[orc]In Part-2 of this series, we look at the source of FDI inflows to India, the trend in disinvestment/repatriation of FDI etc.

In the earlier article, we looked at the different sectors that receive the FDI in India and the trend over the years. In this piece, we look the source countries of these FDIs and the trend in net FDI.

The government of India makes constant changes to the FDI policy and the FDI in any sector are subject to these restrictions. The amount of FDI from a particular source country to India is dependent on multiple reasons. A greater share of FDI comes from countries which are traditionally considered tax havens. FDI from a source also depends on the kind of tax avoidance treaties India signed with these countries.

DTAA as an Incentive to encourage FDI

Governments use various incentives to encourage investors to invest in the country and boost the FDI inflows. DTAA or Double Tax Avoidance Agreement is one such incentive, whose main aim is to promote investment by eliminating double taxation. Having a DTAA in place would ensure that there is clarity on how the cross-border income earned would be treated by both the countries and how it would be divided between them. This would avoid double taxation on the same income.

India currently has DTAA with more than 90 countries. The first DTAA was signed with Egypt in 1969. While, DTAA is seen as an encouragement, concerns are raised about misuse of them for round tripping, money laundering, tax avoidance etc. This is especially the case with countries like Mauritius, Cyprus, Singapore etc. which are known to be tax havens. Government of India’s White Paper on Black Money, tabled in Lok Sabha in 2012, and “Report of Joint Committee On Stock Market Scam and matters relating there to” have highlighted and discussed these issues.

The Government of India has amended the treaties with Singapore, Mauritius and Cyprus in the year 2016.

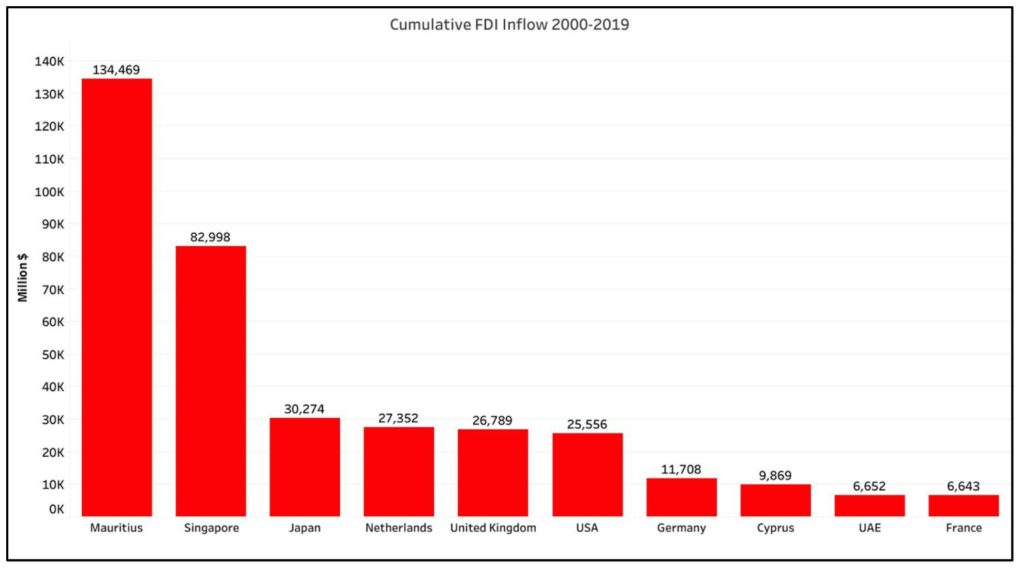

Mauritius, Singapore and Japan are the leading sources of FDI for India

Mauritius is the leading source of FDI in India, with this small island country accounting up-to 32% of the total inflow in the country from April 2000 to March 2019. Singapore on the other hand accounts for 19% of FDI during this 19-year period. Together, these two countries have accounted for over 50% of the FDI into India during this 19-year period. Japan, Netherlands, UK & USA are the other countries through which higher FDI flows into our country. In the recent times (in 2018-19), however, Singapore has overtaken Mauritius as the top investing country with highest FDI.

