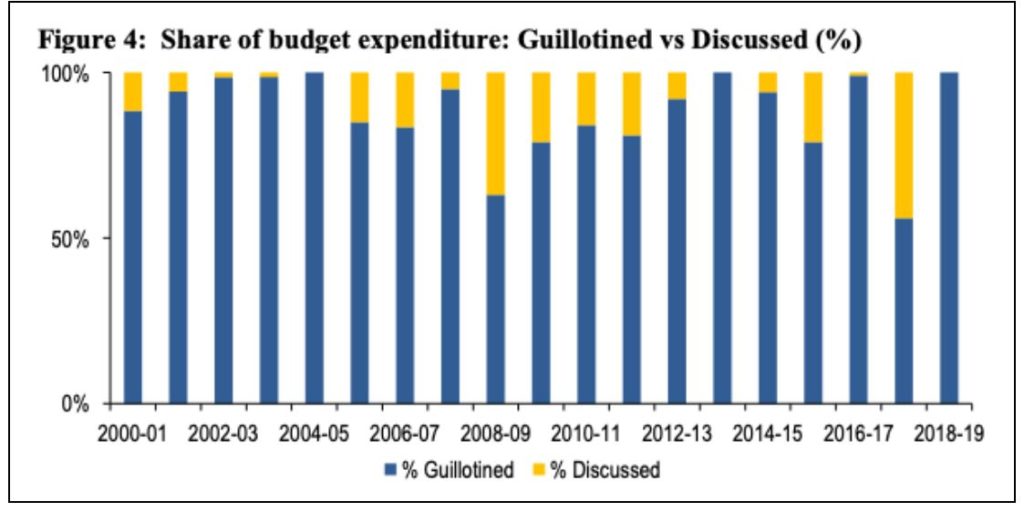

- Due to the paucity of time, there is the option for passing Demand for Grants without discussion. This is generally done on the last day of the parliamentary session and is referred to as ‘Guillotine”. Data from the past budgetary sessions indicate that passing through Guillotine forms a majority.

- There is also scope for reduction in the amounts under Demands for Grants. This is done through ‘Cut Motion”. These could be – Economy Cut, Policy Cut, or Token Cut.

- The Voting on Demands for Grants is restricted only to the Lok Sabha. Lok Sabha has the power to either assent, refuse to assent or reduce the amount of Demand for Grant. In the Rajya Sabha, there is only a general discussion of the budget and there is no vote on Demands for Grants.

During the budget presentation and the ensuing discussions in the parliament on the budget, various bills are presented in the parliament. These include – Finance Bill, Money Bill & Appropriation Bill. Further, as part of the budget, the Government submits various documents including – Receipts Budget, Expenditure Budget, etc.

In conjunction with the budget, the Ministry of Finance releases the annual ‘Economic Survey of India’ report, which provides a summary of the annual economic development and activity through the year. In the context of the COVID-19 pandemic, the economic survey report becomes very crucial to understand the economic situation of the country.

In the next story, we take a detailed look at the various bills & documents presented during the budget.

Featured Image: Preparation of Union Budget