[orc]The CAG in its first ever report on GST highlighted multiple issues like actual GST collections being lower than estimates, lower return filing rates and issues with the GSTN. Here are some of the highlights of the CAG report.

GST (Goods and Services Tax) came into effect from 01 July 2017, with an idea of implementing a simplified, self-regulating and non-intrusive indirect tax compliance regime. Government of India has hailed this to be a landmark achievement by having in place a unified tax system in lieu of the multiple central and state taxes.

Two years into the implementation, a review of GST implementation and the status of the expected goals is paramount. The CAG’s (Comptroller and Auditor General) report on GST, for the year 2017-18, the first year of GST implementation provides insights on the performance of various aspects related to GST.

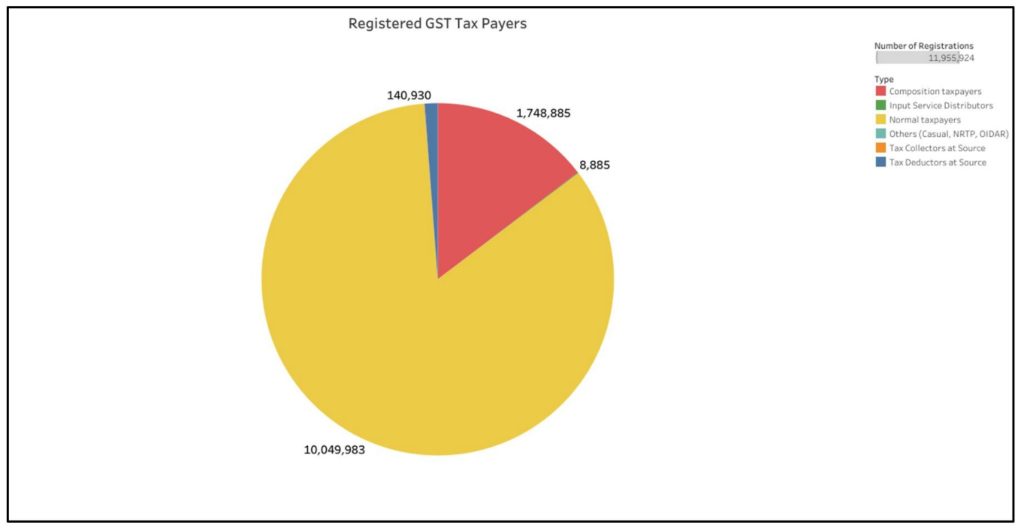

Total number of GST registrations as on 28 February 2019 is about 1.2 crore. The GST registrations are further categorized into Normal taxpayers, Composition taxpayers, Tax Deductors at Source, Tax Collectors at Source, Input Service Distributors and others including NRTP, OIDAR etc.

Maharashtra, Uttar Pradesh, Gujarat, Tamil Nadu and Delhi have the highest number of GST registrations with Maharashtra and UP accounting for nearly a quarter (24.51%) of the GST registrations.

