In the last decade, fintech innovations have ensured that digital transactions have grown at a phenomenal rate. In addition to innovations such as the IMPS, UPI, etc., ‘Prepaid Payment Instruments, particularly digital wallets have played an important role in the growth of digital transactions.

When was the last time you paid for your food delivery using cash? Or the time you last booked a cab and paid cash? Or the time when you stood in a queue to buy a metro ticket using cash? Well, many of us hardly remember those times. All one needs today is a smartphone, enough data, and an amount in your bank account to make quick bookings and payments from anywhere and at any time. This seamless experience in digital payments is a reality because of fintech innovations. However, in today’s frantic world, we don’t wonder at or appreciate these advancements because they fit in with our routines rather than stand out. That’s how embedded these innovations have become.

Thesaurus defines the word ‘embedded’ as ‘incorporated into something as an essential characteristic.’ This word summarizes the entire fintech revolution. Traditionally, it was the responsibility of the banks and financial institutions to provide financial services. The number of players offering these services was quite low owing to numerous restrictions at every stage – starting with the entry barriers to limits on finances and even the exit process. However, as technological advancements happened across the world, the barriers to private entities were minimized. The result is mushrooming of fintech solutions and the crucial role of embedded finance in our lives.

As the Reserve Bank of India’s (RBI) caution to the public over the prepaid payment instruments (PPIs) by unauthorized entities is in news, in this story, we look at the concept of PPIs and various related aspects.

What are Prepaid Payment Instruments or PPIs?

Before we understand PPIs, it is important to understand the concept of embedded financing. In simple terms, embedded financing means integrating financial services into non-financial platforms with an objective to provide the users/clients with a seamless experience. The prime benefits of embedded financing are:

- Enriched customer experiences with a ‘one-stop shop’ approach.

- Increased revenues for businesses with the ‘Buy now Pay later’ kind of systems and insightful data on the working of the business model.

As we have seen, embedded finance is appealing to both the customers as well as businesses. PPIs are one kind of instrument of the embedded financing models. PPIs include m-wallets, cards, prepaid vouchers, and so on. The most popular among these is the m-wallet service. Wallet-as-a-service has gained traction in recent times, validating the compelling benefits it has to offer. In fact, digital wallets are slowly replacing physical wallets.

PPIs in India

Successive governments in India expressed their interest in the digitalization of payment services. The growth of entities offering financial services also pushed the government to take a holistic review of the payment sector in India. The primary objective behind such a review is to foster greater access and competition among the players. Accordingly, the government of India enacted a legislation, ‘The Payments and Settlement Systems Act, 2007’ (the PSS Act). It is the country’s first statute devoted to overseeing and regulating the payment industry.

However, PPIs (though not in the digital or app form) existed way before the PSS act. Gift coupons and food cards were common in old days. To promote the systematic development and working of such instruments, the RBI invited comments on an approach paper in 2008 titled, ‘Guidelines for PPIs.’ A draft set of guidelines were released by the RBI on 30 January 2009, after receiving feedback from all stakeholders. Accordingly, after incorporating other modifications, these guidelines were made effective from 27 April 2009, using the powers conferred to RBI under Section 18 of the PSS Act. The PPI ecosystem underwent several amendments during the last decade – in terms of permitting new entities, limit enhancements, coverage base, and so on.

Types of PPIs

Primarily, PPIs can be classified into Small PPIs and Full KYC PPIs. The small PPIs (also known as minimum-details PPIs) can further be divided into,

- PPIs up to Rs.10,000/- (with cash loading facility)

- PPIs up to Rs.10,000/- (with no cash loading facility)

Alternatively, PPIs can be categorized into three types.

- Closed System PPIs: These are issued to facilitate the purchase of goods and services only from the issuing entity. They also do not allow withdrawal of cash. Hence, these kinds of PPIs do not require any authorization from the RBI.

- Semi-closed System PPIs: They also do not permit cash withdrawal but can be used at a group of merchant establishments that are contracted by the issuer entity, for purchases including financial services.

- Open System PPIs: Issued by only banks, these can be used at any merchant establishment irrespective of the issuer and permit cash withdrawal for purchases including financial services. Such withdrawals can be made at ATMs or Point of Sale (PoS), like debit cards.

Growth of PPIs in India

The growth of PPIs has been steady and consistent since its introduction. The volume of PPI transactions has jumped from 30.6 million in 2011-12 to 4775 million in 2021-22 (up to December 2021). The corresponding increase in the value of PPI transactions is from Rs. 62 billion in 2011-12 to Rs. 2150 billion in 2021-22 (up to December 2021).

Much of such volume expansion is from the m-wallets, whose transaction volume increased from 32.7 million in 2012-13 to 3866.6 million in 2021-22 (up to December 2021). The paper voucher segment has almost vanished from the system.

In terms of the value of transactions, the value of transactions through m-wallets increased from Rs. 10 billion in 2012-13 to Rs. 1695 billion in 2021-22 (up to December 2021). The value of card transactions has not increased proportionately.

If we observe the graphs carefully, there is a sudden spike from 2016-17. Demonetization was announced on 08 November 2016, and its effect is clearly visible in the growth of PPIs in India. December 2016 witnessed a huge jump compared to November 2016. One incidence of steep decline could be seen during March to April 2020, which are the months of the first intense covid lockdown in India. The restrictions were gradually lifted from mid-April.

