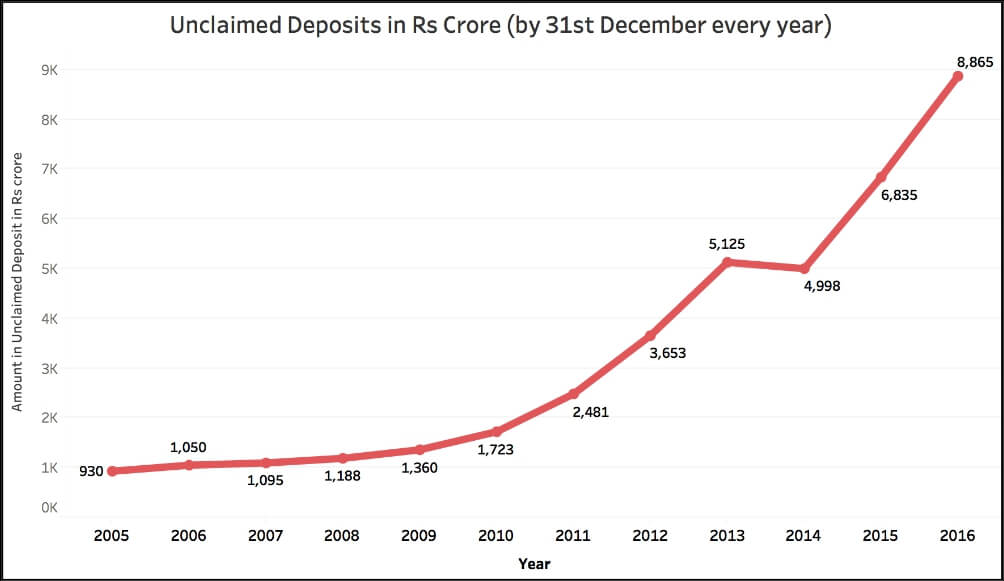

[orc]Unclaimed deposits at end of the year 2016 were close to Rs 9000 crore. This is more than 9 times the unclaimed amount at the end of 2005. Most such unclaimed deposits are because of the death of the depositors. RBI has issued multiple guidelines to claim the deposits of a deceased person in a bid to simplify the procedure.

Reserve of Bank of India (RBI) has issued guidelines which define a bank account as being inoperative/dormant if there are no credit/debit transactions for over two years. RBI has also directed banks to classify those accounts not operative for 10 years as unclaimed deposits. As per government data, such unclaimed deposits are close to Rs 9000 crore by the end of 2016.

Unclaimed deposits increase by 9 times 12 years

The unclaimed deposits increased from Rs 930 crore by the end of 2005 to Rs 8865 crore by the end of 2016, an increase of more than 9 times. Except for the year 2014, the amount has increased every year. The year 2014 was the only year when the unclaimed deposits decreased compared to the previous year. Between 2010 & 2013, the unclaimed deposits increased by over 3 times from Rs 1723 crore to Rs 5125 crore. While the amount has increased, the number of such accounts has not increased at the same rate.

Why are deposits unclaimed?

One of the major reasons for accounts to become inoperative and to subsequently fall in the unclaimed category is the death of the account holder. On some other occasions, people shift to a new place and the account in the old locality is not operated upon. RBI has issued detailed guidelines to banks on how to deal with such inoperative accounts. Among other things, RBI has directed banks to do the following

- Make efforts to find out the whereabouts of customers or their legal heirs in case they are deceased and seek reasons for not operating the account.

- Make an annual review of accounts in which there are no operations for more than one year.

- In case the whereabouts of the customers are not traceable, banks should consider contacting the persons who had introduced the account holder. They could also consider contacting the employer or any other person whose details are available with them.

- Account holders can also be contacted through telephone or e-mail.

- A savings as well as current account should be treated as inoperative/dormant if there are no transactions in the account for over a period of two years.

- Operation in such inoperative accounts may be allowed after due diligence as per risk category of the customer. Due diligence would mean ensuring genuineness of the transaction, verification of the signature and identity etc. The customer should not be inconvenienced as a result of extra care taken by the bank.

- There should not be any charge for activation of inoperative account.

What is to be done if the account holder is deceased?

The RBI has issued multiple directions to banks to simplify procedure for the settlement of claims in case of deceased depositors. These directions contain instructions to be carried out in various scenarios.