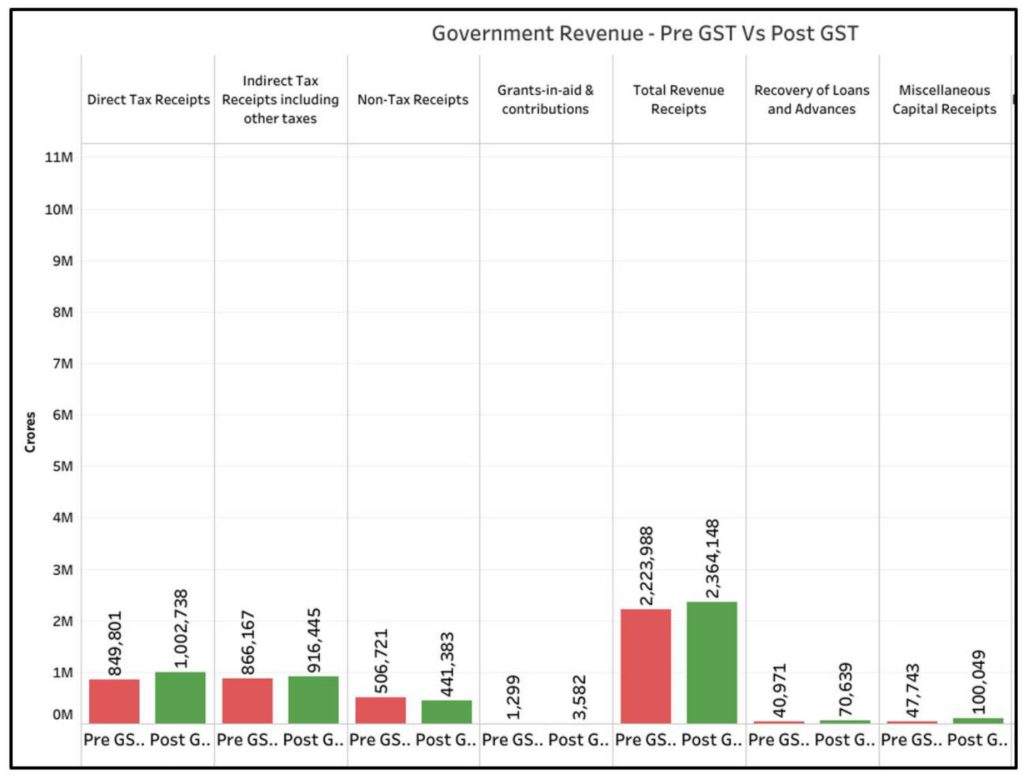

Marginal increase in receipts from Indirect taxes (including GST)

The total tax receipts (direct and Indirect taxes) post GST have increased by ₹ 2,03,215 crores. The increase in total tax receipts is largely due to the increase in Direct Tax receipts (Income tax & Corporate tax). The Direct tax receipts in 2017-18 (post GST) were ₹10,02,738 crores compared to ₹ 8,66,167 crores in 2016-17 (pre GST), an increase of ₹1,52,937 crores or 18%. While the indirect taxes of which GST is a part, have increased only by 5.80% to the tune of ₹ 50,278 crores.

Prior to implementation of GST, Indirect taxes included – Central Excise, Service Tax, and Custom duties. Post GST, it has replaced Service Tax and duties of Central Excise (other than on petroleum products). While, tobacco is subjected to both Central Excise and GST, all the petroleum products continue to have Central Excise.

