The issue of Central Cesses has been a contentious one since the amount collected through Cesses & surcharges is kept out of the divisible pool. The 15th Finance Commission report submitted recently highlights that the share of ‘Cesses & Surcharges’ in Gross Tax Revenue has increased from 10.4% to 15.3% in 10 years.

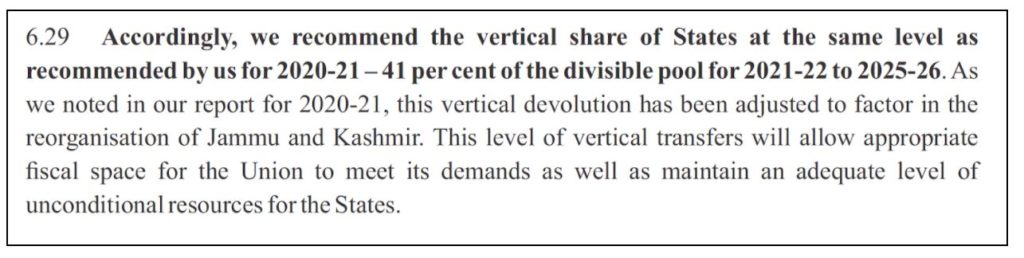

The Fifteenth Finance Commission (XVFC) submitted its Final Report with recommendations for the period 2021-26 on 01 February 2021. Earlier, it submitted its first report, consisting of the recommendations only for 2020-21 during February 2020. Among the key recommendations is that the share of States in the Central taxes was recommended at 41% for the period 2021-26. This is the same as the earlier recommendation made for 2020-21.

XVFC has estimated that the Gross revenue for this period would be Rs. 125.2 lakh crores and the extent of the divisible pool is estimated at Rs. 103 lakh crores i.e., around 82%. The Divisible pool is calculated after deducting the Cesses, surcharges & cost of collection for the Gross revenue. The grants to the states are estimated to be another Rs.10.33 lakh crores.

In a recent interview, N.K.Singh, Chairman of the Fifteenth Finance Commission, has stated that they have recommended more grants to states to compensate for the Cess. Responding to another question about the shrinking of the effective devolution of the share to states because of increased reliance of Centre in cess & surcharge, N.K. Singh opined that there needs to be a public debate of what constitutes a divisible pool to the states. He stated that the inclusion of cess & surcharge in a divisible pool is beyond the purview of the finance commission and it requires a constitutional amendment. However, he did acknowledge that the incidence of Cess & Surcharge between the 14th & 15th Finance commission has gone up.

His statement is in line with an argument that the share of cess & surcharges has increased over time in the central tax revenues which have effectively resulted in States receiving lesser amounts since cess & surcharges are left out of the divisible pool.

