Data shared by the government in response to various questions reveals that the total disbursement of educational loans by Public Sector Banks almost doubled between 2014-15 and 2022-23. Data also reveals that the southern states dominate the number of educational loan applications compared to the rest of India with 45% of all such applications from just 5 states.

Financial constraints are one of the prime reasons behind the discontinuance of secondary education, found the 71st round of National Sample Survey Organization’s report from 2014. Availability and accessibility of credit for higher education are key determinants behind participation in higher education. Well-structured education loans possess the potential to render higher education financially within reach. Further, a thoughtfully crafted education loan scheme doesn’t merely offer financial aid; it becomes the bridge that spans the gap between aspiration and attainment. It empowers households to overcome the low-skill-low-income equilibrium traps. In today’s story, we look at the trends in educational loans in higher education in India.

Financial landscape of higher education in India

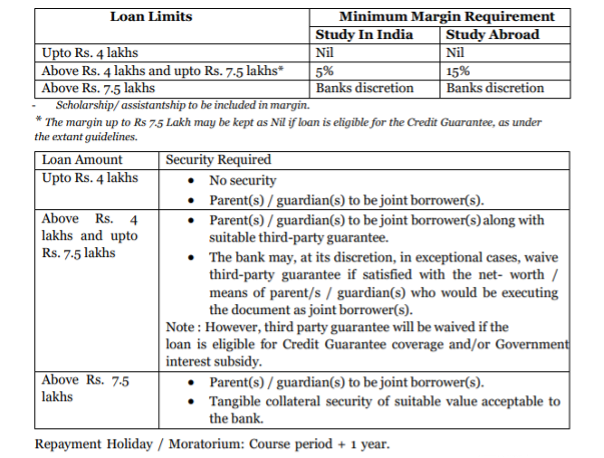

The Government of India, in association with the Indian Banks Association and the Reserve Bank of India, came up with a Model Loan Scheme in 2001. The objective behind such a scheme was to streamline and ease the loan accessibility for higher education in India. The Government also launched the Vidya Lakshmi Portal, aimed at streamlining the application process for the loan disbursals. This Portal serves as a one-stop platform for students, offering a singular gateway to access information and submit applications for educational loans from banks and government scholarships.

In addition to these, the Government also came up with a scheme called the Credit Guarantee Fund Scheme for Education Loans (CGFSEL). Backed by the National Credit Guarantee Trustee Company Ltd (NCGTC), this scheme offered a safety net by guaranteeing repayment in case of default on loans taken by students from lending institutions. A financial cushion of up to Rs. 7.5 Lakh was extended under this scheme, fortifying the educational dreams of countless students.

These two flagship schemes, complemented by tailor-made state-specific initiatives for distinct segments of society, constitute the bedrock of the higher education credit ecosystem. During 2009-10, the Government also launched the interest subsidy scheme for economically weaker section students.

As a result of all these proactive measures, the loan disbursement and loan accounts have grown steadily over the past decade and more.

Educational loans from Public Sector Banks almost doubled since 2014-15

The Public Sector Banks’ (PSBs) active involvement in India’s education loan sector, is particularly due to the Government’s commitment to ensure access to credit for economically vulnerable students. PSBs account for nearly 90% of all the educational loans disbursed by the Scheduled Commercial Banks (SCBs).

It is observed that the education loans from the PSBs grew from Rs. 9190.45 Crores to an all-time high of Rs. 17,688 Crore in 2022-23 (till December 2022). This represents almost a two-fold increase. However, the number of accounts of education loans shows a decline from 6,81,685 to 4,97,395 during the same period. The average ticket size of the loan grew from Rs. 1.35 Lakh to Rs. 3.55 Lakh in the corresponding period.

Large regional disparities in loan applications, as southern states dominate compared to the rest of India.

Demand for education loans is dependent on a multitude of factors- availability of better educational opportunities, level of financial inclusion, and willingness to pay for higher education. The data on the number of educational loan applications received by banks reveal an interesting trend. Banks (both PSBs and Private) in the States that are south of India, i.e. Andhra Pradesh, Telangana, Karnataka, Kerala, and Tamil Nadu, received a greater number of educational loan applications per lakh population compared to the rest of India. Kerala stood highest with 852 applications per lakh population in 2022-23, followed by 352 in Andhra Pradesh, 341 in Tamil Nadu, and 315 in Karnataka. In contrast, Bihar received only 30 applications, followed by 44 in Uttar Pradesh and 51 in Rajasthan. A time-series analysis from 2018-19 shows that there is a growth in applications. However, the growth rate of southern states is much higher as compared to other states.

Rise in number of guarantees for education loans by NCGTC in 2021-22 after witnessing a decline for past four years.

In addition to the above model loan scheme, the Credit Guarantee Fund for Education Loans also is quite significant in removing financial constraints. It provides a safety net against defaults in education loans, securing amounts up to Rs. 7.5 lakh granted by public, private, or foreign banks affiliated with the Indian Banks Association (IBA). By 31 March 2022, a total of 6.48 lakh loans, totalling Rs. 23,306.30 crores, were guaranteed, marking a substantial rise from the 5.46 lakh loans amounting to Rs. 19,175.28 crores recorded on 31 March 2021—a growth of approximately 22%. Loans under 4 lakhs comprise a significant 74% of the total guaranteed loans. Notably, almost 60% of the beneficiaries are females. Further, almost half of the total guarantees since inception were from South India.

Further, Public Sector Banks (with 12 registered Money Lending Institutions (MLIs)) secured guarantees for 6,42,684 loans totalling Rs. 23,131.72 crores, while private banks (with 6 registered MLIs) secured guarantees for 27,458 loans amounting to Rs. 174.58 crores by 31 March 2022.

Large untapped potential in educational loans yet to be realized.

The distribution of educational loans across India reveals a higher concentration in Southern India. And majority of these loans are from public sector banks. This highlights that there is a large untapped potential that is yet to be realized in the educational loan ecosystem. With increasing costs for higher education, as can be seen through NSSO reports, the demand for educational loans is expected to grow. Private banks must also become more responsive to educational loans.

On the other hand, since the majority of loans come under the average ticket size of Rs. 4 lakhs, no collateral is pledged by the banks for loan disbursal. Banks need to work on specialized approaches to ensure that these advances do not turn into NPAs. These could include looking at parameters such as university credentials, educational background, and past academic performances among others. A fine balance must be struck to ensure free flow of credit to higher education, but with adequate checks and balances.