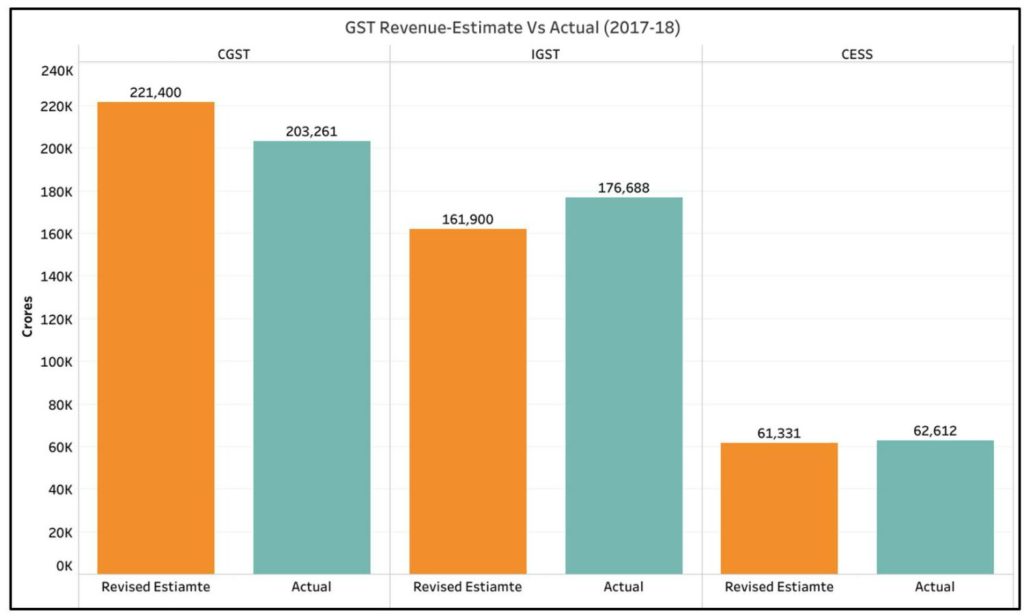

Actual GST revenue fell short of estimates in both 2017-18 & 2018-19

The actual estimates for revenue through GST for 2017-18 were ₹ 4,44,631 crores. However, the actual GST revenue received for the year is ₹ 4,42,561 crores. While the actuals for IGST (Integrated GST) and Cess are higher than the estimates, the actual CGST (Central GST) is less than the estimates. It has to be noted that these are revised estimates, as there was no provision for the budget estimates in the budget for 2017-18 as GST was implemented in the middle of the year.

The actual IGST revenue was ₹ 1,76,688 crores which is ₹ 14,788 crores more than the estimates. Of the IGST revenue, ₹ 67,998 crores was allocated to the states with the balance being retained by Central Government. The actual CGST fell short by ₹ 18,139 crores compared to the estimates i.e. 8.2% less than the estimates.

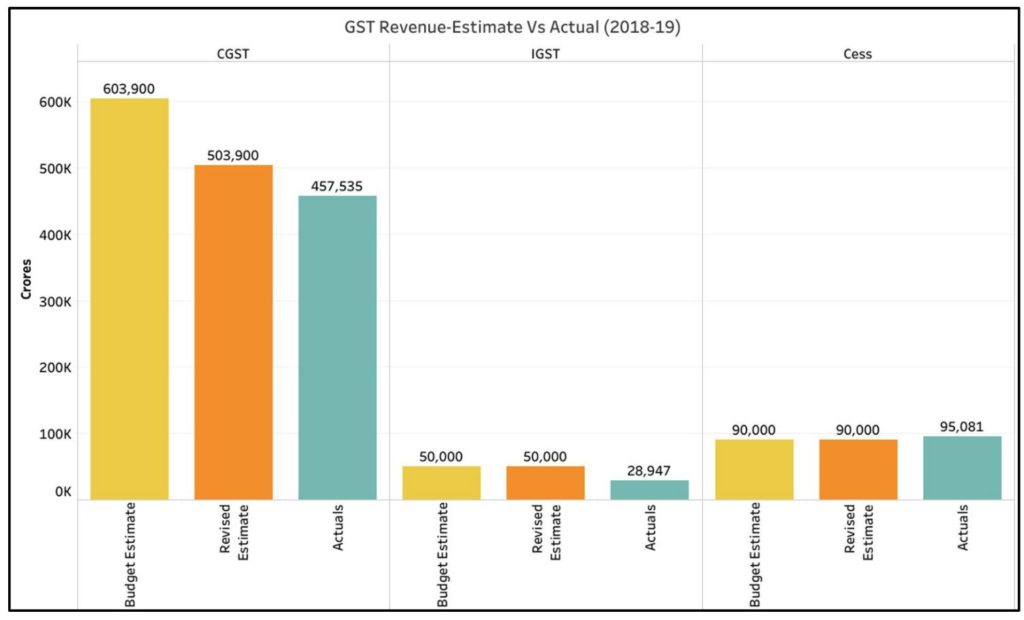

Even for the year 2018-19, the actual GST receipts fell short of the estimates. There were initial budget estimates provided as part of 2018-19 budget. Later these estimates were revised. The CGST actuals are less than both the budget as well as the revised estimates.

The Budget estimates for CGST were ₹ 6,03,900 crores which was later revised to ₹ 5,03,900 crores. However, the actuals fell short by ₹ 46,365 crores compared to the revised estimates. IGST also had a shortfall of ₹ 21,053 crores with actuals being only 58% of the revised estimates. Meanwhile, the cess collected is ₹ 5,081 crores more than the revised estimate of ₹ 90,000 crores. It has to be noted that the figures for 2018-19 are provisional figures as available on the website of the Controller General of Accounts (CGA) as of March 2019.

