In this week’s review of Court Judgments, we look at Himachal Pradesh High Court’s decision that the complainant’s consent is not necessary to compound a case when he is duly compensated, Supreme court judgment regarding non applicability of benefit of lapse, Delhi High Court’s judgment in a trademark related case, NCLAT’s admission of Google’s appeal with the provision that 10% of fine is paid first and Karnataka High court’s judgment regarding liability of legal heir.

Himachal Pradesh HC: Complainant’s consent not necessary for compounding case when he is duly compensated.

Hearing a plea challenging a Sessions Court order, Justice Vivek Singh Thakur of Himachal Pradesh High Court held that a case registered under Negotiable Instrument Act can be compounded even in the absence of consent of the complainant, where the complainant is duly compensated.

As per the details of the case, Rajinder Kumar vs. Pushpa Devi, the Sessions court has earlier convicted the petitioner under Section 138 of Negotiable Instrument Act (NI Act) and sentenced to undergo simple imprisonment of four months and to pay fine of Rs. 50 thousand payable to the respondent (complainant) as compensation.

As per the submission of the petitioner, the compensation amount was already deposited with the High Court registry. He has expressed the willingness to compound the case by making additional payment of 10% of awarded compensation. Reference was made to a Supreme Court judgement in Meters and Instruments Pvt Limited and another vs. Kanchan Mehta (2018) 1 SCC 560 with the contention that in case of NI Act, the case can be compounded even without the absence of consent of complainant, provided the complainant was duly compensated.

The plea for compounding the case was refused by the complainant via the counsel. Justice Thakur, observed that as per provisions of Section 147 of Negotiable Instruments Act along with the inherent power of the High Court under Section 482 Cr.P.C, the high court is sufficiently empowered to compound the case even in the absence of consent of complainant, wherein the complainant is duly compensated.

The court further pointed out the fact that the petitioner is 52% handicapped and has deposited in the Court 10% over and above the compensation. The court adjudged that the complainant has been compensated adequately and therefore, a substantive sentence of imprisonment imposed upon him is not necessary.

Supreme Court: Benefit of Lapse not available if delay in taking possession was due to pending litigation

In the case Govt. of NCR of Delhi vs. Sunil Jain & Ors, Supreme Court held that the delay in taking possession of land because of a pending litigation does not entitle the original owner of the land the benefit of lapse under Section 24(2) of the Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013. (RFCTLARR).

This observation was made by the Supreme Court Bench comprising of Justice MR Shah and Justice CT Ravi Kumar, in a Civil Appeal, wherein the Government of NCT of Delhi had approached the top court feeling aggrieved and dissatisfied with the judgment passed by High Court of Delhi.

In that judgment, High court of Delhi allowed the writ petition preferred by the private respondents in the Civil appeal and held that the acquisition with respect to the land in question is deemed to have lapsed under RFCTLARR Act.

The appellant i.e., Government of Delhi put fort two arguments in the Supreme court.

- It argued that the original writ petitioners, who were the subsequent purchasers of the land, do not derive any right or title to the land at the time of Award. Therefore, cannot challenge the acquisition proceedings. It was further argued that the original petitioners had no locus to file the writ petition and seek any relief with respect to the acquisition.

- The appellants also argued that the possession of the land in question could not be taken over due to the pending litigation initiated by the original landowners challenging the acquisition.

Reviewing the merits of the case, the Court held that the acquiring body was not able to take the possession due to pending litigation initiated by the landowner, and hence, the landowner cannot be permitted to take the benefit/advantage of the same. And hence cannot content to be entitled to benefit of lapse.

It therefore stated that the judgment and order passed by the High Court is unsustainable and needs to be set aside. The original writ petition filed by the petitioners regarding lapse of the acquisition stands lapsed.

Delhi HC: Registration of Tread pattern nearly identical to ‘Suit pattern’ as a design would not disentitle it from being regarded as trademark.

In the case, Apollo Tyres Limited vs. Pioneer Trading Corporation & Ors, Delhi High Court has ruled that registration of a tread pattern, which is nearly identical to the suit pattern, as a design would not ipso facto (by that very fact ) operate to disentitle it from being regarded as a ‘ trade mark’ as per Trade Marks Act, 1999.

In the case, the argument before the court was whether Apollo Tyres Limited, which filed a suit against Pioneer Trading Corporation accusing it of violating a 2018 settlement agreement, deserves to be non-suited. The argument is based on the ground that it had applied for registration of the suit pattern as a design under Section 5 of the Designs Act. It was argued that by making such an application, Apollo Tyres has lost its right to any statutory right in respect to the tread pattern treating it as a trademark in view of the exception of Trademarks from the definition of ‘design’.

