A video spreading the message that the government is offering women collateral-free loans of up to one crore under the Stand Up India scheme is gaining traction on social media platforms. In this article, let’s fact-check the assertion presented in the post.

Claim: Government is offering women collateral-free loans of up to one crore rupees under the Stand Up India scheme.

Fact: Stand-Up India scheme guidelines specify that banks are required to facilitate at least one borrower from the SC or ST community and at least one woman borrower per branch for establishing a greenfield enterprise. Though the loans offered under the scheme do not require collateral, the guidelines specify a mandatory margin ranging from 10% to 15% of the loan amount. Hence, the claim made in the post is PARTLY TRUE.

As claimed in the viral video, the government is reportedly offering women loans of up to one crore rupees under the Stand Up India scheme. However, the details provided in the video are incomplete. The scheme aims to promote entrepreneurship and is not exclusively designed for women; it also encourages entrepreneurship among Scheduled Castes (SC) and Scheduled Tribes (ST) communities.

Stand-Up India Scheme:

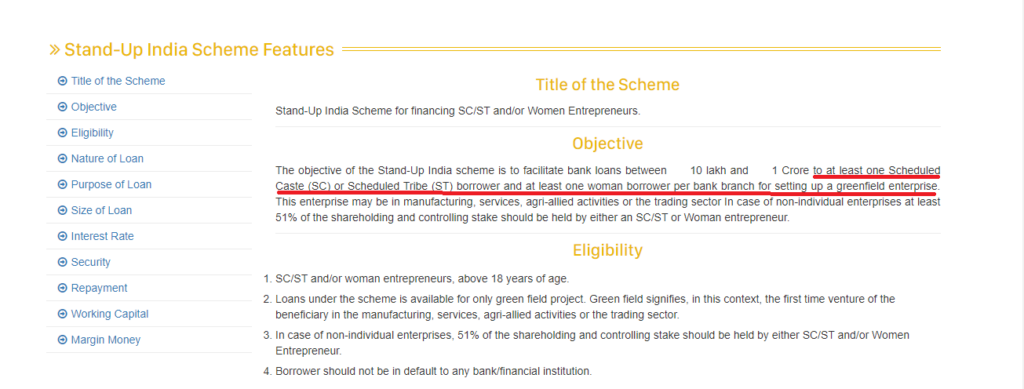

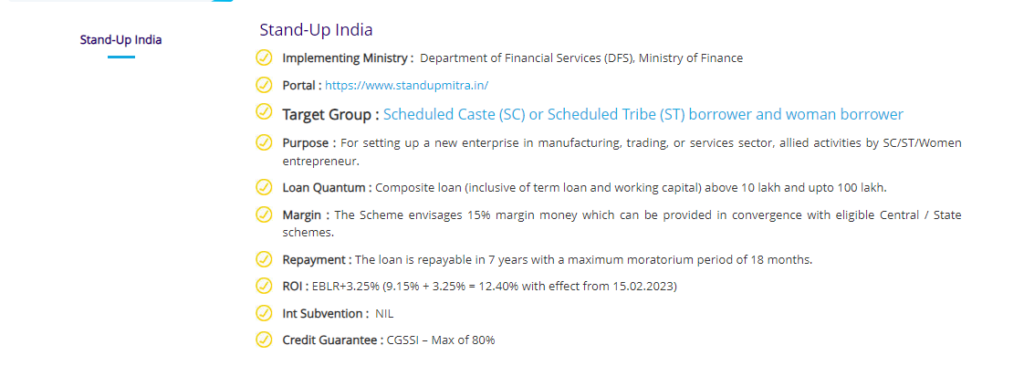

In view to promote entrepreneurship among the SCs, STs, and Women, the union government in April 2016 launched the Stand Up India Scheme (SUPI). The scheme facilitates bank loans of value between Rs. 10 lakh and Rs.1 crore for setting up greenfield enterprises in manufacturing, services, the trading sector, and activities allied to agriculture.

While women entering entrepreneurship are eligible to apply for the loan, not all women applicants will probably secure the loan, as this is not a conventional loan; rather, it aims to promote entrepreneurship. It is explicitly stated in the scheme guidelines, specifying that ‘banks are required to facilitate at least one borrower from the Scheduled Castes (SC) or Scheduled Tribes (ST) and at least one woman borrower per branch for establishing a greenfield enterprise.’ This suggests that the branch has the discretion to choose beneficiaries based on factors such as project viability and other considerations.

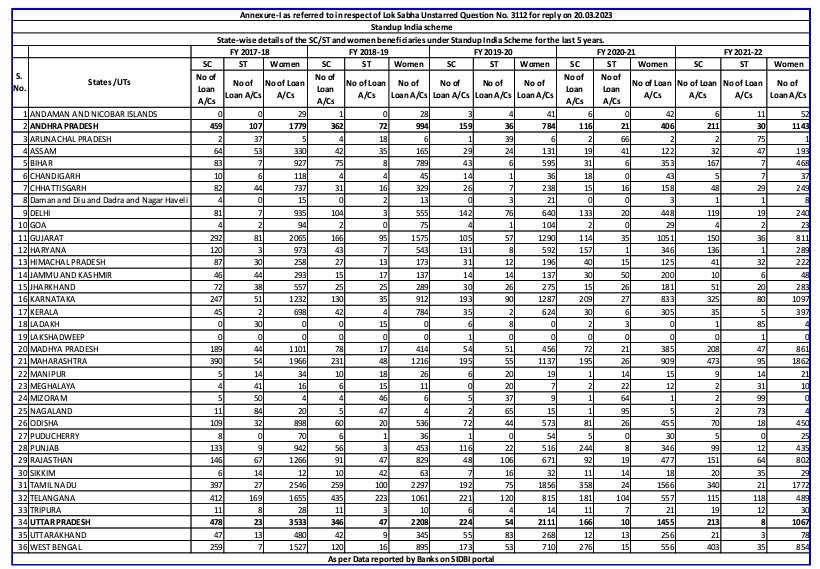

The details provided by the government regarding loan disbursements corroborate this. As per the information, more than Rs. 40,700 crores were sanctioned to over 1,80,630 accounts under Stand-Up India Scheme in 7 years as of April 2023. State-specific information on beneficiaries under the scheme for each of the past five years is accessible here.

Mandatory Margin :

Additionally, even though the loans offered under the scheme do not require collateral, the guidelines specify a mandatory margin ranging from 10% to 15% of the loan amount. This means that the beneficiary is required to make an upfront down payment of 10-15% when obtaining the loan. All these loans will be secured under the CGSSI (Credit Guarantee Scheme for Stand-Up India Scheme), and the repayment period extends to 7 years, with a maximum moratorium period of 18 months.

The comprehensive guidelines regarding the execution of the scheme can be viewed here and here. Furthermore, the specific provisions adhered to by scheduled commercial banks, such as the State Bank of India, concerning the implementation of the scheme can be accessed here and here.

To sum it up, the stand-up India Scheme aims to promote entrepreneurship among the SCs/STs and Women by facilitating bank loans.