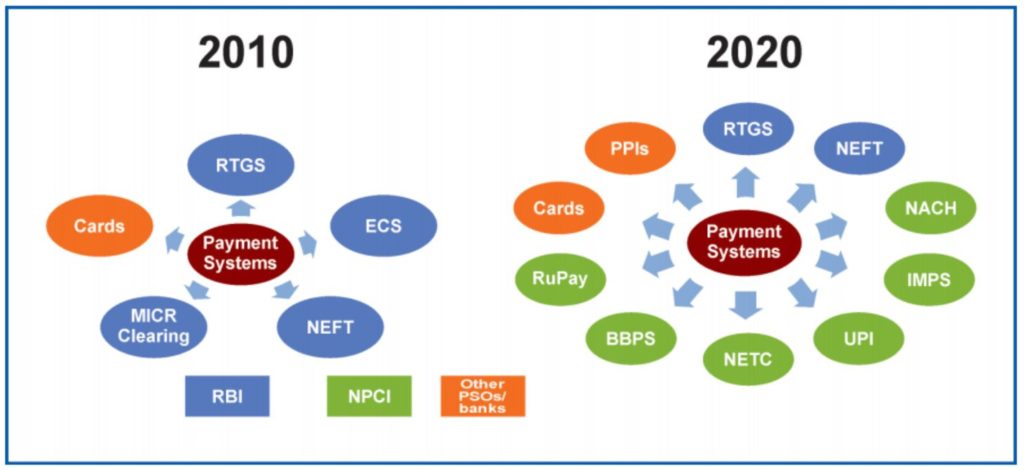

The last decade has witnessed an exponential increase in the adoption of digital payments by a large section of the population. This was driven by increased access to the internet & the mobile phone. Here is a review of the evolution of various digital payments systems in India between 2010 & 2020.

Recently, the Reserve Bank of India (RBI) released a booklet on Payment Systems titled ‘Journey in the Second Decade of the Millennium’. The book documents the developments in payment systems in the country in the last decade from 2010 to 2020. In India, the period 2010 to 2020 witnessed many defining moments such as the expansion of digital payments, the introduction of wallet applications, etc. which influenced consumer behaviour and hence resulted in the transformation of the payment ecosystem in the country. RBI had released booklets on payment systems earlier in 1998 and 2008. In this story, we briefly look at some of the developments in the payment systems through this period.

RBI to supervise payment systems in India

The Payment and Settlement Systems Act, 2007 provides for the regulation and supervision of payment systems in India. The Act appoints RBI to supervise the payment systems in India. The payment system has been defined under the Act as “a system that enables payment to be effected between a payer and a beneficiary, involving clearing, payment or settlement service or all of them, but does not include a stock exchange”.

NPCI is an umbrella organization for operating retail payment systems in India

RBI has authorized various Payment System Operators (PSOs) such as NPCI, CCIL, ATM networks, TReDS platform providers, to name a few, to operate payment systems in India. National Payments Corporation of India (NPCI) was established in 2008 by RBI and Indian Banks’ Association as an umbrella organization for operating retail payment systems in India. The role of NPCI is to provide infrastructure to the banking system in India for physical and electronic payment systems. It works on bringing innovations in retail payment systems. Some retail payments products brought about by NPCI are IMPS, RuPay card scheme, UPI, NACH, Aadhaar-enabled Payments System (AePS), and BBPS. Even Cheque Truncation System (CTS) was transferred to NPCI. With NPCI International Payments Limited, NPCI is also working towards the internationalization of RuPay and UPI.

Paper clearing has been made faster and secure

Initially, cheque/DD were the only alternative payment options to cash. To clear cheques, a centralized payment and settlement system was needed. Magnetic Ink Character Recognition (MICR) clearing system was brought in the mid-1980s under which cheque clearing was carried out electronically through the use of technology. High-Value Clearing was introduced during the eighties (and discontinued in 2009) for clearing cheques of the value of Rupees one lakh and above. Following a pilot study in 2008, the RBI rolled out CTS under which image of the cheque was enough for payment processing. Standards were framed in 2010 to include mandatory security features such as paper, watermark, void pantograph, etc. Banks were also permitted to include other features on cheques without disrupting the mandatory features.

With effect from January 2021, the RBI has introduced the ‘Positive Pay System’ for cheques under which the issuer must enter details like date, beneficiary’s name, payee, and amount in NPCI’s digital platform. The details entered will be cross-checked with the presented cheque in banks for averting fraudulent actions.