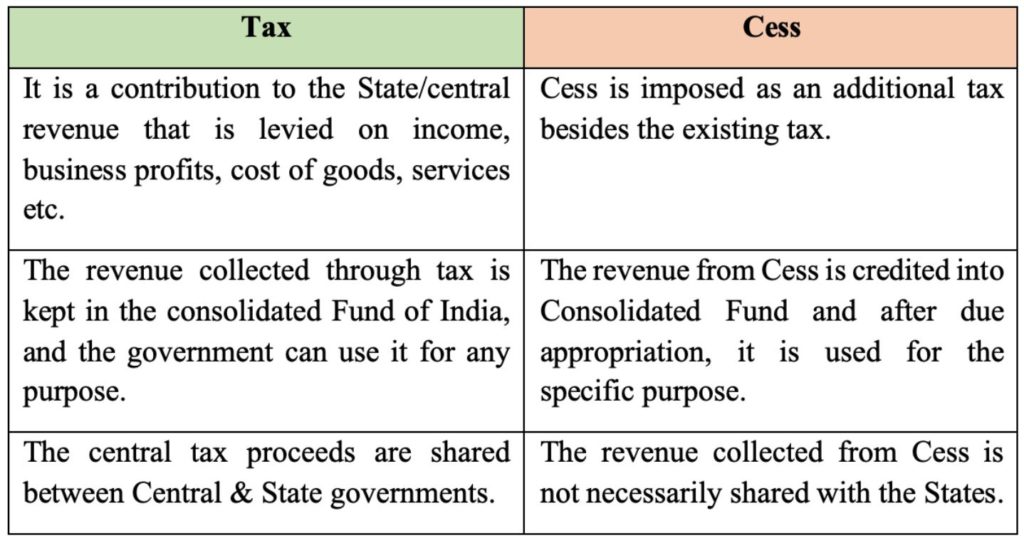

But what is Cess? How is it different from other taxes? Why do the States not have a share of the revenue generated through Cess? Here is a brief review.

Cess is levied as an additional tax and is for a specific purpose

Cess is imposed as an additional tax besides the existing tax whereas surcharge is a tax on tax, with the purpose of raising the funds for a specific purpose. For example, the Swachh Bharat cess is levied by the government for the various cleanliness initiatives under Swachh Bharat Mission.

It is one of the means for the Union government to raise revenue apart from other forms of taxes, fees, etc. Broadly, the following are the differences between Cess and Tax.

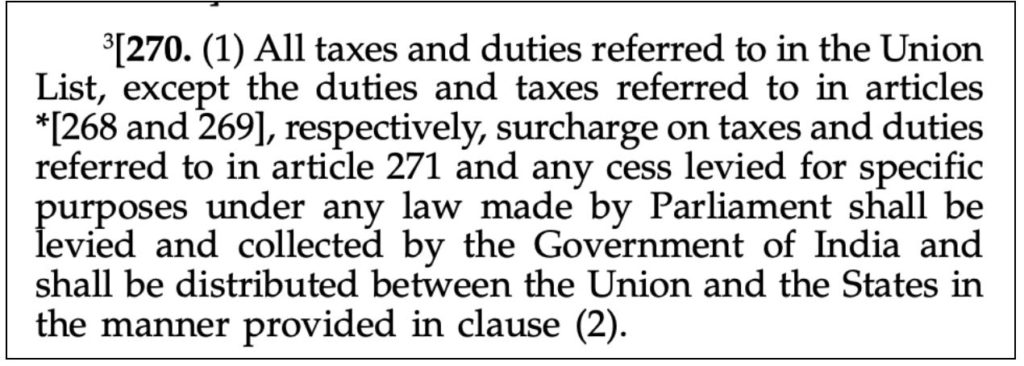

The term ‘Cess’ finds reference in two separate articles of the Constitution. Article 270 (1) & 277. In the latter i.e. Article 277, the reference is to the continuation of taxes, fees, cess, etc. which are already levied prior to the Indian constitution coming into effect.

Article 270 (1) on the other hand mentions that various taxes form part of the divisible pool, whose proceeds are distributed between Union & States. It further highlights that any ‘cess’ levied for ‘specific purposes’ under any law passed by the Parliament is an exception i.e., they are not part of the divisible pool.

The term ‘specific purpose’ is considered as the key to the idea of imposing any cess. It ought to be noted that the current form of Article 270 with the special mention of Cess being an exception is after the Eightieth Constitutional Amendment Act made in 2000. This Amendment Act gave the constitutional sanction to the earlier practice of keeping cess taxes and surcharges outside the divisible pool.