PPIs require authorization by the RBI and strict adherence to the guidelines set by RBI. Any default could result in the cancellation of authorization of PPIs. The list of authorized PPIs as of 03 March 2022 was recently published by the RBI. One can cross-check with this list before using any new PPI.

Regulation of digital Payments

The intense proliferation of digital technology in the payment systems gave rise to a distinct industry that is heavily dominated by Fintech companies. The regulatory function should focus on fostering a competitive market so that the market functions efficiently and attracts new customers while retaining the old ones. To perform this function and to define the contours of the state in the digital payment ecosystem, the Government of India constituted a committee in August 2016 under Ratan. P. Watal, popularly known as Watal Committee. It submitted its report in December 2016 and made a few recommendations:

- Make Payment regulation independent from the functioning of the central bank- Formation of Payment Regulatory Board (PRB) within RBI from the earlier Board for Regulation and Supervision of Payment Settlement Systems (BPSS) to oversee such functions.

- Modification and updating of PSS Act, 2007 to incorporate changes relating to the regulatory governance, protection of data and consumers, interoperability and so on.

- Implement additional measures that can stimulate digital payments such as reward framework, Aadhaar based eKYC, etc.

Accordingly, the finance minister, in the 2017-18 Budget Speech, announced the creation of PRB within RBI by replacing the BPSS, and review of the PSS Act, 2007. In October 2017, an inter-ministerial committee was constituted to review the draft PSS Bill. The committee submitted the report in 2018. This committee recommended that the PRB should be an independent entity outside RBI and also suggested changes in the composition of PRB. The RBI was adamant in its opposition to this proposal. It released a dissent note in reply to the recommendations of the inter-ministerial committee. Though RBI did not disagree totally with the new PSS Bill, 2018, it did not intend to initiate any changes that have the potential to shake the existing foundations and create disturbances in otherwise well-functioning structure.

Interoperability was also allowed in PPIs as per the recommendations of the Watal Committee and it is now mandatory for the PPI issuer to allow interoperability. However, this facility is only available to full-KYC PPIs.

Customer liability & Grievance Redressal

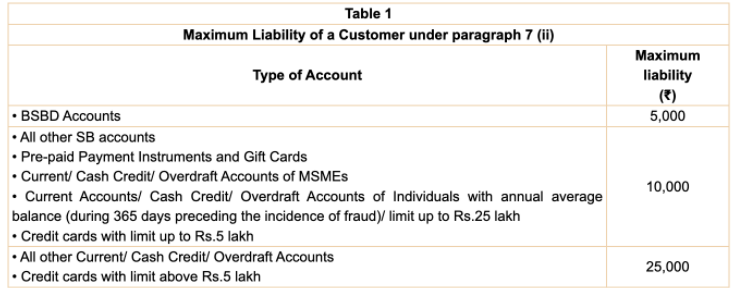

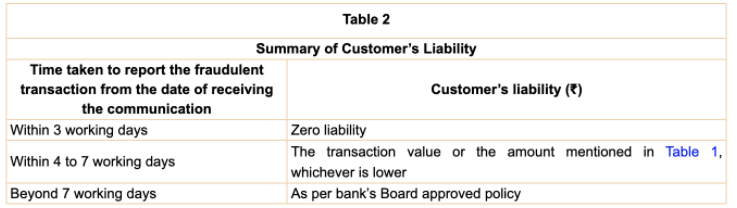

RBI has also issued circulars about limiting the liability of the customers in case of any unauthorized electronic transactions. Below is the screenshot of the circular.

The RBI also launched an integrated ombudsman scheme, 2021 to facilitate and ease the process of grievance redressal and enhance customer satisfaction. It integrates the Banking Ombudsman Scheme, 2006; Ombudsman scheme for non-banking financial companies, 2018 & Ombudsman scheme for digital transactions, 2019. PPIs are covered under this integrated scheme. More information on the working of such scheme can be found here.

Limitations of PPIs

Though convenient, PPIs have certain limitations both from the customer standpoint as well as the regulatory standpoint.

- Limited Credit availability: PPIs generally have limits on the transactions they provide. This could be justified in the sense that PPIs focus is mainly to provide services for individuals without access to banking facilities.

- Capital requirement: The net worth of non-bank companies issuing PPIs is raised from Rs. 2 crores to Rs. 5 crores, making it difficult for small companies to enter and stay in the competition. Further, 3 years after authorization, net worth should be Rs. 15 crores/

- KYC Compliance: The latest KYC requirements as well as the requirement to maintain a log of all the transactions of PPIs for at least ten years might further burden the companies.

The actions initiated by the governments suggest an aggressive strategy to make the Indian economy more digital and less cash-driven. This indicates the future holds enough for PPIs.

- PPIs offer benefits by way of reward points and cashback, which enhance the customer experience, making them more attractive than traditional modes of banking which are increasingly becoming a costly affair.

- According to a report by the Internet and Mobile Association of India (IAMAI) and Kantar, 3 out of 5 individuals with active internet in Urban India adopt digital payments, while this is 33% in rural areas. With the potential for rapid expansion of the smartphone industry, this ratio is set to improve in the future.

- The constant revision of guidelines by the RBI to maintain a balance between market enhancement and strict compliance for guidelines will lead to an increased trust in the PPIs, thereby expanding the customer base and the network.

Thus, unless some unanticipated shocks emerge, the future of PPIs in India looks promising.

Featured Image: Prepaid Payment Instruments in India