As already highlighted, Mauritius, Cyprus and Singapore had favourable tax regulations and were considered as tax havens. Netherlands and United Kingdom also have lower tax rates and hence these countries are the source of highest FDI into India. Even if the parent country of the investing company is in a different country, the FDI is routed through one of these countries.

Japan although not a tax haven, has higher volumes of FDI inflow into India. Japan ranks third in the overall volume of FDI received in this century (since 2000). The investments from Japan are into diverse fields like retail, textile, banking, food & beverages, consumer durables etc.

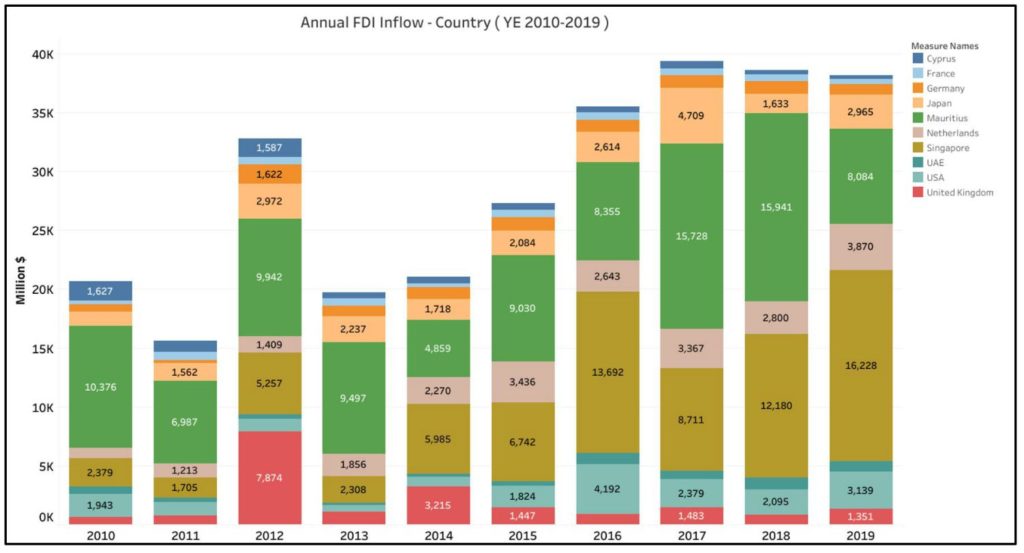

Singapore, Netherlands and USA show an increasing trend over the decade with FDI from Cyprus going down

Singapore was the largest source of FDI in the year 2018-19 with $16,228 million followed by Mauritius ($8084 million), Netherlands ($3870 million) and USA ( $3139 million). Mauritius, which has traditionally been the top investing country FDI has ceded space to Singapore in 2018-19. Before this, even in 2015-16, Singapore was the top investing country.

Netherlands has consistently increased its FDI in India over the decade. For the FY 2009-2010 the FDI inflow of Netherlands was $899 million and has increased incrementally every year to $3,870 million for 2018-19.

UK had a peak year in 2011-12 second only to Mauritius but over the years has a relatively lesser share of the annual FDI inflow. Japan is a consistent contributor to FDI with not much variance in the annual FDI inflows into India, with a peak year in 2016-17 with $4,709 million in FDI that year.

USA also has a consistent increase in its FDI investment into India, especially after a lean period during 2012-14. On the contrary, Cyprus which is known tax haven, has seen a significant decrease over the decade. The investments from Cyprus in 2009-10 were to the tune of $1,627 million which has gradually come down to $296 million. The decline began from FY 2012-13.