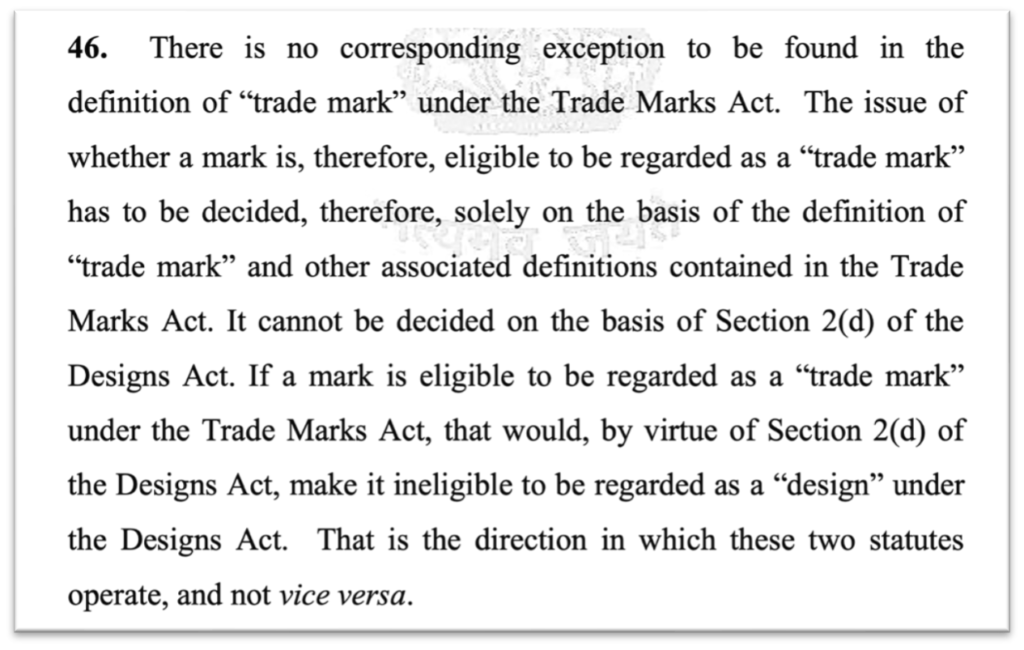

Delhi High Court stated that the issue of whether a mark is eligible to be regarded as a ‘trademark’ has to be decided solely on basis of the definition in the Trade Marks Act and cannot be decided on basis of Design Act.

It further noted that, in the current case, the Suit pattern is not registered as a design and hence referring to definition under Designs Act would not arise, unlike the case of Havells India Ltd vs. Panasonic Life Solutions India Pvt. Ltd.

On comparing the two tread patterns, the court said that the only difference that one can see in the two patterns is in the nature of the cuts on the cubes on the two tread patterns, otherwise the placement of the various pieces on the two tread patterns is identical.

Considering the agreement between the two parties, the court was of the view that the defendants carried out only cosmetic changes to the tread pattern. This cannot be considered as a compliance as the defendants has agreed not to manufacture any tread pattern which was similar to the plaintiffs tread pattern.

The court stated that there is no dispute on the fact that the plaintiff has never applied for registration of tread pattern. However, even if the defendants file a registration for tread pattern, they will not disentitle the plaintiff in respect to the tread pattern.

In its application seeking injunction, Apollo has argued that considerable research has gone into developing the tread pattern and that Pioneer by using a similar pattern, is trying to pass off their tyres as that of Apollo’s. The court allowed for the injunction if favour of Apollo.

NCLAT Delhi Directs Google to Deposit 10% of Penalty Amount in a Google Play Store Dispute

In the case, Alphabet Inc. & Ors vs. Competition Commission of India & Ors, the National Company Law Appellate Tribunal (NCLAT) has admitted Google’s appeal against a CCI Order subject to deposit of 10% of penalty amount of Rs. 936.44 crores.

As per the details of the case, the Competition Commission of India (CCI) adjudicated a complaint filed in XYZ (Confidential) vs Alphabet Inc & Ors, wherein the allegation of abuse of dominant position by Google were raised.

App developers use App stores for distributing their apps to the end users. Google Play Store, owned by Google (whose holding company is Alphabet Inc) is the main distribution channel for app developers in Android mobiles.