For accounts with survivor/nominee: In the case of deposit accounts where the depositor had utilized the nomination facility and made a valid nomination or where the account was opened with the survivorship clause, the payment of the balance in the account to the survivor(s)/nominee of a deceased account holder is to be done except in cases where there is an order from a competent court restraining the bank from making the payment. Banks are also directed to exercise due care in establishing the identity of the survivor/nominee. Banks have also been asked to desist from insisting on production of succession certificate, letter of administration or probate, etc., or obtain any bond of indemnity or surety from the survivor(s)/nominee, irrespective of the amount.

For accounts without the survivor/nominee: In case where the deceased depositor had not made any nomination, banks are required to adopt a simplified procedure for repayment to legal heir(s) of the depositor. Banks, based on their risk management systems, can fix a minimum threshold limit, for the balance in the account of the deceased depositors, up to which claims could be settled without insisting on production of any documentation other than a letter of indemnity.

Premature Termination of term deposit accounts: In the case of term deposits, banks are required to incorporate a clause in the account opening form itself that in the event of the death of the depositor, premature termination of term deposits would be allowed. The conditions subject to which such premature withdrawal would be permitted should also be specified in the account opening form. Such premature withdrawal would not attract any penal charge.

Time limit for settlement of claims: Banks should settle the claims in respect of deceased depositors and release payments to survivor(s)/nominee(s) within a period not exceeding 15 days from the date of receipt of the claim, subject to the production of proof of death of the depositor and suitable identification of the claim.

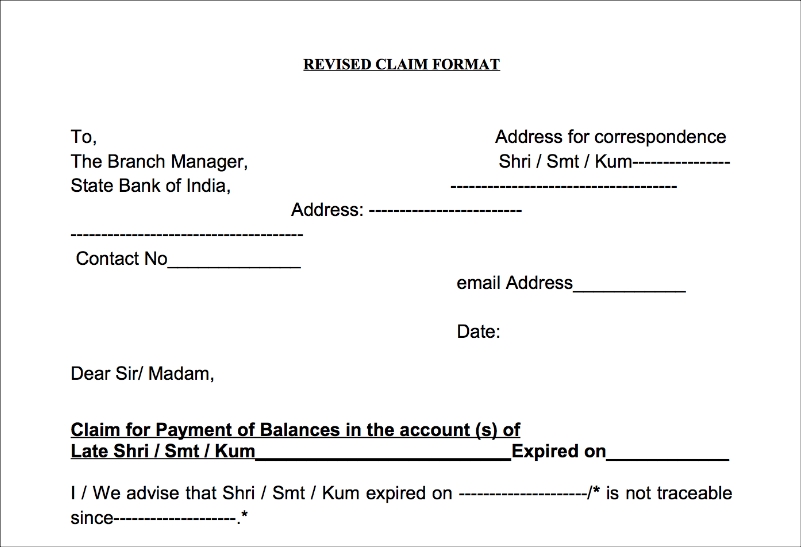

Claim Forms to be made available: Banks are advised to provide claim forms for settlement of claims of the deceased accounts, to any person who asks for one. Claim forms should also be available on the bank’s website prominently.

Simplified procedure: As per RBI’s direction, the Indian Banks’ Association (IBA) has formulated a Model Operational Procedure (MOP) for settlement of claims of the deceased depositors. Banks are advised to follow this MOP.

Customer guidance and publicity: Banks should place on their websites, the instructions along with the policies/procedures for this purpose.

