[orc]The Sukanya Samirddhi Yojana, a small savings scheme for the welfare of the girl child was launched in 2014. Till 30 June 2018, a total of 1.39 crore accounts were opened under the scheme. Which of the states are doing well and which ones are lagging behind?

The Government of India launched a new small savings scheme by the name ‘Sukanya Samriddhi Yojana’ which is targeted at the girl child as a part of the ‘Beti Bachao- Beti Padhao’ campaign. The scheme was launched in December 2014. When it was launched, the scheme offered an interest rate of 9.2% per annum, one of the highest for any small savings scheme. Currently, the scheme offers an interest rate of 8.1%. The objective of the scheme is to promote the welfare of the girl child.

What is the scheme all about?

The scheme is targeted at the girl child and her welfare. The natural or legal guardian of the girl child can open the account from the time of her birth till she attains an age of ten. The minimum deposit amount has been reduced to Rs 250 from the existing Rs 1000. The scheme provides for triple-E exemptions under the income tax act. The following exemptions are applicable

- Exemption at the time of investment/deposits under Sec 80 C

- Exemption of interest accrued on yearly basis, and

- Exemption of maturity amount at the time of account closure

1.39 crore accounts opened till 30 June 2018

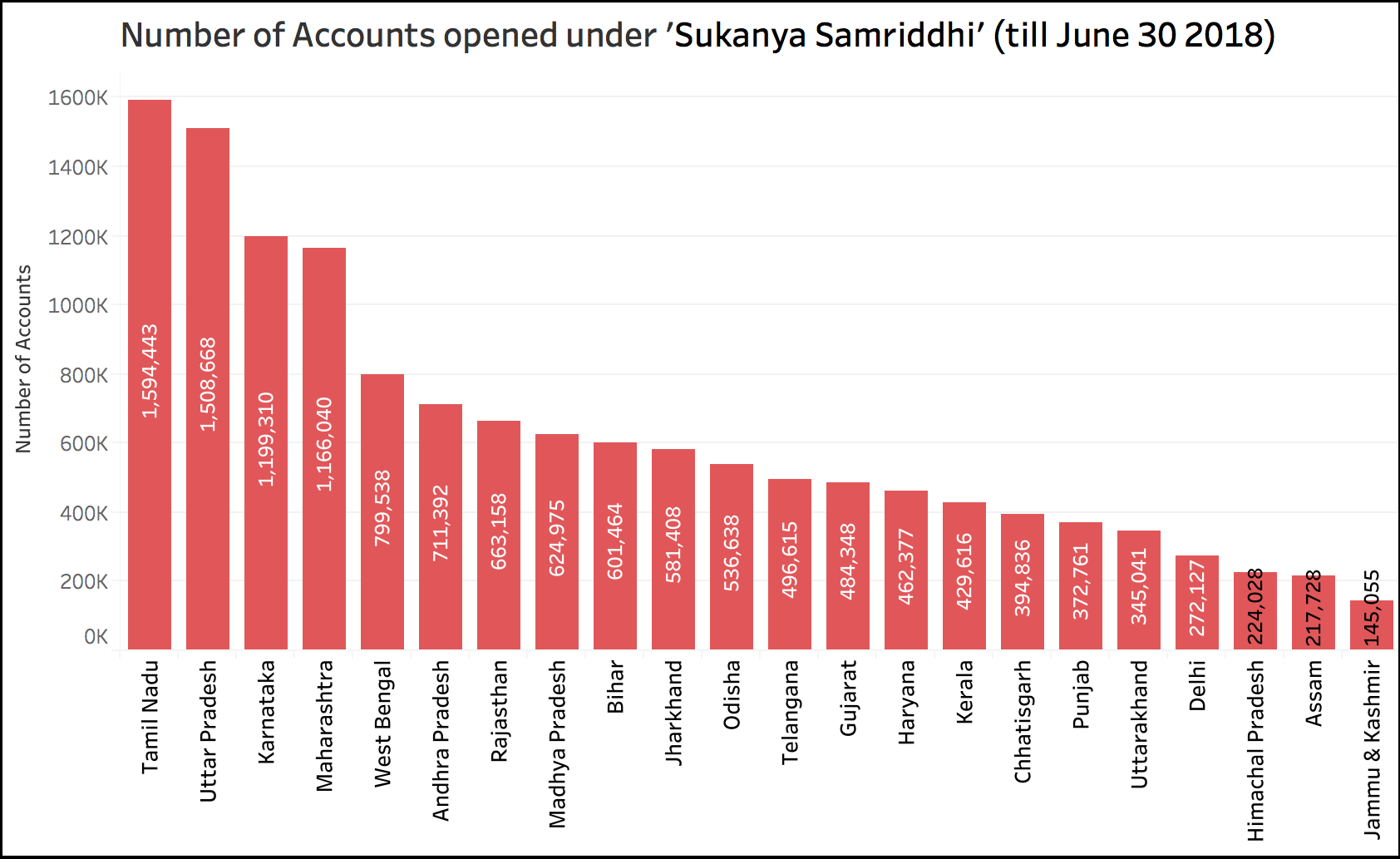

As per the data shared by the government in the Lok Sabha, a total of 1.39 crore accounts (1,39,85,442) were opened under this scheme till 30 June 2018. Most such accounts were opened in Tamil Nadu (15.94 lakh) followed by Uttar Pradesh (15.08 lakh). Karnataka & Maharashtra are the only two other states where more than 10 lakh such accounts were opened. More than five lakh such accounts were opened in eleven (11) states while more than one lakh such accounts were opened in 22 states/UTs.

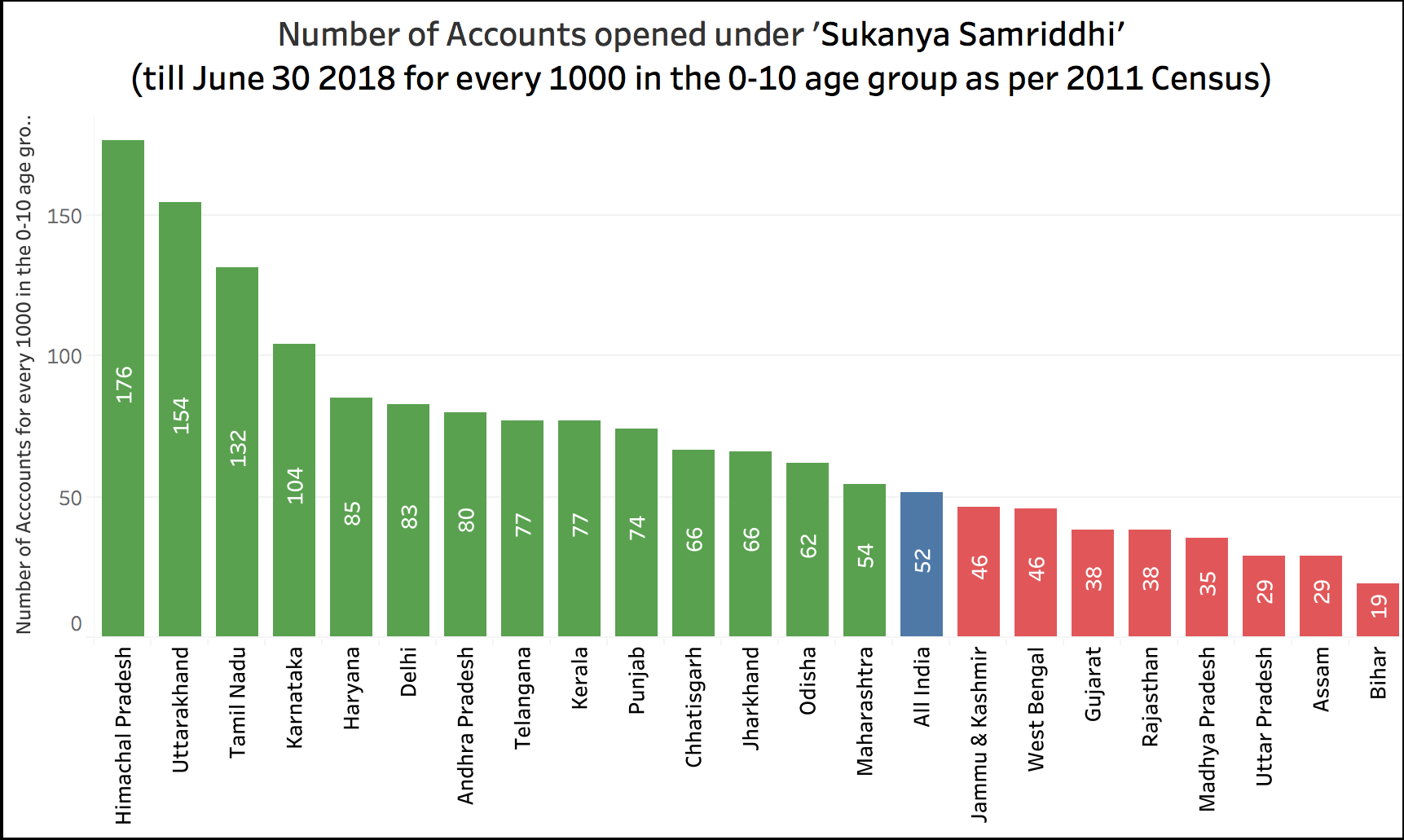

If the population in the 0-10 age group is taken into account (as per the 2011 census), then the following picture emerges. At an All-India level, 52 accounts were opened under the scheme for every 1000 in the 0-10 age group. In four (4) states, more than 100 accounts were opened for every 1000 in this age group. Himachal Pradesh, Uttarakhand, Tamil Nadu & Karnataka are part of this list. The number of accounts opened for every 1000 in the 0-10 age group is more than the national average in all the southern states. In states like Jammu & Kashmir, West Bengal, Gujarat, Rajasthan, Madhya Pradesh, Uttar Pradesh, Assam and Bihar, the number of accounts opened for every 1000 in the 0-10 age group is less than the national average. Of the bigger states, Bihar stands at the bottom with only 19 such accounts for every 1000 in this age group.