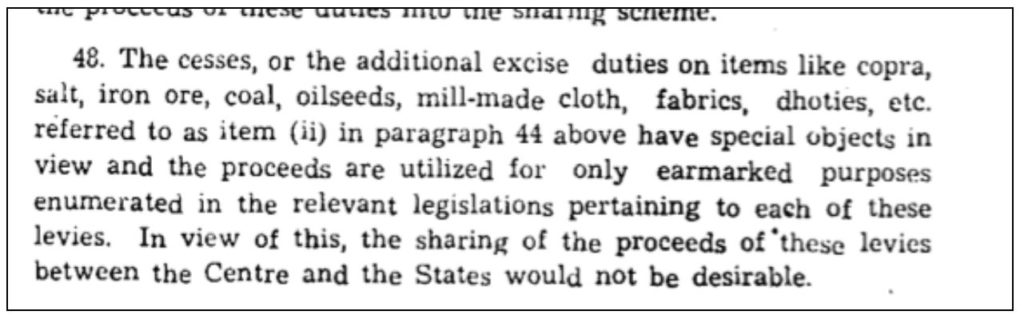

Cesses were earlier kept out of divisible pool based on Finance Commission recommendations

Prior to the 80th constitutional amendment, the practice of keeping Cess out of the divisible pool was based on recommendations of successive Finance Commissions.

The first instance was in the report of the Fourth Finance Commission (1965). Chapter 6 of the report noted it is undesirable to share the cess proceeds with the State governments as the legislation under which the cesses are levied have already earmarked the purpose of the proceeds.

This stand was continued in the recommendations of Fifth, Sixth & Seventh Finance conditions. The Eighth Finance Commission disallowed the sharing as it opined that this could result in diverting of the funds for unintended purposes. The Tenth Finance Commission reiterated the earlier view that cess is levied for a specific purpose and the utilization is governed by relevant legislation, hence cannot be part of the divisible pool.

Based on the amendment as part of the 80th Constitutional Amendment, the Thirteenth Finance Commission rejected the demand of States to include Cess in the divisible pool. This was reiterated further by the Fourteenth & Fifteenth Finance Commission, which opined that there is a need for a constitutional amendment to include Cess as part of the divisible pool.

Introduction of GST in 2017 has resulted in subsuming of many of the Cesses

As per a Study Report commissioned by the Fifteenth Finance Commission, there are 42 cesses that were levied at different points of time since 1944.

As per this study, the first cess levied was on ‘Matches’. There are various reasons specified for the purpose of levying a cess. A good portion of the reasons for the Cess was linked to the development of a specific industry. For example, Salt Cess in 1953., or for the purpose of welfare of workers/labourers, for e.g., Cess on Mica Mines in 1946 or the Iron Ore mines labour welfare Cess in 1961.

The introduction of Goods and Services Tax (GST) in 2017 has resulted in most of the cesses being done away with. However, the following Cesses are still levied:

- Cess on Exports

- Cess on Crude Oil

- Health & Education Cess

- Road & Infrastructure Cess

- Other Construction Workers Welfare Cess

- GST Compensation Cess

- Health Cess

In the recent Budget, the Government of India introduced Agriculture Infrastructure Development Cess.

Unlike other Cesses collected by the Central government, States get a share GST Compensation Cess. In fact, the purpose of the ‘GST Compensation Cess’ is to compensate States which lose out on the revenue due to the introduction & implementation of GST.

Increase in Cess revenue and its utilization raise questions on keeping it out of divisible pool

The initial premise as observed by the earlier finance commissions regarding Cess was that it is earmarked for a specific purpose and hence it is not logical to give the states a share of Cess proceeds. However, there have been questions and apprehensions around the utilization of Cess collected over the years. The CAG (Comptroller & Auditor General) has many times highlighted the non-utilization or misutilization of the Cess amount.

Further, as per the information provided in XV Finance Commission Report, the share of Cess & Surcharges in 2010-11 was 11.1% of the total Gross Tax Revenue. However, by 2018-19, it increased to 15.3% and the Budget Estimate for 2020-21 also pegs it at 15.3% (excluding GST compensation Cess). This increased share of Cesses is at the cost of decreased share of other tax revenues, which in turn reduces the amount in the divisible pool. States are hence losing out on their share in central tax revenue. We will explore this & the utilization of the various cesses in the next story.

Featured Image: Gross Tax Revenue