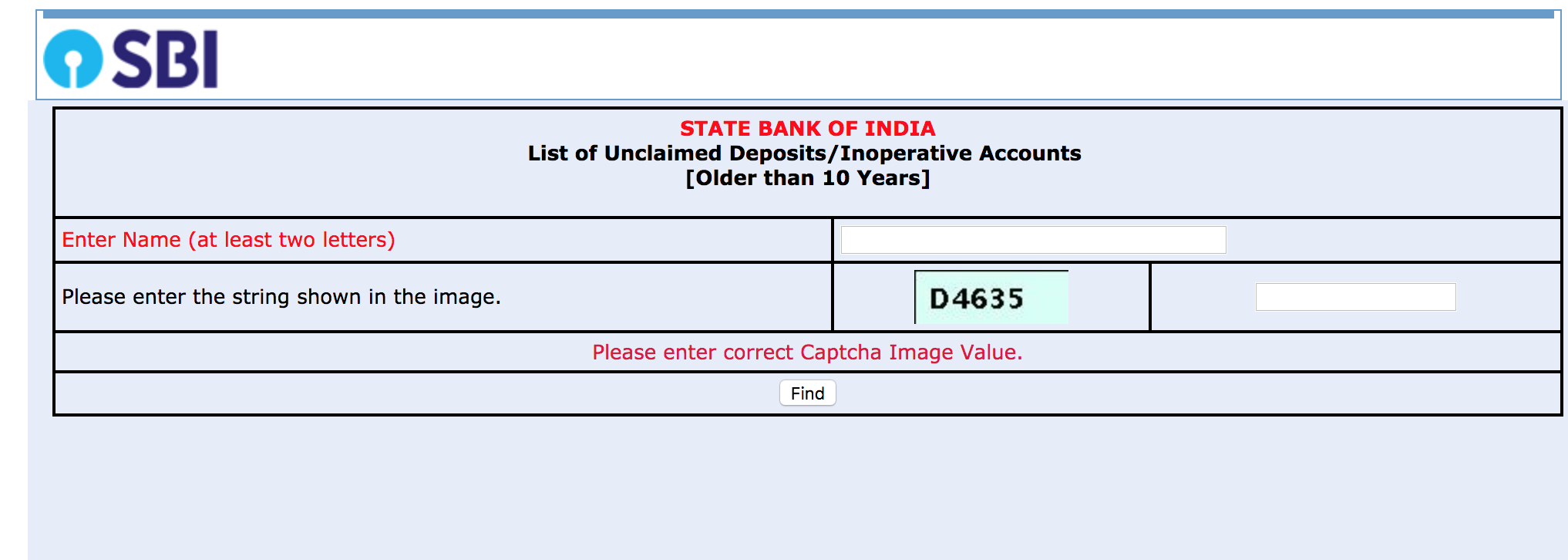

Display list of Inoperative Accounts: Banks should also display the list of unclaimed deposits/inoperative accounts which are inoperative for ten years or more on their respective websites. The list published by the banks should also provide a ‘Find’ option to enable the public to search the list of accounts by name of the account holder. Similar procedure exists in the case of missing persons.

Similar procedure exists in the case of missing persons.

What happens to these unclaimed deposits?

RBI has established the ‘Depositor Education and Awareness Fund’ as per section 26A of the Banking Regulation act. Any amount remaining unclaimed for more than 10 years has to be credited to this fund within three months from the expiry of the said period of ten years. The fund is to be utilized for promotion of depositors’ interest.

However, the depositor would be entitled to claim any unclaimed amount even after the amount has been transferred to the fund. The bank would be liable to pay the amount to the depositor/claimant and claim refund from the Fund. Further, RBI has made it clear that the rate of interest payable by banks to the depositors/claimants on the unclaimed deposit amount transferred to the fund shall be 4% simple interest per annum.

8 Comments

In April 2017, there was an amendment in the Senior Citizens’ Welfare Fund Rules, which expanded the purview beyond the unclaimed amounts in small savings and other saving schemes of the Centre, PPF, and EPF. It brought in the unclaimed amount lying with banks, including cooperative banks and RRBs; dividend accounts, deposits and debentures of companies coming under the Companies Act; insurance companies and Coal Mines PF.

http://www.thehindu.com/business/transfer-unclaimed-accruals-to-fund-irda/article19359622.ece

So, now how DEAF and SCWF, will determine there share?

Yes, with respect to senior citizens, the amendment now forces banks also to transfer it to SCWF. For anyone trying to claim such an amount, the rules wont be different, because the claimant has to approach the respective institution like the bank, post office etc to claim the amount. So in effect, there is no difference in the procedure for a claimant while the unclaimed amount in case of senior citizens goes to SCWF instead of DEAF

Finance act 2015 that introduces SCWF (sections 122 to 124): http://www.cbec.gov.in/resources/htdocs-cbec/finact2015.pdf

Original rules of SCWF: https://dea.gov.in/sites/default/files/SCWF%20Rules2016.pdf

Amended rules of SCWF: http://egazette.nic.in/WriteReadData/2017/175533.pdf

Thank you.

Just another query: What percent of money will be given to the SCWF from the unclaimed amount lying with banks?

The entire amount has to be transferred. The banks can claim refund when they pay back to the claimant

Can you share the reference of this information?

Awesome work. Thank you.

I found a lot of interesting information here. A really good post, very thankful and hopeful that you will write many more posts like this one.

I like this article, it is very meaningful and detailed, I hope you will have many good articles like this to share.

usps tracking

I am looking for something like this and I am very glad to see the infor.