Rs 25979 crore deposited under the scheme

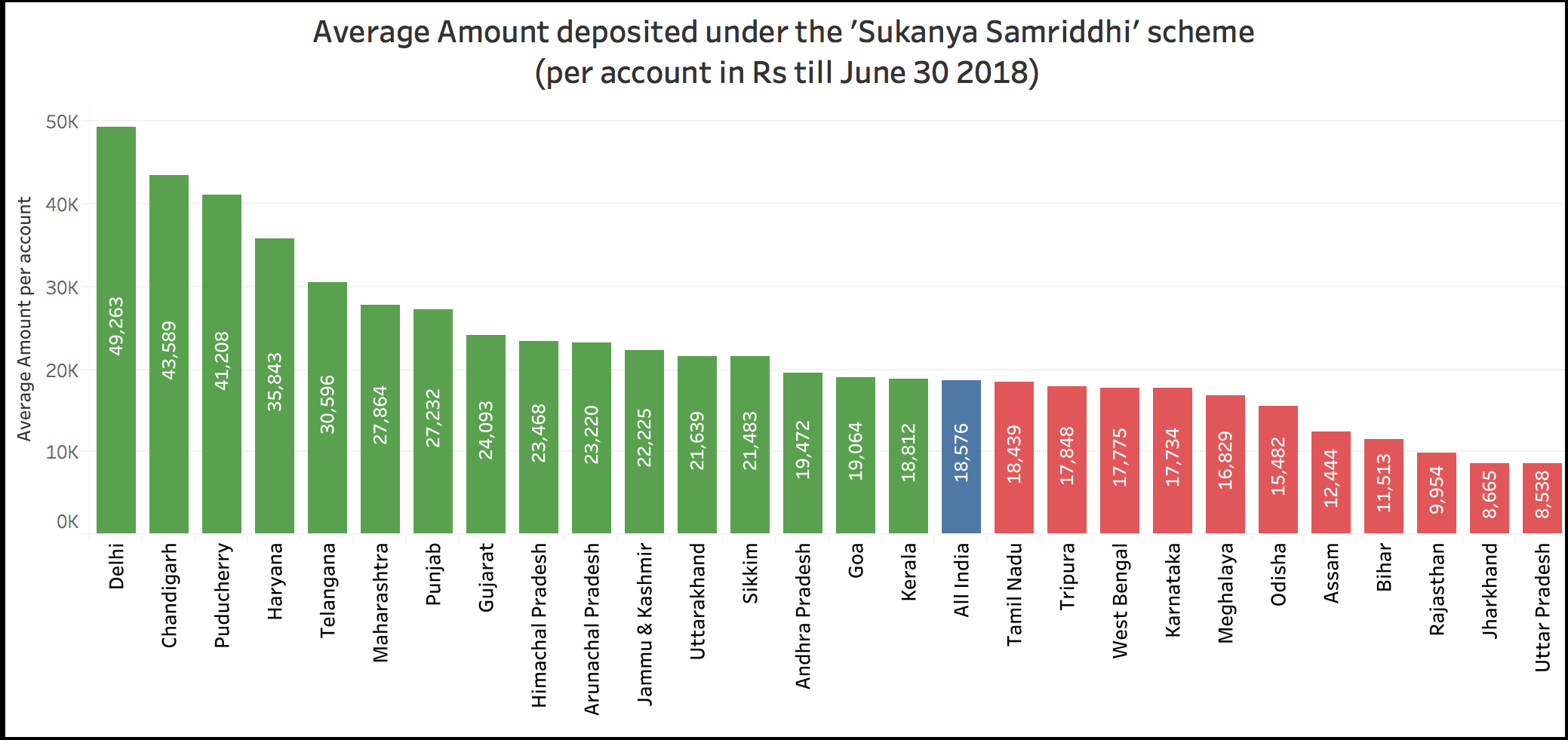

At an All India level, a total of Rs 25979 crore was deposited under the scheme till 30 June 2018, an average of Rs 18576 per account. The greatest average amount per account of Rs 49,263 was deposited in Delhi. The average amount per account was more than the national average in 16 States/UTs. Though States like Tamil Nadu & Karnataka had more than a million accounts opened under the scheme, the average deposit amount was less than the national average in these states. The average in Uttar Pradesh was less than half the national average.