Recent years have also seen a rise in Disinvestment decreasing the net FDI

FDI is a two-way street. While there is scope of FDI inflow into the country, chances are that the investments could leave the country as well. This could be either to recoup or withdraw the investments made, back to the country of origin or due to the investment being made by domestic investors into outside countries.

The outflow of investment can either be (i) outbound FDI i.e. the FDI being invested by Indian investors in other countries and (ii) Disinvestment/repatriation. Disinvestment refers to taking back the investments being made in a country back to the original country. Simply speaking, it is about pulling back the investments made.

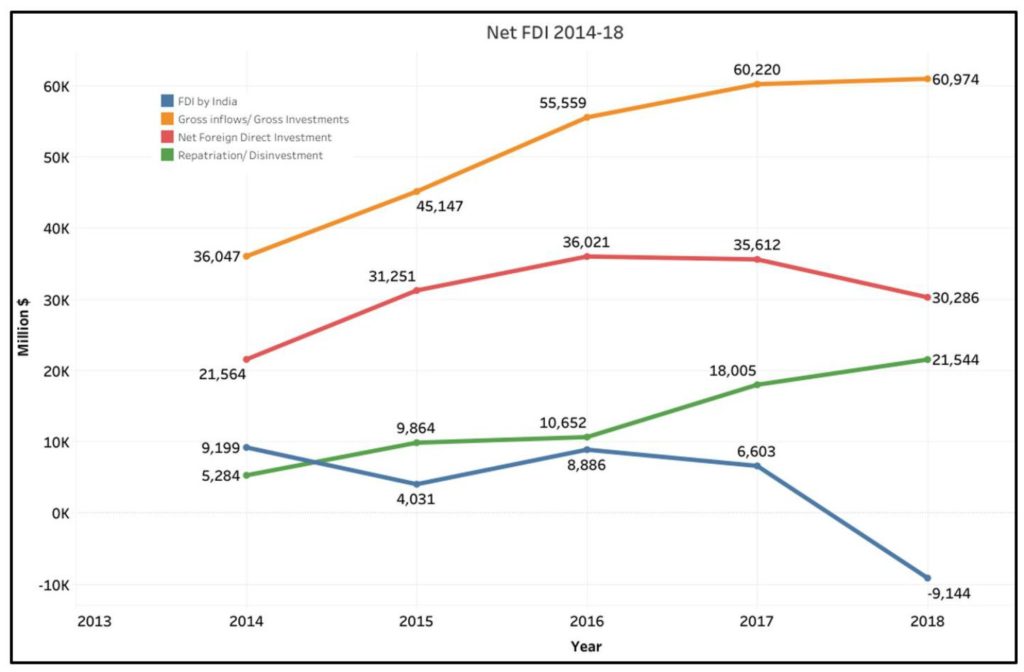

While the FDI inflows have increased over the years, the Net FDI has been on a declining trend recently.

Net FDI can be understood using this simple formula:

Net FDI = Gross FDI Inflows – FDI outflow – disinvestment/repatriation

A major contributor towards the fall in Net FDI is disinvestment/repatriation. Over the last five years, the disinvestment/repatriation has increased from $5284 million in 2013-14 to $21544 million in 2017-18. This has affected a negative trend in the Net FDI.

There could be multiple reasons for the disinvestment/repatriation. These could include non-favourable conditions in the invested country (in this case India), more favourable factors in other markets etc. Outbound FDI where Indians invest in other countries could be a result of favourable markets in other countries, which encourages the domestic investors to invest in other countries rather than within India.

Sustained favourable environment in India can help to increase the Net FDI

A favourable business environment, relevant FDI policy changes and other economic incentives like DTAA, Tax rebates etc. may be necessary for boosting FDI inflows. The World Investment Report (2018) notes that new investment restrictions or regulations in 2017 mainly reflected concerns about national security and foreign ownership of land and natural resources. It also notes that several countries are considering tightening investment screening procedures. While this may not be the case for India, the repatriation/disinvestment is a cause for concern.

Featured Image:FDI Inflows to India