The 47th GST council recommendations proposing rate change for some items and withdrawal of tax exemptions for few other items have come into effect on 18 July 2022. It is in this context, a social media post comparing GST rates of certain goods with that of their respective pre-GST tax rates is being widely shared. By comparing these rates, the post claims that the GST rates on these goods are low compared to the pre-GST tax rates. Through this article let’s fact-check the claim made in the post.

Claim: Comparison of GST rates of certain goods with that of their pre-GST tax rates.

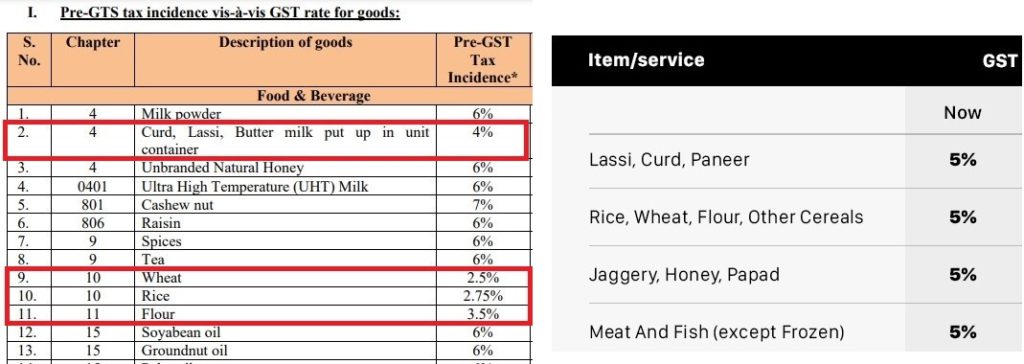

Fact: Before the introduction of GST, the taxes were not uniform across all the states. State VAT used to vary from state to state. Thus, comparing the current GST rates with that of a purported uniform pre-GST tax rates is not rational. While the introduction of GST brought down taxes on certain goods and services, there are few other goods and services which are taxed more now compared to the pre-GST regime. For example, essential commodities like wheat, curd, rice, flour are currently slabbed under 5% GST (if they are pre-packed), whereas these items were taxed lesser under the pre-GST regime. The post makes a selective comparison of those goods and services which are taxed less under the GST compared to the pre-GST regime. Hence the claim made in the post is MISLEADING.

Goods and Services Tax (GST) was introduced replacing a host of indirect taxes like excise duty, service tax, state VAT and others. The main aim of GST was to curb the cascading effect of other indirect taxes. In the earlier tax regime, the tax structure was complicated with multiplicity of tax rates, including cess, additional duties, etc.

Further, in the earlier tax regime, the center and states used to tax separately. And the state taxes were different in each state. For example, on a particular commodity, state VAT used to be different in different states. However, the post lists pre-GST tax rates of certain items as if the rate is uniform across all states. This implies the comparison of GST rates with that of purported uniform pre-GST taxes is not rational.

Have taxes reduced after GST?

While it is true that taxes on multitude of goods and services have indeed come down after the introduction of GST, there are few other goods and services on which the tax under the new GST regime is more compared to the pre-GST tax regime. For example, prices of most services have gone up as they are now taxed at 18% while they were charged 15% service tax in the pre-GST regime.

Likewise, according to the revised rates, essential commodities like curd, rice, wheat, flour, etc. would attract 5% GST (if they are pre-packed). However, these items attracted lesser tax under the pre-GST regime. Wheat, Rice, flour was taxed with 2.5%, 2.75% & 3.5% respectively under the pre-GST regime.

Hence, the comparison of pre- and post-GST tax rates listed in the viral post is nothing but a selective comparison of those goods and services which are taxed less under the GST compared to the pre-GST regime.

To sum it up, this comparison of pre & post GST taxes on different goods and services is not rational.