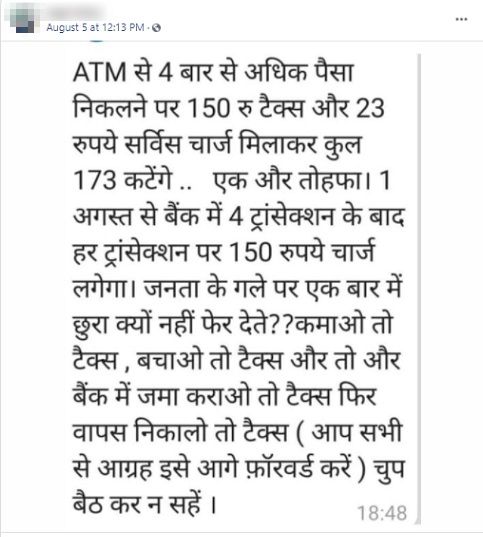

A post is being shared on social media claiming that banks will charge 173 rupees for every Automated Teller Machine (ATM) transaction beyond the permissible limit. This post claims that beyond four free ATM transactions, banks are going to charge ₹ 150 tax and ₹ 23 additional service charge for every transaction. Also, the post claims that beyond four free bank transactions, banks will charge ₹ 150 rupees per additional bank transaction. According to the post, these new guidelines will come into force from 01 August 2021. Let’s verify the claims made in the post.

Claim: Banks are now going to charge 173 rupees for every ATM transaction beyond the permissible limit.

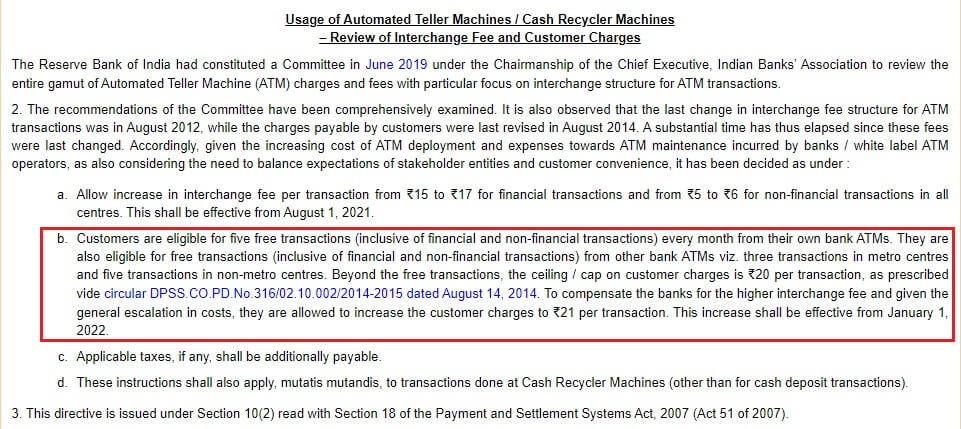

Fact: On 10 June 2021, RBI issued a notification by revising the interchange fees and customer service charges of Automated Teller Machine (ATM) transactions. According to the new RBI regulations, customers are eligible for five free transactions every month from their own bank ATMs and three free transactions in other bank ATMs in metro centres. Beyond the free transactions, banks are allowed to charge 21 rupees for every additional ATM transaction. These RBI guidelines will come into force from 01 January 2022. The charges mentioned in the post are related to the cash transfer charges (does not include ATM transactions) in few private banks including ICICI, HDFC and HDFC. Hence, the claim made in the post is MISLEADING.

When we searched to check whether RBI had issued any such new regulations on their website, we found out that on 10 June 2021, RBI had issued a notification by revising the interchange fee structure and customer service charges of Automated Teller Machine (ATM) transactions. Considering the increasing cost of ATM deployment, expenses towards ATM maintenance and the need to balance the expectations of stakeholders, RBI decided to increase the interchange fees and customer service charges of ATM transactions.

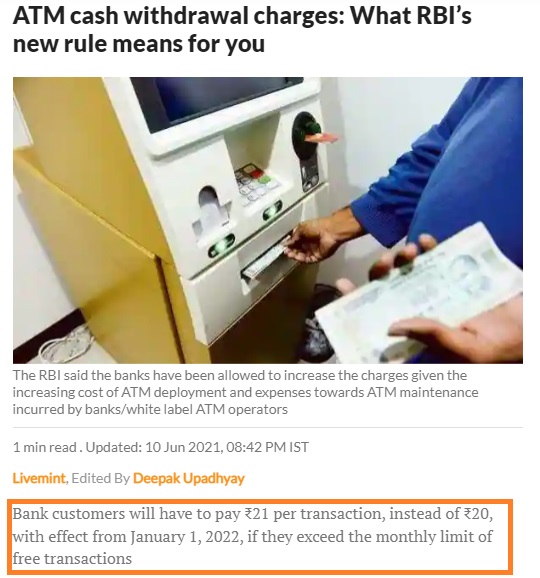

According to the new RBI guidelines, customers are eligible for five free transactions every month from their own bank ATMs. They are also eligible for three free transactions in other bank ATMs in 6 metro centres, and five free transactions in non-metro centres. Beyond the free transactions, banks are allowed to charge ₹ 21 for every ATM transaction. These RBI new guidelines will come into force from 01 January 2022. Currently, banks are charging ₹ 20 for every ATM transaction beyond the permissible limit. Several news websites published articles reporting the new guidelines issued by RBI. They can be seen here and here.

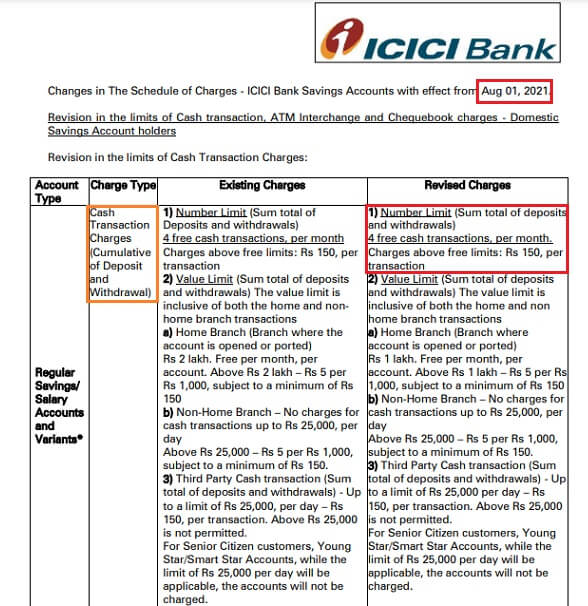

The charges mentioned in the post are related to the cash transfer charges (does not include ATM transactions) in few private banks including ICICI, HDFC and AXIS banks. ICICI recently issued a notification by revising the limits of cash transactions, ATM interchange and chequebook charges. These new regulations reportedly came into force from 01 August 2021. According to the ICICI regulations, ICICI allows their customers four free cash transactions (cumulative of both deposit and withdrawals) per month. Thereafter, it will charge 150 rupees for every cash transaction. HDFC and AXIS banks are also charging the same cash transfer fees from their customers. ICICI, HDFC and AXIS banks are charging ₹ 20 for every ATM transaction beyond the free limit. The ATM interchange and cash transaction charges in these banks can be seen here, here, and here.

To sum it up, banks will not charge 173 rupees for every ATM transaction beyond the permissible limit.