MSMEs play an important role in the Indian economy so much so that they contribute around 30% of the GDP. Despite playing such an important role, they face multiple challenges. It remains to be seen if the government’s recent measures help the sector overcome these challenges.

Addressing the nation on 12 May 2020, Prime Minister Narendra Modi gave a call for ‘Aatma Nirbhar Bharath Abhiyan’ or Self-reliant India. A package for ₹ 20 lakh crores were announced by the government to overcome COVID-19 crisis, the details of which were announced over next few days. In the first tranche of details, measures for MSMEs (Micro, Small, Medium Enterprises) were announced. MSMEs were among the worst effected affected during the lockdown.

These measures announced by the government were aimed at providing support and stimulus to MSMEs, which make a key contribution to Indian economy. The recent events involving China and the call for banning Chinese imports have reemphasized their role in the larger movement for a self-reliant India.

In this story, we take a look at the current state of MSMEs in India, the recent measures announced by the Government of India and the prospective impact of such measures.

MSMEs account for around 30% of India’s GDP

MSMEs account for a major share of India’s GDP. They are spread across various sectors including manufacturing & services and service both domestic and global market.

As per the data provided in Annual Report 2018-19, of the Ministry of Micro Small and Medium Enterprises, the volume GVA ( Gross Value Addition) of MSMEs have increased over the five year period of 2012-17 , however their share in the total GVA and GDP has slightly reduced.

For the year 2012-13, the GVA of MSMEs was ₹ 30.2 Lakh crores which formed 32.8% of total GVA and 30.4% of the total GDP of the country. In the ensuing year, the GVA of MSME increased to ₹ 33.8 lakh crores, which is 32.7% of total GVA and 30.2% of total GDP.

The latest information available in the report is for the year, 2016-17, where in the total GVA of MSMEs was ₹ 44.05 lakh crores. This is 31.8% of the total GVA in that year and 28.9% of the total GDP. (Note that the volume of GVA is adjusted as per current prices).

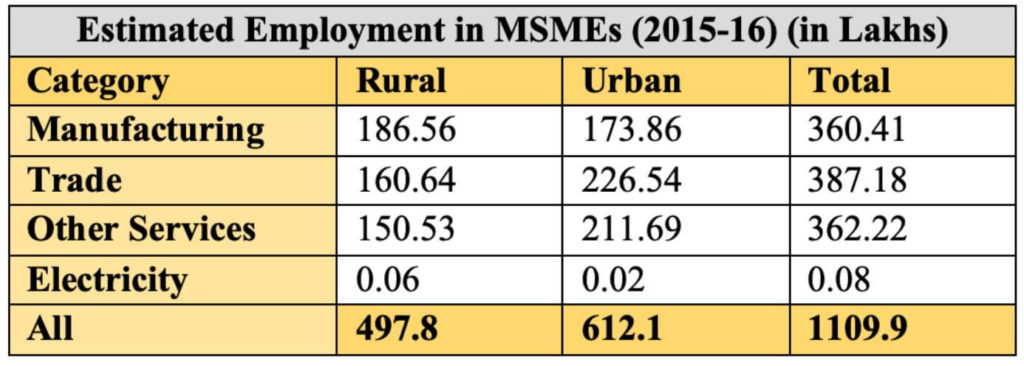

Around 11 crore people employed by MSMEs as per 2015-16 survey

As per National Sample Survey (NSS) 73rd round conducted during 2015-16, MSMEs created around 11.1 crores jobs. Out of these, a majority are employed in Trade with 3.87 crores. MSMEs involved in Manufacturing employ around 3.6 crores while another 3.62 lakh crores are employed in Other services. A minute portion i.e. around 7 thousand jobs are under ‘Non-captive Electricity Generation and Transmission.

Out of the total employment in MSMEs, 6.12 crores are employed in Urban areas and the remaining 4.97 crores jobs are in Rural areas. While MSMEs in manufacturing employee more in Rural areas compared to Urban, it is vice versa for MSMEs in Trade and Other Services, where the employee generation is higher in Urban areas.

- MSMEs employ a significant number of male workers i.e. 8.44 crores compared to female workers who are estimated to be around 2.64 crores.

- Micro enterprises account for bulk of employment with 10.76 crore jobs, with Small and Medium enterprises providing for around 31.95 and 1.75 lakh jobs.

More than 99% of the MSMEs are Micro Enterprises

As per the estimates of National Sample Survey, there are a total of 6.33 crore MSMEs in India as of 2015-16. Of these, 3.24 crores are in Rural areas and 3.09 crores in urban areas. More than 99 % i.e. around 6.31 crores of MSMEs are Micro Enterprises. There are estimated to be around 3.31 lakh Small scale enterprises and 0.05 lakh medium scale enterprises.

