[orc]In part-1 of a two-part series, we look the overall FDI inflow of the last 10 years along with sectoral FDI inflow.

On 10 July 2019, the Minister for Commerce and Ministry, provided answers to question asked in Lok Sabha regarding Foreign Direct Investment (FDI) inflows in India. In response to one of the questions, the minister has provided the sector wise FDI of the past three years and also reiterated that India continues to rank in the top 10 countries with the highest FDI inflows as per United Nations Conference on Trade and Development (UNCTAD)’s World Investment Report (WIR) in 2017,2018 and 2019.

In a two part series, we analyse the FDI inflows to India over the past decade including the trend of FDI inflows across various key sectors, source of the FDI inflow etc.

Equity and reinvestment are major component of FDI inflow

Before getting into the sector wise FDI inflows and the source of FDI in India, let us first understand the different components of FDI inflow.

The total FDI inflow comprises of three main components:

- Equity Capital: This refers to the total value of the Investor company’s investment into the shares of the business entity into which the FDI is being made. These generally form a major share of the total FDI.

- Reinvestment earnings: These are the earnings on the investments which is not distributed to the investors but is retained. In simpler terms, these earnings from a business do not go back the foreign investor but is being invested back into the business, there by becoming a form of FDI.

- Other Capital: This comprises of debt securities, lending of funds etc. done between the investors and the subsidiaries in the country.

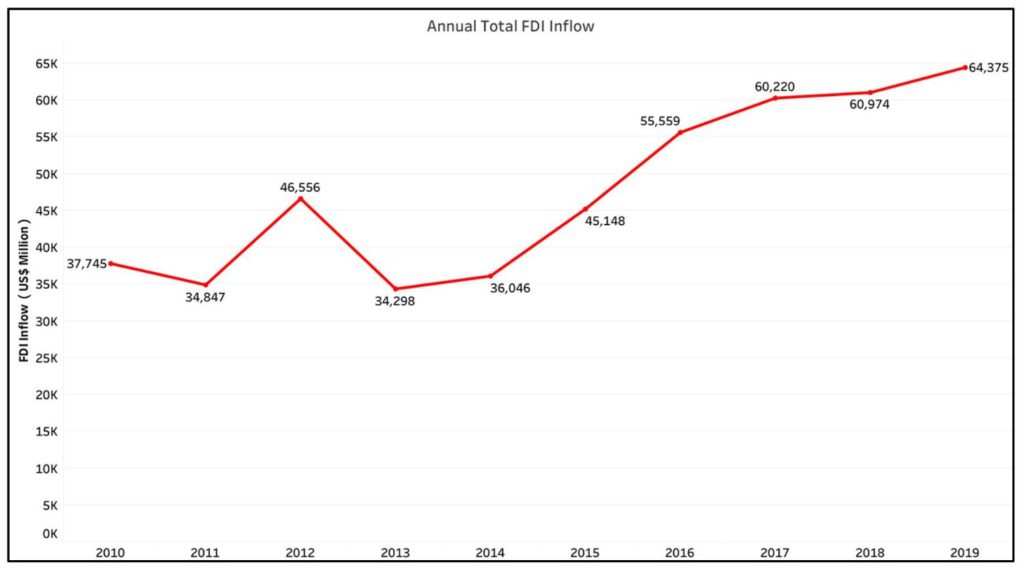

Consistent increase in Annual FDI inflows over the decades barring couple of years

The FDI inflows for financial year (FY) 2009-10 was $37,745 million and over the ensuing decade, the FDI inflows have recorded a steady growth every year. For FY 2018-2019, the inflows were $64,375 million i.e. 70.55% higher than the annual inflows in 2009-10.

The FDI inflows decreased compared to the previous year only on two occasions, FY 2010-11 and FY 2012-13 where they fell by 8% and a sharp 26% respectively. It can be noted that the highest annual increase over the decade was recorded in the year between these two i.e. FY 2011-12, where the FDI inflows showed an annual increment of 34%. Few Big-ticket deals in the Oil & Gas sectors was said to have contributed for the higher FDI inflow in spite of the lack of FDI reforms during that period.

After a meteoric annual growth during 2014-15 and 2015-16, the FDI inflows only increased by single digit percentage points annually over the last three years (8%, 1% and 6% respectively between 2016-17 and 2018-19).

