MSMEs have been one of the worst affected sectors due to the COVID-19 pandemic. Multiple studies by KVIC, NSIC, ABDI highlight the severe stress in the sector and the various problems faced by them. A parliamentary standing committee recently made important recommendations to revive the MSMEs. Here is a review.

Among the various sectors impacted by COVID-19 pandemic, MSMEs (Medium, Small & Micro Enterprises) are one of the worst affected. The lockdowns & restrictions imposed as a response to contain COVID-19 spread had a severe impact on various aspects related to the functioning of the MSMEs. This is reflected in MSMEs being included in the various COVID-19 relief packages announced by the Government of India.

In an earlier story, we highlighted the various challenges faced by MSMEs during the early period of the COVID-19 onset in India. Since then, the country experienced a period of opening of the economy followed by further control measures due to the second wave of COVID-19 infection. These could have further aggravated the challenges already faced by MSMEs.

As per a government response in the Lok Sabha on 22 July 2021, it is understood that no study has been conducted by the Ministry of MSME (MoMSME) to assess the impact of COVID-19 & the stimulus package on MSMEs.

However, in the same response, there is a reference to the studies conducted by the National Small Industries Corporation (NSIC) & Khadi and Village Industries Commissions (KVIC) to assess the impact of the COVID-19 pandemic on MSMEs. Further, there is a report by the Parliamentary Standing Committee on Industry submitted in July 2021, regarding the impact of COVID-19 on the MSME sector.

In this story we look at the findings of these studies & reports along with the responses in the parliament by the Government and a few other international reports, to ascertain the impact of COVID-19 on MSMEs.

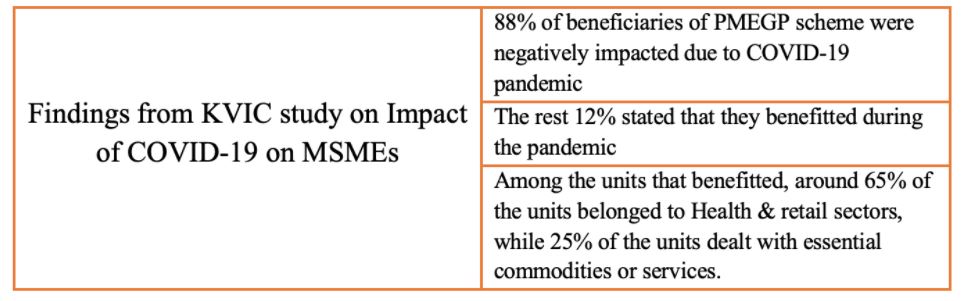

88% of beneficiaries under the PMEGP scheme reported a negative impact of COVID-19

As already highlighted earlier, the Ministry of MSME has not yet conducted a study on the impact of the pandemic on MSMEs. However, in a press release on 19 July 2021, the government referred to two studies conducted by KVIC & NSIC. The ministry provided the important findings of these studies in their statement.

As per the study by KVIC, which apart from studying the impact of COVID-19 on MSMEs, more specifically focused on the units’ set-up under the Prime Minister’s Employment Generation Programme (PMGEP) scheme.

Apart from these, around 57% of those who said there was a negative impact on their business stated that they had to shut down their business for some time. The study finds that the impact on the revenues of the employers has percolated to the employees as well. Around 42.5% of the employers stated that they paid partial salaries to their employees, while around 11% of them were unable to pay any salary for some time. These responses from the study indicate a deeper negative impact on the MSMEs due to the pandemic. However, it also presents a positive picture of those MSMEs who are involved in specific businesses-like essentials & health-related.

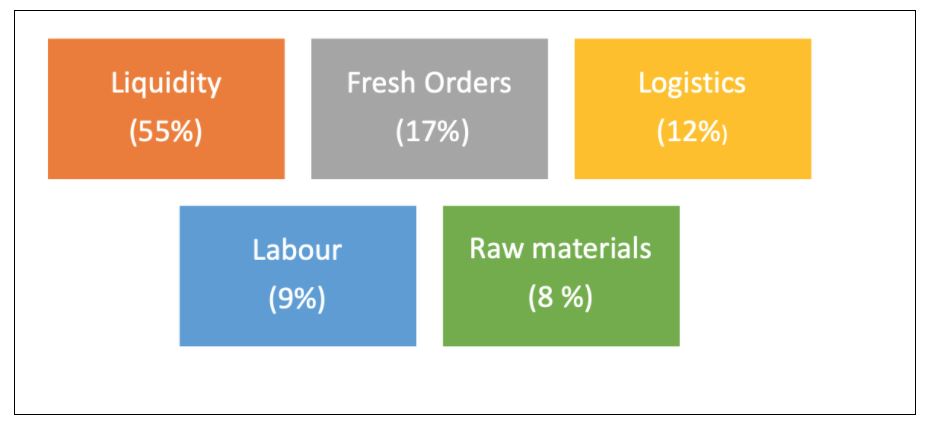

The ministry also referred to another study conducted by NSIC. The study which focused on beneficiaries of NSIC due to the pandemic found that around 91% of the MSMEs were functional. Apart from this, the study identified different critical problems faced by the MSMEs during the pandemic. The majority of the units i.e., 55% identified liquidity to be the major problem faced by them.