The highest number of MSMEs were engaged in Trade related activities with 235.3 lakh of which 121.64 lakhs are in Urban areas and the rest in Rural. A total of 206.85 lakh MSMEs are engaged in ‘Other Services’ while 196.65 lakh enterprises are engaged in Manufacturing activity. Among the MSMEs in Manufacturing sector, majority of them are in Rural areas with 114.14 lakh MSMESs and 82.5 lakh in Urban areas.

- 79.63% of the MSMEs are under Male ownership.

- Rural MSMEs have a better ratio of Female ownership with 22.24% while it is 18.42% among Urban MSMEs.

- Micro Enterprises have 20.44% female ownership while it is comparatively lower in the case of Small and Medium enterprises with 5.26% and 2.67% respectively.

Cabinet approval for change of definition for MSMEs

As the number indicates, significantly large portion of MSMEs are categorized under Micro enterprises. This categorization is done on the basis of an earlier definition of MSMEs, the one which has changed in subsequent years.

On 01 June 2020, the Cabinet Committee on Economic Affairs has approved a change in the definition on the MSMEs. This change in definition is based on the announcement made as part of the Aatma Nirbhar package.

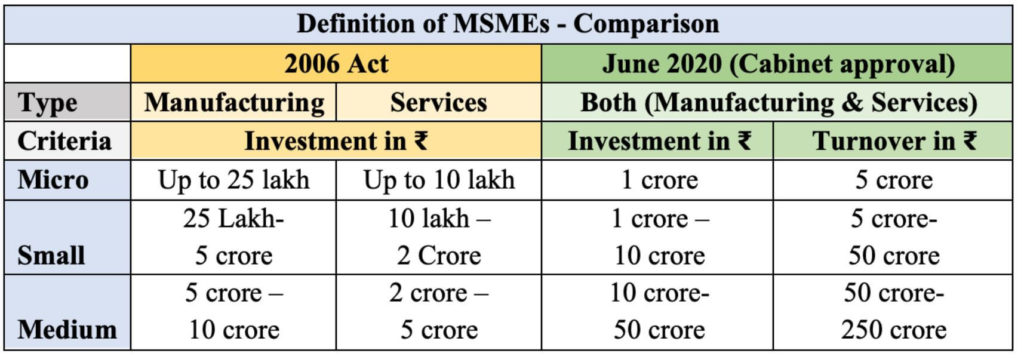

The classification of MSMEs into Micro, Small & Medium enterprises is based on the criteria defined in MSME Development Act, 2006. Investment is a major criterion for such classification.

- Investment in plant & machinery for enterprises engaged in manufacturing or production of goods

- Investment in equipment for enterprises providing services

Apart from these, ‘Annual turnover’ is also used as a criterion for classification. Prior to the current approval for the change in definition, there have been two earlier attempts to change the definition.

- MSME Development (Amendment) Bill, 2015, which was withdrawn in July’2018.

- MSME Development (Amendment) Bill, 2018, which lapsed due to dissolution of 16th Lok Sabha.

As per the initial definition provided under MSME Development Act, the criteria of classification were different for enterprises involved in Manufacturing activities and those involved in Services. This has now been modified in the new definition, wherein no classification was made on the basis of activity of the enterprise.

Further, in the earlier definition, only the investment was considered as a criterion. As per the new definition, even turnover is included for classification of MSMEs. This is based on an Expert committee report of RBI, which recommended the use of turnover as criteria instead of investment.

The 294th Report of the Parliamentary Standing Committee on Industry, on MSME Development Bill, 2018 suggested the inclusion of ‘Number of employees’ also for the classification, which was not considered. In many of the developed economies, the classification of MSMEs is made on the basis of number of employees as one of the criteria.

Change in definition could result in inclusion of many enterprises under MSMEs

The change in definition of MSMEs will have an impact on the enterprises currently classified under different categories of MSMEs as well result in inclusion of new enterprises.

- Many of the enterprises which are currently classified as Small would now be categorized as Micro as per new definition. This could further increase the number of Micro enterprises, which already account for more than 99% of the current MSMEs. The programs and schemes related to MSMEs need to be allocated more funds in line with the increase in numbers.

- As per the existing definition, there are many enterprises which are not included under the gambit of MSMEs. With the upper limit of Medium scale enterprises raised to ₹ 50 crores, there would be many enterprises that will be included under MSMEs. As in the case of increase in Micro enterprises, this would entail increase in the budgetary allocation of various schemes in place for MSMEs.

Therefore, the re-classification as per the new definition could substantially increase the number of MSMEs and budgetary allocation under various schemes related to MSMEs.

