The recent remarks of the finance secretary that the central government may not be able to pay the GST compensation to the states in the wake of the economic crisis created quite a stir. Data of the last three years indicates that four states of Karnataka, Maharashtra, Gujarat & Punjab received about 42% of the total GST compensation cess released till date.

The Central Government has recently, on 27 July 2020, released the GST compensation pending to the states for March’2020. This amounted to a total of ₹ 13.8 thousand crores and with this payment, the entire compensation due to the states for the year 2019-20 has been released by the Centre.

Why does the Centre pay GST Compensation to States? How is the amount of compensation decided and how does the centre finance the compensation due to states? In this story we take a look at Centre’s GST Compensation to the States and look at trends over the last three years since GST came into effect.

Compensation is paid to States for any loss of revenue due to implementation of GST

The provisions of Goods & Services Tax Act (GST) came into force from 01 July 2017, with an intention to implement a simplified, self-regulating and non-intrusive indirect tax compliance regime.

At the Central level, Service Tax, Custom Duties, Central Excise (except for products of Petroleum & Tobacco) etc. were subsumed by GST. Since GST is a consumption-based tax, it was believed that manufacturing states might tax revenue. Therefore , to compensate for the loss of revenue, The Goods and Services Tax (Compensation to States) Act, 2017 was passed.

For the purpose of calculation of GST Compensation to be paid to the states:

- The Financial Year (FY) ending 31 March 2016, is taken as the base year.

- The base year revenue for a State is the Sum of Revenue collected by the State and local bodies on account of the taxes levied. These taxes include among others – VAT, Sales Tax, purchase tax, Central Sales Tax, entry tax, octroi, taxes on luxuries, entertainment etc., excise duties etc.

- The exclusions from the tax revenue include tax on sale and purchase of petroleum products & alcohol.

- For any state, the projected nominal growth rate of the revenue that is subsumed by GST during this transition period is taken as 14% per annum. Projected revenue is calculated by applying this growth rate over the base year revenue.

- The compensation payable to the state would be the difference of the projected revenue and the actual net revenue earned by the state.

Provisional Compensation is required to be calculated every two months on pro-rata basis and paid to the states. Adjustment for any over-payment or under-payment is done in the subsequent months or in few instances in subsequent financial years once the official audit is done.

Provision for levy and collection of Cess for GST compensation

Section 8 of GST (Compensation to States) Act -2017, provides for levying of Cess on Intra-state and Inter-state supply of Goods & Services, for the purpose of providing compensation to the States, for any loss of revenue due to the implementation of GST. The time provision for collection of this levy is initially proposed to be for 5 years, which can be reviewed by the GST council.

Central Government based on the recommendations of GST Council has levied varied GST Compensation Cess rates of different Goods & Services. The initial notification with this schedule of tariffs was released on 28 June 2017. There have been subsequent changes made for few of the items in due course. GST Cess is levied on the transactional value in addition to GST.

Section -10 of GST (Compensation to States) Act- 2017, states that the proceeds of the cess levied would be credited to Goods & Services Tax Compensation Fund, which is a non-lapsable fund.

The compensation amount that is paid to the states is paid out of this fund. The act further states that if there is any amount remaining unutilized at the end of the GST transition period, 50 % of the same shall be transferred to the Consolidated Fund of India and the balance to be distributed among States & UTs as per the ratio of their GST revenues.

Marginal Increase in the GST Compensation Cess collected in FY 2019-20

A total of ₹ 2.31 lakh crores of GST Compensation Cess are collected so far i.e. from July’2017 to March’2020. At the end of the first financial year after the rollout of GST, the amount of GST Compensation cess collected amounted to ₹ 58.3 thousand crores.

In the next Financial Year (2017-18), which is the first full financial year in GST regime, the GST compensation cess collection increased by 54% to reach ₹ 87.2 thousand crores. There was only a marginal increase in the collection of cess in 2019-20 with a collection of ₹ 95.3 thousand crores.

Over this 3-year period, the highest GST Compensation Cess was collected from Uttar Pradesh, totalling to ₹ 32.6 thousand crores followed by Maharashtra with ₹ 30.5 thousand crores.

Karnataka, Tamil Nadu and Telangana complete the top-5 states with the highest cess collection for the period 2017-20.

Punjab & Kerala are among the states with lower GST Compensation Cess collection along with most of the NE states and UTs.