RBI has issued standards for payment systems

Standardization is necessary for the harmonization of payment processing across payment systems. The standards set by the RBI for payment systems are;

- Magnetic Ink Character Recognition (MICR)- As already seen earlier, this is a 9-digit code printed on cheques that are run through MICR reader and sorter machines so as to clear cheques faster. The 9 digit represents city code, bank code, and branch code.

- INdian FInancial NETwork (INFINET)- It is a Closed-User Group Network for the exclusive use of RBI, Member Banks, and Financial Institutions. The communication network aims at improving efficiency and productivity as well as provide customer services through innovative delivery channels such as internet banking, home banking, etc.

- Structured Financial Messaging System (SFMS)- Through SFMS, a secure and common messaging system for intra-bank and inter-bank applications was established using INFINET as a communication medium.

- Indian Financial System Code (IFSC)- Like MICR Code, the 11-digit alphanumeric IFSC code also helps in the identification of the destination of the beneficiary bank and branch. It is mandatory for fund transfers through RTGS, NEFT, and IMPS.

Apart from these, there are international standards such as ISO 20022, SWIFT, and Legal Entity Identifier (LEI).

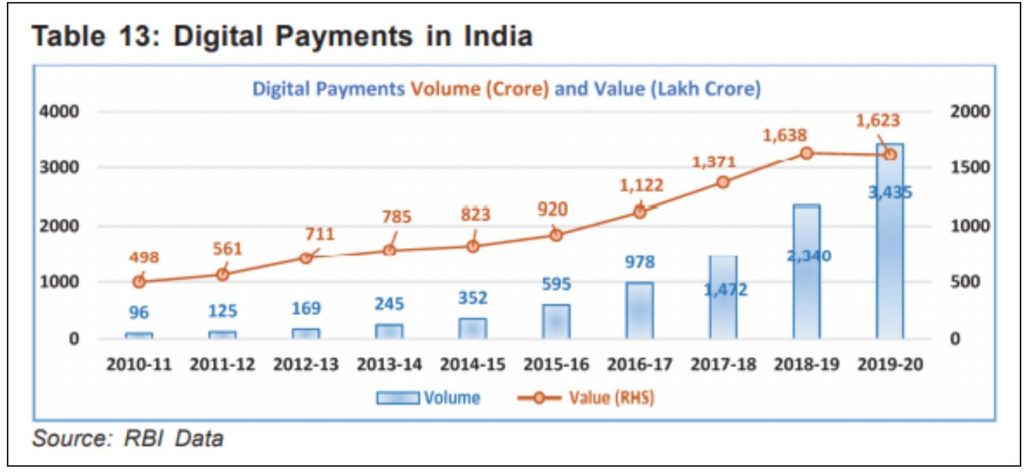

Digital payments have grown substantially in the last decade due to increased access to mobile and internet

In the last ten years, there has been a shift in payment preference from paper clearing to digital payment. RBI data indicates that in 2010-11, paper clearing constituted 60% of the total retail payments and dropped to 3% in 2019-20 by volume, while retail electronic payments increased from 18% to 61%. In terms of value, paper clearing comprised 89% of the total retail payment system in 2010-11 which fell to 20% in 2019-20. Digital payments have grown from 498 crore transactions with a value of Rs. 96 lakh crores in 2010-11 to 1623 crore transactions with a value of Rs. 3,435 lakh crores in 2019-20.

This shift is attributed to the increased penetration of mobile phones and the internet in the country which has helped in the quicker adoption of cashless transactions. The report states that low-value payments dominate the volume/turnover, and products that afford real-time, instantaneous transfers are the most preferred modes of payment as revealed by data.

Many digital payment options have evolved over the years

As compared to the onset of the decade, there are many digital payment options available to consumers today which even operate throughout the day. These are:

For periodic payments:

- Electronic Clearing Service (ECS)- Introduced in the 1990s to deal with the bulk and repetitive payments, RBI later introduced an ECS (Debit) scheme which is a faster mode of effecting periodic and repetitive collections of utility payments by companies.

- National Automated Clearing House (NACH)- NACH is a centralized ECS launched by NPCI used for both debit and credit purposes. It offers paper and paperless mandates and uses Aadhar to detect destination account. All ECS centres were fully migrated to NACH by January 2020 as NACH is more effective. Aadhaar Payment Bridge System (APBS) is a component of NACH that is used by the government to transfer benefits and subsidies to beneficiaries using the Aadhar number.