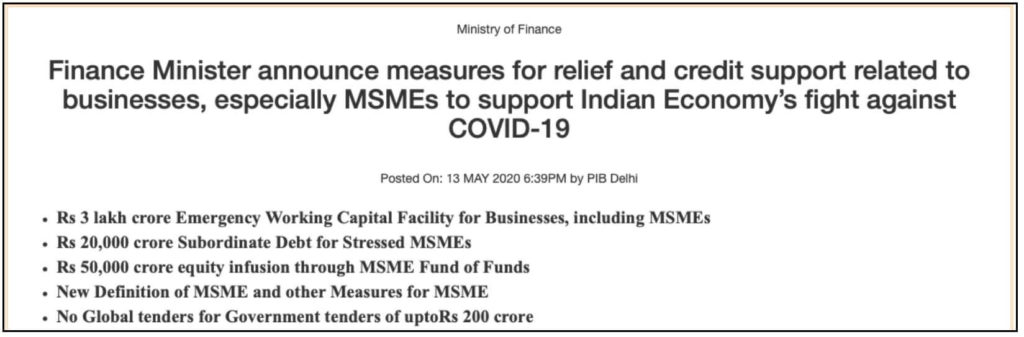

Relief measures announced to support MSME in wake of COVID-19 lockdown

As highlighted earlier in the story, MSMEs account for nearly 31.8% of the total GVA and nearly 29% of the total GDP in 2016-17. As per National Sample Survey, it provides employment for more than 11 crores people.

The numbers indicate their influential role in the functioning of the economy. However, the lockdown due to COVID-19 had a severe effect on MSMEs. Recognizing this, the Government of India announced several measures for MSMEs in the package announced recently.

The summary of the announcements made by government in relation to MSMEs are,

As highlighted earlier in the story, change of definition for classification of MSMEs is also part of the measures announced by Government of India.

Implementation remains the key

Aatma Nirbharata or self-reliance aims at building a self-sufficient economy across different sectors. This can also refer to import substitution, wherein India can reduce the volume of imports and substitute with domestic products & services. MSMEs can play a key role towards achieving these goals.

Various input credit initiatives are an announcement in the right direction. However, previous experiences show that small businesses continue to face challenges in securing bank loans, especially with provision of collateral. There are reports, stating that banks are reluctant to issues collateral free loans, despite guarantees from the government.

Another challenge for MSMEs is delay in payments. Government itself is a culprit with long standing dues to be paid out to MSMEs. While one of the recent measures announced is to clear all pending dues within 45 days, it is still a one-time measure, assuming that the government does clear all pending dues till date. There aren’t any policy changes announced which would safe-guard MSMEs against any future payment delays from government.

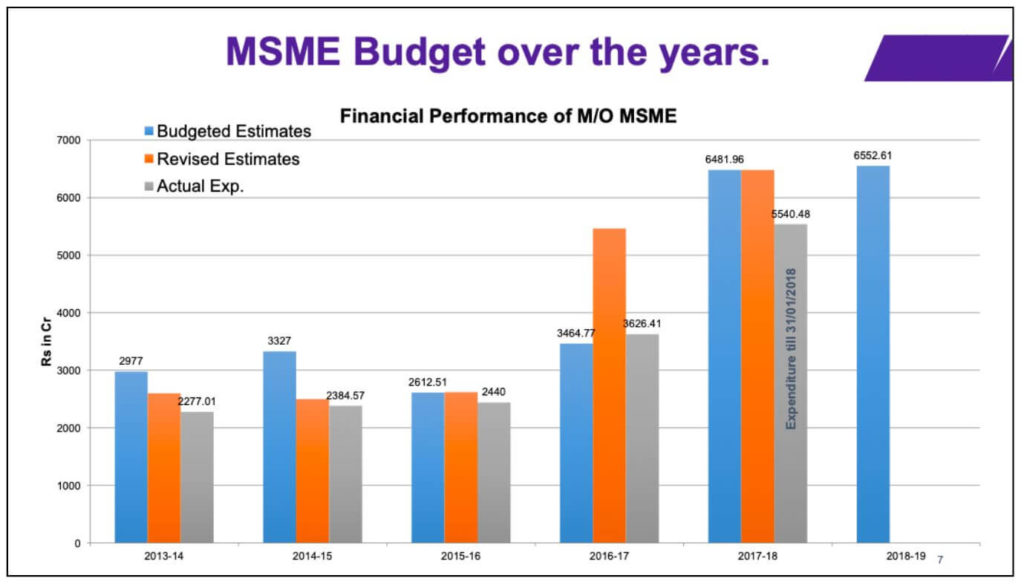

It has to be noted that these payments are pending despite the presence of MSME Samadhan initiative for delayed payments. The report of Parliament Standing Committee on Commerce and Industry- 2018 also reveals that the actual expenditure by Government of India has been consistently less than the allocated budgetary allocation for MSMEs.

While the measures announced recently are in the right direction, previous experiences indicate that implementation has been tardy and there are many gaps in execution. Correcting these would be the key if the intended results are to be achieved.

Featured Image: Stimulus to MSMEs