As per a study by ADB, 49% of firms in India reduced the number of Permanent employees

The Asian Development Bank Institute (ADBI) published a working paper on the impact of the COVID-19 pandemic on Micro, Small & Medium Enterprises in Asia. The study was conducted in 8 Asian countries including India. Few of the observations from this study confirm the observations made in the studies of KVIC & NSIC.

KVIC’s study highlights the impact of COVID-19 on the workers in MSMEs, where-in employers were unable to pay salaries to employees. ADBI’s working paper observes that in India, around 49% of the firms have reduced the number of permanent employees after the pandemic. Further, 17% of the firms reduced the number of permanent employees by more than 40%. Among the 8 countries that were studied, the situation in India is better off than in Laos, Vietnam & Pakistan.

There was a comparatively greater negative impact on the temporary employees. 60% of the firms stated that they have reduced the number of temporary employees after the pandemic. Around 22% of the firms reduced the temporary employees by more than 40%. The numbers relating to temporary employees working in MSMEs in countries like Malaysia, Pakistan & Vietnam is bleaker.

Furthermore, the study observes that around 78% of the firms have experienced a decline in their sales compared to the earlier year. More than a third i.e., 36% of the firms had experienced a decline in sales by more than 40%.

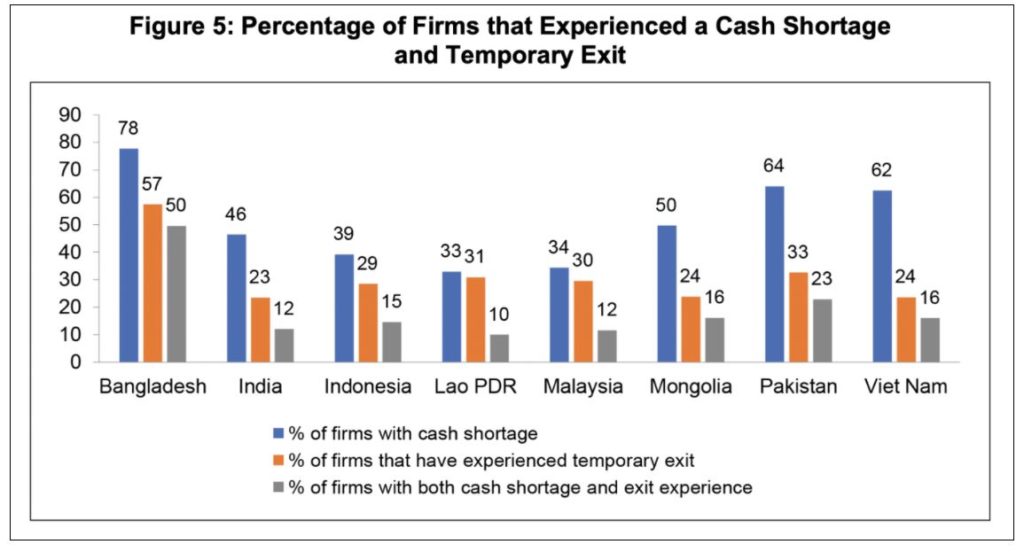

In the study conducted by NSIC, the majority of the firms highlighted liquidity as one of the major challenges during the pandemic. This is further corroborated by ADBI’s study. Nearly 46% of the firms have experienced Cash shortage due to the pandemic. However, the situation in India is better off compared to Bangladesh, Mongolia, Pakistan & Vietnam.

Around 23% of the MSME firms in India stated that they had experienced a temporary exit, while 12% of the firms faced a situation of cash shortage as well as temporary exit.

Union Government announced various initiatives as part of ‘Aatmanirbhar Bharat’

The government of India identified MSMEs as one of the key sectors impacted due to the COVID-19 pandemic. Hence, various initiatives & relief measures were announced by the government as part of the Aatmanirbhar scheme. In various responses provided in the parliament and also in the press release by the relevant ministry, the government has specified the various initiatives it took to support MSMEs.

- Provision of Rs. 20 thousand crores subordinated debt for MSMEs.

- Rs. 3 lakh crores as collateral-free automatic loans

- An infusion of Rs. 50 thousand crores through MSME fund of funds

Apart from this, the union government has also made some changes in criteria & functioning relating to MSMEs. One of the important policy decisions to encourage the domestic MSMEs is to keep a stop on global tenders for procurement up to Rs. 200 crores. This is aimed at facilitating the domestic MSMEs to gain greater business by reducing the international competition.