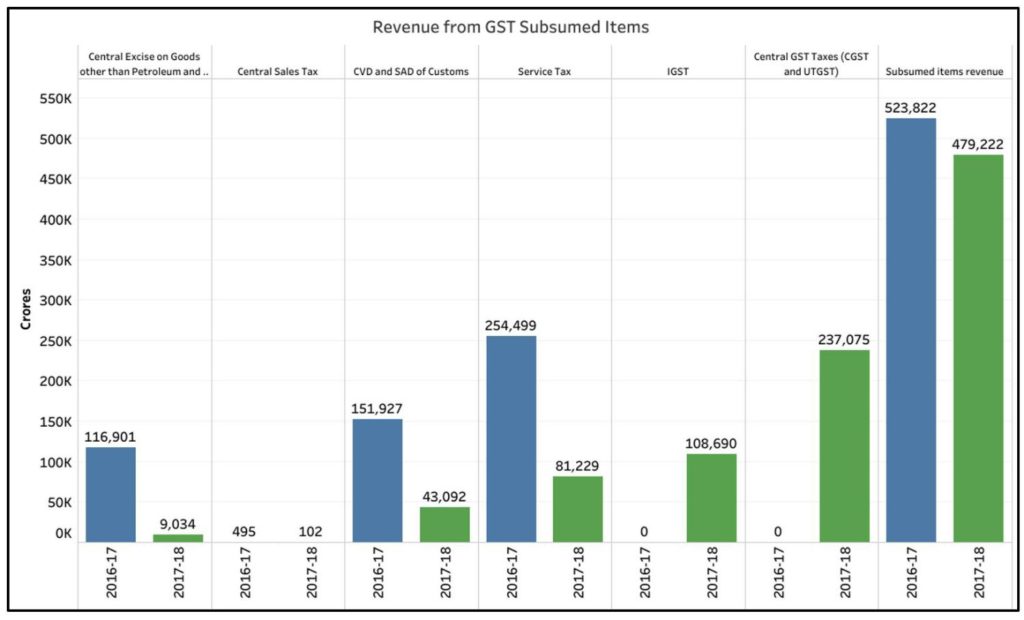

Revenue from GST less than the earlier revenue generated from GST subsumed Indirect Taxes

As discussed earlier, GST has replaced a slew of Indirect taxes. The Central Excise on products of Petroleum and Tobacco do not form part of GST. The Central excise on rest of items, Service tax and Custom duties are replaced by GST at the central level.

The revenue collected through GST for 2017-18 is less than the revenue through the Indirect taxes in previous years, which GST has replaced, as per the CAG’s calculations.

The total subsumed items revenue in 2016-17 was ₹ 5,23,822 crores. However, the revenue generated of these subsumed items post implementation of GST for 2017-18 is ₹ 4,79,222 crores i.e. ₹ 44,600 crores or 10% less than the subsumed items revenue in 2016-17.

