[orc]In the previous story, we looked at how there has been a significant decrease in the number of public sector bank ATMs. In this story, we look the numbers related to private banks & white label ATMs and what it means in the larger context.

In the previous story, we looked at how there is a significant decrease in the number of public sector bank ATMs. At the same time, RBI data shows that the gap created by the decreasing ATMs of Public sector banks is being covered by ATMs of Private Sector Banks and White Label ATMs. This is the reason why the total number of ATMs in the country have not seen much of a variance in-spite of the dwindling numbers of Public sector ATMs.

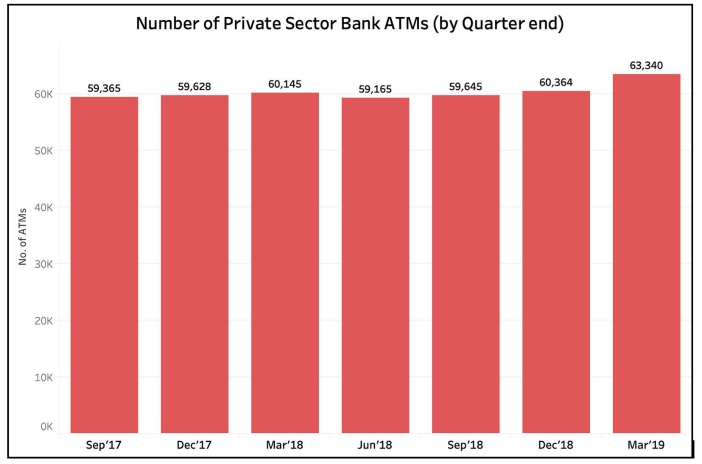

The number of Private sector Banks have seen an increase in the previous quarter, after a period of decline last year. In the previous quarter itself, there was an increase of 2976 ATMs out of the 3712 ATMs added by private banks over the past 6 Quarters.

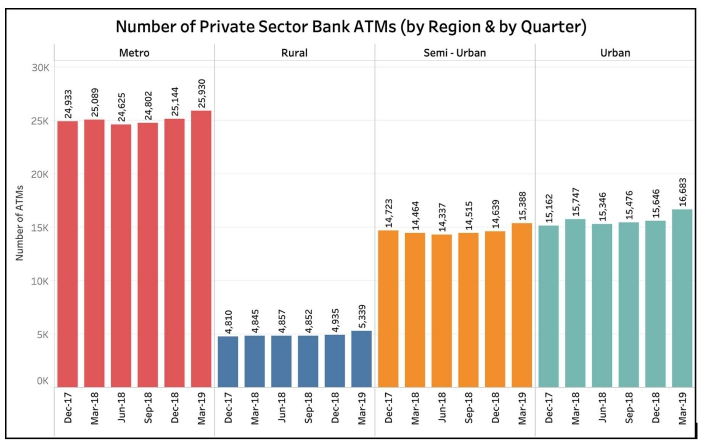

The national wide increase in the private bank ATMs is consistent across all the different regions – Metro, Rural, Urban and Semi-urban areas without any particular disparity.

What about States & different Banks?

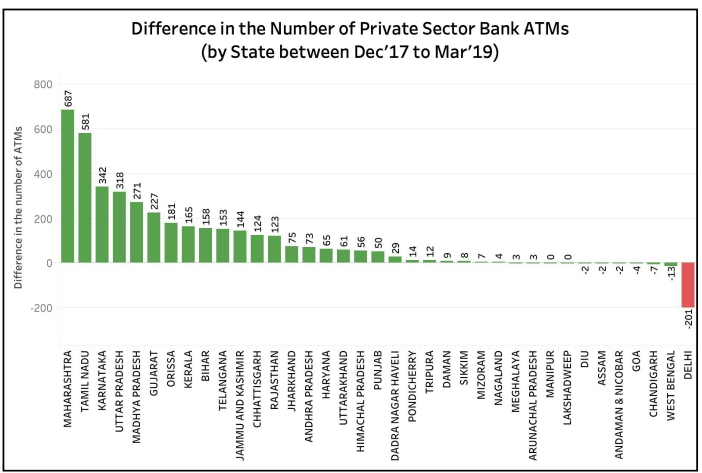

Private sector banks have managed to increase the number of ATMs across all the states, with Delhi being the only state which has seen a dip in the number of private sector bank ATMs.

Maharashtra, Gujarat, Uttar Pradesh & Madhya Pradesh, the states which had more number of public ATM closures over the last 6 quarters also happen to be among the top states which have more number of private bank ATMs being opened.

In terms of individual banks, Axis bank is the only exception among private sector banks, with more than 2000 ATMs being closed in the past 6 quarters.

What about White Label ATMs?

White Label ATMs were first introduced in the year 2012 when RBI introduced new guidelines. These guidelines have been revised multiple times. White Label ATM Operators (WLAO) have agreements with various banks for cash management and fund settlement.