Most of these initiatives were announced in the immediate aftermath of the spread of the first wave of the COVID-19 pandemic. However, the findings from the different studies as discussed above raise important questions about the efficacy of these measures.

A deeper study by the Ministry could have helped understand the impact of the COVID-19 pandemic on the MSMEs and analyze the benefits of the government initiatives and the gaps in providing support to MSMEs. In this context, the observations made by the Parliamentary Standing Committee in its recent report provide important insights.

The Standing Committee observed that the stimulus package announced by the government was inadequate

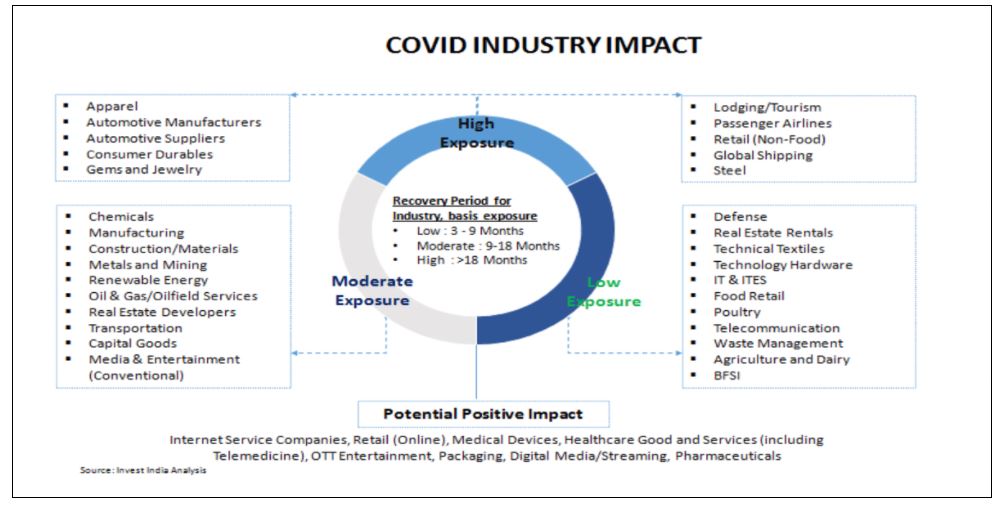

The standing committee noted that the impact of COVID-19 on MSMEs has been disastrous and that this sector is one of the most severely impacted ones. Various segments of the industry have had varied impacts due to the COVID-19 pandemic. While units in Automotive, tourism, non-food retail, appeals, etc. were among the most impacted, sectors like pharma, online retailers, essentials, medical equipment, OTT, etc. had a positive impact. The MSME units relating to these sectors had the respective impact.

Few of the key observations of the committee based on the views of different organizations associated with the sector include:

- The Government initiatives for economic revival are found to be inadequate. It observed that most of the measures were in the form of loan offering and long-term measures, while the MSMEs needed cash flows. It may be noted that the lack of liquidity was one of the key challenges highlighted in the various study reports.

- The lack of cash flow has a higher impact on the Small-scale firms which are more dependent on it compared to large & medium-scale firms.

- The impact of COVID-19 has a domino effect. The impact has resulted in job losses & decreased income of the personnel associated with MSMEs, impacting households.

- Another observation was regarding the release of payments to MSMEs. While the order issued by the government has helped MSMEs getting quicker payments, many of the PSUs & CPSEs are yet to release payments.

- Few of the schemes like sub-ordinate debt schemes have been availed by only a few MSMEs.

The committee took cognizance of the fact the Ministry has not conducted any intensive study to understand the losses suffered by the MSME sector. It observed that a study would have helped in understanding the vulnerabilities and the problems faced by the sector and enabled in taking the necessary steps in the wake of further waves of COVID-19 pandemic and to chalk out an effective plan in the revival of the MSME sector.

The committee made the following key recommendations in the report.

- The government needs to come up with a larger economic package that aims at increasing the demand, investment, exports & employment generation, thereby helping MSMEs to recover from the impact of the pandemic.

- Provide incentives to encourage MSMEs to register on Udyam Portal. The committee observed a fall in the number of registered MSMEs after the criteria have changed. The firms might have felt that the costs were more than the benefits of registering.

- Strict provisions against delayed payments to MSMEs.

- Identify industries that have profited during the pandemic and encourage MSMEs to invest in those sectors.

- Government to revisit the various schemes already announced and make provisions to encourage more MSMEs to take benefit of these schemes.

- Encourage MSMEs to explore digital & e-commerce platforms. This was one of the recommendations of the ADBI study as well.

It is evident from the studies that MSMEs are one of the worst-hit by the pandemic. The studies indicate that despite the measures announced, there has been extreme stress on the sector and the relief packages have not been adequate.

The government needs to take cognizance of these observations and develop a plan that would provide immediate relief to MSMEs to tide over the current challenges and also lay out a plan for the stabilization of the sector.

Featured Image: Impact of COVID-19 on MSMEs