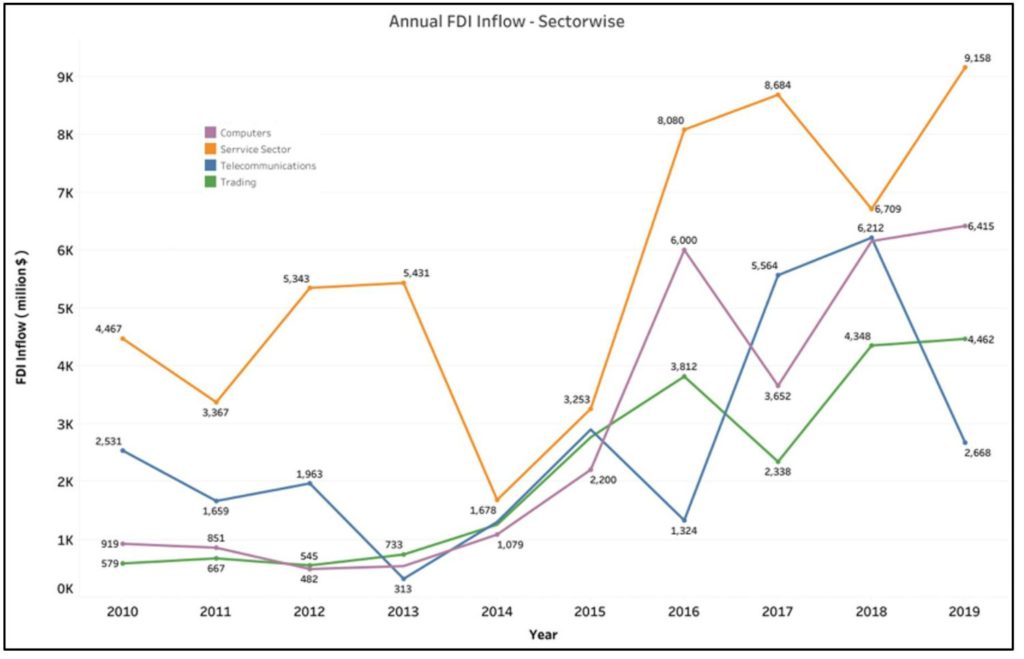

Service Sector, Hardware & Software, Trading and Automobile are the consistent high performing sectors

Service sector has been always had a major share of the FDI inflows every year. Apart from two lean years in 2013-14 & 2014-15, this sector has always recorded a share of minimum 10% of the total FDI received annually. Especially during the ensuing four years after the lean period, FDI in Service sector has a share of 14.5%, 14.4%, 11% and 14.2% respectively. The FDI in service sector has grown by 181% during these four years. i.e., From $3252.97 million in 2014-15 to $9157.54 million in 2018-19. Services under Banking, Insurance, Non-Finance & Business Outsourcing, Finance, R&D, Technology, Testing, Analysis etc. are categorized under service sector.

FDI into Computer (Hardware & Software) sector has increased from $918.66 million in 2009-10 to $6415.21 million in 2018-19. The annual inflow has grown by more than 500% in just 5 years between 2014-15 and 2018-19.

Trading sector includes businesses dealing with trading related to exports, bulk imports, cash & carry whole sale trading, hi-tech goods, medical & diagnostic items etc. The FDI inflows last year were recorded at $4,462 million compared to $578.61 million a decade ago.

Telecommunication sector has also received consistent high volume of FDI annually. Although there was a dip in the FDI received last year (2018-2019), this was after high volume of FDI inflows the previous two year.

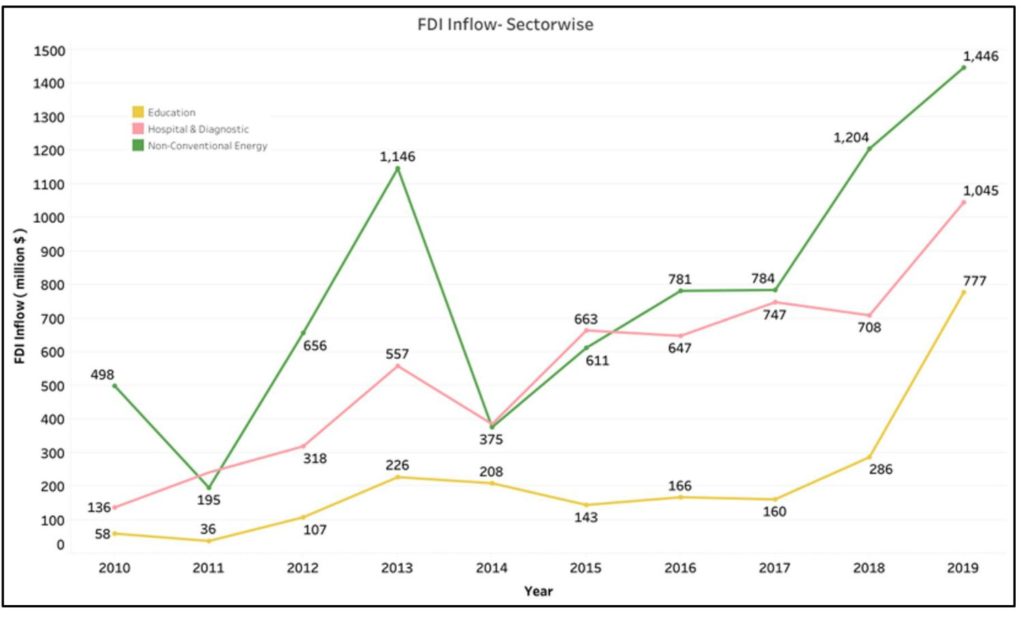

In recent years, FDI inflows have increased in Education, Non-Conventional Energy, Hospital & Diagnostic sectors

