[orc]As a part of the ‘Beti Bachao – Beti Padhao’ campaign, the government launched the ‘Sukanya Samriddhhi Yojana’ last year. This is a small savings scheme aimed at securing the future of the girl child. Apart from one of the highest interest rates, the amount deposited in this account is exempt from Income Tax.

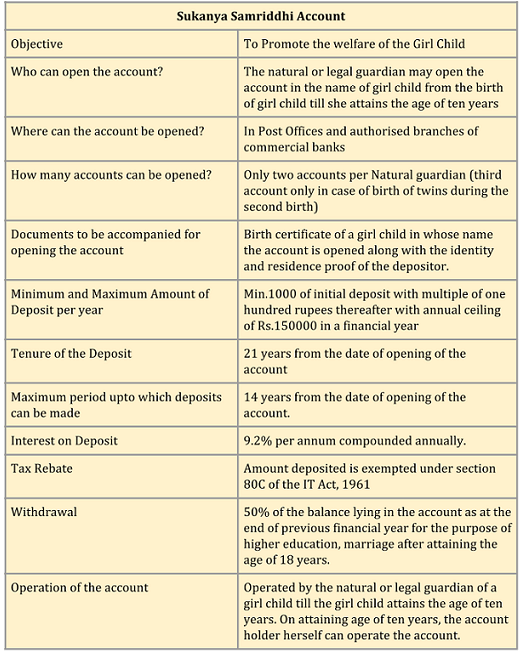

The Government of India launched a new small savings scheme which goes by the name ‘Sukanya Samriddhi Yojana’ targeted at the girl child as a part of the ‘Beti Bachao- Beti Padhao’ campaign. The scheme was launched in December 2014. At 9.2% per annum, this account offers one of the highest rates of interest of all the small savings schemes in the country. The objective of the scheme is to promote the welfare of the girl child.

What is the scheme all about?

How is it doing?

Sukanya Samriddhi Account scheme is run by Union Government and it entirely bears operation/management costs of this scheme. Till April, 2015 a total of 1.47 crore rupees was spent on the publicity related to the scheme.

A total of 511 crore rupees has been deposited in the scheme as of March 2015, according to the annual report of the National Savings Institute.

Karnataka leads with the most amounts of deposits (about 90 crore) till March 2015. More than 10 states have a total deposit of more than 5 crore and six states with a total deposit amount of more than 20 crore.

The highest number of accounts was opened in Karnataka (more than 50000) followed by Tamil Nadu and Andhra Pradesh. More than 5000 accounts were opened in 9 different states and more than 1000 accounts in 16 different states.

1 Comment

Pingback: Know about the ‘Pradhan Mantri Ujjwala Yojana