Maharashtra received the highest GST Compensation for 2019-20 followed by Karnataka

A total of ₹ 1.65 lakh crores are released as GST compensation to the states for 2019-20. As per the information provided in an official Press Release, apart from the GST Compensation Cess for 2019-20 and the arrears from previous years, the government has transferred ₹ 33.41 thousand crores from Consolidated Fund of India to release GST compensation to the states. This transfer from Consolidated Fund of India was done as part of an exercise to apportion balance of IGST pertaining to 2017-18.

Among the states, Maharashtra has received the highest amount of GST compensation for 2019-20 with ₹ 19.23 thousand crores. Another traditional high revenue state, Karnataka received ₹ 18.62 thousand crores as GST Compensation. These two states are also among the states which have collected the highest GST Cess.

Gujarat, Tamil Nadu & Punjab make up the rest of top-5 States followed by U.P, Delhi & Kerala in the list of states that received the highest GST compensation for 2019-20.

With the exception of Assam & Tripura, the North-Eastern states have not received any GST Compensation. Jharkhand, Andhra Pradesh & Telangana are among the comparatively larger states which have received less GST compensation.

Karnataka has received the highest GST Compensation till date

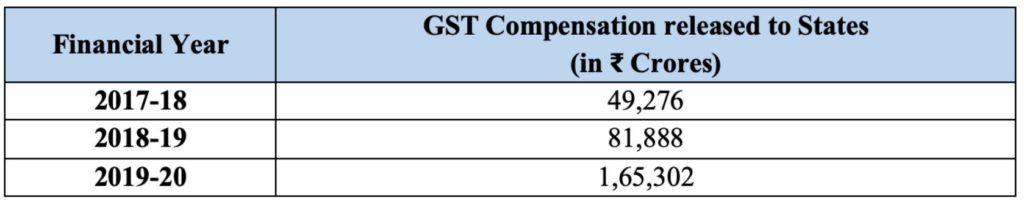

GST Compensation released to States for 2019-20 was more than double the amount released for 2018-19. For 2019-20 a total of ₹ 1.65 lakh crores were transferred, while it was only ₹ 81.8 thousand crores in 2018-19.

The highest GST Compensation till date (from July’2017 to March 2020) was released to Karnataka, amounting to ₹ 38.7 thousand crores, of which around 18 thousand crores were released for 2019-20.

Meanwhile, Maharashtra received the second highest GST compensation with ₹ 31.67 thousand crores. Similar to Karnataka, a major portion of this i.e. 19 thousand crores were received in 2019-20. Around ₹ 12 thousand crores were transferred during June’19-Nov’19 in three instalments.

Uttar Pradesh, which did not receive any compensation for 2017-18, has received nearly 79% of its total compensation so far in 2019-20.

Across the board, the same trend is observed, where in the states received higher GST compensation in 2019-20 compared to previous years, with most of the states having received proportionately double the amount, largely on account of the economic slowdown coupled with COVID-19 crisis that has severely affected tax collections.

Economic Slowdown could have a serious impact on Centre’s commitment towards GST compensation

Although there is a near double increase in the GST compensation payment for 2019-20, there has been extreme delay in the payment of this compensation. The payment due for 2019-20, was paid 4 months into the next financial year. Meanwhile there are allegations from opposition ruled states that the Centre is delaying the GST dues, thereby impacting State-level Schemes.

In an earlier story, we had observed that ‘State’s Own Tax Revenues’ (SOTR), GST & Sales tax form the major component of State Revenues. In the same story, we have also observed that there is a short fall in the amount being devolved by the Centre to the states. This creates enormous fiscal strain on the states who have their own budgetary expenses.

The CAG Report on GST indicated short fall in the GST collection compared to the estimates. As per the available data on GST portal, there hasn’t been any significant improvement in GST collections for 2019-20. The Total GST collections (CGST+ SGST+ IGST+ Cess) was around ₹ 9.44 lakh crores in 2019-20, compared to that of ₹ 8.76 lakh crores the previous financial year of 2018-19 i.e. an increase of only around 8%.

In view of the impending economic slowdown due to COVID-19, the situation does not look promising. Along with Centre, even the states are staring at a substantial fall in their SOTR and GST revenues.

As per few news reports, Finance Secretary Ajay Bhushan Pandey has said before a parliamentary panel that the central government would not be able to pay the GST Compensation for any shortfall at the current rates of 14% per annum. Any attempt towards reworking on this formula in the wake of lower GST collections, could affect the idea of GST framework itself.

The recent reported remarks by the Attorney General of India that the Centre is not obliged to pay for GST Compensation shortfall, created more ambiguity on the course of action the Centre would pursue to compensate the states in 2020-21.

1 Comment

Pingback: Till date, four states received about 42% of the total GST Compensation released by the Central Government - GSTIndiaPro