FDI into Hospitals & Diagnostic centers has shown a gradual and consistent increase all through the decade. In 2009-2010, the inflow was $135.91 million and has shown an incremental increase in the annual inflow every year. Last year, there was the greatest increase in an annual year with 47% higher FDI inflows compared to 2017-18.

Education Sector has also started receiving higher FDI over the decade, with a dip in the inflows during 2013-15. Last year, has an exponential increase in this sector with FDI inflows at $776.73 million compared to earlier year’s $285.75 million. Regulations allow for 100% FDI in education. Vocation and Technical education receive most of the foreign investment.

Non-Conventional Energy sector FDI inflows have increased annually since 2014-15, more than doubling up on yearly figures. In the year 2012-13, this sector received FDI to the tune of $1,146 million, which was only surpassed in the last two years i.e. 2017-18 & 2018-19.

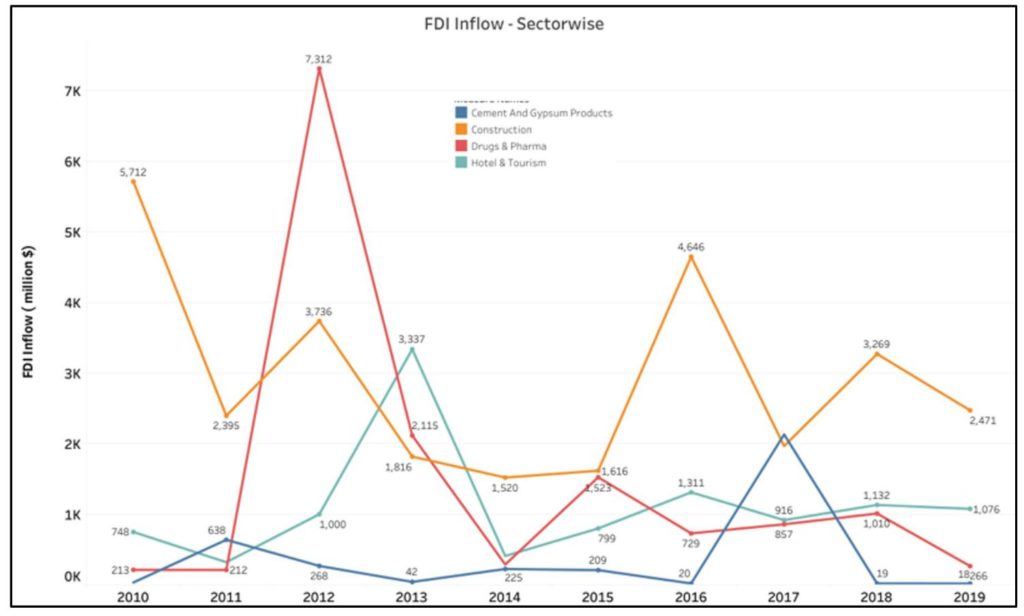

Hotel & Tourism, Construction, Drugs & Pharmaceuticals among the sectors receiving inconsistent FDIs annually.

The FDI inflows are dependent on various factors apart from the regulation and policies of the government. While positive government initiatives and environment are influencing factors, the actual deals can vary annually. This results in irregular annual FDI inflows in few sectors.

Hotel & Tourism sector received highest FDI over the decade in 2012-13 with $3336.68 million followed by last year 2018-19 ($1310.93 million). It had comparatively lean annual inflows in 2010-11 ($320.73 million) and 2017-18 ($408.75 million).

The categorization of construction industry has varied the FDI numbers of the government. It being reported as – Construction Activities, Housing & Real Estate, Construction Development, Construction (Infrastructure) etc. During 2009-10 (15%), 2011-12 (8%) and 2015-16 (8.3%), this sector had major contribution to the FDI inflow albeit with some lean years in between.

The FDI into Cement and Gypsum sector has been very volatile over the last decade. During 2016-17 it received $2,130 million, encapsulated between years of less FDI – 2015-16 ($19.78 million), 2017-18 ($19.44 million) and 2018-19 ($17.61 million).

Drugs & Pharma sector FDI inflows have also been highly inconsistent over the years. In 2011-12, it received $7,311 million in FDI with the next highest in the immediate next year with $2,115 million.

1 Comment

Pingback: Fact Check: How true are Government claims about FDI flows? - Fact Checking Tools | Factbase.us