Card based payments:

- Card (debit and credit) Payments– Between 2010-11 and 2019-20, the number of debit cards issued increased from 22.78 crores to 82.86 crores, and the number of credit cards issued increased from 1.8 crores to 5.77 crores. Since 2019, the RBI made it mandatory to use only EMV chip and PIN-based cards, replacing the magstripe cards. Contactless cards are also becoming popular as one can just ‘Tap and Go’ for transactions up to Rs. 5000.

- National Common Mobility Card (NCMC)- Launched in 2019, NCMC offers a combination of Debit/Credit with a prepaid card where the Debit/Credit component can be used in an online environment whereas the prepaid component is used in the offline environment, wherever offline payments are permitted.

- RuPay Card- NPCI introduced domestic RuPay cards in 2012 as domestic cards helped in the quicker transition to a less-cash economy in most countries. In India, RuPay comprised of only 15% of total cards issued in 2017. As of 30 November 2020, over 60.36 crore RuPay cards have been issued. RuPay is also tying up with international payment networks.

Direct Transfer:

- Real-Time Gross Settlement (RTGS)- RTGS facilitates high-value (above Rs. 2 Lakhs) inter-bank transactions instantaneously. Initially, there were time slots for RTGS which have been removed since 14 December 2020, making it accessible 24*7.

- National Electronic Funds Transfer (NEFT)- NEFT helps in transferring funds from one bank account to another. However, unlike RTGS, the clearance occurs in half-hourly batches. There is no ceiling on the amount that can be transferred in a single transaction.

- Bharat Bill Payment System (BBPS) offers convenient utility bill payment to customers using online payments or through physical agents.

- National Electronic Toll Collection (NETC) facilitates FASTag based toll payments where toll collection takes place directly from the user’s account. In the future, the same tag may be used for parking charges, fuel purchases, etc.

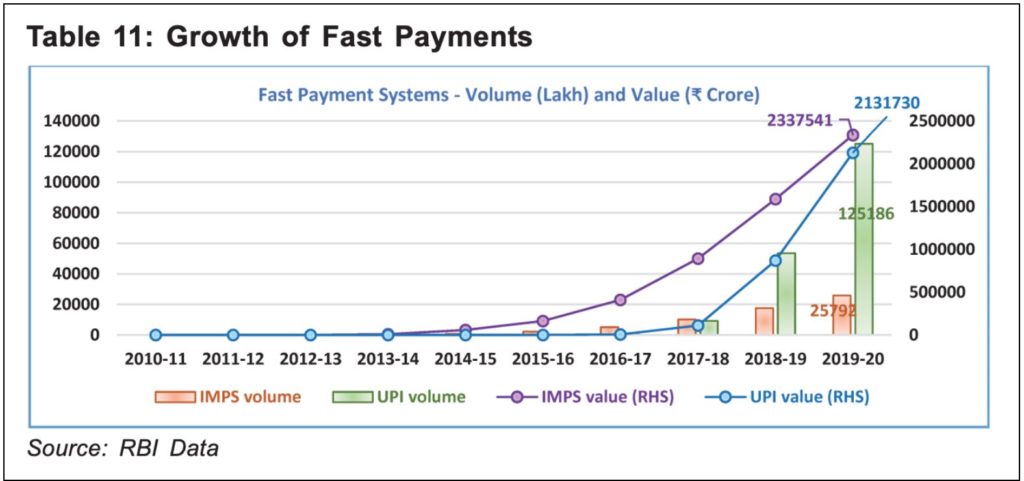

Fast payments through IMPS & UPI are becoming popular

Fast payments are characterized by speed and continuous availability. IMPS and UPI are the two fast payment systems existing in India. In 2010, India became the fourth country to introduce IMPS with an Rs. 2 lakh limit. Even non-bank entities can participate in these payments. On the other hand, UPI is a mobile-based fast payment system under which bank details need not be shared with the remitter. It helps in money transfer with persons, merchants, utility bill payments, and QR code-based payments. Interoperability is also a factor that RBI considers important. As per the data with the RBI, the two systems handled 8.35 crore transactions on a daily basis for a value of Rs. 22,854 crores in December 2020. The adoption of the two fast payment systems has exponentially increased in the last few years with them becoming the preferred mode of small payments for a majority of the people.

Challenges still persist

Though the adoption of digital payments has taken off exponentially in the last few years, multiple challenges still exist in the country for the government to achieve its goal of cashless India such as connectivity issues, poor infrastructure, and lack of awareness about the payment options. Even with respect to digital payments, issues of security and privacy, fraud, and other related risks need to be addressed for more people to use digital payments.

Featured Image: Digital Payments in India