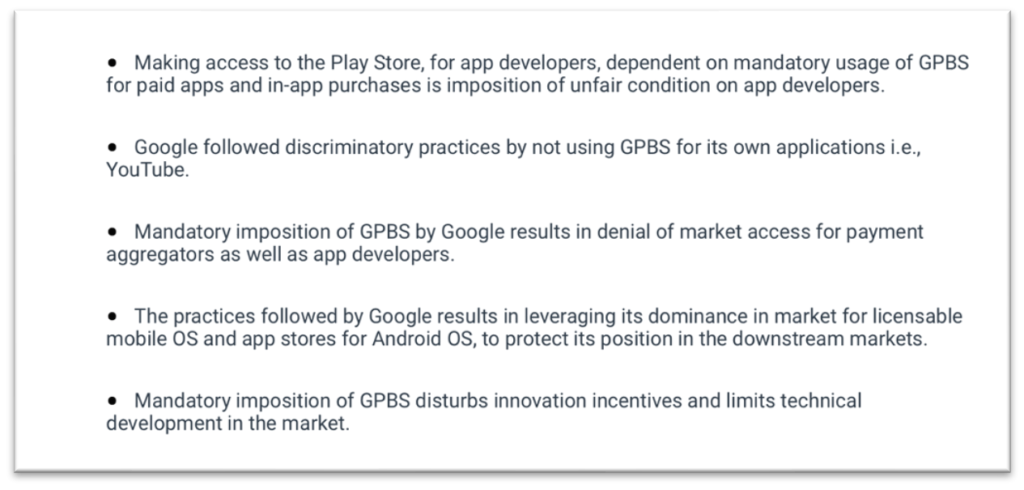

App developers monetise their innovations by selling in-app digital goods. A per Google’s Play Store policy, the App developers are required to mandatorily use Google Play’s Billing System (GPBS) for receiving payments for Apps and in-app purchases from Play Store. App developers are not permitted to list their apps in case of non-compliance to this.

CCI observed that this making access to Play Store dependant on mandatary usage of GPBS is devoid of any legitimate business interest and leaves the app developers bereft of any choice. It noted that Google has violated the provisions of Section 4 of Competition Act.

CCI therefore imposed a monetary penalty of Rs. 936.44 crores on Google for abusing its dominant position. Google filed an appeal before NCLAT challenging the order passed by CCI. NCLAT admitted Google’s appeal, subject to deposit of 10% of the penalty amount. The matter was next listed for 17 April 2023 and NCLAT declined to grant any interim relief. Google has approached the Supreme Court against this decision of NCLAT.

Karnataka HC: Deceased Father’s dues qualify as legally enforceable debt

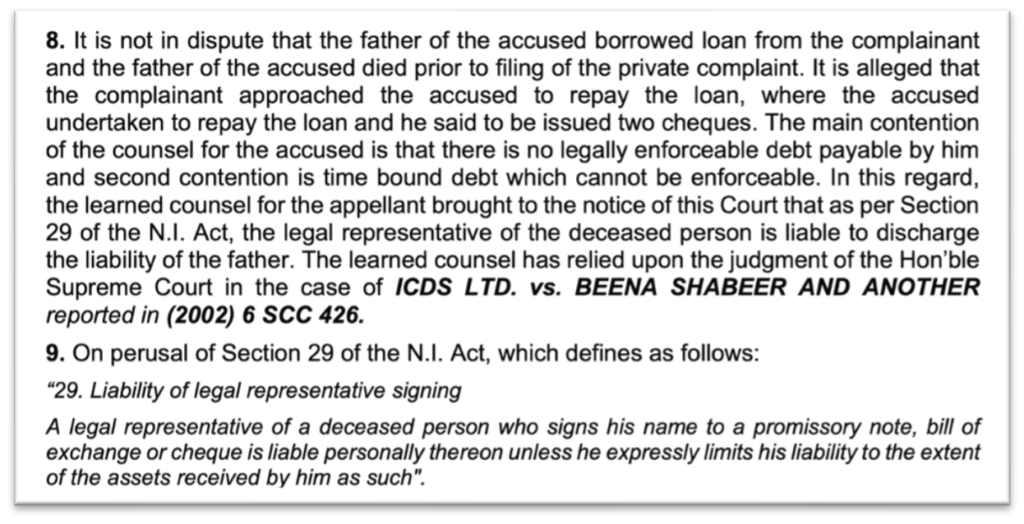

Single judge of Justice K Natarajan of Karnataka High court said that a son being the legal representative is liable to discharge the liability of the deceased father under the Negotiable Instruments Act.

As per the case details, a complaint was filed by Prasad Raykar, as per which Bharamappa, the father of respondent is said to have borrowed Rs. 2.6 lakhs for his business and family necessities and agreed to pay 2% interest per month, for which a promissory note was also executed.

In due course, Bharamappa died, leaving his son as a legal heir. The complainant asked the deceased’s son B T Dinesh for repayment of the loan. Dinesh asked for time and paid Rs. 10 thousand on 10 June 2005. Later, the respondent issued two cheques for sum of Rs. 2.25 lakhs. The cheques were dishonoured as the account was closed. A notice was served but he did not pay the amount. Hence, a complaint was filed under sections of Negotiable Instrument act before the Magistrate.

The bench referred to a case of ICDS Ltd vs. Beena Shabbet & Anr and held that the legal representative of the deceased is liable personally.

The court also rejected that the debt is time barred since his father has borrowed the loan in 2003. In this regard, the court stated that the case of debt being time barred does not arise since he has paid Rs. 10 thousand by cash and has issued a cheque, therefore is liable for discharging the liability of the father.