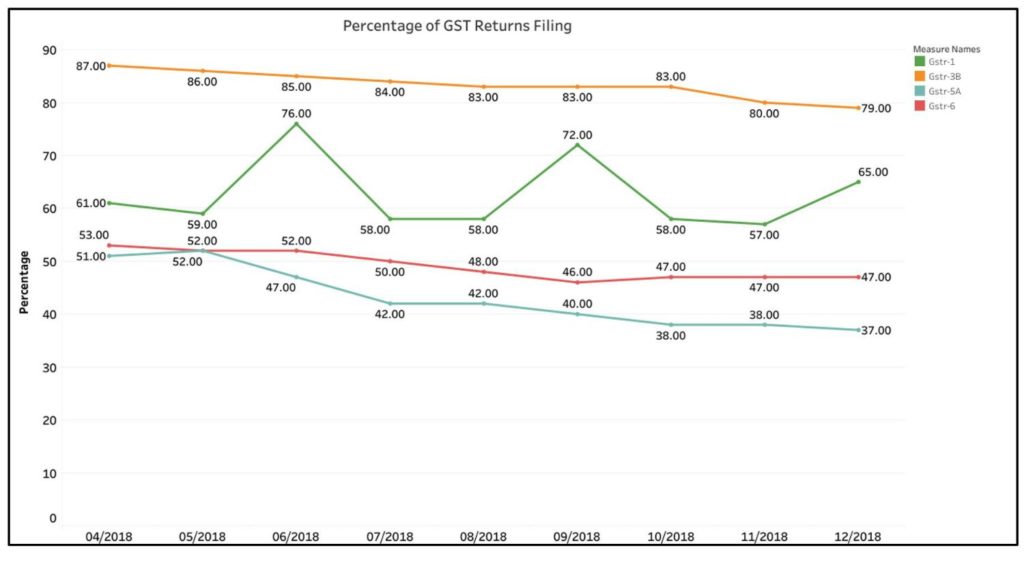

During 2018, percentage of GST returns filed showed a consistent decrease

In its report, the CAG provided the trends of actual rate of GST returns filed for various GST return types for the period – April 2018 to December 2018. One consistent observation across the various GST return categories across all the months is the large difference between the expected GST returns and the actual GST returns filed.

GSTR-1 is a monthly return which needs to be filed for outward supplies. In the data provided for the nine months, the best performance was in June 2018, where in ₹ 70,48,521 crores worth of GST returns was filed against ₹ 93,16,710 crores that were due to be filed i.e. 78% of the actual GST returns. The end of quarter months (June, September & December 2018) have higher return filing percentage than the other months.

GSTR-3B is a summary form which needs to be filed every month for all the supplies made. It is a compulsory return which needs to be filed every month. The return filing Percentage has seen a consistent decline over the months. While 87% returns were filed in April 2018, it tapered off every month and in December 2018, only 79% were filed. It needs to be noted that the GSTR-3B returns filed prior to the due date are much lesser, with it ranging from 59%-64% in these 9 months. The CAG report notes that, 20% of GSTR 3B returns are filed after the due date.

GSTR-5 is a return which needs to be filed by Non-Resident or Casual taxpayers. This filing percentage was very low initially with 11% in January 2018. The return filing percentage has subsequently increased and peaked in November 2018 at 87% but again fell to 61% in December 2018.

GSTR-5A returns and GSTR-6 returns needed to be filed by OIDAR (Online Information and Database Access or Retrieval services) and ISD (Input Service Distributor) have also seen lower filing rates with highest in a month being 52% and 53% respectively.

GSTR-4 is a quarterly return required to be filed by a composition taxpayer. The Percentage of reruns filed has seen a consistent decrease over the quarters. In quarter ending June 2018, the filing rate was 85% which reduced to 82% in the quarter ending September 2018 and further decreased to 78% in the quarter ending December 2018. The composition tax scheme is applicable for taxpayers with less than ₹ 1 crore turnover and can pay a fixed rate instead of the tedious GST calculations. This limit was further increased to ₹ 1.5 crores.

Need to facilitate a convenient mechanism for filing GST returns

One of the main ideas behind introducing GST is to cut through the challenges & complexities faced by taxpayers in payment of taxes. Making the process simpler and having few tax rates instead of multiple rates are two of the main actionable items. While GST has replaced multiple taxes, there are many issues with the process involved in GST return filing as highlighted in the CAG report.

The CAG further highlighted the following issues in its audit report regarding GSTN, the IT backbone of the GST system.

- Business Continuity Policy was not finalized and only Disaster Recovery Plan had been in place.

- The failure to map business rules correctly and the absence of key validations in the system points to inadequacies in the functioning of GSTN.

- GSTN needs to prioritize development of various functionalities, strengthen their root cause analysis and testing process to ensure that critical deficiencies in application are detected and rectified before rollout to public.

- The problem of accumulation of IGST balance due to unavailable IGST settlement reports should be resolved on priority to minimize the need for resorting to ad hoc apportionment of unsettled IGST, to be adjusted against future apportionments due to the States. The role of the executive in UAT / SRS sign off also needs to be re-examined.

While, these can be considered as teething issues, it has been two years since the implementation of GST and the process has actually started much before that. Lack of complete understanding on the GST process, issues with the GST portal, non–clarity on the reimbursement and delays surrounding this are few of the reasons for lower GST filing rate. The decreasing trend of tax filings is also a major concern especially with GSTR-1 and GSTR-3B returns. The government needs to focus on addressing these concerns to ensure that the revenue generated through GST is at par with the estimates.