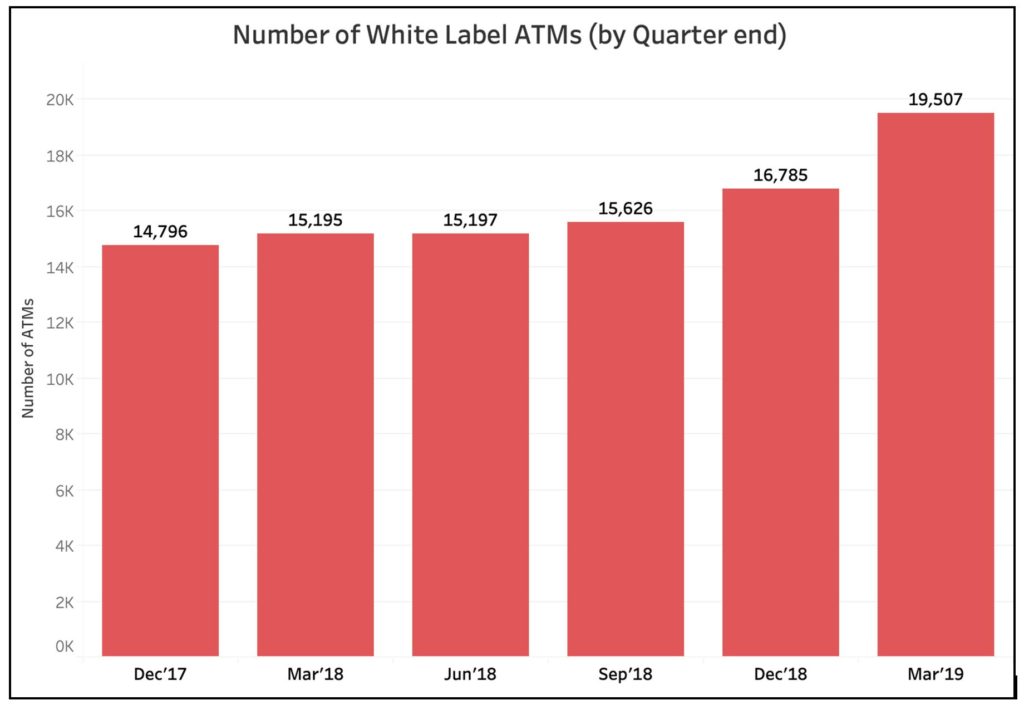

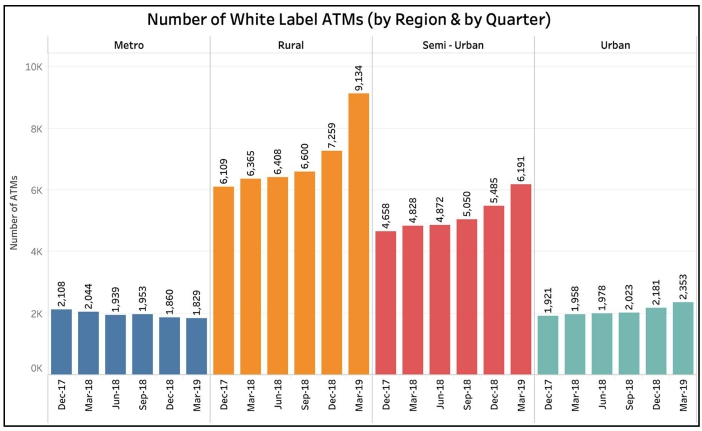

The number of White Label ATMs has been on the rise since Dec’2017. Like in the case of Private Bank ATMs, a sizable portion of the growth was achieved during the previous quarter (Jan’19 to Mar’19) when 2722 White label ATMs were added.

One of the main objectives of introducing White Label ATMs was to meet the purpose of financial inclusion as recommend by Rangarajan Committee. Since the inception, white Label ATMs have had a good presence in the Rural and Semi-Urban areas, in line with the directive and has seen a continuous growth over the years.

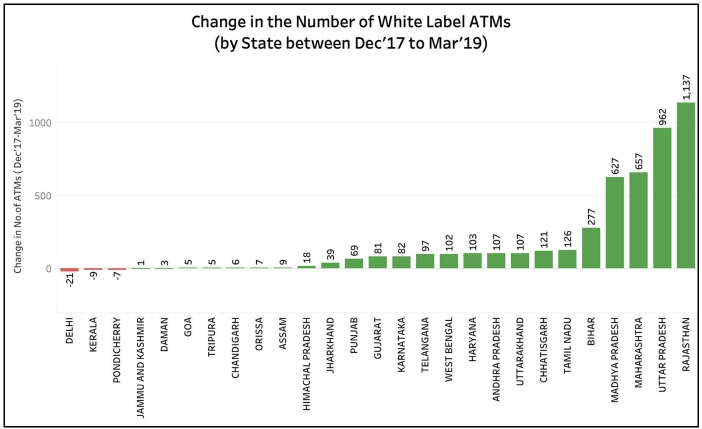

With 1875 white label ATMs added in Rural areas and 706 in semi-urban areas in the previous quarter, these ATMs seems to be compensating for the huge dip in the number of public sector bank ATMs. The increase in the number of White label ATMs in states like Maharashtra, Rajasthan, UP & MP which are the sates where the Public Sector Bank ATMs have gone down the most, further validates the increasing presence of these ATMs in lieu of Public sector Bank ATMs.

The recent guidelines by RBI relaxing the norms for setting up and operation of White label ATMs might further encourage setting up of such ATMs.

Encouraging White label ATMs can help achieve financial inclusion

While there has been an increase in the cashless digital transactions, Indian economy still remains to be largely a cash driven economy. With more people coming under the gamut of banking system, it is important that ATM facility is accessible, to encourage and retain them as part of the system.

The experience of public sector banks in running the ATMs has over the period of time proving to be an avoidable overhead cost. The cutting down on operation costs does seem to be in the right direction in the context of Public sector banks. The reducing numbers of these ATMs is now quite evident.

However, in context of the larger picture, White label ATMs have to compensate for these reducing numbers, as well as expand to locations where Public sector banks could not reach out earlier and where private sector banks would find it less viable. We will have to wait and see if the relaxation of guidelines by the RBI would increase the number of white label ATMs.

This is a 2-part series on the number of ATMs in the country. The first part looked at the decreasing number of Public Sector bank ATMs.